Sovereign Credit Rating plays a vital role in evaluating a country’s creditworthiness, directly impacting its borrowing costs and investor confidence. These ratings, assigned by agencies like S&P, Moody’s reflect the economic and political stability of a nation. Understanding them can help investors and businesses make informed decisions about global opportunities. Want to stay ahead in the financial market? Dive deeper into how Sovereign Credit Ratings affect economies and investments worldwide. Start exploring now!

What is a Sovereign Credit Rating?

The Sovereign Credit Ratings is an evaluation of a country’s ability to meet its financial obligations, such as repaying government debts. It is assigned by credit rating agencies like Standard & Poor’s, Moody’s, and Fitch Ratings, and reflects the economic stability, political environment, and fiscal health of a nation.

The rating uses a scale of grades, ranging from AAA the highest, indicating minimal risk to D the lowest, indicating default. Countries with higher ratings enjoy lower borrowing costs, while those with lower ratings face higher interest rates due to perceived risk.

Sovereign Credit Ratings are essential for investors, as they provide insights into the reliability of investing in a country’s bonds or other financial instruments.

See now:

- Hidden Truths About Bond Spreads Not Everyone Knows

- What is Currency Carry Trade? Example of Spread Trading

- How Foreign Currency Effects Impact Different Sectors

Why Sovereign Ratings Matter

Sovereign ratings play a crucial role in global finance and economics. Here’s why they matter:

Investor Confidence

Sovereign ratings, issued by agencies like S&P, Moody’s, and Fitch, provide investors with an assessment of a country’s ability to repay its debts. A higher rating (e.g., AAA) signals stability and low risk, while lower ratings (e.g., BB or below) indicate higher risk. This helps investors make informed decisions about government bonds or other debt instruments.

Access to Borrowing

Countries use sovereign ratings to access international loans and capital markets.

- A strong rating helps countries secure loans at lower interest rates.

- A downgrade increases borrowing costs, as lenders demand higher returns to offset perceived risks.

Impact on Currency and Economy

Sovereign ratings affect investor perception of a country’s economic health:

- A downgrade can weaken the national currency as foreign investors pull out funds.

- Economic growth may slow if borrowing becomes costly, reducing public spending or investment.

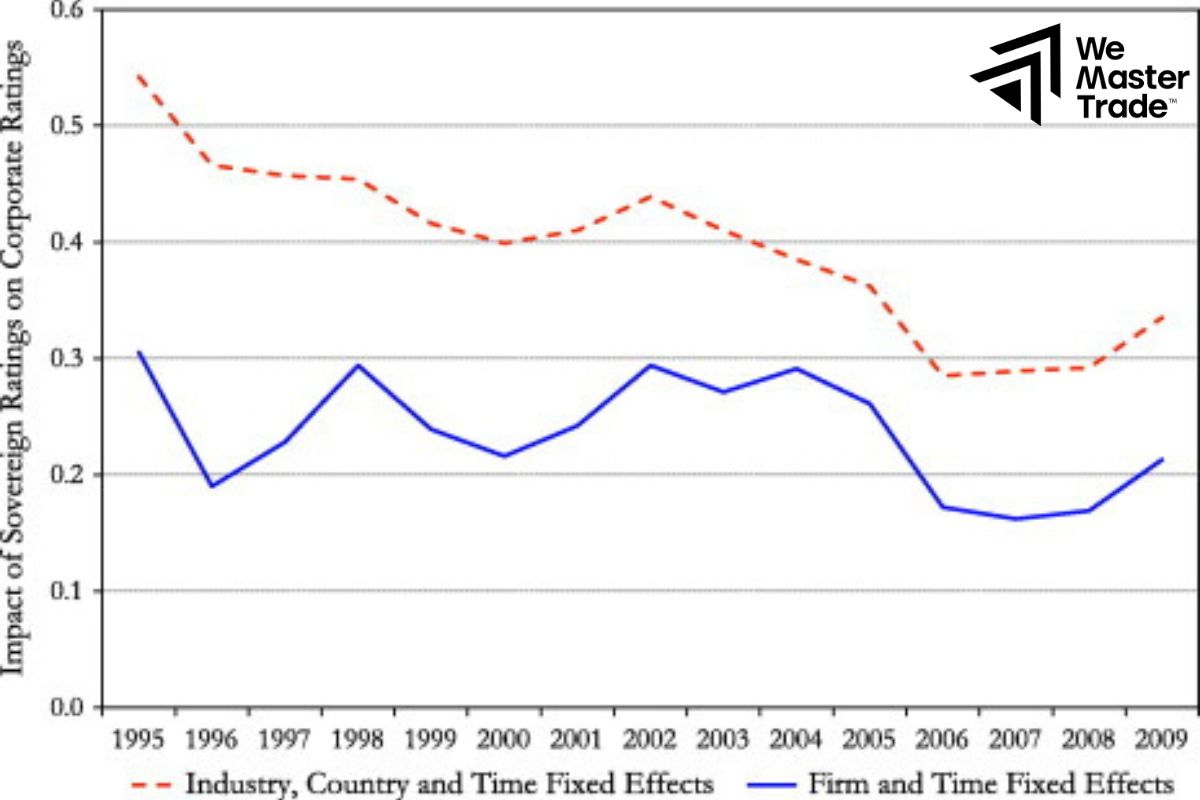

Effect on Corporate Ratings

Companies operating in a country are often capped by the sovereign rating. For example:

- If a country’s rating is BB, it’s unlikely a local company will achieve a higher rating.

- Sovereign ratings impact corporate borrowing costs and access to global investors.

Policy Implications

Sovereign ratings serve as feedback for governments, influencing fiscal and monetary policies:

- A lower rating may push governments to address issues like public debt, corruption, or deficits.

- Conversely, positive upgrades can boost political and economic reforms.

Global Trade and FDI

A strong sovereign rating attracts Foreign Direct Investment and promotes trade partnerships. Investors and businesses view highly rated countries as safer options for long-term investments.

Factors that Determine Sovereign Credit Ratings

Sovereign credit ratings are determined by evaluating a country’s ability and willingness to repay its debts. Credit rating agencies like Moody’s, S&P, and Fitch analyze a wide range of economic, political, and financial factors. Here are the key determinants:

Economic Factors

- GDP Growth Rate: A higher and consistent growth rate signals a strong, expanding economy, reducing credit risk.

- Income Levels: Countries with higher GDP per capita are generally considered more creditworthy.

- Inflation Rate: Stable, low inflation reflects sound economic management. High inflation erodes confidence.

- Economic Diversification: Economies relying on diverse industries are less vulnerable to external shocks.

Fiscal and Debt Metrics

- Public Debt-to-GDP Ratio: A high ratio signals greater risk of default. Managing sustainable debt levels is crucial.

- Fiscal Deficit: Persistent budget deficits indicate excessive borrowing, which can weaken ratings.

- Revenue Collection: Countries with efficient tax systems and strong revenue streams are seen as more creditworthy.

Monetary and Financial Stability

- Foreign Reserves: Large reserves improve a country’s ability to meet external debt obligations.

- Exchange Rate Stability: Volatile exchange rates increase risks, especially for debt denominated in foreign currencies.

- Banking System Health: A strong, stable financial system supports economic growth and debt repayment.

External Position

- Current Account Balance: Persistent deficits indicate reliance on external financing, increasing vulnerability.

- External Debt: A country’s ability to service its foreign-currency debt impacts ratings.

- Foreign Direct Investment (FDI): Higher FDI inflows signal economic confidence and boost foreign currency reserves.

Political and Institutional Factors

- Political Stability: Stable governments inspire investor confidence, while political turmoil can increase default risk.

- Quality of Governance: Effective institutions, transparency, and anti-corruption measures improve creditworthiness.

- Policy Continuity: Frequent policy changes or populist measures can deter investor trust.

Structural and Social Factors

- Demographic Trends: A young, growing population supports long-term economic growth, while aging populations pose fiscal challenges.

- Infrastructure Quality: Strong infrastructure promotes investment and economic competitiveness.

- Income Inequality: Extreme inequality can lead to social unrest, disrupting economic stability.

History of Default

A country’s past behavior regarding debt repayment significantly influences ratings. Default history, even decades ago, can signal risk and reduce trust.

External Environment

- Global Commodity Prices: Resource-dependent countries face risks from price volatility.

- Geopolitical Risks: Trade wars, conflicts, or sanctions can disrupt economic performance and debt repayment.

- Global Interest Rates: Rising global rates increase borrowing costs for countries with external debt.

Examples of Sovereign Credit Ratings

Here are examples of sovereign credit ratings across different categories:

Investment-Grade Ratings (Low Risk)

Countries with strong economic fundamentals and low default risk:

| Country | S&P Rating | Moody’s Rating | Fitch Rating |

| United States | AA+ | Aaa | AAA |

| Germany | AAA | Aaa | AAA |

| Australia | AAA | Aaa | AAA |

| Japan | A+ | A1 | A |

| Singapore | AAA | Aaa | AAA |

Explanation:

- AAA or Aaa: Highest rating, indicating minimal risk.

- AA+ or A1: Strong credit quality but slightly below the highest tier.

Non-Investment Grade (Junk Status)

Countries with higher risk, indicating challenges in meeting debt obligations:

| Country | S&P Rating | Moody’s Rating | Fitch Rating |

| Argentina | CCC+ | Caa3 | CCC |

| Venezuela | SD (Selective Default) | C | RD (Restricted Default) |

| Pakistan | CCC+ | Caa3 | CCC- |

| Nigeria | B- | B3 | B- |

| Ghana | SD | Ca | RD |

Explanation:

- B- / B3: Highly speculative, significant credit risk.

- CCC / Caa: Substantial risks, very vulnerable to non-payment.

- SD (Selective Default) or RD (Restricted Default): Country has defaulted on some obligations.

Middle-Tier Ratings (Moderate Risk)

Countries that fall between investment-grade and junk status:

| Country | S&P Rating | Moody’s Rating | Fitch Rating |

| India | BBB- | Baa3 | BBB- |

| Indonesia | BBB | Baa2 | BBB |

| Brazil | BB- | Ba2 | BB- |

| Turkey | B+ | B3 | Bg |

| South Africa | BB- | Ba2 | BB- |

Explanation:

- BBB- / Baa3: Lowest investment-grade rating.

- BB / Ba2: Speculative, moderate risk but not yet junk status.

Frequently Asked Questions about Sovereign Credit Ratings

Can sovereign credit ratings change?

Yes, ratings are dynamic and can be upgraded or downgraded based on economic performance, political events, or external shocks (e.g., global financial crises).

Who uses sovereign credit ratings?

- Investors: To assess the risk of government bonds and securities.

- Governments: To understand borrowing costs and attract investments.

- Businesses: For evaluating country risk before entering new markets.

- International institutions: For loan decisions (e.g., IMF, World Bank).

Which countries have the highest sovereign ratings?

Countries like Germany, Switzerland, Singapore, and Australia typically hold the highest ratings (AAA/Aaa) due to strong economies, political stability, and low debt.

Conclusion

In conclusion, sovereign credit rating plays a critical role in assessing a country’s financial health, influencing borrowing costs, investor confidence, and economic stability. To stay updated on Sovereign Credit and their impact on global economies, subscribe to our newsletter or explore our detailed insights. Making smarter financial decisions starts by understanding the numbers that matter!

See more: