Forex and Stocks offer endless opportunities for those looking to grow their wealth and diversify their investments. Understanding the dynamics of these markets can empower you to make informed trading decisions and increase your returns. Whether you’re new to trading or a seasoned investor, staying updated on Forex and stocks market trends is essential. Ready to boost your financial portfolio? Start exploring strategies and insights that can set you up for success in the Forex and stock markets today!

What is Forex and Stocks Trading?

Forex and Stocks trading involve the buying and selling of different financial assets, with each offering unique opportunities and risks.

Forex Trading is the global marketplace for exchanging national currencies. Traders buy one currency and sell another in pairs (e.g., USD/EUR) to profit from changes in exchange rates. The Forex market is the largest and most liquid in the world, operating 24 hours a day during the weekdays, allowing for constant trading opportunities.

Stocks Trading involves buying and selling shares of publicly listed companies, like Apple or Tesla, on stock exchanges. When you buy a stock, you own a piece of that company. Stock trading is influenced by factors like company performance, economic conditions, and investor sentiment, and traders aim to profit from price changes over time.

Both types of trading allow investors to grow wealth, but they differ in how they operate, the level of risk involved, and the strategies used. Interested in trying Forex or Stocks trading? Start by learning the basics, setting goals, and practicing risk management to make informed decisions.

See more:

- How to Use Currency Correlations to Trade Forex for beginner

- Choosing PAMM and MAM Accounts for Your Brokerage Platform

- Top VPS Hosting You Must Know for Your best Trading

Difference Between Forex and Stocks Trading

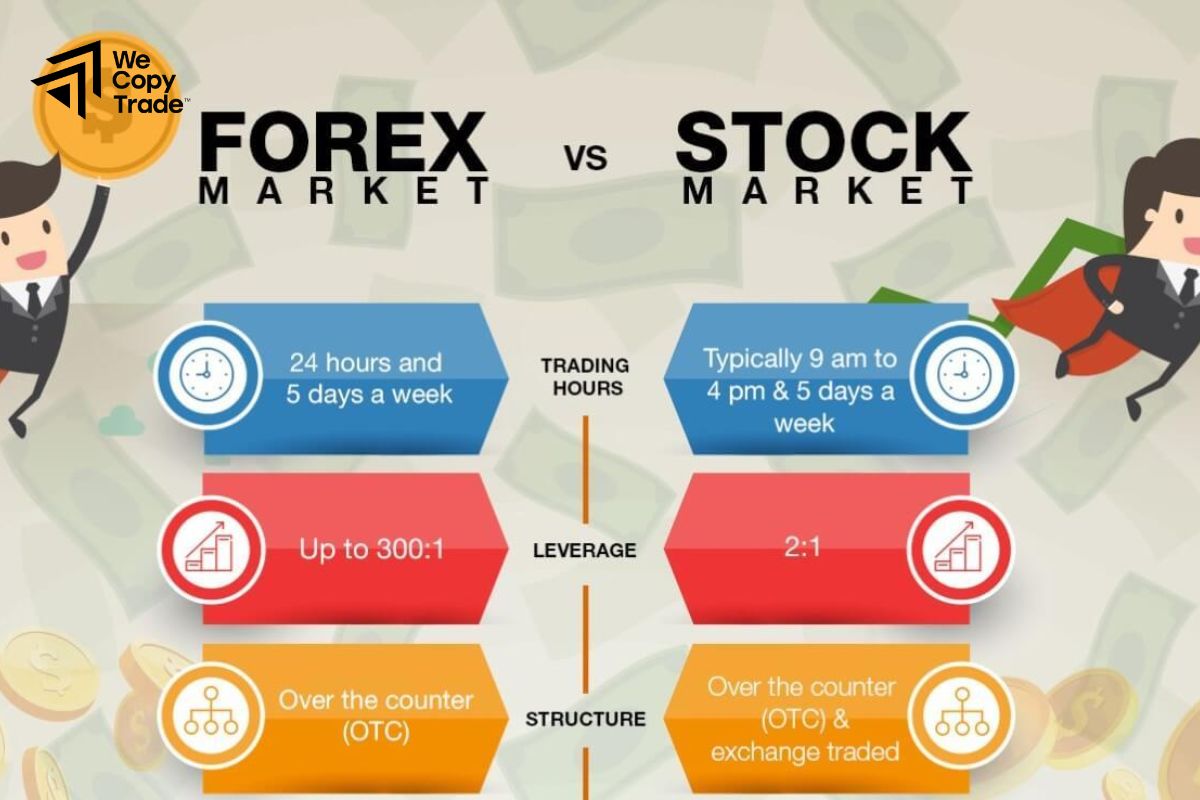

Forex and Stocks trading differ in several key ways, including market structure, liquidity, operating hours, and factors that drive price movements. Here’s a breakdown:

| Criteria | Forex | Stocks |

| Market Structure | Decentralized, trading through a global network. | Centralized, trading on stock exchanges. |

| Market Size | Largest in the world, with daily trading volume over $6 trillion. | Smaller than Forex, daily volume in the billions. |

| Trading Hours | 24/5, continuous from Monday to Friday, following global time zones. | Fixed hours, usually 9:30 AM – 4:00 PM (local time). |

| Liquidity | Very high, especially in major currency pairs like EUR/USD, USD/JPY. | Varies by stock, large-cap stocks are highly liquid. |

| Factors Influencing Price | Macroeconomic factors like interest rates, inflation, political events. | Company performance, financial reports, industry trends. |

| Volatility | High, especially during major economic or political events. | Varies by industry, company, and market conditions. |

| Leverage Options | High leverage, up to 100:1 or 500:1 (depending on regulations). | Limited leverage, typically up to 2:1 for retail investors. |

| Common Trading Style | Often suited for short-term or scalping trades due to liquidity and flexible hours. | Suitable for long-term investment and those focused on company growth. |

Advantages and Disadvantages of Forex and Stocks

Here’s a comparison of the advantages and disadvantages of Forex and Stocks trading:

Forex Trading

Advantages:

- The Forex market is the largest in the world, with trillions traded daily. This high liquidity allows traders to enter and exit positions quickly with minimal slippage.

- Unlike stock markets, Forex operates 24 hours a day from Monday to Friday, providing flexibility for traders around the globe.

- Forex brokers often offer high leverage, allowing traders to control larger positions with smaller capital, increasing potential profits (but also risks).

- Forex trading generally has lower transaction costs due to the lack of middlemen and higher market liquidity, making it more affordable for frequent trades.

Disadvantages:

- Forex is influenced by numerous factors, including international trade, economic data, and geopolitical events, making it challenging to predict.

- While leverage can amplify profits, it can also magnify losses, potentially resulting in significant financial loss for inexperienced traders.

- Forex markets are less regulated than stocks, leading to the possibility of encountering fraudulent or less reputable brokers.

Stock Trading

Advantages:

- Purchasing stocks means owning a part of a company, which gives investors a claim on earnings and assets and sometimes provides dividend income.

- Historically, stocks have offered good returns over the long term, and investors can gain through both capital appreciation and dividends.

- The stock market offers thousands of companies across various sectors, allowing investors to diversify their portfolios and reduce risk.

Disadvantages:

- Stock markets operate only during specific hours, which limits the flexibility for investors to act on sudden news or price changes outside market hours.

- Smaller companies or stocks with low trading volume can experience low liquidity, making it difficult to buy or sell quickly without affecting the price.

- Stock trading can have higher transaction costs due to broker fees, especially for frequent traders, impacting profits.

- Stocks may require a longer holding period to realize significant gains, as they are generally less volatile than Forex pairs.

Forex Trading vs Stock Trading What Should Traders Know?

When deciding between Forex and Stocks trading, traders should understand key differences in market structure, trading strategies, risk factors, and other characteristics that can influence their success in each. Here’s a breakdown of what traders should know about each market:

Market Structure and Accessibility

If flexibility and around-the-clock access are priorities, Forex may be more suitable. Stocks may appeal to those who prefer centralized markets with more structured trading hours.

Instruments and Diversification

Stock trading provides more opportunities for diversification and sector-based strategies, while Forex trading focuses on economic fundamentals and international factors influencing currencies.

Volatility and Risk

Forex may suit those who thrive in fast-moving environments and have strategies for managing volatility. Stock trading can be more stable, especially for long-term investors focused on established companies.

Leverage and Margin

High leverage in Forex trading appeals to traders with risk tolerance but requires strict risk management. Stock trading’s lower leverage suits those seeking more gradual growth and lower risk.

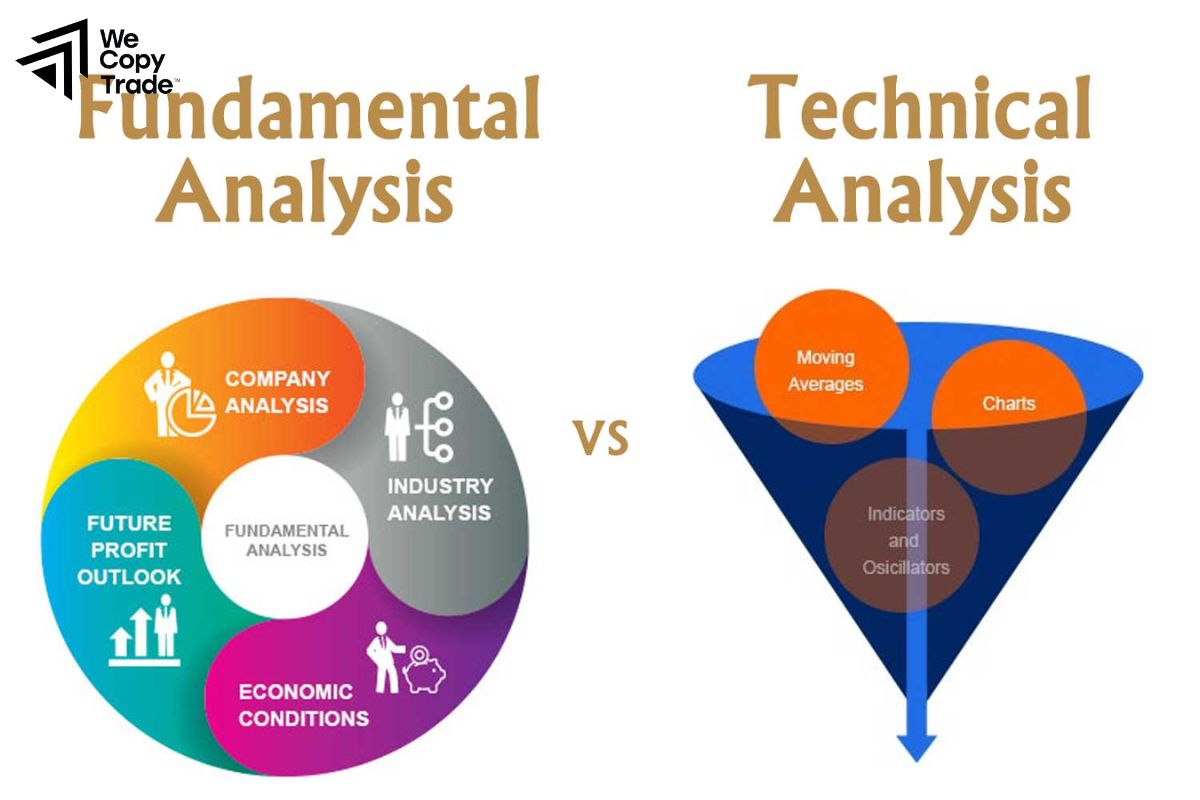

Technical and Fundamental Analysis

Forex traders may need more proficiency in technical analysis and global economic trends. Stock traders should also be familiar with evaluating company fundamentals and industry trends.

Transaction Costs and Fees

Forex offers lower costs for frequent trading, while stocks might incur more transaction fees. Traders should consider the impact of these costs on their trading strategy and frequency.

Suitability for Different Strategies

Forex favors traders with a short-term focus, while stocks offer versatility for both active and long-term investment strategies.

Forex vs Stocks What Impacts the Market?

The Forex market is primarily driven by macroeconomic factors, geopolitical events, and global trade dynamics.

- Interest Rates: Central banks, like the Federal Reserve (U.S.) and the European Central Bank, set interest rates to control inflation and stimulate economic growth. Higher interest rates generally increase demand for a currency, as investors seek higher returns, while lower rates can decrease its value.

- Economic Indicators: Reports on GDP growth, unemployment rates, inflation, retail sales, and industrial production provide insight into the economic health of a country. Positive economic indicators often strengthen a currency, while negative indicators weaken it.

- Political Stability and Geopolitical Events: Political events, elections, and international conflicts can impact a country’s currency. Political stability tends to support currency strength, while uncertainty or conflict can cause volatility or depreciation in a currency’s value.

- Global Trade and Supply/Demand: Countries with strong exports, like Japan or Germany, may have stronger currencies due to high demand for their goods. Conversely, countries that heavily rely on imports might face currency depreciation if trade balances widen.

FAQ about Forex and Stocks

Here’s a FAQ section to address common questions about Forex and Stocks trading:

Is Forex more risky than stocks?

- Both markets carry risk, but Forex trading often involves higher leverage, which can amplify gains and losses, making it riskier for inexperienced traders. Stocks tend to be less volatile than currencies, especially for established companies, making them potentially less risky for long-term investors.

What factors impact Forex prices?

- Forex prices are influenced by economic data (e.g., GDP, unemployment, interest rates), central bank policies, geopolitical events, global trade, and market sentiment.

Do Forex and stocks require different trading strategies?

- Yes, Forex trading often involves short-term strategies like day trading, scalping, and swing trading due to high liquidity and leverage. Stocks, on the other hand, are suited to both short-term and long-term strategies, including day trading, swing trading, and long-term investing.

Conclusion

In conclusion, both Forex and Stocks offer exciting opportunities for traders and investors, but each market comes with its own set of challenges and benefits. If you’re ready to dive into Forex and Stocks trading, now is the perfect time to start learning, strategizing, and growing your investment portfolio. Take the next step today for a trading account, access valuable resources, and start building your future in the world of financial markets!

See now: