Are you confused about whether to choose the market execution or the instant execution? Actually, both have their own advantages and disadvantages. I think you should choose them based on their suitability for your trading purposes instead of choosing which trading method is the best. Let’s find out their advantages and disadvantages to make your best decision!

What is Market Execution?

Market execution is a trading method that occurs when you place a market order, which is a request to your broker to buy or sell a financial asset immediately at the market’s best price. You simply specify the amount of the asset you want to trade (volume), and the price is determined by the market, regardless of whether that price is higher or lower than the price you see on your screen.

Since prices are always fluctuating, there is no way to guarantee that your order will be executed exactly at the price you want. It is possible that the price changes immediately after you place your order, resulting in your order being filled at a higher (if you buy) or lower (if you sell) price than you expected. This phenomenon is called “slippage”.

Suppose you’re interested in buying EUR/USD. When you click the “Buy” button on the trading platform, the current price is 1.21705/1.21735 (bid/ask). However, while the system is processing your order, the price may change to 1.21719/1.21740. Your order will be automatically filled at the new ask price of 1.21740, meaning you will buy EUR/USD at a slightly higher price than the price you saw initially.

See now:

- Tips Simplify Your Financial Risks Management Process

- Financial Risk Assessment, Identification and Management

- What is interest rate risk? How to manage interest rates

- Some Steps to Successful Liquidity Risk Management 2024

When should we use Market Execution?

Market orders are the perfect choice for traders who want to quickly seize profitable opportunities in the market, especially during times of high market volatility, thanks to the ability to:

- Market orders allow you to execute trades immediately, without being delayed by confirmation steps, helping you capture fleeting market opportunities.

- You can open and close positions whenever you want, helping you make the most of short-term price fluctuations.

- In volatile markets, where prices change rapidly, market orders allow you to quickly adjust your trading strategy.

Pros and Cons of Market Execution

Here are the pros and cons of market orders to keep in mind to avoid and maximize your investment success:

Pros of Market Execution

- Your order will be executed almost instantly (usually within seconds), helping you not miss any opportunities in the market, especially during times of high volatility.

- Seize market opportunities immediately thanks to the feature that allows you to execute transactions whenever you want, without being limited by complicated order conditions.

- If you are a frequent trader and want to make the most of short-term price fluctuations, market orders are a perfect choice.

Cons of Market Execution

- You will not be able to know exactly at what price your order will be executed. This means you can buy at a higher price or sell at a lower price than you want.

- When the market is volatile, prices can change very quickly and your order may be filled at a price quite far from the price you quoted.

Process of market execution

- Enter the information about the asset you want to trade (e.g. EUR/USD currency pair) and the volume you want to buy or sell into the trading system to complete the order.

- The system will automatically search for the most suitable counter-order on the market to match your order.

- The price of the order will be the best price available on the market at the time the order is executed. This price may be higher or lower than the price you previously referenced.

- Once the order is matched, your trading position will be opened and you will own or sell that asset.

Instant Execution vs. Market Execution

When trading on the Exness platform, you can choose one of the following two types of order execution:

Instant Execution

With instant execution, your order will be executed immediately at the price you requested or not executed if there is no such price on the market. This gives you control over the price at which you want to buy or sell.

However, there may be cases where your order is not filled if there is not enough liquidity at that price.

Market Execution

With market, your order will be executed instantly at the best price available on the market at that time and your order is guaranteed to be filled, helping you capture market opportunities quickly.

However, there is a risk of “slippage”, meaning that the price of the order may be different from the price you expected, especially in volatile markets.

Difference between two types of order execution

| Features | Instant Execution | Market Execution |

| Price | You Set a Price | Best Available Price |

| Execution Speed | May Be Slower | Very Fast |

| Order Matching Possibility | May Not Match | Always Match |

| Slippage | Minor | May Happen |

Successful Trading by Combining Trading strategies with market execution

Here are some commonly used strategies that help investors take advantage of the functionality and make trading more successful when executing the market:

Scalping

- Is a method of taking advantage of short-term price fluctuations by quickly entering and exiting positions to profit from small price movements.

- To successfully execute the strategy, quick decision making, low slippage is important, and a high-speed trading platform is beneficial.

Day Trading

- Is the buying and selling of assets within the same trading day. This method uses market orders to enter and exit quickly to take advantage of intraday price fluctuations.

- Note that strict risk management is essential, as positions are usually held for short periods of time.

News Trading

- Is a reaction to important news events that can cause sudden price movements. Execute market orders to quickly enter or exit positions based on news-driven movements.

- First of all, timely analysis of news events is important and understanding market sentiment is essential.

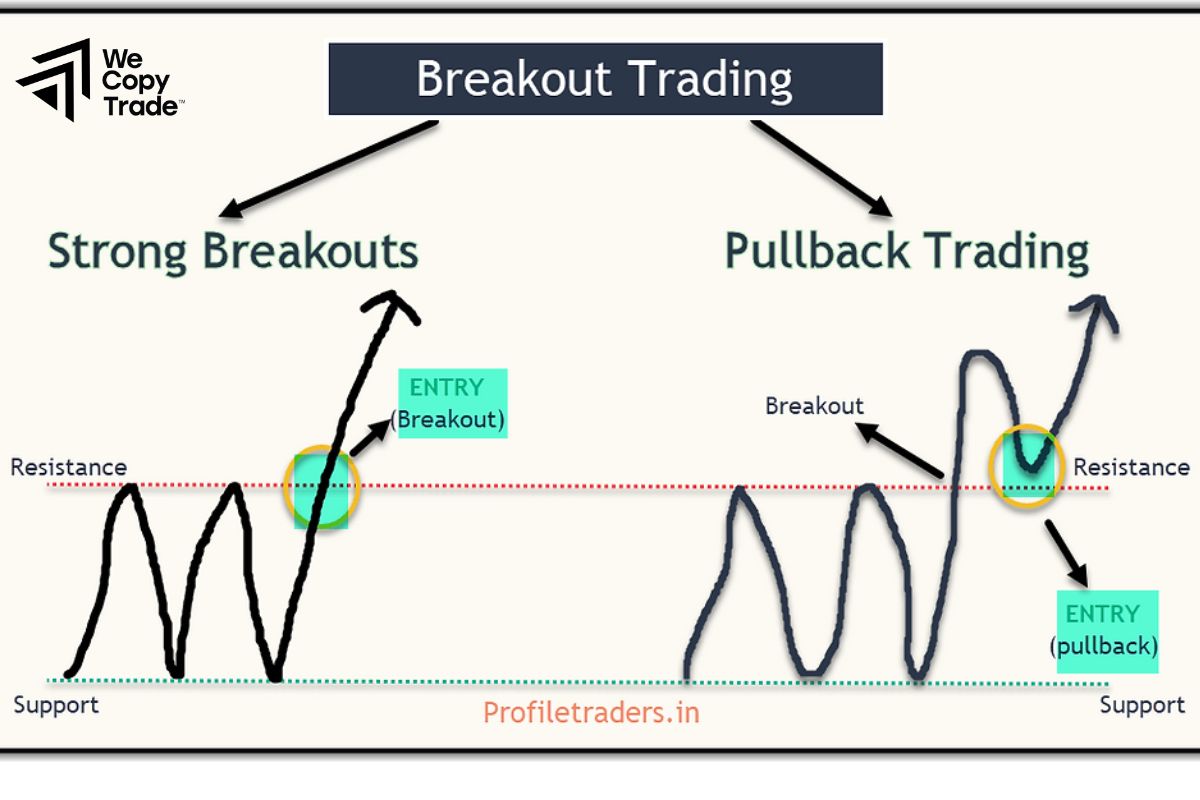

Breakout Trading

- A strategy that identifies and trades breakouts from support and resistance levels by using market orders to enter positions as soon as the breakout occurs.

- Note that accurate identification of breakouts is essential and stop-loss orders can help minimize risk.

Momentum Trading

- A strategy that identifies and trades assets with strong upward or downward momentum by using market orders to quickly enter or exit positions as momentum accelerates.

- Note that timely identification of momentum trends and effective risk management are important.

Conclusion

In conclusion, market execution is a process that helps you make quick asset purchases and sales, but they also come with risks, such as when faced with unexpected market fluctuations, you may not be able to control the price you want. So learn and improve your skills to make the right trading decisions!

See more: