A trading journal is an essential tool for any serious trader. By keeping a detailed record of your trades, you gain insights into your strengths and weaknesses, helping you refine your strategy. Start tracking every move from entry and exit points to emotions and market conditions to spot patterns and avoid costly mistakes. Don’t leave your trading success to chance; create a trading today and watch your performance improve. Take control of your trading journey and start your trading journal now!

What is a Trading Journal?

A trading journal is a tool that traders use to record and review their trading activities. It serves as a detailed log of every trade, capturing important information like the date, time, asset traded, entry and exit prices, trade size, strategies used, and the reasons for making each trade. Beyond the numbers, often includes notes on emotions, market conditions, and personal observations that influenced the decision-making process.

The main purpose of a trading journal is to help traders analyze their trading performance, identify patterns, and learn from past trades. By reviewing a trading regularly, traders can spot strengths and weaknesses in their strategies, make adjustments, and develop a more disciplined approach to trading. Keeping trading is one of the most effective ways to refine trading skills, avoid repeating mistakes, and improve long-term profitability.

See now:

- How To Calculate The Risk-to-Reward Ratio In Forex Trading

- Contrarian Trading – 5 Valuable Lessons of Famous Contrarian

- Maximum Your Profit From Taking Advantages Market Sentiment

Why should you use a Trading Journal?

Using a trading journal not only helps track performance but is also a crucial tool for building discipline and accountability in trading. Because you record every detail of each trade from entry and exit points to personal emotions this allows you to recognize the impact of emotions on trading decisions. This way, you can adjust your behavior to avoid repeating similar mistakes.

Additionally, a trading journal is an excellent tool for risk management, enabling you to analyze the risk-reward ratio and adjust your approach to optimize profits. In short, a trading journal not only helps improve trading results but also helps you develop confidence and sustainable trading skills over time.

Key Components of a Trading Journal

Here are the key components of a trading journal:

Date and Time of the Trade

Record the date and time when you executed and closed the trade, to easily analyze based on time frames and market conditions.

Asset Trading

Clearly note the type of asset you are trading, such as stocks, forex, or cryptocurrencies, helping you track performance for each type.

Entry and Exit Points

Log the price at which you entered and exited the market, to assess your timing and decision-making.

Trade Size

Record the trade size, like the number of shares or contracts, to understand the impact of each trade on your overall results.

Trade Outcome

Note the profit or loss from each trade, helping you track performance and success rate.

Emotions and Reason for the Trade

Document your emotions and reasons for making the trade, to understand what factors influenced your decision-making.

How to Build an Effective Trading Journal?

Here are 4 simple steps to build an effective trading journal:

Step 1: Choose the Right Format

Decide whether to record your trades on paper or use digital tools like Excel or specialized apps. A digital format is easier to analyze and track data.

Step 2: Record Essential Data

Include key details such as the date, asset traded, entry and exit points, trade size, trade outcome, and your emotions during the trade. These components are crucial for analyzing and learning from each trade.

Step 3: Evaluate and Reflect

After each trade, take time to assess what went well and what could be improved. Analyze your emotions, strategy, and decisions to identify patterns or mistakes.

Step 4: Analyze Performance and Adjust

Regularly review your performance from the journal. Identify strengths, weaknesses, and make adjustments to your strategies or trading psychology to improve long-term results.

The Best Trading Journal Support Tools Today

Here are some of the best trading journal support tools available today, designed to help traders track, analyze, and improve their trading performance:

Trade Bench

TradeBench is a popular web-based tool that offers a simple and customizable trading journal. It allows you to record key trade details like entry and exit points, trade size, and strategy. You can also track risk-reward ratios, performance, and analyze your overall trading history.

- Customizable trade entry fields.

- Performance analytics and reporting.

- Risk management tracking.

- Portfolio performance analysis.

Edgewonk

Edgewonk is a professional-grade trading journal that provides detailed analytics and in-depth performance tracking. It’s suitable for traders of all experience levels and supports various asset classes, including stocks, forex, and cryptocurrencies.

- Advanced trade analysis tools.

- Automated trade categorization.

- Emotional tracking and behavioral insights.

- Backtesting features to test trading strategies.

TradingDiary Pro

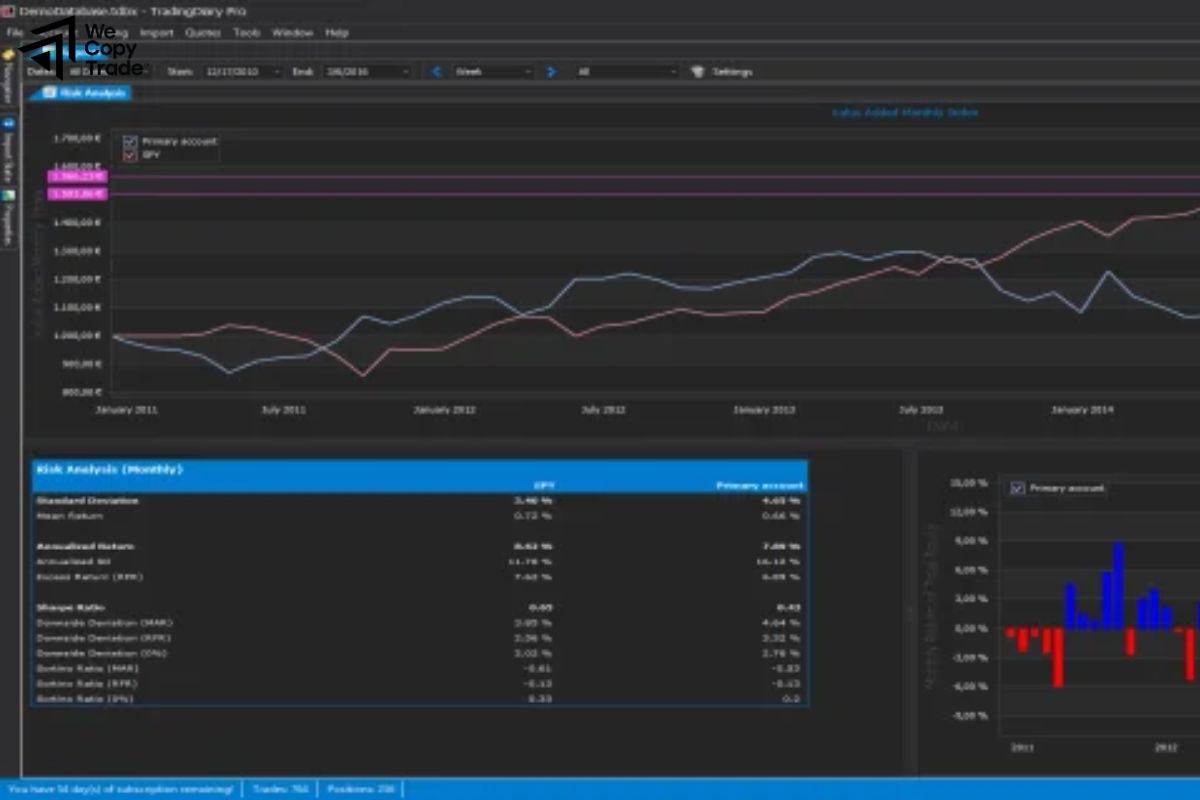

TradingDiary Pro is a powerful desktop-based trading journal designed for serious traders. It allows you to track various trading strategies, performance metrics, and analyze your trades in detail.

- Real-time trade tracking and automatic import from broker accounts.

- Advanced reporting and performance metrics.

- Customizable categories for different trade types.

- Tax reporting and P&L tracking.

TradeLog

TradeLog is a trading journal specifically designed for tax reporting and performance tracking, especially for active traders. It helps automate tax calculations and generates detailed reports for your trades.

- Automatic trade import and tax calculations.

- Detailed P&L tracking and performance breakdown.

- Integration with brokers and trading platforms.

- Report generation for tax filing purposes.

Zerodha Varsity

While primarily an educational platform, Zerodha’s Varsity offers tools that can act as a trading journal, with a strong emphasis on strategy and trade analysis. It helps you track trades and evaluate your learning process.

- Learning-focused with trade tracking features.

- Easy-to-understand performance analysis.

- Helpful for beginners learning trading strategies.

Example of a Sample Trading Journal

Here’s a single sample trading journal entry:

Trade #1: EUR/USD – Forex Trade

- Date: November 26, 2024

- Time: 10:30 AM (GMT)

- Asset Traded: EUR/USD (Euro/US Dollar)

- Trade Size: 1 standard lot (100,000 units)

- Entry Point: 1.0650

- Exit Point: 1.0700

- Profit/Loss: +50 pips / $500 profit

Strategy Used:

- Breakout Strategy – Entered after the price broke through the resistance level at 1.0650.

Emotions:

- Before the Trade: Confident, felt the setup was solid based on price action and volume.

- During the Trade: Calm but slightly cautious as the price approached resistance.

- After the Trade: Satisfied with the outcome, as the plan executed well.

Conclusion

In conclusion, maintaining a trading journal is an essential practice for any trader looking to improve their performance, refine strategies, and build a disciplined approach to trading. Whether you’re a beginner or an experienced trader, using a trading system can significantly enhance your trading. Start tracking your trades today and watch your trading skills grow. Ready to take control of your trading success? Begin your trading now and make every trade a step toward better performance!

See more: