If you have a good understanding of the market as well as how to use technical indicators and want to apply your strategies, ECN brokers are definitely a perfect choice that you cannot ignore. Let’s find out the outstanding features and how to choose a reliable broker companion for yourself. Shorten the path to success right here:

What Is An ECN Brokers?

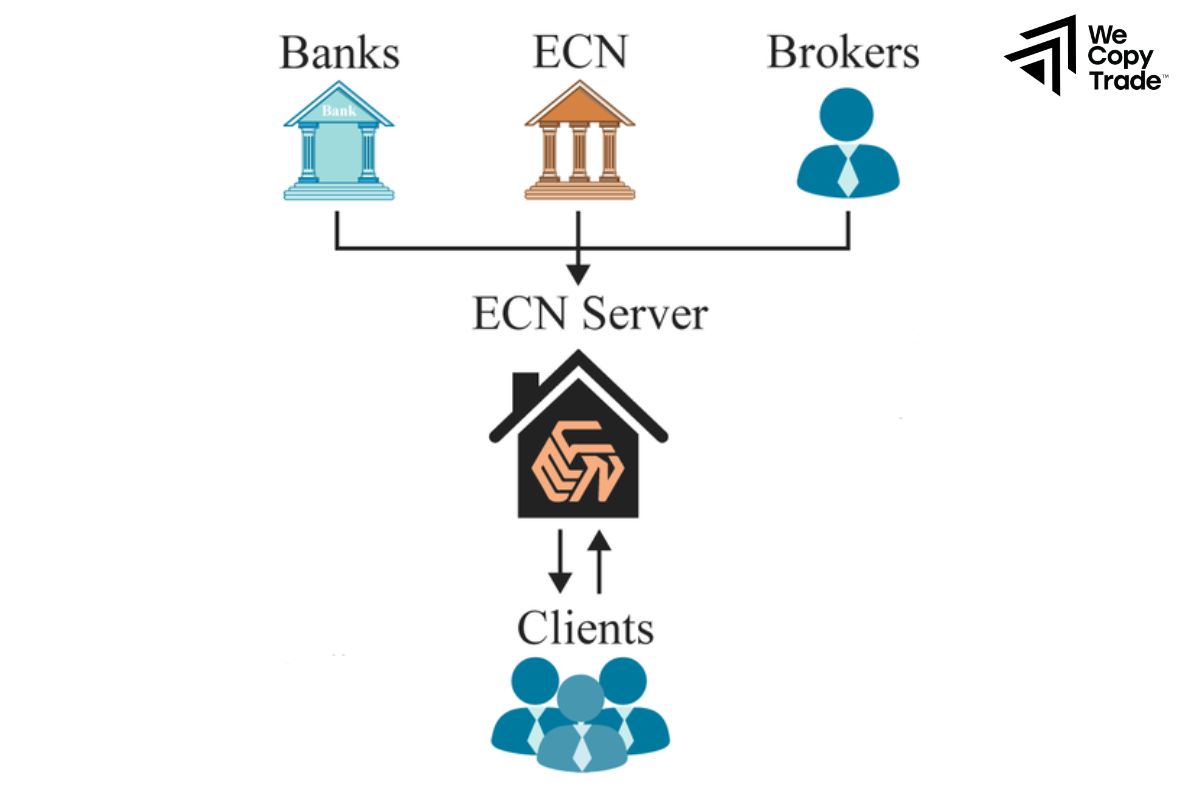

An ECN brokers acts as a bridge between investors and the forex market, a bustling gathering place where buyers and sellers meet to trade foreign currencies. Instead of going through an intermediary, an ECN connects you directly to other investors around the world.

When you want to buy or sell a currency pair (e.g. EUR/USD), your order is sent to the ECN system. This system automatically searches for a corresponding sell or buy order to match the order, ensuring that the transaction is carried out quickly and efficiently.

ECN provides you with detailed and constantly updated price information, including the best buy price and the best sell price available on the market. This allows you to make trading decisions based on the most accurate information.

Unlike the stock market, the forex market does not have a central exchange. ECN acts as a platform that connects investors globally, creating a decentralized forex market that is always open 24/5.

See more:

- What is Position Sizing? Popular Methods You Should Know

- Applying the Kelly Criterion to Your Trading Systems

- Martingale or Anti-Martingale Strategy? Which one is better?

- Definition, Pros and Cons of Using Martingale Strategy

Benefits of ECN brokers

Trading hours through ECN brokers are flexible. You can trade whenever you want, even outside of regular trading hours. This is convenient for investors with busy schedules or who want to take advantage of market opportunities that appear outside of hours.

Compared to traditional brokers, ECNs often have lower commissions and spreads (the difference between the bid and ask price), helping you save a significant amount of money.

ECNs provide transparent market information, making it easy for you to monitor prices and make trading decisions.

If you want to trade anonymously, ECNs can meet this need.

Disadvantages of Electronic Communications Networks

- To use an ECN, you usually have to pay a fairly high initial fee.

- ECN trading platforms are often more complex than those of traditional brokers, requiring you to spend time getting used to them.

- ECN brokers often do not offer as many technical and fundamental analysis tools as traditional brokers.

- In some cases, ECN spreads can be wider than those of traditional brokers, especially when the market is less volatile.

List of Top ECN Forex Brokers in the U.S.

To be successful, your investment partner must be experienced and trustworthy. Here are 2 recommendations for excellent ECN brokers:

Interactive Brokers

If you are a professional investor looking for a powerful and reliable ECN trading platform, Interactive Brokers is definitely a great choice. With over 4 decades of experience in the industry, Interactive Brokers has established itself as one of the world’s leading brokers. Reasons to choose Interactive Brokers:

- Interactive Brokers provides access to a wide range of financial markets across the globe, from stocks, ETFs, options to currencies, cryptocurrencies and more. You can diversify your portfolio easily.

- Interactive Brokers is known for its low trading fees, helping you save costs and maximize profits.

- You can start trading with Interactive Brokers without having to deposit a large initial amount.

- Interactive Brokers offers an advanced trading platform, allowing you to execute trades quickly and accurately.

- With a long history and good reputation, Interactive Brokers is a reliable choice for investors.

Forex.com

Forex.com is a reputable online trading platform that not only allows you to trade forex but also offers a wide range of other assets such as gold, oil, stock indices, etc. This helps you diversify your portfolio and increase your chances of making a profit.

GTX Direct, a trading platform from Forex.com, is easy to use, offers a variety of analytical tools and professional customer support, providing you with a professional ECN trading environment. There, you will be directly connected to major liquidity providers around the world, helping to ensure competitive prices and fast order execution. You only need $50 to start trading, which is suitable for both new and experienced investors.

How Does An ECN Differ From A Traditional Stock Exchange?

ECN (Electronic Communication Network) and traditional stock exchanges are two popular forms of financial asset trading. However, they work in different ways:

- ECN is an electronic trading network that connects buyers and sellers directly with each other, so transaction fees are usually low. This means that there is no intervention from an intermediary like traditional brokers. ECN operates 24/7, providing a clear view of ongoing buy and sell orders so you can make better trading decisions.

- Traditional stock exchanges are where investors buy and sell securities through brokers. Transactions are usually made on a physical or electronic trading floor, but brokers are still involved. Compared to ECNs, traditional exchanges often have more complicated processes and transaction costs can be higher.

What Types Of Assets Can Be Traded On An ECN?

ECN brokers are not limited to forex trading. They also open up the opportunity to trade a wide range of financial assets such as stocks, commodities, and derivatives. Through their extensive network, ECNs help connect investors with large liquidity providers around the world. This means you can trade different financial assets quickly and efficiently on the same platform.

Factors To Consider When Choosing An ECN Broker

To choose a useful ECN brokers, we first need to set standards and see if they are satisfied. Here are some highly rated standards to help you choose the right companion:

- Make sure the broker is licensed by a reputable financial authority to protect your interests.

- Compare the spreads and commissions of the brokers carefully. The lower the spread, the less your trading costs.

- The platform must be modern, stable and provide all the necessary tools for you to analyze the market and execute transactions.

- The interface must be friendly and easy to use so that you can focus on trading without being distracted.

Choosing the right broker that you can trust helps ensure a fair, transparent and safe trading environment for your assets, minimizes trading costs to increase profits, provides tools to support you in making better trading decisions and creates a smooth and efficient trading experience.

Conclusion

In conclusion, ECN brokers are a great proposition for investors who want to trade forex professionally and efficiently. With transparency, efficiency and low costs, ECN helps you make the most of opportunities in the forex market. However, to limit risks, you should first use a demo account to get used to the interface and how it works.

See now: