Are you looking to enhance your investment strategy and minimize risks? Understanding the 1% or 2% Rule can be a game-changer for your financial journey. This simple yet effective guideline helps investors determine how much to risk on each trade or investment, allowing for better money management and a more secure portfolio. Whether you’re a seasoned trader or just starting, mastering this rule is essential for long-term success.

What is the 1% or 2% Rule?

The 1% or 2% Rule is a popular guideline in trading and investing that helps individuals manage risk effectively. Here’s a breakdown of what it entails:

- 1% Rule: This rule suggests that an investor should not risk more than 1% of their total trading capital on a single trade. For example, if you have a trading account with $10,000, you would limit your potential loss to $100 (1% of $10,000) on any individual trade.

- 2% Rule: Similarly, the 2% Rule allows for a slightly higher risk, recommending that no more than 2% of your total capital should be risked on a single trade. Using the same account example, this would mean a maximum risk of $200 per trade.

See now:

- What is Capital Management? Strategies You Need to Know

- How to Choose The Best Financial Risk Management Software

- All Processes of Portfolio Management Most Effective

- What is Hedging? How to hedge in stock investment

Types 1% or 2% Rule in Trading

In trading, the 1% and 2% Rules refer to guidelines that help traders manage their risk exposure. While these rules primarily focus on how much capital to risk on individual trades, they can be applied in various contexts. Here are some common types and interpretations of the 1% and 2% Rules in trading:

Risk Per Trade

- 1% Rule: Limit the amount of capital at risk on a single trade to 1% of your total trading account. For instance, if your account balance is $10,000, you would risk no more than $100 on one trade.

- 2% Rule: Increase the risk threshold to 2% of your total account. In the same scenario, you could risk up to $200 on a trade.

Portfolio Diversification

- Single Asset Risk: The 1% or 2% Rule can guide how much to invest in a single asset or position, ensuring that no single investment significantly impacts the overall portfolio.

- Sector Allocation: Traders can apply these rules across different sectors to limit exposure to any particular sector, maintaining a balanced portfolio.

Stop-Loss Placement

- Stop-Loss Calculation: These rules help determine where to place stop-loss orders. For example, if risking $100 (1% Rule), a trader will set a stop-loss at a price that limits losses to that amount based on the position size.

- Dynamic Adjustments: As market conditions change, traders can adjust their stop-loss levels while adhering to their 1% or 2% risk thresholds.

Position Sizing

- Calculating Position Size: Traders use the 1% and 2% Rules to calculate the number of shares or contracts to purchase based on their risk tolerance and the distance between the entry point and stop-loss.

- Risk-to-Reward Ratios: Traders can combine these rules with risk-to-reward ratios to ensure that potential rewards justify the risks taken on each trade.

Trading Strategy Implementation

- Strategy Evaluation: When developing or evaluating trading strategies, the 1% and 2% Rules can serve as benchmarks for testing how the strategy performs under different risk scenarios.

- Consistent Approach: Using these rules helps maintain a consistent risk management approach, regardless of the trading strategy employed.

Psychological Factors

- Emotional Control: By capping losses at a fixed percentage, traders can manage their emotional responses to losing trades, which helps in maintaining discipline.

- Building Confidence: Adhering to these rules can enhance a trader’s confidence, knowing they have a structured plan to protect their capital.

Gross Rent Multiplier the 1% and 2% Rule

The Gross Rent Multiplier (GRM) and the 1% and 2% rules are valuable tools in real estate investing. They help investors quickly evaluate potential rental properties. Here’s a breakdown of each concept:

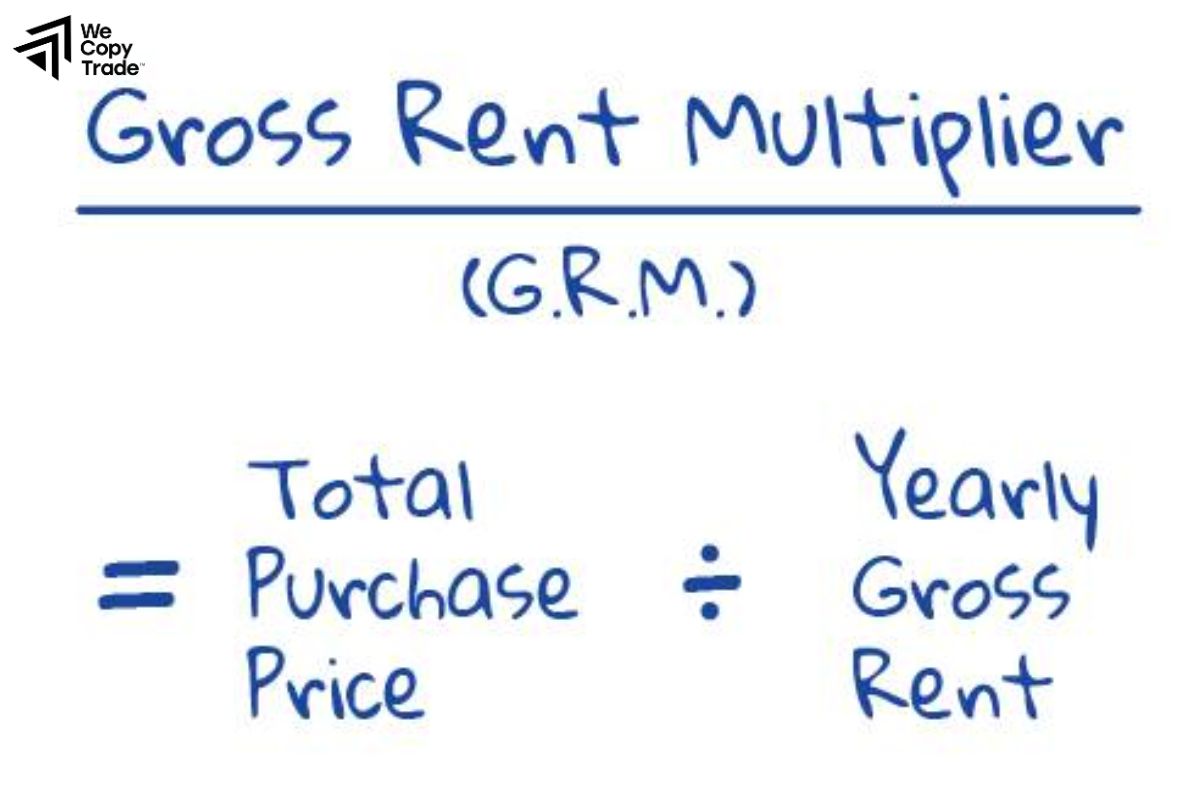

Gross Rent Multiplier (GRM)

A metric used to assess the value of rental properties by comparing purchase price to gross annual rental income.

GRM = Property Price / Gross Annual Rent

A lower GRM indicates a better investment. It helps investors compare properties quickly.

The 1% Rule

A guideline stating that monthly rent should be at least 1% of the property’s purchase price.

Formula:

Minimum Monthly Rent = 0.01 × Purchase Price

Helps ensure positive cash flow. For example, a $200,000 property should rent for at least $2,000/month.

The 2% Rule

An aggressive guideline suggesting that monthly rent should be at least 2% of the property’s purchase price.

Formula:

Minimum Monthly Rent = 0.02 × Purchase Price

Targets higher cash flow potential, useful in markets with better rental yields. For a $150,000 property, it should rent for at least $3,000/month.

What are the Pros and Cons of Using the 1% and 2% Rule?

Here are the pros and cons of using the 1% or 2% Rule in real estate investing:

Pros of the 1% or 2% Rule

1% Rule

- Quick Evaluation: Allows investors to quickly filter potential properties based on rental income relative to purchase price.

- Cash Flow Indicator: Ensures the property has the potential to generate positive cash flow, which is crucial for long-term investment success.

- Simplicity: Easy to calculate and understand, making it accessible for both novice and experienced investors.

2% Rule

- Higher Cash Flow Potential: Targets properties with greater cash flow, making it suitable for investors seeking significant returns.

- Market Flexibility: Useful in markets with lower property prices and higher rental yields, enabling investors to find lucrative deals.

- Aggressive Investment Strategy: Encourages investors to pursue high-yield properties that may provide substantial income.

Cons of the 1% or 2% Rule

1% Rule

- Market Variability: May not apply well in high-cost markets where achieving 1% is unrealistic, leading to missed opportunities.

- Doesn’t Account for Expenses: Ignores operating expenses, property management costs, and other factors that affect actual cash flow.

- Oversimplification: Can lead to poor investment decisions if used as the sole evaluation criterion, without considering other financial metrics.

2% Rule

- Stringent Criteria: May limit investment options, as many properties won’t meet the 2% threshold, particularly in competitive or high-value markets.

- Potentially Risky: Pursuing only high-yield properties may lead to investing in less desirable areas or properties with higher vacancy rates.

- Neglecting Quality: Focusing solely on rental income percentages can overshadow important factors like property condition, location, and long-term value appreciation.

Compare between 1% and 2% Rule

Here’s a comparison between the 1% or 2% Rule in real estate investing, highlighting their differences and similarities:

| Criteria | 1% Rule | 2% Rule |

| Definition | Rent ≥ 1% of the property’s purchase price. | Rent ≥ 2% of the property’s purchase price. |

| Cash Flow Potential | Moderate cash flow. | Higher cash flow potential. |

| Market Suitability | Broad applicability, including high-cost areas. | Best for lower-priced markets with higher yields. |

| Investment Approach | Conservative; ensures positive cash flow | Aggressive; seeks significant returns. |

| Risk Level | Generally lower risk. | Higher risk; may lead to less desirable areas. |

| Property Variety | More diverse property options. | Higher risk; may lead to less desirable areas. |

| Expense Consideration | Ignore operating expenses. | Also ignores operating expenses. |

Conclusion

In conclusion, both the 1% or 2% Rule are invaluable tools for real estate investors looking to evaluate potential rental properties quickly. While the 1% Rule offers a conservative approach suitable for a broader range of markets, the 2% Rule targets higher cash flow opportunities, ideal for investors willing to take on more risk. Are you ready to dive deeper into real estate investing? Explore more strategies and insights to maximize your returns today!

See more: