Maximize your trading potential with trailing stops! Discover how this powerful tool helps secure profits and minimize losses by automatically adjusting to market movements. Learn how to set up trailing and boost your trading strategy. Start mastering trailing today!

What are Trailing Stops?

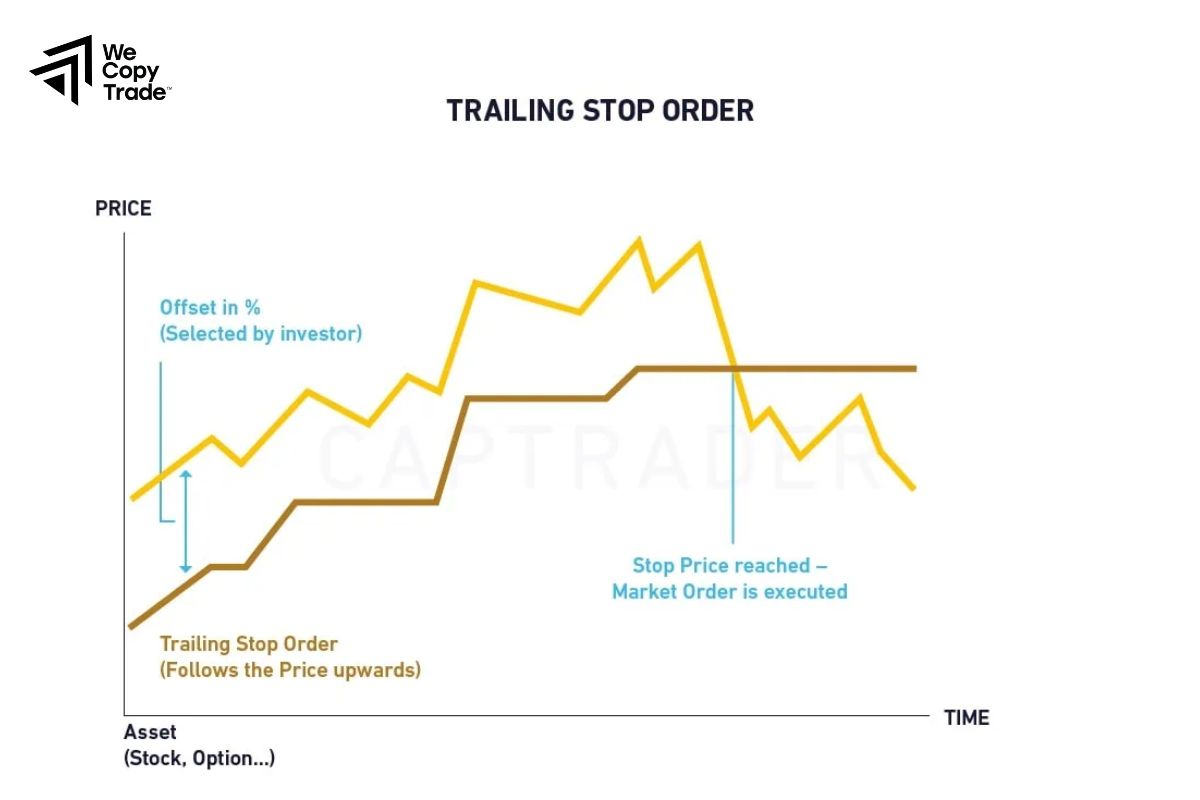

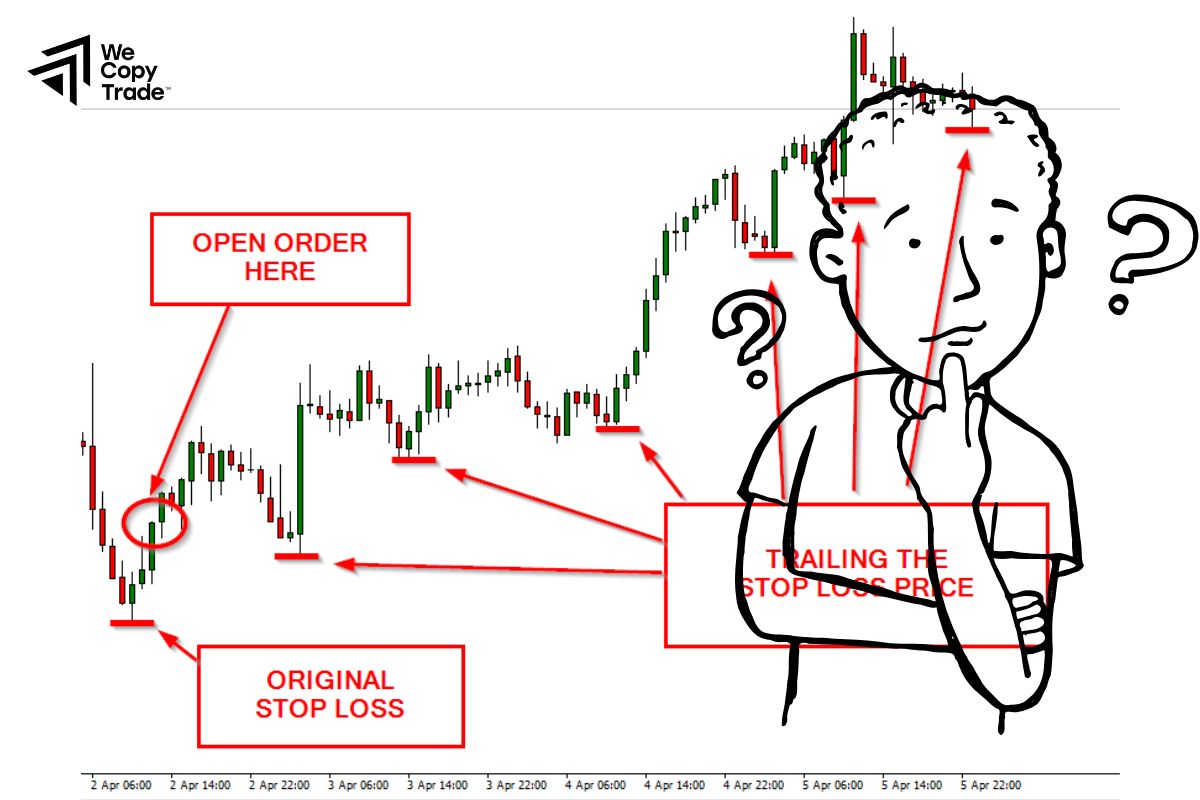

Trailing stops is a type of stop-loss order in trading that automatically adjusts to the market price, helping traders protect profits while limiting potential losses. Unlike a fixed stop-loss, which remains static, a trailing stop follows the market’s direction by a specified amount, or trail.

Here’s how it works:

- Dynamic Adjustment: If the asset price moves favorably, the trailing stop moves along with it by a set percentage or dollar amount. For example, if you set a trailing stop at 10% and the stock price rises, the stop price also rises to maintain that 10% distance.

- Locking in Profits: If the market price reverses and moves against your position, the trailing stop doesn’t adjust. This way, if the price drops (for long positions) or rises (for short positions) beyond the set threshold, the trailing stop is triggered, locking in profits or limiting losses.

- Flexibility: Trailing stops allow traders to let profits run in trending markets while automatically selling or buying if the price reverses significantly, making them useful in volatile markets.

See more:

- Market Risk Mitigating and Managing Guidelines Most Simple

- Methods used to calculate effective Value at Risk Analysis

- What is Hedging? How to hedge in stock investment

- All Processes of Portfolio Management Most Effective

Why and When Should I Use Trailing Stops Orders?

Trailing stop orders can be a powerful tool in a trader’s strategy, helping to manage risk and secure profits without requiring constant monitoring. Here’s why and when you might consider using trailing stops:

Why Use Trailing Stops?

Using a trailing stop is an effective risk management strategy because it helps protect profits and limit losses when asset prices fluctuate. A trailing stop works by automatically following the price upward when it rises, but it remains fixed if the price drops. This allows investors to lock in profits they’ve gained without needing to monitor the market constantly, optimizing trading efficiency.

Additionally, a trailing stop minimizes the impact of emotions, preventing investors from holding positions in the hope of further gains or a recovery when prices fall. Automating the exit point helps traders maintain discipline, avoiding impulsive decisions, especially in volatile market situations.

Moreover, trailing stops are flexible and can be adjusted to fit different trading strategies (short-term, medium-term, or long-term), saving investors time and effort. Thus, trailing stops are essential tools, effectively supporting risk management and maximizing profit potential in investments.

When Should I Use Trailing Stops Orders?

Trailing stop orders are only allowed to be triggered during standard trading hours, from 9:30 AM to 4:00 PM ET. This means that when you place a trailing stop order, it will not function during extended hours trading, such as pre-market or after-hours sessions. Additionally, the order will not be executed if the stock is halted, such as during trading halts or on weekends and market holidays.

An interesting point is that you can decide how long your trailing stop will remain effective. If you only want the order to be active for the current trading session, you can set it as a day order, and it will automatically expire at the end of the session if it hasn’t been triggered. However, if you want the order to continue being effective for future trading sessions, you can choose a good-’til-cancelled (GTC) order. GTC orders will remain active in future standard trading sessions until you decide to execute or cancel them. At Schwab, GTC orders can even last up to 180 calendar days, giving you more time to monitor market developments.

How to Use Trailing Stops in Crypto Trading

Here’s the translation of the previous response into English:

Step 1: Choose a Suitable Exchange

First, you need to find an exchange that supports trailing stop orders. Not all exchanges have this feature, so select reputable ones like Binance, Coinbase Pro, Kraken, or Bybit, where you can easily place these orders.

Step 2: Determine the Trailing Stop Distance

The trailing stop distance plays a crucial role in protecting your profits. This is the distance between the current price and the stop-loss level you set. To determine the optimal distance:

- Analyze Price Volatility: Consider how the cryptocurrency you are trading fluctuates in price. For instance, Bitcoin may have larger price swings compared to other altcoins.

- Set the Trailing Stop Distance: Decide whether you want to set this distance as a percentage or a fixed amount. This depends on your risk tolerance (e.g., 5% or $2000).

Step 3: Set Up the Trailing Stop Order

On a platform like Binance, follow these steps to set up your trailing stop order:

- Log in to your trading account.

- Locate the trading pair you wish to engage in (e.g., BTC/USDT).

- Select the “Stop-Limit” option and then choose “Trailing Stop.”

- Enter the distance you determined in the previous step (based on percentage or specific value).

- Confirm the order and monitor it on the exchange interface.

Step 4: Monitor and Adjust the Order

Once your order is set, it’s essential to keep an eye on it to ensure the trailing stop works as intended.

- Adjust the Distance: If the market experiences significant volatility, consider adjusting the trailing stop distance to protect yourself from being triggered too early.

- Monitor Market Conditions: If the market remains stable, you may reduce the distance to better safeguard your profits.

How to Place Trailing Stop Buy and Sell Orders on Binance

Placing trailing stop buy and sell orders on Binance is a strategic way to manage your trades and protect profits. Here’s a step-by-step guide on how to do it:

Log into Your Binance Account

- Open the Binance app or website and log in with your credentials.

Select the Trading Pair

- Go to the trading section and choose the cryptocurrency pair you want to trade (e.g., BTC/USDT).

Access the Order Types

- Locate the order entry box on the trading interface. Here, you will find various order types like Market, Limit, Stop-Limit, and Trailing Stop.

Placing a Trailing Stop Sell Order

To protect your profits on a long position, follow these steps:

- Select ‘Trailing Stop’: Choose the trailing stop option.

- Set the Trail Amount:

- Enter the amount by which you want the trailing stop to follow the market price (this can be set as a fixed amount or a percentage). For example, if you set a trailing stop of $200 and the price rises to $40,000, the stop-loss will be set at $39,800.

- Place the Order: After setting the trail amount, confirm the order.

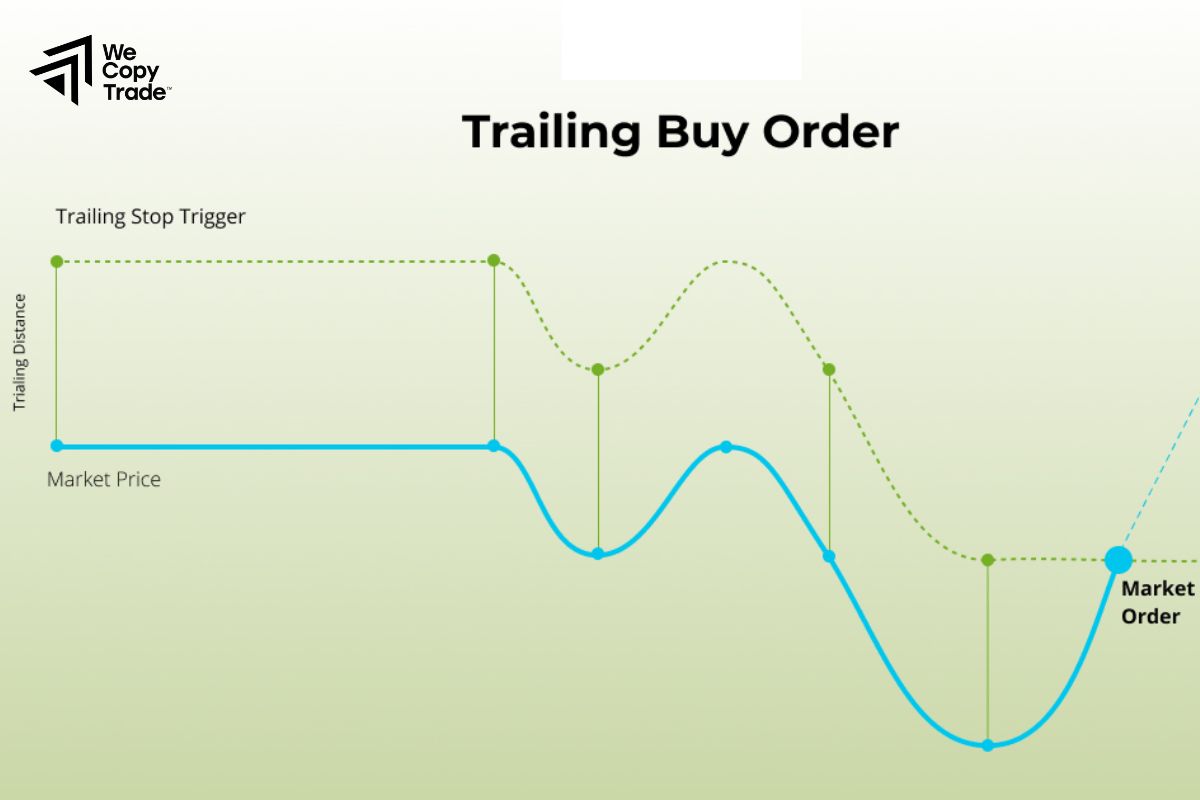

Placing a Trailing Stop Buy Order

If you want to enter a position when the price moves upward, you can place a trailing stop buy order:

- Select ‘Trailing Stop’: Again, choose the trailing stop option.

- Set the Trail Amount: Enter the trailing amount to trigger a buy order once the price increases. For example, if you set a trailing stop of $50 and the price rises to $35,000, the buy order will trigger when the price drops back to $34,950.

- Place the Order: Confirm the order after setting the parameters.

Monitor Your Orders

- Once you’ve placed the orders, monitor them regularly. You can view your open orders in the ‘Open Orders’ section on the trading interface.

Adjust or Cancel Your Orders

- If market conditions change, you can modify or cancel your trailing stop orders. Simply locate the order in your open orders list, and you will have the option to edit or delete it.

FAQ about Trailing Stops

Here’s a comprehensive FAQ about trailing stops, covering key concepts and common questions:

Can I set a trailing stop on any trading platform?

- Most modern trading platforms offer the option to set trailing stops. However, it’s important to check with your specific broker to ensure that this feature is available.

Can I manually adjust my trailing stop?

- Yes, many platforms allow you to manually adjust your trailing stop at any time before it is triggered. This flexibility can help you adapt to changing market conditions.

Are there any risks associated with trailing stops?

- While trailing stops can help protect profits, they are not foolproof. Sudden market movements can result in slippage, where the order executes at a different price than expected. Additionally, in highly volatile markets, a trailing stop might trigger prematurely, closing a position before a favorable movement occurs.

Conclusion

In conclusion, trailing stops are a powerful tool for managing risk and maximizing profits in trading. By automatically adjusting your stop-loss levels as market prices move, trailing stop help protect gains while allowing trades to run. Ready to enhance your trading strategy? Start using trailing stop today to secure your profits and trade with confidence!

See now: