Unlock the potential of Currency Carry Trade, a popular forex strategy that allows traders to profit from interest rate differences between currency pairs. By borrowing in low-interest-rate currencies and investing in high-yielding ones, you can generate steady returns. Whether you’re a beginner or an experienced trader, mastering the carry trade can open new opportunities in the forex market. Start learning today and take your trading skills to the next level!

What is Currency Carry Trade?

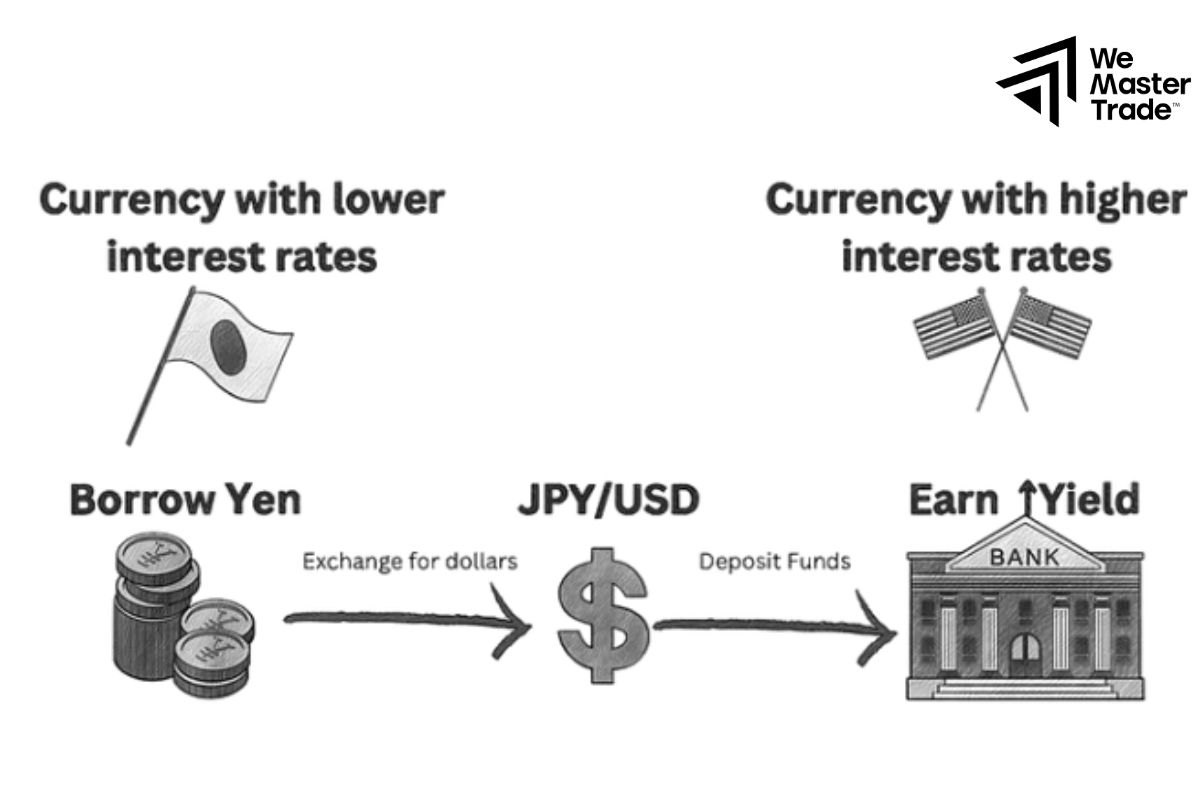

Currency Carry Trade is a popular forex trading strategy where investors borrow funds in a low-interest-rate currency and convert them into a higher-interest-rate currency to profit from the interest rate difference. This difference, known as the “interest rate differential,” serves as the primary source of income for this strategy.

This strategy relies on two main factors: the stability of the exchange rate and the interest rate gap between the two currencies. However, Currency Carry Trade is not without risks. Exchange rate fluctuations can reduce or even eliminate expected profits. Additionally, other risks, such as changes in monetary policy or global economic volatility, can impact trading outcomes.

See now:

- Learn How Forex Traders Are Taxed and Their Tax Obligations

- Understanding Monetary Policy? Common Types of Policy

- Why is National Debt Important? The Structure of National

- Apply The Labor Market Reports Effectively In Forex Trading

Why Use Carry Trade?

Carry trades are attractive for traders looking to generate steady returns, especially in low-volatility markets. However, they require careful risk management and monitoring of global interest rate policies.

By mastering the currency carry trade strategy, traders can create opportunities to profit both from interest rates and forex market movements.

The Basics of Currency Carry Trade

Currency Carry Trade is a fundamental forex trading strategy where traders borrow in a low-interest-rate currency and invest in a high-interest-rate currency to profit from the interest rate differential. The core idea is to capitalize on the gap between borrowing costs and returns.

- Borrow Low: Traders take a loan in a currency with a low interest rate (e.g., Japanese Yen).

- Invest High: They convert the borrowed amount into a currency with a higher interest rate (e.g., Australian Dollar) to earn a higher yield.

- Collect the Difference: The profit comes from the interest rate spread, and additional gains can occur if the high-yielding currency appreciates in value.

Trading strategy for forex carry trade

A forex carry trade strategy involves borrowing in a currency with a low interest rate and investing in a currency with a higher interest rate to profit from the difference (interest rate differential). Here’s a step-by-step guide to building an effective carry trade strategy:

Identify Currency Pairs with High Interest Rate Differentials

- Look for currency pairs where the interest rate of one currency (e.g., AUD) is significantly higher than the other (e.g., JPY).

- Central banks’ interest rate policies provide key insights into which currencies are low-yielding (borrow) and high-yielding (invest).

Monitor Market Trends

- Carry trades are more effective in stable or bullish markets where the high-yielding currency appreciates or remains steady.

- Use technical analysis to identify uptrends or stable market conditions.

Focus on Risk Management

- Exchange Rate Risk: If the high-yield currency depreciates, your profits can be wiped out. Always use stop-loss orders to limit losses.

- Leverage Risk: Carry trades often use leverage to amplify gains, but this also increases potential losses. Start with manageable leverage (e.g., 2x or 5x).

- Diversification: Avoid putting all funds in one carry trade. Diversify across multiple pairs to spread risk.

Track Central Bank Policies

- Interest rates can change based on central bank decisions. Pay attention to economic calendars, monetary policy statements, and rate hikes or cuts.

- A surprise rate cut in the high-yielding currency can negatively impact your trade.

Use Positive Swap Rates

Ensure your broker offers positive swap rates on overnight positions for the chosen currency pair. Positive swaps allow you to earn daily interest, boosting long-term gains.

Combine Carry Trade with Technical Indicators

- Use tools like moving averages, trend lines, or RSI to time your entry and exit points.

- Enter trades when the high-yielding currency shows strong upward momentum.

Pros and Cons of Currency Carry Trade

The Currency Carry Trade strategy is a popular method in forex trading, but like any strategy, it comes with both advantages and disadvantages. Here’s a breakdown to help you understand its full scope:

Pros of Currency Carry Trade

- Steady Interest Income: The main advantage is earning a consistent profit from the interest rate differential between two currencies.

- Potential for Currency Appreciation: Besides interest income, traders can also profit if the high-yielding currency appreciates in value against the low-yielding currency.

- Long-Term Profit Potential: Carry trades are often used as long-term strategies, making them ideal for traders who prefer holding positions for extended periods.

- Low-Volatility Suitability: In stable or low-volatility markets, carry trades thrive as exchange rates remain steady, minimizing risks while ensuring steady returns.

Cons of Currency Carry Trade

- Exchange Rate Risk: Currency fluctuations can offset profits or cause losses if the high-yielding currency depreciates significantly.

- High Leverage Risk: While leverage increases profit potential, it also magnifies losses if the trade goes against the trader.

- Economic Policy Changes: Central banks can change interest rates, which may narrow or reverse the interest rate differential, reducing or eliminating carry trade profits.

- Opportunity Costs: Funds tied up in carry trades could be used in other potentially higher-yielding opportunities, especially during active or trending markets.

Examples of Currency Carry Trade

Here are some practical examples of how a Currency Carry Trade works, illustrating both the process and the potential outcomes:

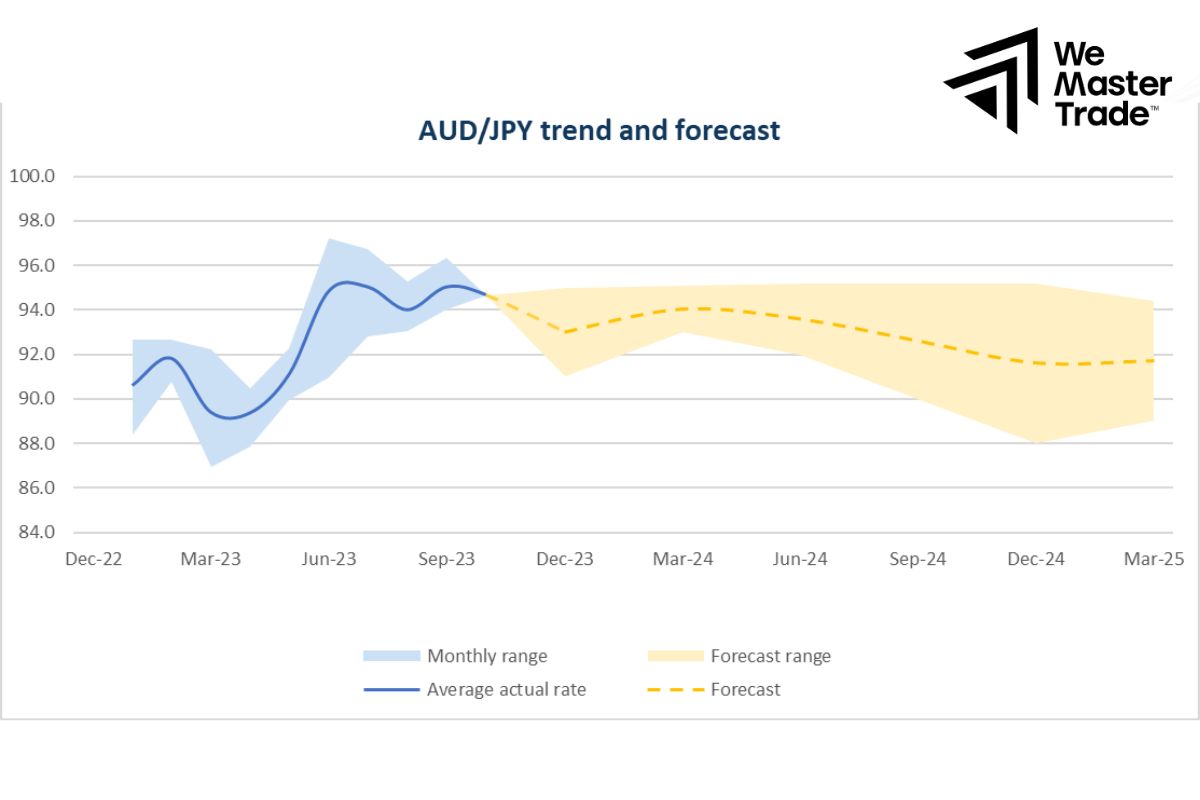

Example 1: AUD/JPY (Australian Dollar / Japanese Yen)

Scenario:

- The interest rate in Japan (JPY) is 0.5% (low-yielding currency).

- The interest rate in Australia (AUD) is 4.5% (high-yielding currency).

Carry Trade Setup:

- A trader borrows JPY at 0.5% interest and converts it to AUD.

- The funds are then invested in an Australian account or instrument that earns 4.5% interest.

Profit Calculation:

- The interest rate differential is 4% (4.5% – 0.5%).

- The trader earns this 4% annually, assuming the exchange rate between AUD and JPY remains stable.

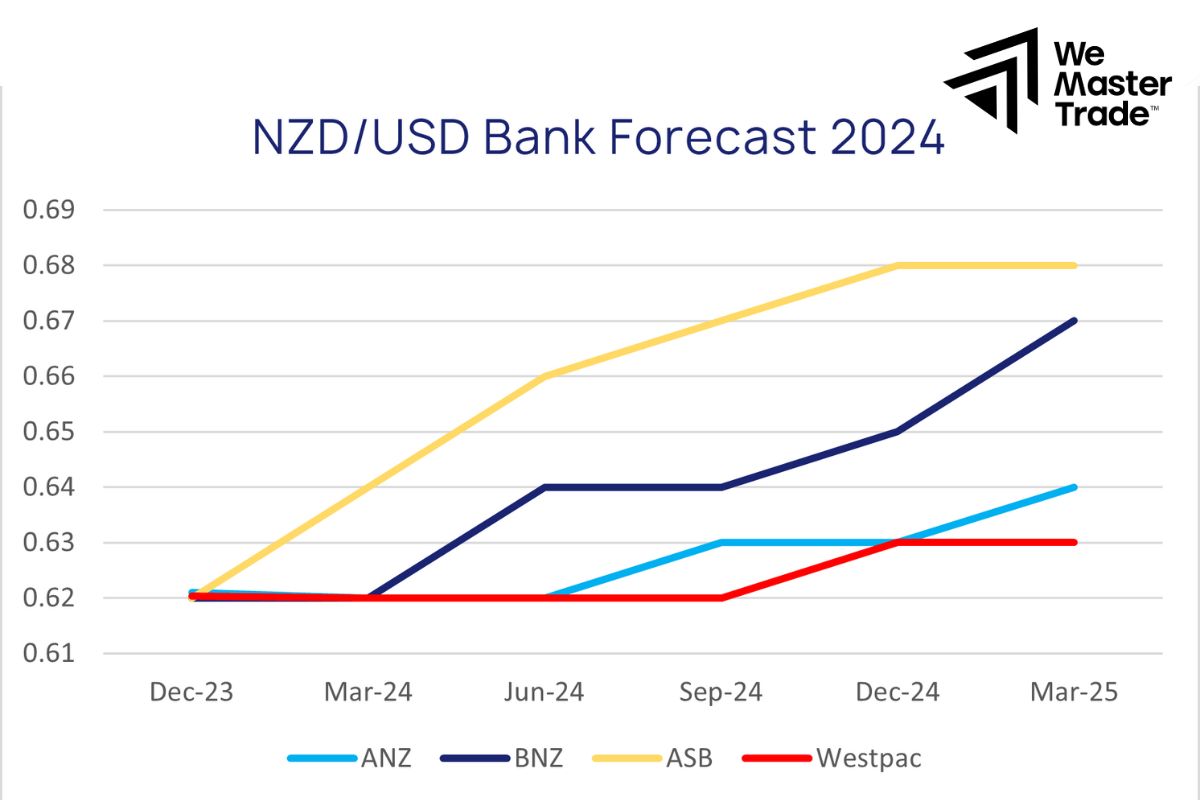

Example 2: NZD/USD (New Zealand Dollar / US Dollar)

Scenario:

- The interest rate in the US (USD) is 1.0%.

- The interest rate in New Zealand (NZD) is 5.0%.

Carry Trade Setup:

- A trader borrows USD at 1% interest.

- They convert USD to NZD and invest it in a New Zealand financial instrument earning 5%.

Profit Calculation:

- The trader earns a net interest rate of 4% (5% – 1%) annually.

- If the exchange rate remains stable, this profit is consistent.

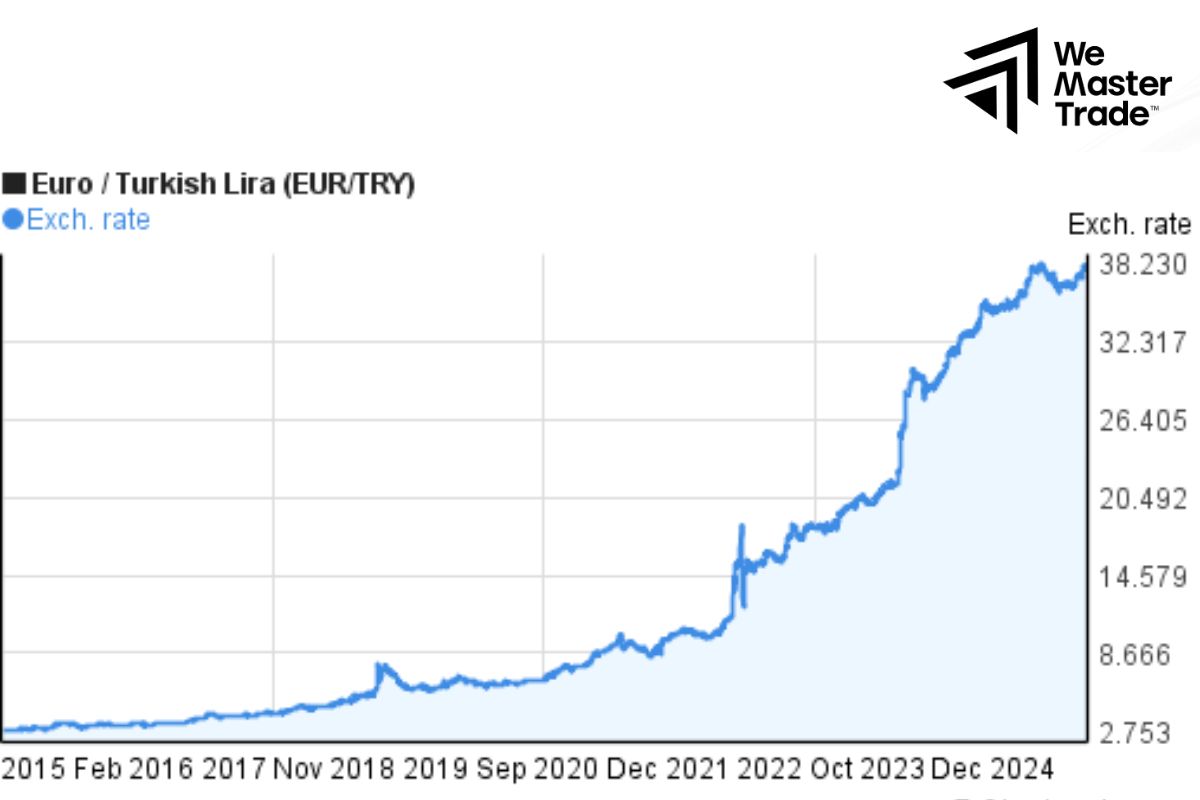

Example 3: EUR/TRY (Euro / Turkish Lira)

Scenario:

- The European Central Bank (EUR) offers near 0% interest.

- Turkey (TRY) has a much higher interest rate of 15% due to inflation and economic conditions.

Carry Trade Setup:

- A trader borrows EUR (at close to 0% interest).

- The EUR is converted to Turkish Lira (TRY), where it earns 15% interest annually.

Profit Potential:

- The interest rate differential is significant (15%).

Conclusion

In conclusion, Currency Carry Trade offers traders a unique opportunity to profit from the difference in interest rates between two currencies. By borrowing in a low-interest-rate currency and investing in a higher-yielding one, traders can earn significant returns through interest rate differentials, with the potential for additional gains from favorable currency movements. Ready to dive in? Start your Currency Carry Trade journey today and capitalize on this potentially profitable trading strategy!

See more: