You know that arbitrage strategy is considered the secret to success of top traders, right? However, along with the outstanding benefits, they also have certain risks if you do not have knowledge about it. Don’t worry, in the following article, I will summarize the most essential things you need to know about arbitration. Don’t miss it!

What Is Arbitrage?

Arbitrage is an investment strategy in which investors buy an asset in one market and simultaneously sell the same or a similar asset in another market to take advantage of the small price difference between the two markets. In other words, arbitrage is buying low in one place and selling high in another to make a profit.

In the financial market, people trade assets such as stocks, bonds, foreign currencies, etc. on many different exchanges.

Arbitrage traders will use software and analytical tools to search for assets with different prices on the exchanges.

When they find an asset with a low price on one exchange and a high price on another exchange, they will immediately buy at the low price floor and immediately sell at the high price floor.

The difference between the buying price and the selling price is the trader’s profit.

See now:

- List of Top Reliable Safe Haven For Beginning Traders

- What is a sovereign credit rating? Factors Credit rating

- Hidden Truths About Bond Spreads Not Everyone Knows

- The Power of Trend Confirmation Indicator To Trading Result

Examples of Using The Arbitrage

Here is the basic process when an investor chooses an Arbitrage strategy for their trading:

Step 1: Look for an Opportunity

Let’s say you are monitoring the stock price of XYZ company. You notice something interesting: On the New York Stock Exchange (NYSE), the stock is trading at $100, while on the Tokyo Stock Exchange, the same stock is trading at $101. This is your opportunity to make an Arbitrage trade.

Step 2: Buy Low

You decide to buy 1,000 shares of XYZ on the NYSE for $100,000.

Step 3: Sell High

Almost simultaneously, you sell 1,000 shares of XYZ on the Tokyo Stock Exchange for $101,000.

Step 4: Collecting Profits

After deducting transaction costs, you have made $1,000 in profit with virtually no risk.

As more investors make similar trades, demand on the NYSE will increase, pushing the stock price higher. Conversely, supply on the Tokyo exchange will increase, driving the stock price down. Eventually, the price of XYZ stock on both exchanges will gradually become equal, and the arbitrage opportunity will disappear.

Benefits of Arbitration

Arbitration often provides more stable returns than other investment strategies.

By exploiting small price differences, the risk of arbitration is often lower than other forms of investment.

Arbitration helps bring asset prices to equilibrium, making the market more efficient.

Challenges of Arbitration

There are many investors involved in arbitration, making it more difficult to find opportunities.

Transaction costs can erode profits.

Although the risk is lower than other forms of investment, arbitration is still affected by market fluctuations, the prices of bonds and stocks can fluctuate sharply, causing the risk of loss.

Arbitration opportunities often appear and disappear very quickly, especially in today’s increasingly technological era.

Arbitration strategies require investors to have extensive knowledge of finance and trading experience.

Types of Arbitrage

Arbitration strategies are often complex and require a deep understanding of investors. To make it easier and more effective for investors to apply the strategy, arbitration is divided into 3 types. Let’s see which type best suits your trading style.

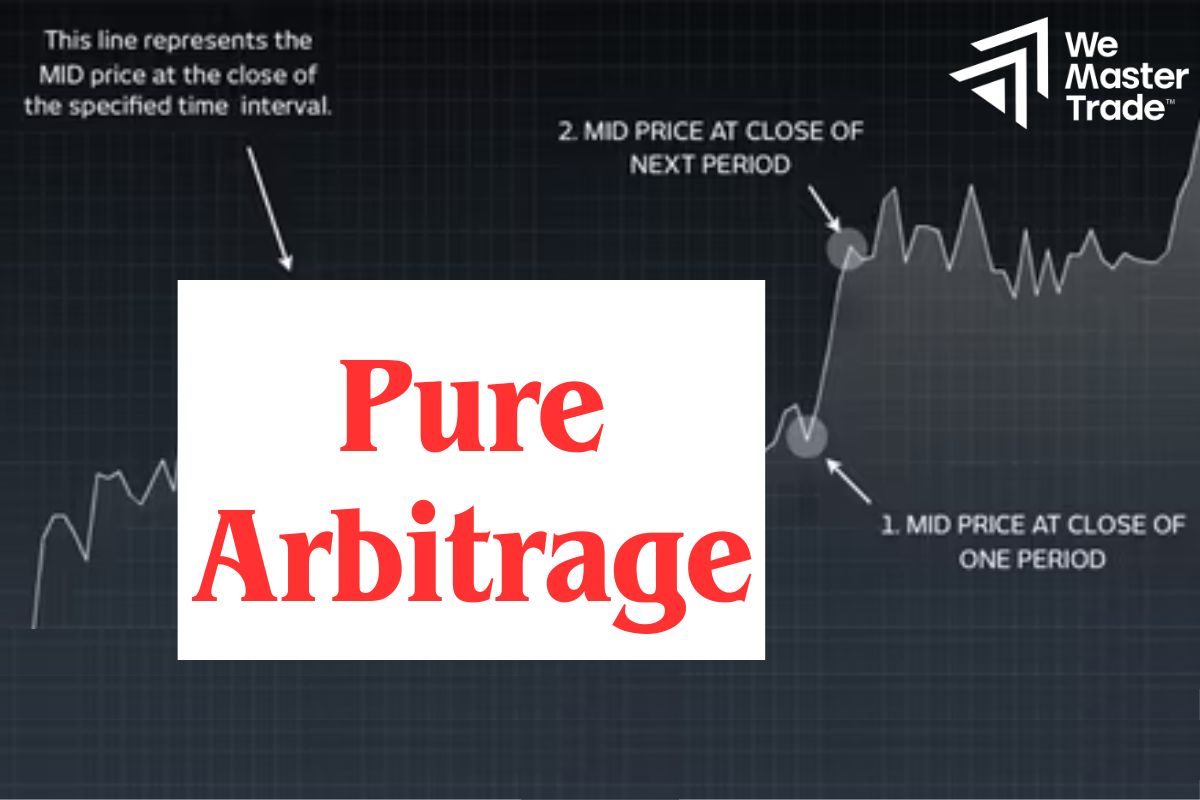

Pure Arbitrage

Pure arbitrage is an investment strategy in which investors seek and take advantage of small differences in the price of a similar asset such as stocks, bonds, foreign currencies, etc. in different markets. In other words, they buy an asset where it is cheap and immediately sell it where it is higher to make a profit.

Why does arbitrage occur?

There are many reasons for arbitrage, such as:

- Uneven information: Not all investors have the same amount of information.

- Different transaction costs: Transaction costs on different exchanges can be different.

- Different regulations: Regulations in each country can be different.

- System errors: Sometimes, trading systems can have errors, leading to temporary price differences.

Merger Arbitration

Merger arbitration is an investment strategy in which investors bet on the outcome of a merger or acquisition. When a large company decides to acquire another company, the stock price of the acquired company usually increases. Investors will buy shares of the acquired company in the hope of selling them when the deal is completed to make a profit.

How merger arbitration works:

- Merger announcement: When a large company announces that it will acquire another company, the stock price of the acquired company usually increases immediately.

- Buying shares: Investors will buy shares of the acquired company in the hope that the stock price will continue to increase when the deal is completed.

- Profiting: When the merger is completed, the stock price usually increases to the agreed price. Investors will sell the shares to make a profit.

For example: Company A decides to acquire Company B for $100/share. Before the announcement, Company B’s stock price was $80 per share. After the announcement, Company B’s stock price increased to $90 per share. An investor who buys Company B’s stock for $90 and sells it for $100 when the deal is completed will make a profit of $10 per share.

Types of merger arbitration

Buying shares of the acquired company before the deal is completed.

Short selling shares of the acquired company if the investor believes the deal will fail.

Using derivatives such as options to manage risk and increase profits.

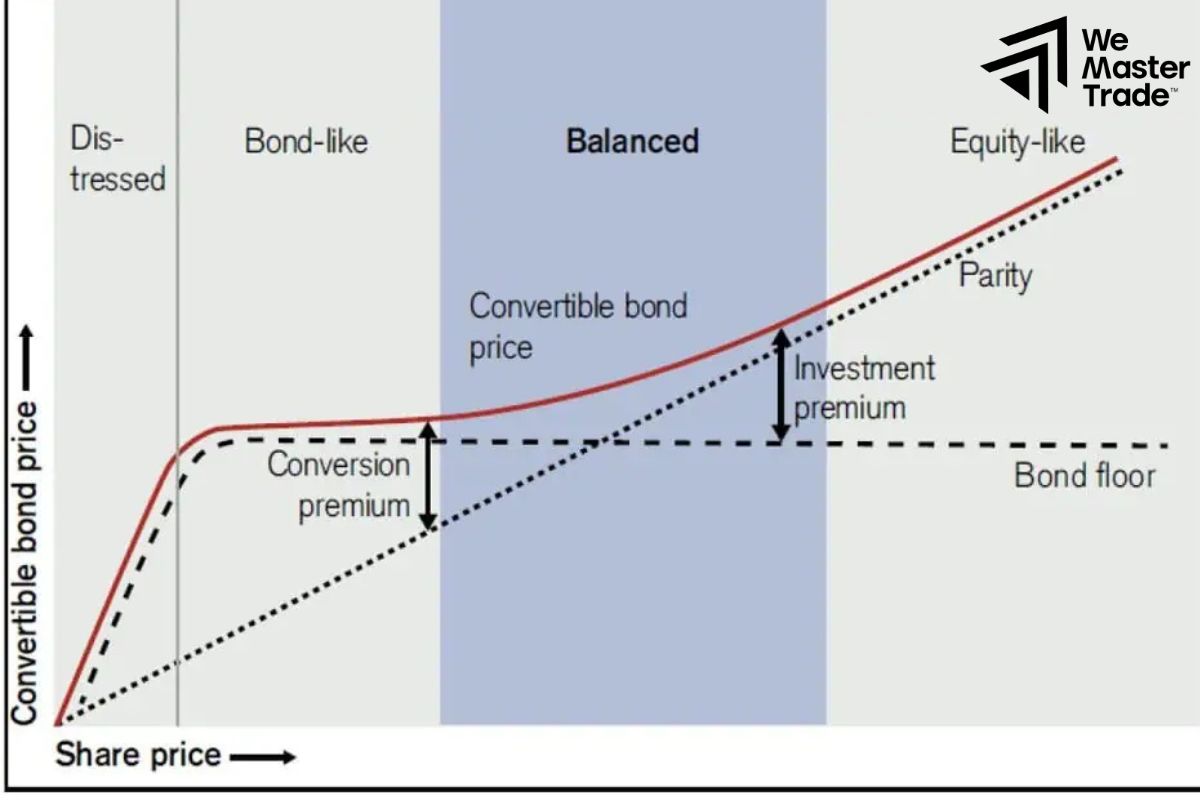

Convertible Arbitration

Convertible arbitrage is an investment strategy that focuses on taking advantage of the opportunity to profit from the price difference between a convertible bond and the stock of the company issuing the bond.

What is a convertible bond?

Before understanding convertible arbitrage, we need to understand convertible bonds. Convertible bonds are a special type of bond, in addition to receiving interest like regular bonds, bondholders also have the right to convert the bond into the stock of the issuing company. In other words, you can choose to receive interest or convert the bond into stock depending on the market situation.

What do convertible arbitrage investors do?

Convertible arbitrage investors will:

- They will carefully analyze the situation of the bond issuing company, the market prices of both bonds and stocks to find abnormalities.

- Based on the analysis results, they will make a decision to buy or sell bonds and stocks. For example, if they think bond prices are too low relative to their intrinsic value, they will buy bonds and short stocks. Conversely, if they think bond prices are too high, they will short bonds and buy stocks.

When the prices of bonds and stocks adjust to the same level, investors will take profits.

Conclusion

In conclusion, arbitrage is a potential investment strategy, but it also requires investors to have extensive knowledge of the market and trading experience. If you want to participate in arbitration, please carefully study the risks and opportunities involved. Good luck!

See more: