Are you looking to understand the role of the National Futures Association in the world of futures trading? Stay ahead of the curve by learning about NFA regulations, compliance, and membership benefits. Whether you’re a trader or an investor, knowing the NFA standards can help you make informed decisions. Explore more now and ensure you’re following industry best practices!

What is the NFA?

The National Futures Association NFA is a self-regulatory organization in the United States that oversees the derivatives markets, including futures, forex, and swaps. It was established in 1982 with the mission of protecting market participants and ensuring the integrity of the financial markets. The National Futures Association operates independently, although it works under the oversight of the Commodity Futures Trading Commission (CFTC), a U.S. government agency that regulates these markets.

See now:

- Resolving Brokers Disputes Process with the CySEC licensed

- Top 5 most reputable Forex brokers with ASIC Licenses

- Top 10 Forex brokers with FCA license – License lookup guide

Responsibilities of the National Futures Association

The National Futures Association is responsible for ensuring integrity in the U.S. derivatives markets. Its main duties include:

- Registration and Compliance: All futures, forex, and swaps market participants must register and adhere to strict standards.

- Regulation and Enforcement: The NFA enforces rules to prevent fraud, conducts audits, investigates misconduct, and disciplines violators.

- Investor Protection: The National Futures Association provides education, fraud alerts, and a database to verify brokers’ and firms’ backgrounds.

- Dispute Resolution: It offers arbitration services to fairly resolve disputes between investors and National Futures Association members.

Who does the NFA regulate?

The National Futures Association regulates individuals and firms involved in the U.S. derivatives markets, which includes futures, forex, and certain types of swaps. As a self-regulatory organization authorized by the Commodity Futures Trading Commission (CFTC), the NFA ensures that participants in these markets adhere to high standards of professional conduct, transparency, and financial responsibility.

The entities and individuals regulated by the NFA include:

- Futures Commission Merchants (FCMs) – Brokers that accept or solicit orders for futures and options on futures, handling customer funds.

- Introducing Brokers (IBs) – Firms or individuals that solicit orders for futures and forex without holding customer funds.

- Commodity Pool Operators (CPOs) – Managers who pool investor funds for investment in futures and related instruments.

- Commodity Trading Advisors (CTAs) – Individuals or firms that provide advice on trading futures and forex.

- Swap Dealers and Major Swap Participants – Entities involved in swap transactions, particularly those that could impact the stability of the U.S. financial system.

NFA licensed brokers

National Futures Association licensed brokers are firms that are registered and regulated by the NFA, meaning they adhere to strict standards for conducting business in the futures, forex, and other derivatives markets. These brokers are required to comply with National Futures Association rules, ensuring fair and transparent trading practices, customer protection, and sound financial management.

Here are a few well-known brokers that are NFA licensed:

TD Ameritrade (Thinkorswim)

- Known for its user-friendly trading platform and offering futures, forex, and other investment products.

Interactive Brokers

- Offers a wide range of investment products, including futures and forex, to institutional and individual traders.

E*TRADE

- A broker that offers access to a variety of asset classes, including futures and forex, with a strong focus on online trading.

NinjaTrader

- Specializes in providing futures and forex trading platforms, with advanced charting and analysis tools.

Forex.com

- A leading retail forex broker in the U.S., offering a variety of forex and futures trading services.

Charles Schwab

- Offers futures trading via its StreetSmart Edge platform and is regulated by the NFA.

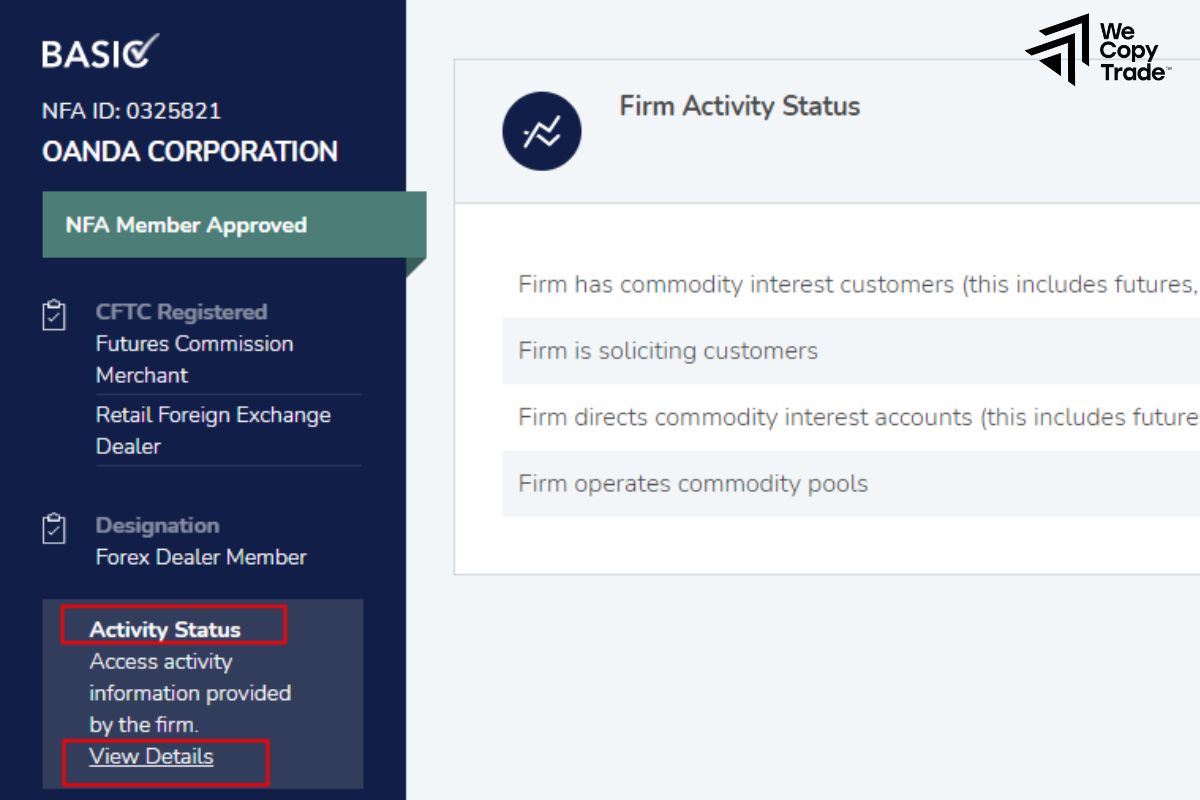

OANDA

- A well-established broker that offers forex trading and is National Futures Association-registered.

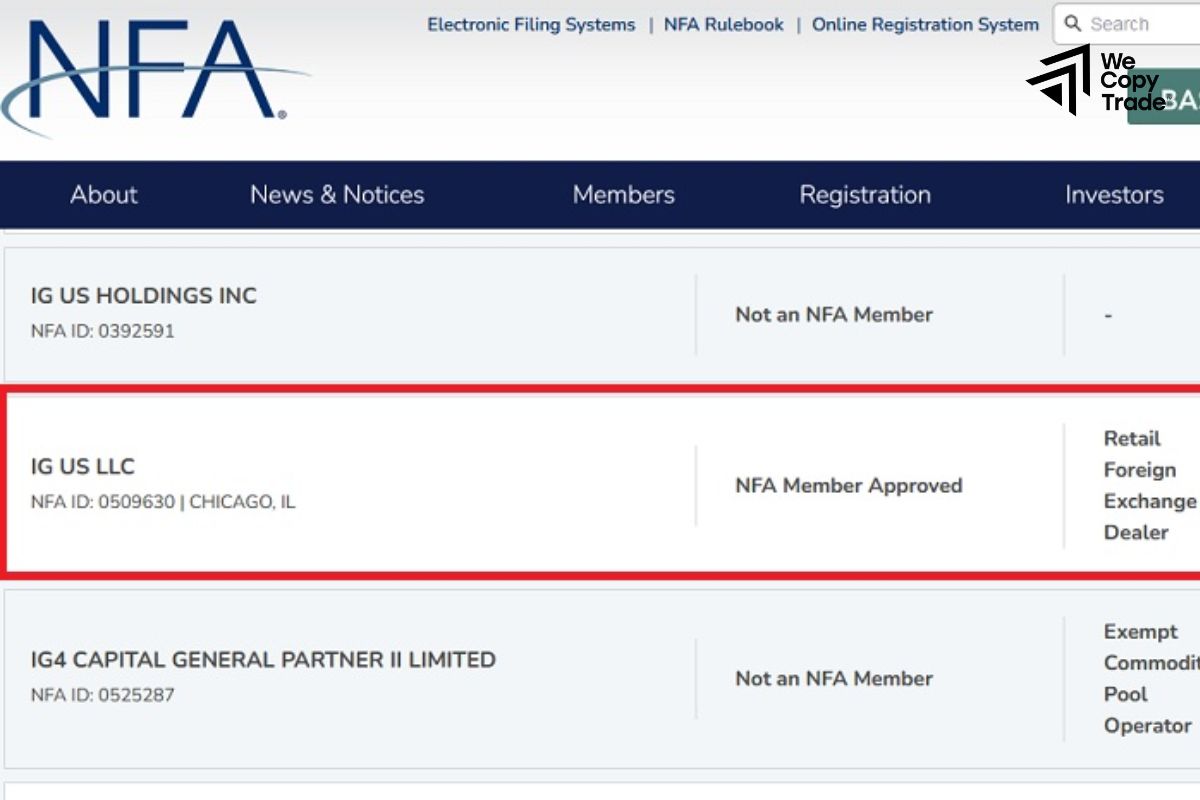

IG US

- Provides access to a range of markets, including forex and futures, and is regulated by the National Futures Association.

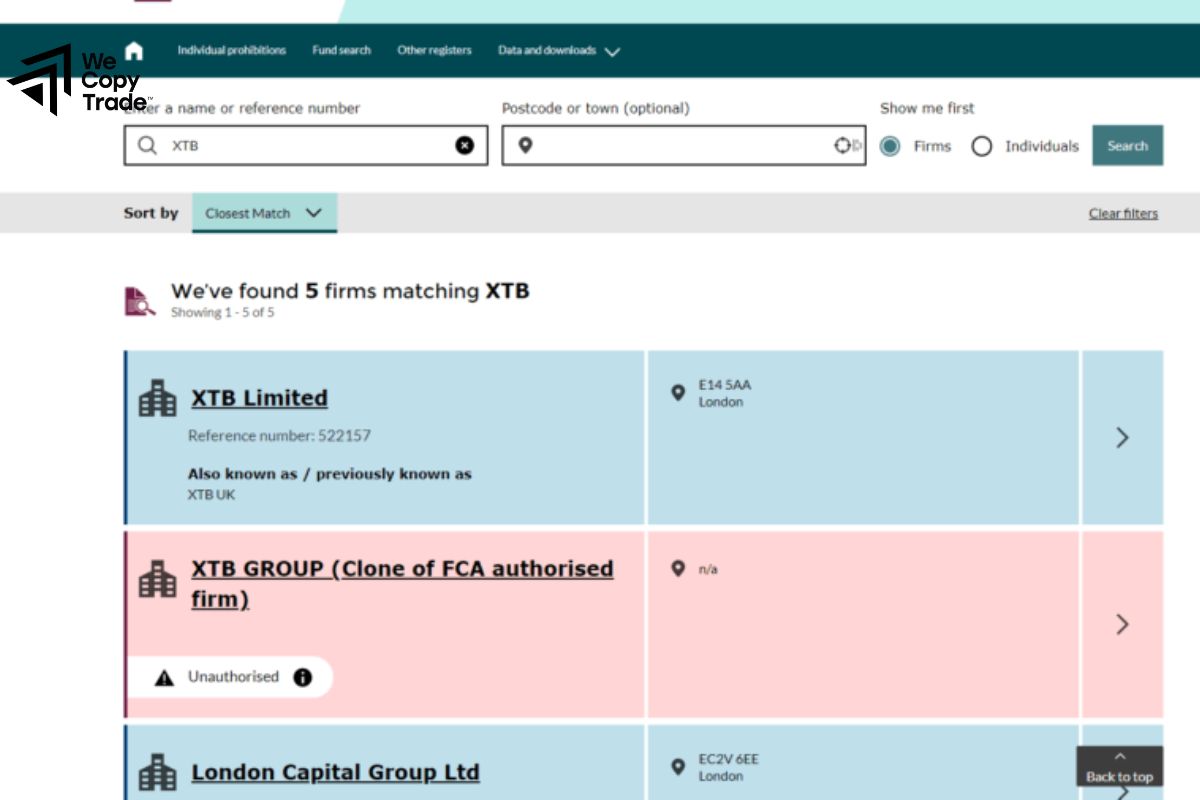

How to check if an environment is NFA licensed or not?

To check if an environment or a broker is NFA licensed (registered and regulated by the National Futures Association), you can use the Background Affiliation Status Information Center tool. Here’s how to do it:

Steps to Check National Futures Association License Status:

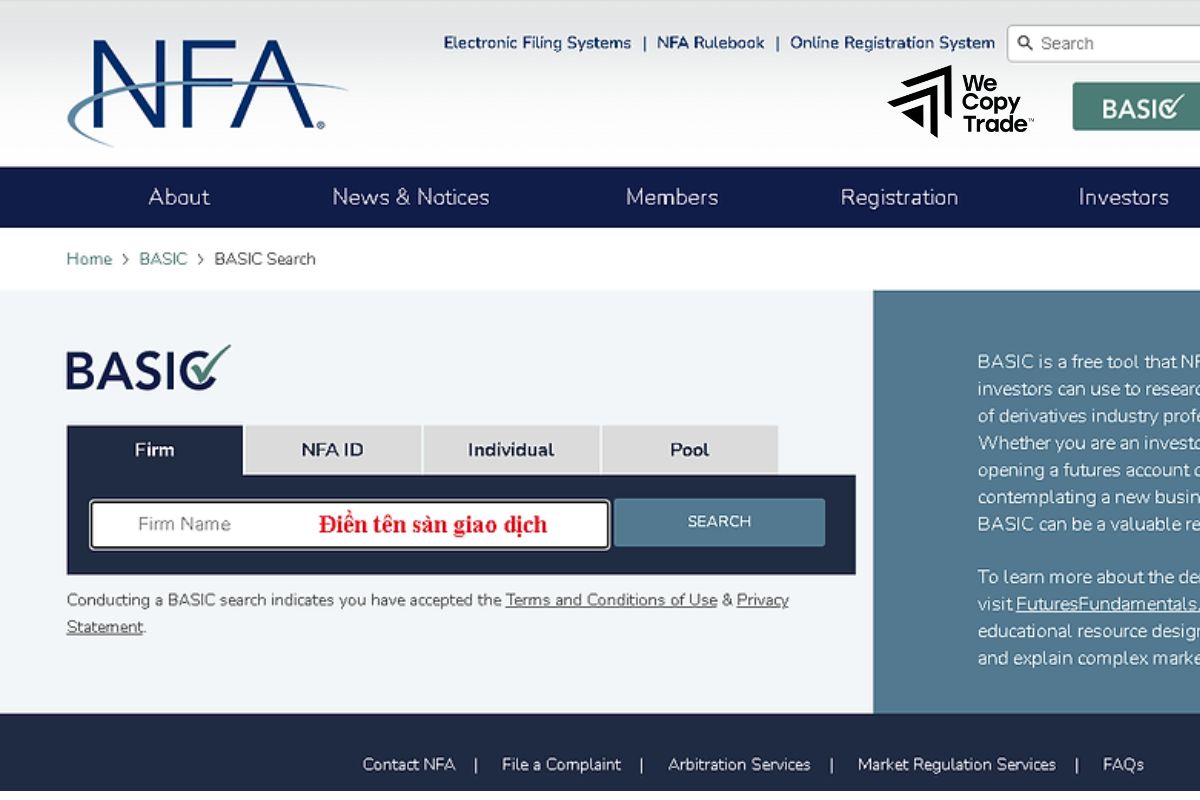

Step 1: Go to the NFA’s BASIC Database

- Visit the National Futures Association BASIC website: NFA BASIC Search.

Step 2: Search by Broker/Entity Name

- Enter the broker’s name or firm name in the search bar. You can also search by the NFA ID number if you have it.

Step 3: Search by Individual

- If you are checking an individual, enter their name or NFA ID number.

Step 4: Review the Results

The search will show detailed information about the entity or individual, including:

- Registration status (active or inactive).

- License type (e.g., futures commission merchant, commodity pool operator, etc.).

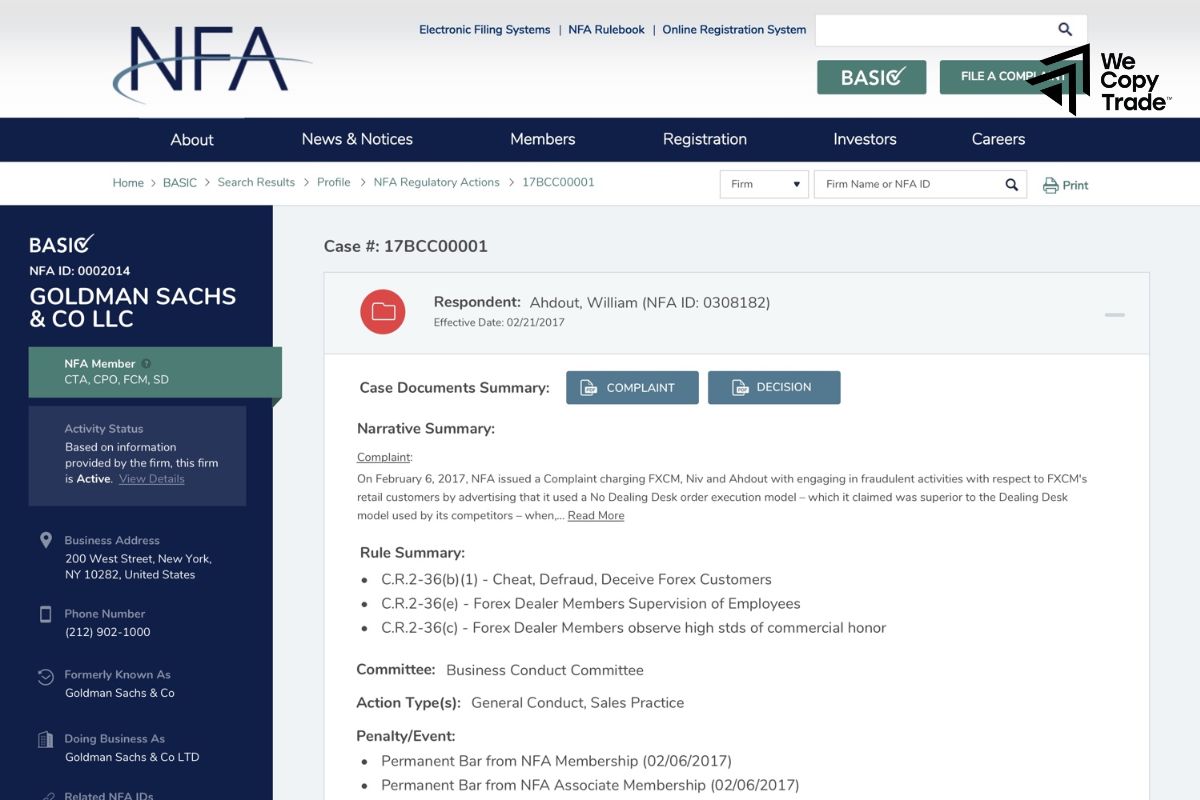

- Disciplinary history (if any).

- Current or past affiliations (which firms they’ve worked with).

Step 5: Verify the Registration

- If the broker or entity is NFA-licensed, it will appear in the search results, confirming their registration. If they are not registered, you will receive a notification that they are not found in the database.

Step 6: Check for Specific Permissions

- In some cases, brokers or firms may have specific regulatory permissions. You can check this in the registration details to ensure the entity is allowed to offer the services you’re interested in.

How many members are in the NFA?

As of recent reports, the National Futures Association has over 4,000 members. This includes a wide range of entities involved in the U.S. derivatives markets, such as:

- Futures Commission Merchants (FCMs)

- Introducing Brokers (IBs)

- Commodity Pool Operators (CPOs)

- Commodity Trading Advisors (CTAs)

- Retail Foreign Exchange Dealers (RFEDs)

- Swap Dealers

- Major Swap Participants

These members operate in various segments of the financial markets, particularly in futures, forex, and commodities trading. The NFA plays a vital role in ensuring that its members adhere to industry regulations and maintain a high standard of transparency, customer protection, and financial integrity.

The membership size fluctuates slightly, as some firms may join or leave the National Futures Association based on their business activities or regulatory compliance status. You can find the most up-to-date member statistics on the NFA‘s official website or by contacting the organization directly.

Conclusion

In conclusion, ensuring that your broker or trading platform is NFA-licensed is crucial for your safety and confidence in the financial markets. The National Futures Association plays a vital role in maintaining high standards of integrity, transparency, and customer protection in the derivatives industry. Start your journey with confidence by checking their registration on the BASIC database now!

See more: