Discover the incredible potential of ASIC technology and how it’s transforming industries like cryptocurrency mining, data processing, and electronics. Whether you’re looking to optimize your mining operations or improve your electronic systems, understanding Australian Securities Investments Commission technology can provide a significant edge. Ready to take your operations to the next level? Explore the benefits of ASIC today and see how they can enhance your performance and results.

What is an ASIC license?

An ASIC license refers to the official authorization issued by the Australian Securities Investments Commission. This license is required for businesses or individuals who want to provide financial services in Australia. It ensures that these entities comply with Australian financial regulations, including laws designed to protect consumers and maintain the integrity of financial markets.

There are various types of ASIC licenses, depending on the financial services being offered, such as:

- Australian Financial Services (AFS) License – Required for businesses offering financial advice, dealing in financial products, or providing custodial services.

- Australian Credit License (ACL) – Required for businesses that engage in credit activities, such as offering loans or credit-related services.

See now:

- How to Open Mini and Micro Accounts Easily in just 5 steps

- What are Islamic Accounts in Forex? Top Accounts Forex

- Tips ECN Accounts Trading for beginner you should know

- What is a Limit Orders? Guide How to place limit orders

What are the conditions for an ASIC license?

To obtain an ASIC license, businesses must meet several key conditions:

- Responsible managers must have the necessary skills and qualifications.

- Applicants must demonstrate sufficient financial stability and meet capital requirements.

- Effective risk management and monitoring systems are required.

- Individuals involved must have a good reputation, with no criminal or bankruptcy history.

- Clear disclosure documents and procedures for handling complaints are essential.

- Annual reports, compliance with Australian laws, and professional indemnity insurance are mandatory.

How does ASIC manage Forex platforms?

Australian Securities and Investments Commission regulates and oversees Forex (foreign exchange) platforms to ensure that they operate fairly, transparently, and in compliance with Australian laws. The key ways ASIC manages Forex platforms include:

Licensing and Oversight

- Forex platforms operating in Australia must obtain an Australian Financial Services (AFS) License from ASIC. This license ensures that the platform meets regulatory standards and provides financial services in a manner that protects consumers.

- The Australian Securities Investments Commission requires Forex providers to meet strict operational standards, such as having responsible managers with appropriate experience and robust financial backing.

Regulatory Compliance

- Forex platforms must adhere to Australian laws, including the Corporations Act 2001, which governs financial services in Australia. This includes obligations related to disclosure, transparency, and client protection.

- Australian Securities Investments Commission ensures that Forex platforms provide clear, accurate information about risks, fees, and trading conditions, protecting investors from misleading practices.

Client Money Protection

- ASIC enforces rules to protect client funds, requiring Forex platforms to segregate client money from the platform’s own funds. This ensures that client funds are safe, even if the platform faces financial difficulties.

Reporting and Disclosure

- Forex platforms are required to provide regular reports to Australian Securities Investments Commission on their financial position and business operations. This transparency helps maintain market integrity and ensures that platforms are financially stable.

How to check if a Forex platform has received an ASIC license

To check if a Forex platform has received an ASIC license, follow these steps:

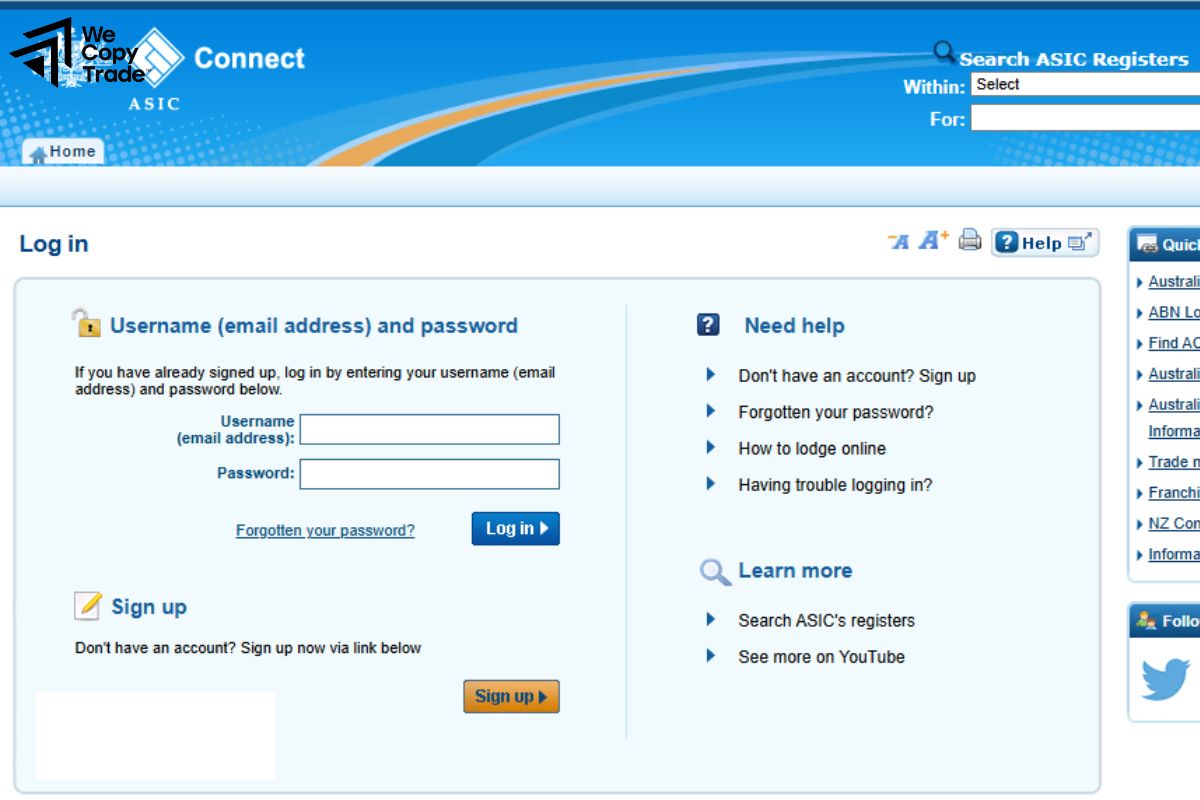

Step 1: Visit the ASIC website

- Go to the official ASIC website.

- Search the Professional Register for Australian Financial Services (AFS) Licensee or Australian Credit Licensee.

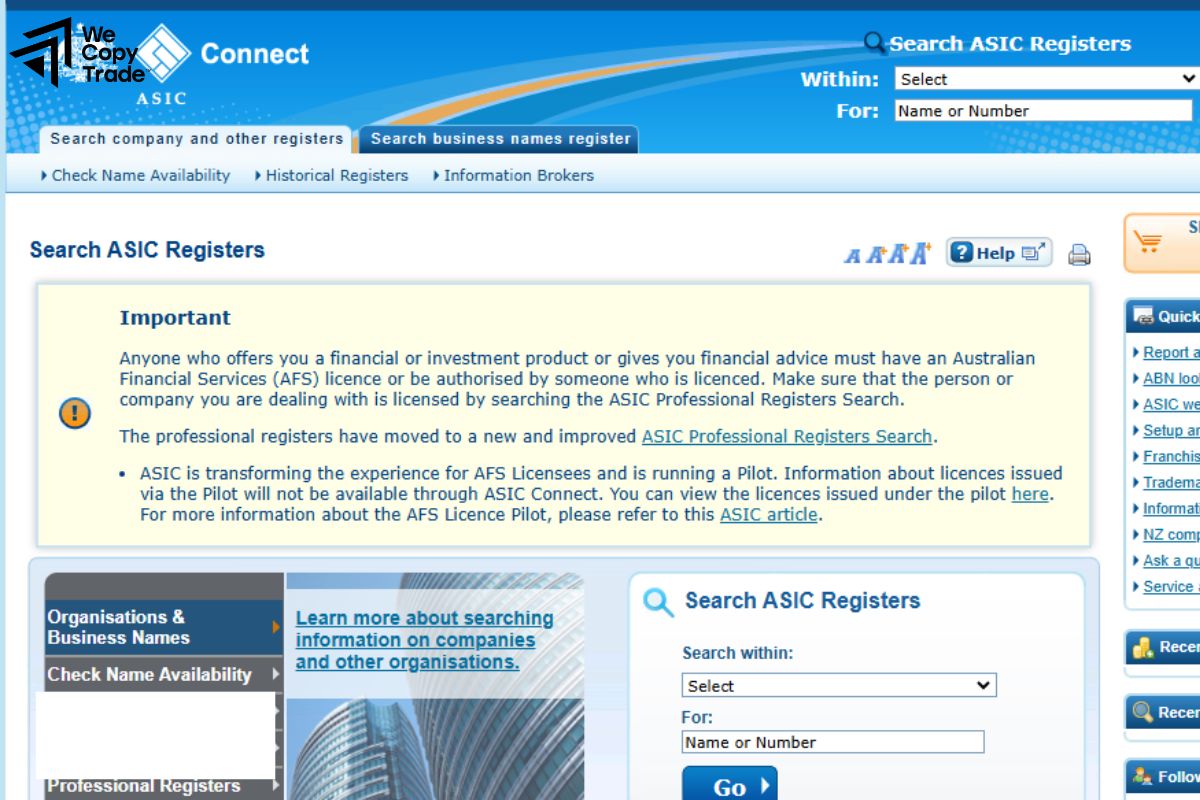

Step 2: Fill in the license registration information

- Search by license number or name

- Enter the platform name or AFS license number into the search engine to confirm if the platform is licensed.

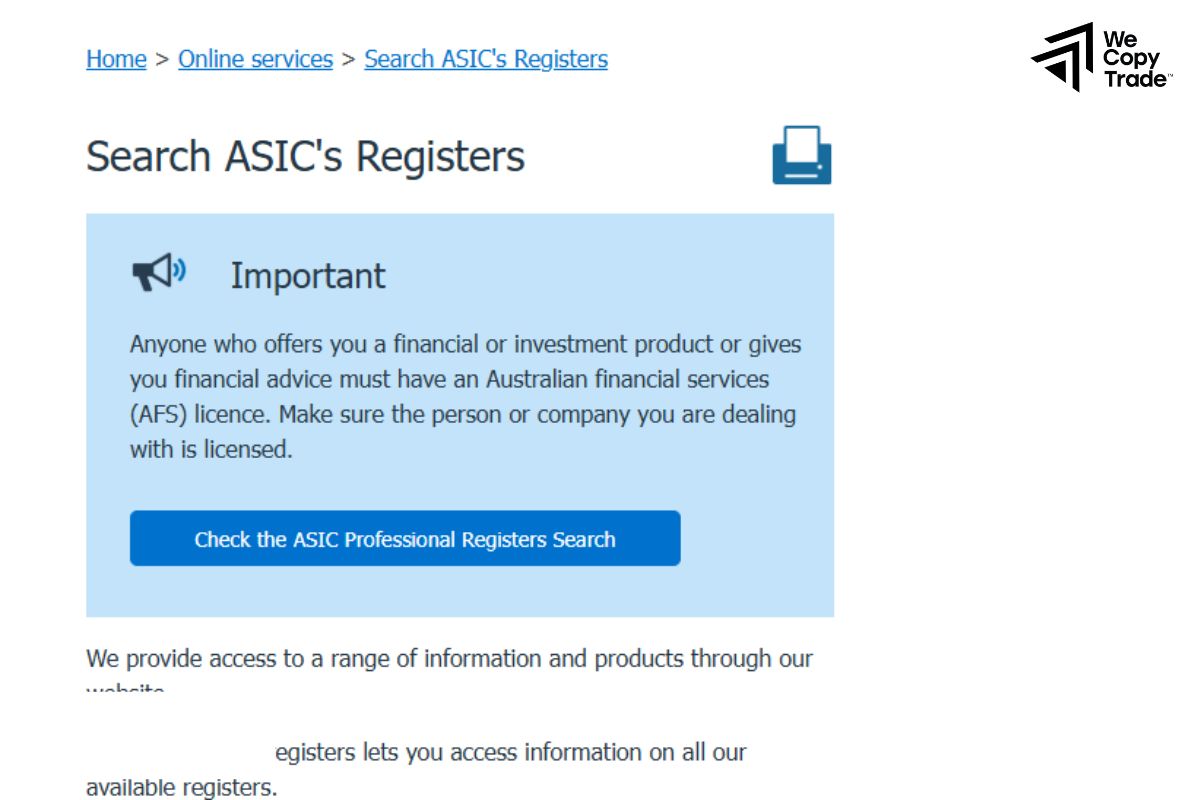

Step 3: Verify the license

- Check if the platform is listed as a licensed entity

- Review the details, including the license status, conditions, and the type of financial services they are allowed to provide.

Top 5 most reputable Forex brokers with ASIC Licenses

Here are five reputable Forex brokers that are regulated by Australian Securities and Investments Commission:

IG Group

- Regulation: ASIC, FCA (UK)

- IG Group is one of the most established brokers, known for its robust trading platforms, educational resources, and regulatory compliance. It offers a wide range of markets, including Forex, CFDs, and stocks.

- Features: User-friendly platforms, low spreads, and strong customer support.

Pepperstone

- Regulation: ASIC, FCA (UK)

- Pepperstone is a popular Forex broker offering competitive spreads and a variety of trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. It is well-regarded for its execution speed and low fees.

- Features: Excellent customer service, multiple account types, and low-cost trading.

AxiTrader

- Regulation: Australian Securities Investments Commission

- AxiTrader is known for its transparency, competitive pricing, and extensive range of trading tools. It offers Forex trading with a strong emphasis on education and support for both beginners and experienced traders.

- Features: Tight spreads, no requotes, and reliable customer support.

CMC Markets

- Regulation: Australian Securities Investments Commission, FCA (UK)

- CMC Markets offers a wide range of Forex pairs, CFDs, and other instruments with advanced trading platforms. It is a trusted broker with a strong regulatory history and a reputation for fair pricing.

- Features: Powerful trading platforms, extensive research tools, and educational content.

eToro

- Regulation: ASIC, FCA (UK), CySEC (Cyprus)

- eToro is a well-known social trading platform that allows users to copy successful traders and engage in Forex trading. It is highly regulated and provides a user-friendly interface with a focus on social investing.

- Features: Social trading, copy trading features, and a wide range of markets.

Why is a Forex platform considered reputable when it has an ASIC license?

A Forex platform is considered reputable when it has an ASIC license because Australian Securities Investments Commission enforces strict regulations to protect consumers and ensure transparency. These platforms must comply with rules regarding client fund protection, segregating client funds from company funds, and ensuring financial stability.

Additionally, ASIC requires platforms to provide clear information about services, fees, and risks, while also conducting ongoing supervision to detect fraudulent behavior. Therefore, having an Australian Securities Investments Commission license demonstrates that the Forex platform adheres to high legal standards and user protection, thus establishing its reputation.

Conclusion

In conclusion, obtaining an ASIC license is a key indicator of a Forex platform’s credibility and trustworthiness. It ensures that the platform adheres to strict regulatory standards, protects client funds, and operates transparently. If you’re looking for a reliable and secure Forex trading experience, choosing a platform regulated by the Australian Securities Investments Commission is crucial. Don’t settle for less ensure your Forex platform is Australian Securities Investments Commission licensed to safeguard your investments and enjoy peace of mind while trading.

See more: