Swing trading is a popular strategy that allows traders to capitalize on short- to medium-term market movements. By focusing on price swings within a trend, swing traders aim to enter positions at the right time and maximize their profits. Are you ready to take advantage of market swings? Learn the ins and outs of swing trading, develop your strategy, and start making informed trades today!

What is Swing Trading?

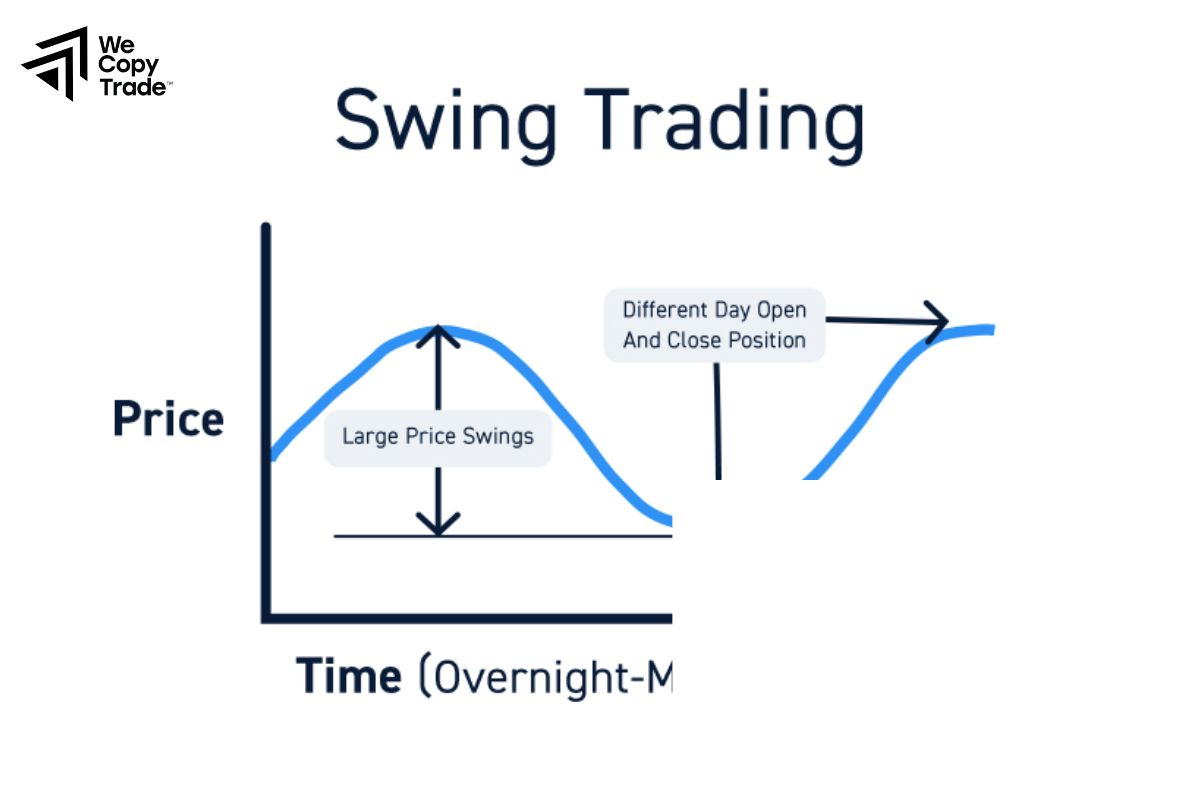

Swing trading is a type of trading strategy that focuses on profiting from short- to medium-term price movements in the market, typically over a period of several days to weeks. Unlike day trading, which involves buying and selling assets within a single trading day, swing traders hold positions for a longer duration to capture “swings” or fluctuations in the price of a security.

Key Characteristics of Swing Trading:

- Time Frame: Positions are held for a few days to weeks, making it a medium-term strategy.

- Goal: To profit from short-term price changes by buying low and selling high, or selling high and buying low.

- Technical Analysis: Swing traders rely heavily on technical analysis, using tools like chart patterns, trend lines, moving averages, and indicators (e.g., RSI, MACD) to identify potential entry and exit points.

- Market Conditions: This strategy works best in markets that have moderate volatility, where price swings are frequent and predictable.

- Risk Management: Since the positions are held for longer periods, swing traders use stop-loss orders and other risk management techniques to protect against significant losses.

See more:

- What is Day Trading? How to use Day Trading effectively

- Top 6 Simple Scalping Trading Strategies When Doing It

- What Is a Forex Broker? Role of Brokers in Forex Trading

- Top Reliable Forex Brokers – How To Choose a Broker

4 Methods to Use Swing Trading Effectively in Forex

Swing trading in the forex market can be a profitable strategy when executed correctly. Here are 4 effective methods for using swing in forex:

Use Technical Indicators

- Moving Averages: Identify trends by checking if the price is above or below key moving averages.

- RSI: Enter trades when the market is overbought (above 70) or oversold (below 30).

- MACD: Use crossovers to signal trend changes and entry points.

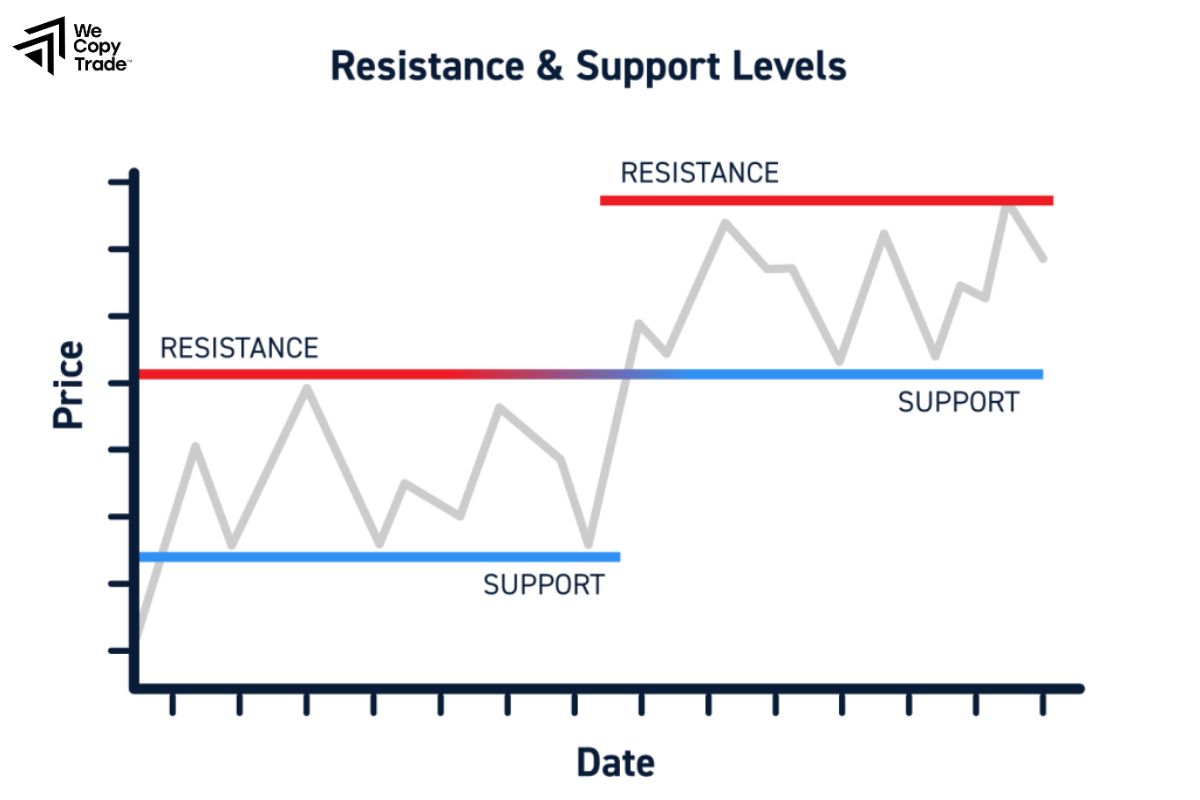

Identify Support and Resistance Levels

- Look for price reversals at support (buy) or resistance (sell) zones.

- Use Fibonacci retracement to spot potential reversal areas during pullbacks.

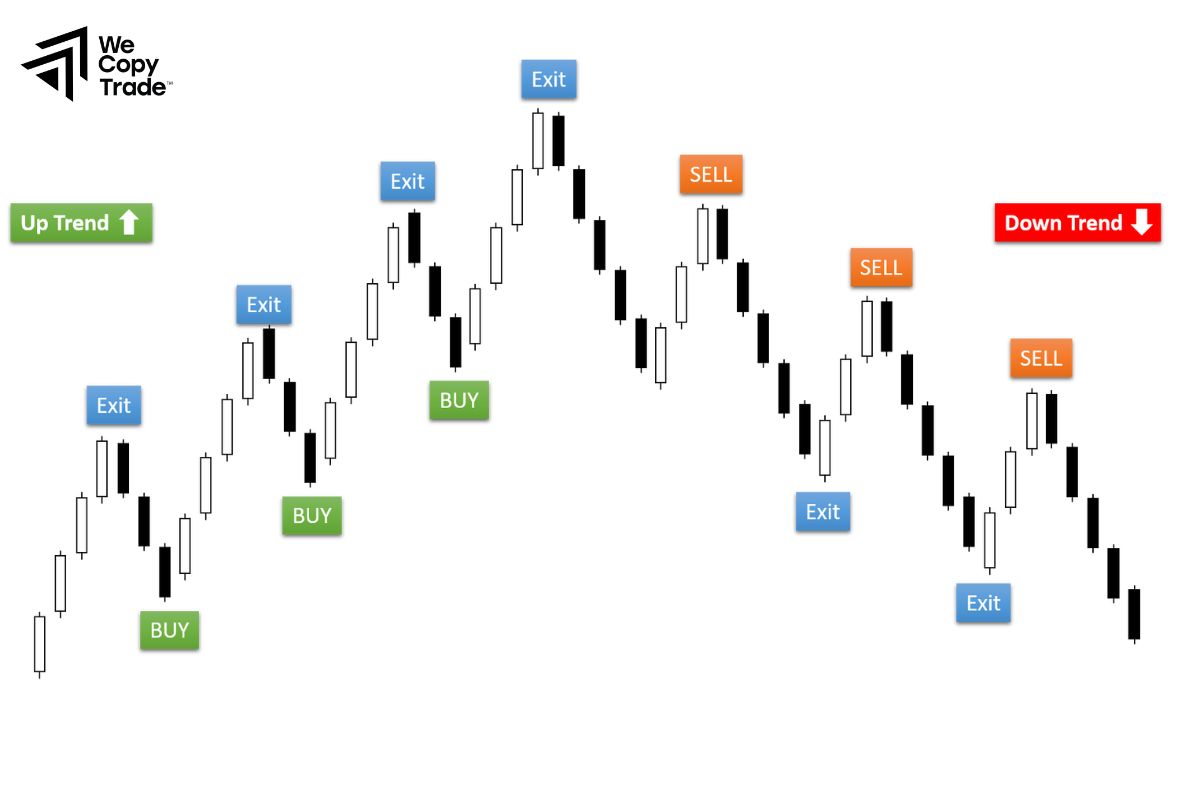

Follow the Trend with Price Action

- Trade in the direction of the trend, entering during pullbacks.

- Look for candlestick patterns (like engulfing or pin bars) to confirm entry signals.

Risk Management

- Set stop-loss orders beyond key levels to limit losses.

- Use position sizing to manage risk, typically risking 1-2% per trade.

Technical Analysis Tools in Swing Trading

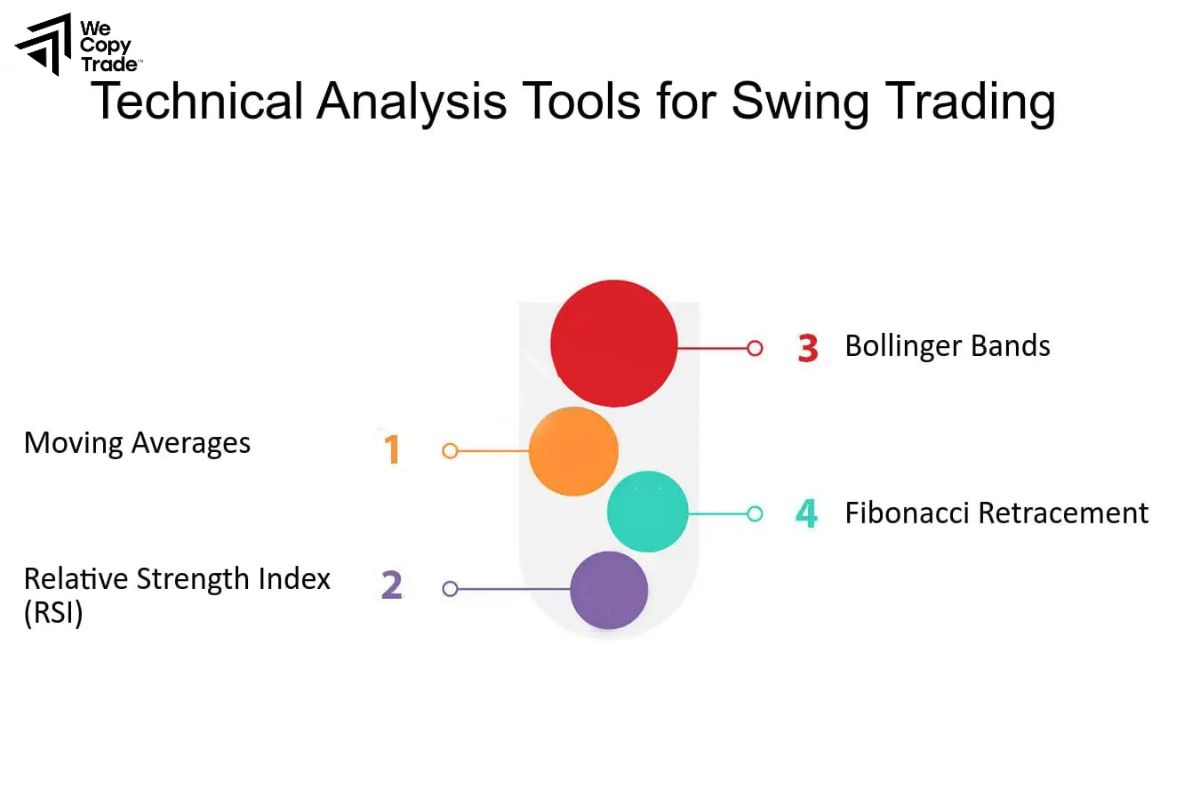

In swing trading, technical analysis tools are essential for identifying entry and exit points. Here are some of the key tools used by swing traders:

Moving Averages

- Simple Moving Average (SMA): Helps identify the overall trend by smoothing out price data over a specified period.

- Exponential Moving Average (EMA): More responsive to recent price changes, making it useful for spotting trend reversals.

Relative Strength Index (RSI)

- Measures overbought or oversold conditions. An RSI above 70 suggests overbought (potential sell), while below 30 suggests oversold (potential buy).

MACD (Moving Average Convergence Divergence)

- Shows momentum and trend changes. Traders use MACD crossovers (when the MACD line crosses above or below the signal line) to identify buy or sell signals.

Support and Resistance Levels

- Horizontal levels where price tends to reverse. Swing traders use these levels to enter at support (buy) and sell at resistance (sell).

Candlestick Patterns

- Patterns like engulfing candles, doji, and pin bars can signal potential trend reversals or continuation patterns.

Fibonacci Retracement

- A tool used to find potential support and resistance levels during a trend pullback. Common levels include 38.2%, 50%, and 61.8%.

Trend Lines and Channels

- Trend lines help visualize the direction of the market, and channels (parallel lines) identify price movement within a range, helping traders spot entries during pullbacks.

Swing Trading Strategy for Beginners

Here’s a simple swing trading strategy for beginners:

Step 1: Identify the Market Trend

- To determine if the market is in an uptrend or downtrend, just look at the 200-period Moving Average (MA). If the price is above the MA, it’s an uptrend; if below, it’s a downtrend.

Step 2: Find Entry Points

- When the price shows signs of reversal at support or resistance levels, it’s time to enter. Use the RSI indicator: If RSI is below 30 (oversold), consider buying; if above 70 (overbought), consider selling.

Step 3: Manage Risk

- Place a stop-loss just below the support level (for buy orders) or above the resistance level (for sell orders) to protect your account. If the price moves in your favor, you can take profit when it reaches the take-profit level.

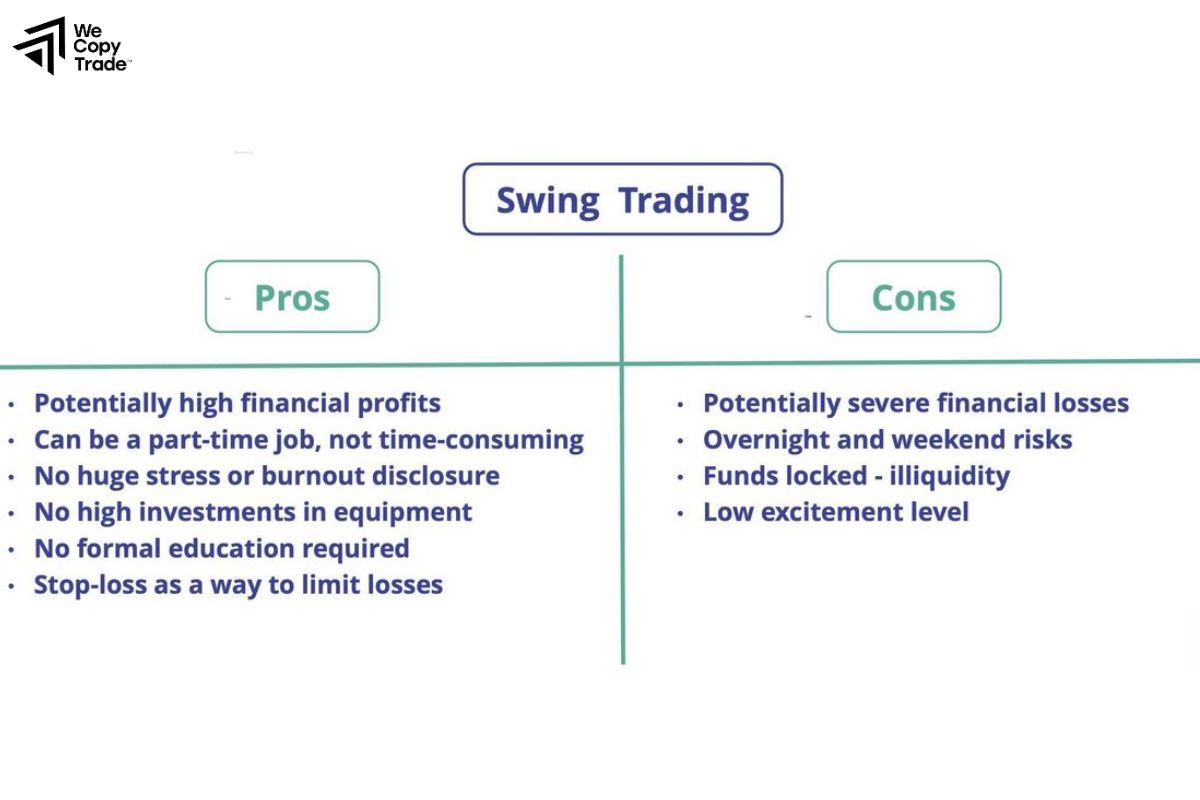

Advantages and Disadvantages of Swing Trading

Here are the key advantages and disadvantages of swing trading:

Advantages of Swing Trading

- Unlike day trading, swing trading doesn’t require constant monitoring, allowing you to trade part-time while holding positions for several days to weeks.

- Swing trading aims to capture larger price movements over days or weeks, which can result in higher profits compared to quick, small trades in day trading.

- Swing trading can be applied to various markets, including stocks, forex, and commodities, making it a versatile strategy.

Disadvantages of Swing Trading

- Holding positions overnight or for several days exposes traders to risks from unexpected market events, news, or economic data.

- Successful swing trading relies heavily on understanding technical indicators, chart patterns, and market trends, which can be challenging for beginners.

- Watching price fluctuations over several days can cause emotional stress, leading to impulsive decisions if not managed properly.

Differences Between Swing Trading and Other Trading Methods

Here’s a concise table summarizing the differences between swing trading and other trading methods:

| Aspect | Swing Trading | Day Trading | Scalping | Position Trading | Investing |

| Timeframe | Days to weeks | Within a single day | Seconds to minutes | Months to years | Years to decades |

| Trade Frequency | Moderate | High | Very High | Low | Very Low |

| Focus | Technical analysis, momentum | Quick market changes | Tiny price movements | Long-term trends, fundamentals | Long-term fundamentals |

| Monitoring | Moderate | Constant | Constant | Minimal | Minimal |

| Risk Exposure | Overnight & weekend risks | No overnight risks | No overnight risks | Long-term exposure | Long-term exposure |

| Profit Target | Larger moves, medium-term | Small, quick gains | Tiny, frequent gains | Large, long-term moves | Significant, long-term gains |

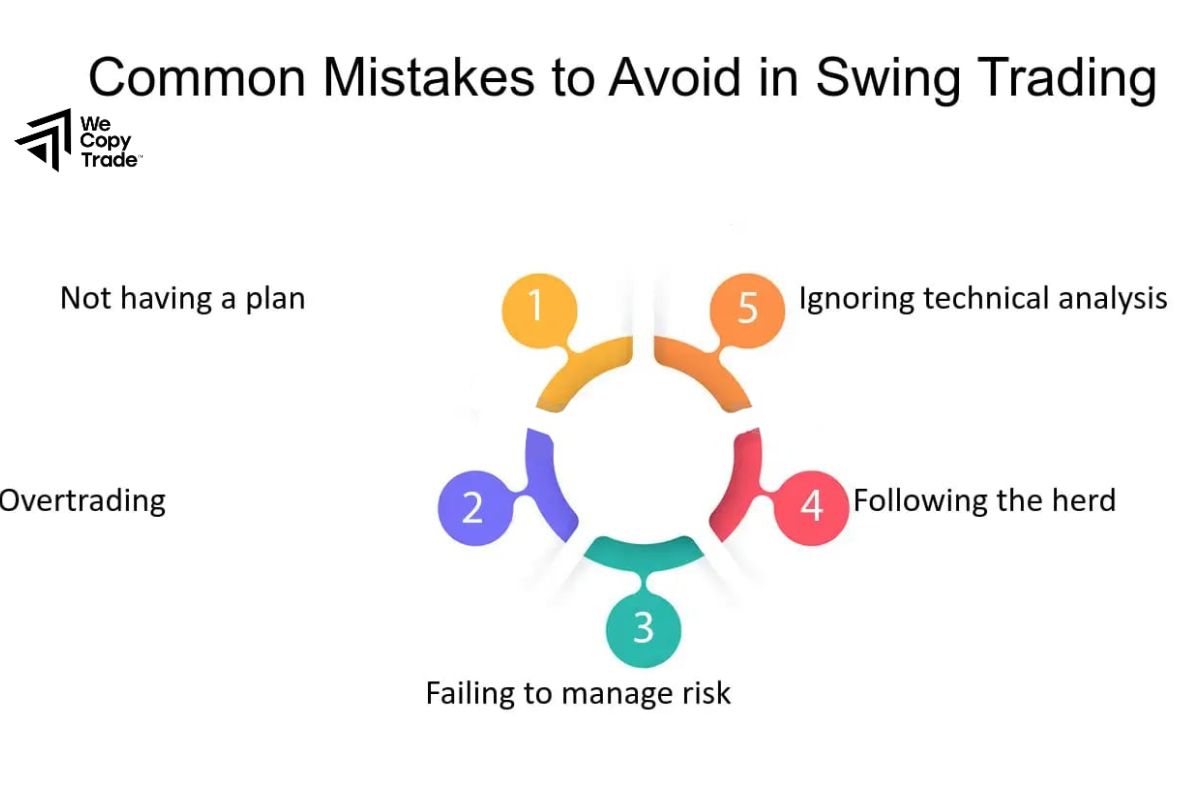

Common Mistakes When Applying Swing Trading

Here are some common mistakes traders make when applying swing trading:

- Ignoring the Trend: Entering trades against the overall market trend, leading to lower success rates. Always trade in the direction of the trend.

- Setting Tight Stop-Losses: Placing stop-loss orders too close to the entry point can result in getting stopped out by normal market fluctuations. Give trades enough room to breathe.

- Neglecting Risk Management: Failing to manage risk properly by not setting stop-losses or risking too much capital per trade can lead to significant losses. Stick to a risk management strategy.

- Ignoring Technical Analysis: Not paying attention to key indicators, support, and resistance levels can result in poorly timed entries and exits. Always use technical analysis to guide decisions.

- Holding Losing Trades Too Long: Refusing to cut losses in hopes of a market reversal can lead to larger losses. Be disciplined about exiting losing positions.

Conclusion

In conclusion, trading offers a balanced approach to capturing short- to medium-term gains, making it an ideal strategy for traders who want to capitalize on market trends without the intense demands of day trading. Whether you’re new or looking to refine your strategies, now is the perfect time to start learning and apply these tips to your trading routine. Ready to dive into the world of Swing Trading? Start trading smarter today and take advantage of those price swings to boost your profits!

See now: