Looking for expert analysis to guide your next move? Our team of specialists provides in-depth reviews, comprehensive insights, and professional evaluations on the latest trends and topics. Whether you’re aiming to stay ahead of the competition or make smarter decisions, our EA gives you the knowledge you need. Don’t miss out exploring our detailed articles today and take the first step toward informed success!”

What Is Expert Analysis In Forex Trading?

Expert Analysis in Forex Trading refers to the comprehensive evaluation of market trends, price movements, and economic indicators by seasoned professionals to help traders make informed decisions. This analysis can be fundamental, technical, or a combination of both, and it plays a crucial role in predicting future currency price movements.

See more:

- What are trading signals? How to use trading effectively?

- How to Predict and Take advantage of Market News thoroughly

- Forex and Commodities – Which can we get more profits from?

Why Is Expert Analysis Important in Forex Trading?

Expert analysis is important in Forex trading because it provides traders with the knowledge and insights needed to navigate the complexities of the market. By leveraging professional evaluations, traders can make informed decisions, reduce the risks associated with volatile price movements, and anticipate market trends. This analysis saves time and effort by offering clear entry and exit points, helping traders maximize profits and minimize losses. Additionally, expert analysis enhances trading discipline by providing structured strategies, which prevents emotional decision-making.

For beginners, expert insights boost confidence, allowing them to learn from seasoned professionals and develop their skills over time. Ultimately, expert analysis is crucial because it equips traders with the strategic edge necessary to succeed in the highly competitive Forex market.

Types of Expert Analysis in Forex Trading

Each type provides unique insights and helps traders make more informed decisions.

Fundamental Analysis

Fundamental analysis involves studying economic and financial factors that impact currency values. This type of analysis focuses on the underlying economic indicators and events that can influence the Forex market.

- Interest rates, inflation, GDP growth, employment rates, central bank policies, political stability, and global economic conditions.

- To determine the intrinsic value of a currency and predict how future economic events might affect its price.

Technical Analysis

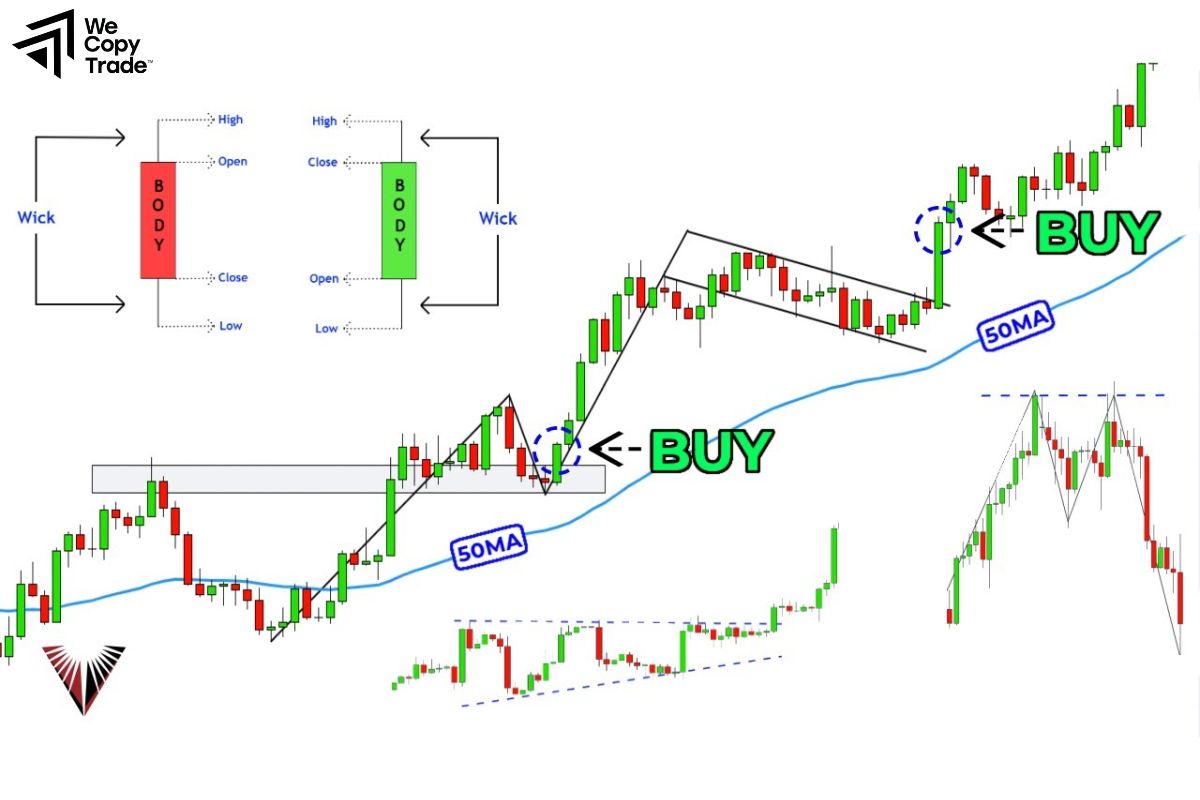

Technical analysis uses historical price data, chart patterns, and technical indicators to forecast future market movements. It is based on the idea that price movements follow certain patterns and trends over time.

- Charts (candlestick, line, bar), moving averages, trend lines, support and resistance levels, and indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

- To identify trading opportunities based on price patterns, trends, and statistical analysis.

Sentiment Analysis

Sentiment analysis assesses the overall mood or sentiment of the market to understand the psychological factors driving price movements. It gauges whether traders feel optimistic (bullish) or pessimistic (bearish) about a particular currency.

- Market sentiment indicators, trader behavior, news reports, social media trends, and surveys that reflect the prevailing market outlook.

- To predict potential reversals or continuation of trends based on the collective sentiment of market participants.

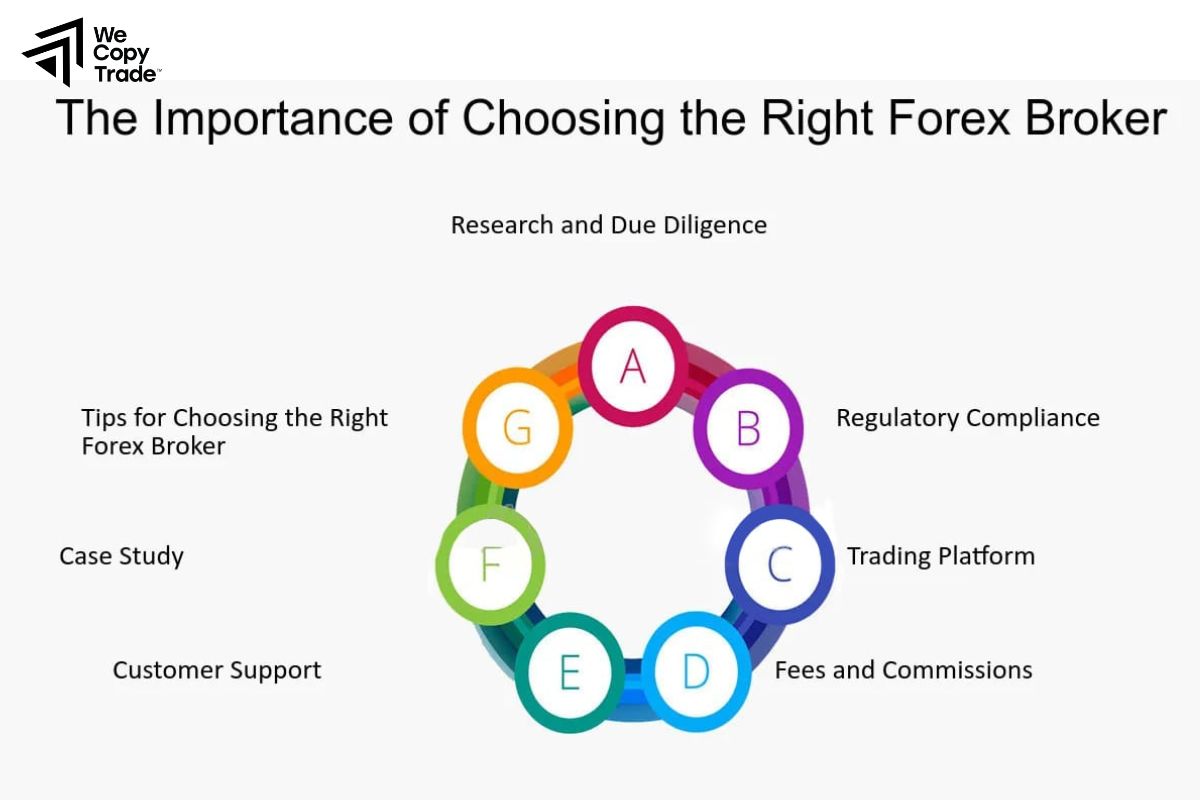

Choosing a Broker for a Forex Expert Analysis

Here’s a concise 4-step guide for choosing a broker for expert analysis in Forex trading:

Check the Quality of Analysis and Tools

- Look for brokers that provide reliable research, market updates, and in-depth reports. Choose those that offer strong technical and fundamental analysis tools, such as MetaTrader 4 or 5.

Evaluate Educational Resources

- Ensure the broker offers webinars, tutorials, and articles to help you understand market analysis. A good broker will provide resources for both beginners and experienced traders.

Verify Regulation and Transparency

- Choose a broker regulated by reputable authorities like FCA or ASIC. Regulation ensures the broker follows standards and delivers accurate, unbiased analysis.

Test with a Demo Account

- Use a demo account to explore the broker’s platform and analysis tools. Make sure they suit your trading style before committing to a live account.

What are the Benefits of Using Expert Analysis Forex?

Using expert analysis in Forex trading offers several key benefits that can enhance trading success and reduce risks. Here are the main advantages:

- Expert analysis provides well-researched insights, helping traders make smarter and more accurate trading decisions based on data and trends rather than relying on guesswork.

- By understanding the factors that influence currency movements, traders can minimize risks. Expert analysis often includes guidance on risk management strategies, such as setting stop-loss levels or diversifying trades.

- Analyzing the Forex market requires extensive research and time. Expert analysis saves traders time by offering concise and clear insights, allowing them to focus on executing trades.

- Expert analysis helps identify trading opportunities by pinpointing potential market trends, entry, and exit points. This can lead to better timing and more profitable trades.

- By following expert advice, traders can refine their strategies and adapt to changing market conditions. This helps improve long-term trading success and consistency.

What is the Difference Between an Expert Analysis and a Forex Robot?

An Expert Analysis and a Forex Robot are terms often used interchangeably, but they have slight differences, particularly in how they are used in forex trading. Here’s a breakdown:

| Criteria | Expert Analysis | Forex Robot |

| Nature | Manual or semi-automated analysis by human experts | Fully automated software system for trading |

| Execution | Involves human judgment and decision-making | Executes trades based on pre-set algorithms and data analysis |

| Customization | Highly flexible, based on the expertise and strategy of the trader | Operates according to a fixed algorithm, but can be customized to a degree |

| Adaptability | Can adapt quickly to changing market conditions based on experience | Limited adaptability; follows programmed rules and market signals |

| Time Involvement | Requires human involvement to analyze markets and make decisions | Operates continuously without human intervention |

Conclusion

In conclusion, Expert Analysis is a crucial element for making informed and strategic decisions in forex trading. By combining professional analysis with a solid trading plan, you can better navigate market trends and make smarter decisions. Join our platform now and gain access to real-time expert insights and strategies that can help you achieve your trading goals.

See now: