Scalping is a popular trading strategy for those who want to make quick profits in a fast-paced market. It involves buying and selling assets within a short timeframe to capitalize on small price changes. If you’re looking to dive into Scalping, understanding the basics and using the right tools can make all the difference in your success. Ready to learn more? Explore our comprehensive guide to mastering strategies and boost your trading game now!

What is Scalping in Trading?

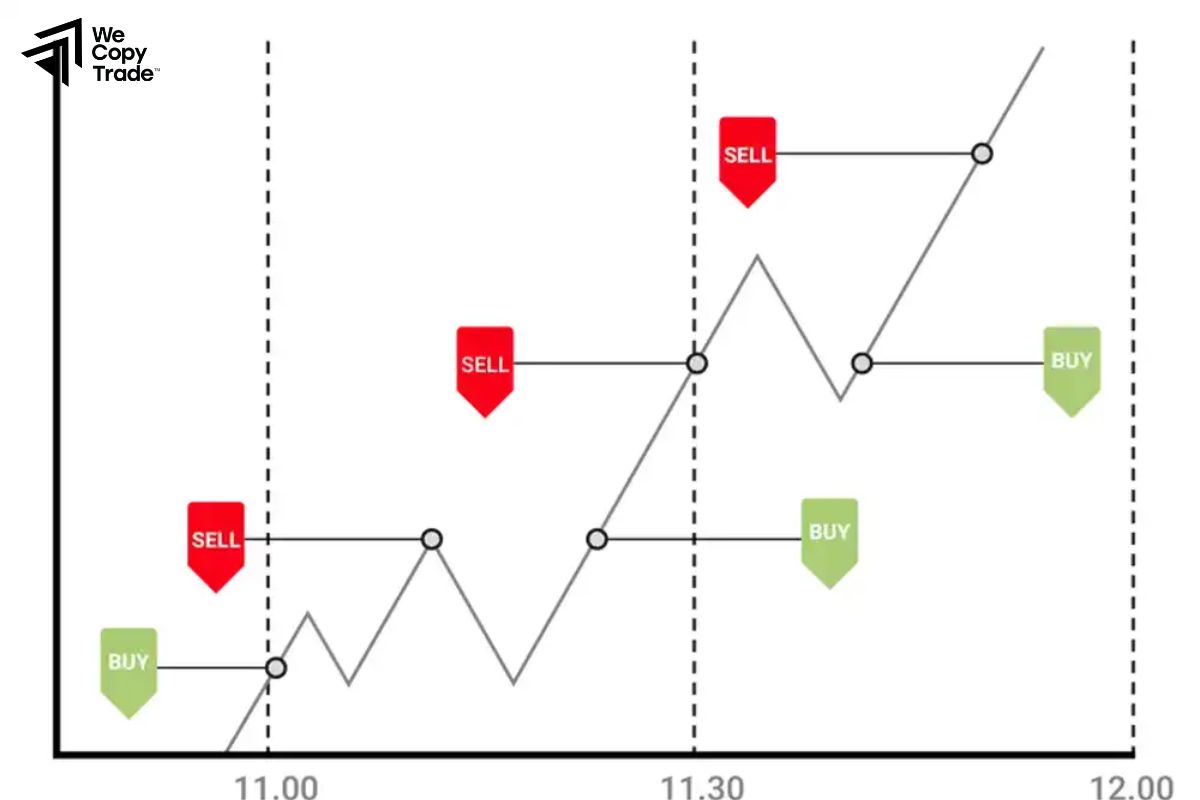

Scalping in Trading is a strategy that involves making quick, small profits by buying and selling financial instruments, such as stocks, currencies, or cryptocurrencies, within very short time frames. The goal is to capitalize on minor price fluctuations, often holding a position for just a few minutes or even seconds.

Scalpers aim to make multiple trades throughout the day, targeting small gains that add up to a significant profit over time. Because the strategy relies on speed and precision, often requires advanced trading tools, fast market analysis, and a solid understanding of technical indicators.

See now:

- What Is a Forex Broker? Role of Brokers in Forex Trading

- Top Reliable Forex Brokers – How To Choose a Broker

- Top 9 Best Crypto Payments Gateways for Business 2024

- What are eWallets? Top 5 Forex eWallets you should know

What You Need to Know Before Scalping?

Before diving into Scalping, here are key points to consider:

- Choose a Fast Platform: Look for low fees and rapid trade execution to handle the high volume of trades.

- Master Technical Analysis: Learn to read charts, use indicators like RSI and MACD, and understand short-term trends.

- Stick to a Plan: Set clear profit goals, strict stop-losses, and avoid emotional trading.

- Prepare for Intensity: It is fast-paced and stressful, requiring quick decisions and focus.

- Manage Risk: Use leverage carefully and keep trades small to control exposure.

6 Simple Scalping Trading Strategies

Here are 6 Simple Scalping Trading Strategies to help you get started:

Moving Average Scalping

- Use short-term moving averages like the 5 and 10-period to identify quick trends.

- Buy when the shorter moving average crosses above the longer one, and sell when it crosses below.

Breakout Strategy

- Focus on trading assets that break through support or resistance levels.

- Enter a trade when the price breaks above resistance or drops below support, aiming to capture momentum.

Bid-Ask Spread

- Take advantage of small fluctuations between the bid and ask prices.

- Buy at the bid price and sell at the ask price quickly for a small profit.

Bollinger Bands Strategy

- Use Bollinger Bands to identify overbought and oversold conditions.

- Buy when the price touches the lower band and sell when it hits the upper band.

Stochastic Oscillator Scalping

- Use the Stochastic Oscillator to spot potential reversals.

- Enter trades when the oscillator crosses from below 20 (oversold) or above 80 (overbought).

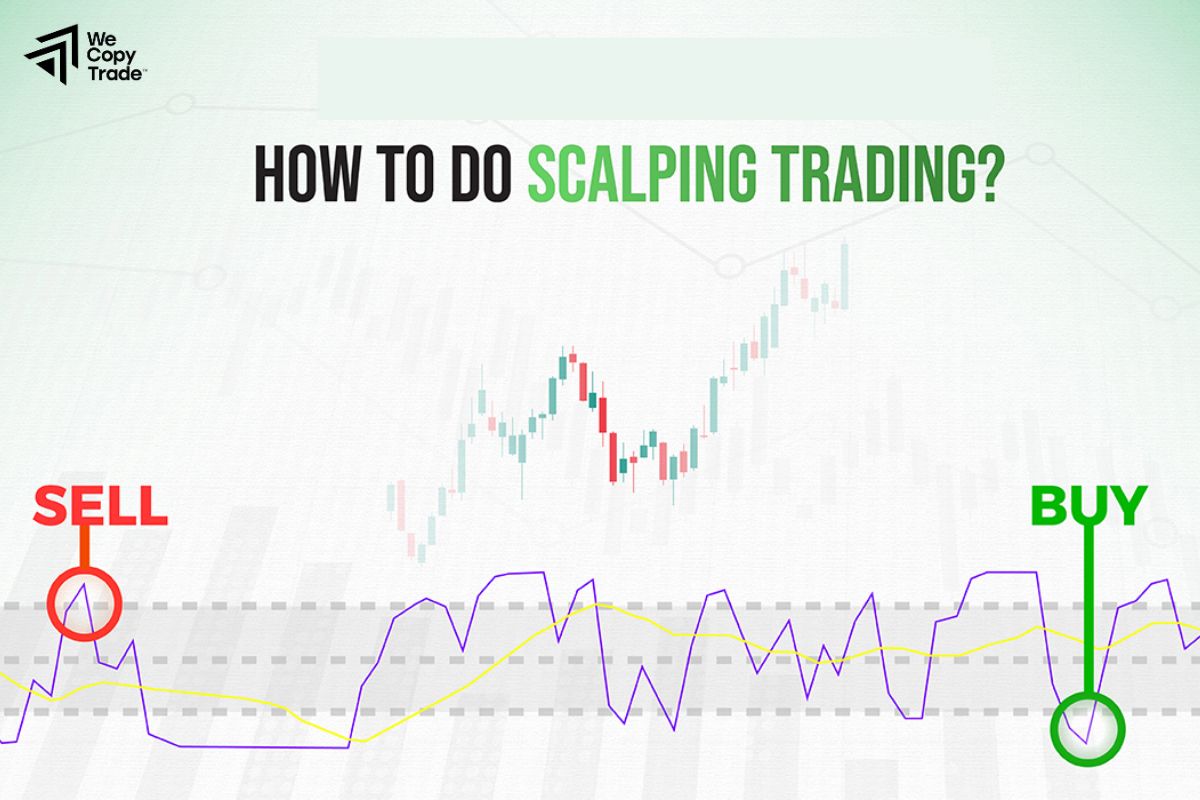

Trend Following with RSI

- Use the Relative Strength Index (RSI) to confirm trends.

- Enter trades in the direction of the trend when the RSI is above 50 (uptrend) or below 50 (downtrend).

Key Scalping Tools

Here are the main tools for Scalping trading:

Charting Platforms

- TradingView: Offers a variety of charting tools and technical indicators, easy to customize with real-time tracking.

- MetaTrader (MT4/MT5): Popular for its technical indicators and automated trading capabilities.

- ThinkorSwim: Advanced charting with short time frames suitable.

Technical Indicators

- Moving Averages (MA): Identifies trends and reversal points.

- Bollinger Bands: Detects volatility and price breakouts.

- RSI and Stochastic Oscillator: Evaluates overbought/oversold conditions.

Level 2 Data (Market Depth)

- Level 2 Quotes and Order Book: Display detailed buy/sell orders, helping to identify order flow and market sentiment.

Fast Order Execution Platforms

- cTrader and Lightspeed Trader: Fast execution speed, ideal.

- Interactive Brokers: Direct market access with a variety of order types.

News and Economic Calendars

- Forex Factory and Bloomberg Terminal: Provide real-time news and economic events.

How to Start Scalping Today?

Here are 4 basic steps to start scalping:

Step 1: Choose the Right Market and Platform

- Select a highly liquid market Forex, major stocks, cryptocurrencies.

- Choose a fast execution platform like MetaTrader or cTrader with low transaction costs and quick order execution.

Step 2: Use Technical Analysis Tools

- Use short time frames (1-5 minutes) to track small price movements.

- Common indicators: Moving Averages, RSI, Bollinger Bands to identify entry and exit points.

Step 3: Create a Trading Plan

- Risk management: Use tight stop-loss orders and set specific profit targets for each trade.

- Adjust position sizing based on your account and risk level.

Step 4: Practice and Review

- Practice with a demo account to get familiar with the strategy and execute trades quickly.

- Keep a trading journal to analyze and improve your strategy over time.

Pros and Cons of Scalping

Pros of Scalping

- Quick Profits: Scalping allows traders to make multiple trades in a short time, potentially earning small profits with each trade. This can add up to significant gains throughout the day.

- Lower Exposure to Market Risk: Since scalpers typically hold positions for only a few seconds or minutes, they are less exposed to market risks from longer-term trends or unexpected news events.

- Less Emotional Stress: Scalpers can avoid the stress of holding positions overnight or through major price swings, as trades are closed quickly, reducing the emotional impact.

- Profit from Small Price Movements: Scalpers can profit from even small price movements, which can be especially beneficial in markets with low volatility or during quiet market conditions.

Cons of Scalping

- High Transaction Costs: Frequent trading leads to high transaction costs, including spreads, commissions, and fees. These can eat into profits, especially if the broker doesn’t offer low-cost options.

- Limited Profit per Trade: Scalping typically results in small profits per trade. While they can add up over time, the overall profit per trade is much smaller compared to longer-term strategies.

- High Stress and Pressure: It requires quick decision-making and precise execution. The pressure to make the right choice in such a short time can lead to stress, especially for less experienced traders.

- Risk of Overtrading: The fast-paced nature can lead to overtrading, where traders may take excessive positions in an attempt to capture more profits, potentially resulting in significant losses.

Conclusion

In conclusion, scalping can be a highly effective trading strategy for those who are ready to commit time, discipline, and focus to achieve quick, consistent profits. By choosing the right market, using technical analysis tools, and practicing sound risk management, you can unlock the potential to enhance your trading success. If you’re ready to dive into the fast-paced world of scalping, start by educating yourself, testing strategies, and refining your skills.

See more: