Understanding the Debt-to-GDP Ratio is key to grasping a country’s economic health. This critical metric compares national debt to the size of the economy, offering insights into financial stability and sustainability. Curious about how it works and what it means for global markets? Keep reading to uncover its significance and see why it’s essential for economists, policymakers, and investors. Learn more now to make informed financial decisions!

What is Debt-to-GDP Ratio?

The Debt-to-GDP Ratio is a key economic indicator that measures the proportion of a country’s total public debt relative to its gross domestic product (GDP). It serves as a reflection of a nation’s financial health and its ability to manage and repay its debt obligations. A higher ratio suggests that a country may be heavily reliant on borrowing, potentially indicating challenges in meeting its debt commitments without significant adjustments to spending, taxation, or borrowing.

Conversely, a lower Debt-to-GDP Ratio indicates that a nation is producing sufficient economic output to sustain its debt levels, signifying better financial stability and creditworthiness.

See now:

- Understand The Importance Of Fiscal Policy In Trading Market

- How To Contribute A Good ISM Manufacturing Index In Trading

- Learn How Forex Traders Are Taxed and Their Tax Obligations

- What is a Contractionary Policy? Tools Used for Policies

The Importance of Understanding Debt-to-GDP Ratio

Understanding the Debt-to-GDP Ratio is crucial for several reasons, as it provides valuable insights into a country’s economic health and its ability to manage public finances. Here are the key reasons why it is important:

- Assessing Fiscal Health: The Debt-to-GDP Ratio helps determine whether a country is living within its means or relying too heavily on borrowing to fund government spending.

- Government Policy Decisions: Governments use the Debt-to-GDP Ratio to make informed decisions about fiscal policies. If the ratio is too high, policymakers may choose to implement austerity measures, raise taxes, or reduce public spending to improve the country’s financial standing.

- Sustainability of Debt: This ratio helps gauge whether a country’s level of debt is sustainable in the long term. If debt grows faster than GDP, it may indicate that the country is borrowing at an unsustainable pace, which can eventually lead to a debt crisis.

- Comparing Economies: The Debt-to-GDP Ratio is a useful tool for comparing the economic stability of different countries. It allows for an objective assessment of how much debt a country has relative to its economic output, making it easier to evaluate fiscal risks across nations of different sizes and stages of development.

- Credit Rating Implications: Credit rating agencies, which assess the risk associated with a country’s bonds, closely monitor the Debt-to-GDP Ratio. A high ratio can lead to a downgrade in a country’s credit rating, which in turn can increase borrowing costs for the government.

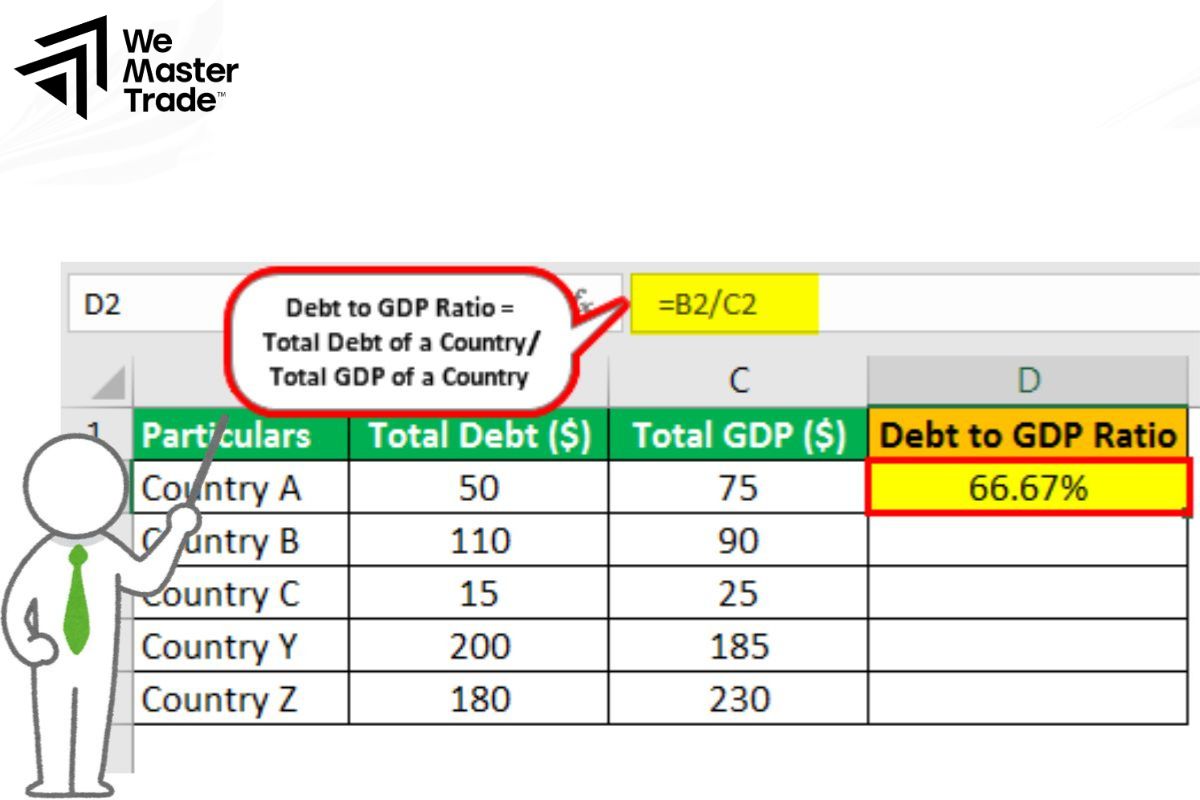

Formula and How to Calculate Debt-to-GDP Ratio

The Debt-to-GDP Ratio is calculated by dividing a country’s total public debt by its gross domestic product (GDP), and then multiplying the result by 100 to express it as a percentage.

Formula

Debt-to-GDP Ratio = (GDP/Total Public Debt)×100

While:

- Obtain Total Public Debt: This refers to the total amount of money that the government owes. It includes both external and internal debt.

- Obtain the GDP: GDP is the total value of all goods and services produced in the country within a specific period, usually a year.

- Divide Debt by GDP: Divide the total public debt by the GDP to get the ratio.

- Multiply by 100: Multiply the result by 100 to convert the ratio into a percentage.

Example Illustrative

If a country has:

- Public Debt = $1.5 trillion

- GDP = $3 trillion

The Debt-to-GDP Ratio would be:

(1.5 trillion/3 trillion)×100=50%

Interpretation:

- A 50% Debt-to-GDP Ratio means that the country’s debt is half the size of its economy.

- A higher ratio may indicate a greater debt burden, which could raise concerns about the country’s ability to repay its debt.

- A lower ratio generally suggests that the country is more economically stable and less reliant on borrowing.

Factors Affecting Debt-to-GDP Ratio

The Debt-to-GDP Ratio is influenced by several key factors:

- Economic Growth: Faster GDP growth reduces the ratio, while slow growth or recession increases it.

- Interest Rates: Higher rates increase debt servicing costs, potentially raising the ratio.

- Inflation: Moderate inflation can reduce the real value of debt, but high inflation may increase borrowing costs.

- Exchange Rates: A weaker currency raises the cost of foreign debt, increasing the ratio.

- Demographic Changes: Aging populations may increase debt, while growing populations can boost economic output.

How to Reduce Debt-to-GDP Ratio Effectively

Here are several effective strategies to reduce the debt-to-GDP ratio:

Increase Economic Growth

- Promote Innovation and Productivity: Encouraging technological advancements, investments in research and development, and improving workforce skills can increase productivity. A higher GDP, even without additional debt, naturally reduces the debt-to-GDP ratio.

- Support Export Growth: By promoting exports, countries can increase their economic output, raising GDP. Diversifying export markets and improving competitiveness in global markets are key strategies.

Fiscal Consolidation

- Increase Government Revenues: Strengthening tax collection systems, broadening the tax base, and reducing tax evasion can boost government revenues. Introducing or raising taxes on higher income brackets or luxury goods can also help reduce deficits.

- Reduce Government Spending: Cutting non-essential government spending, particularly in areas prone to inefficiency, such as subsidies and unnecessary public sector wages, can reduce the need for borrowing. Focusing on targeted social programs rather than blanket support is another option.

Debt Restructuring

- Negotiate Better Terms with Creditors: Restructuring existing debt by negotiating lower interest rates or longer repayment periods can reduce the debt burden without requiring immediate fiscal tightening.

- Debt Swaps and Buybacks: In some cases, countries may negotiate debt swaps, where debt is exchanged for equity or long-term investments in national assets, or buy back debt at a discount if market conditions allow.

Maintain a Strong Monetary Policy

- Inflation Control: A central bank that focuses on controlling inflation helps to maintain stable economic growth and avoid devaluation of the currency. Inflation reduces the real value of debt, easing repayment burdens in some cases.

- Lower Interest Rates: Reducing interest rates can help decrease the cost of borrowing for both the government and businesses, potentially lowering debt servicing costs.

Structural Reforms

- Labor Market Reforms: Reforming labor markets to increase employment, particularly in high-growth sectors, can lead to higher wages and greater productivity, further stimulating economic growth and reducing debt-to-GDP.

- Pension and Welfare Reforms: Reforms to pension systems, healthcare, and social benefits to ensure sustainability can free up government funds for reducing debt.

Conclusion

In conclusion, effectively managing and reducing the debt-to-GDP ratio is essential for ensuring long-term economic stability and growth. By implementing strategies such as fostering economic growth, reducing unnecessary spending, and negotiating better debt terms, governments can strengthen their financial position. Let’s work together towards a stable financial future!

See more: