Are you experiencing a blocked order and unable to complete the transaction? This causes you a lot of trouble and frustration, right? Don’t miss the following article! I will point out the causes of the order rejections to help you limit your mistakes and have a successful transaction!

What are the Reasons for Order Rejections?

To avoid the case that you accidentally place an order at a price that is too high or too low due to a mistake and to help the trading market take place fairly and transparently, sometimes the order will be rejected. Here are the top reasons why your order is rejected, please refer to and note it immediately:

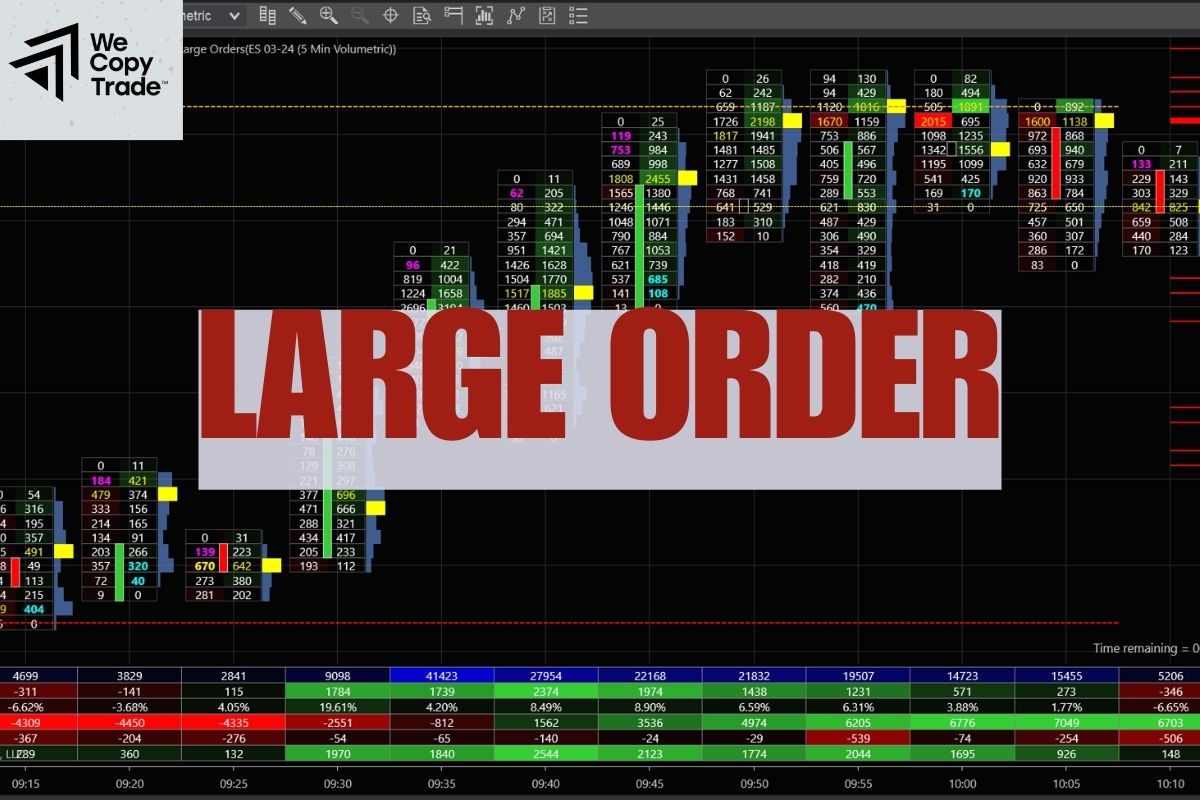

The order is too large

- The first reason for order rejections may be that you order too many products or the total order value exceeds the limit allowed by the system.

- Suppose you want to buy 10,000 shares of a company, but the system only allows you to buy a maximum of 5,000 shares in one transaction.

Inappropriate Order Rejections type

- When you choose the wrong order type (for example: market order, limit order, stop loss order…) or choose an order type that is not suitable for your account type, the system will automatically reject your order.

- For example, you are using a margin trading account but placing a limit order, while a margin account usually only supports market orders.

Place Order Rejections outside of business hours

- Order types are only available during market hours, so if you place a buy/sell order when the market is closed, the order will not be executed.

- For example, the exchange closes at 4:30 p.m., but if you place a buy order at 5 p.m., your order will be rejected.

Insufficient stock

- If you want to sell more than the amount you own or the amount of stock left in stock, this is considered an invalid order.

- For example, if you only have 100 shares but want to sell 200 shares, it is not possible and the order will be rejected.

Blocked order

- Due to some technical reasons or regulations of the exchange, the order type you selected is temporarily blocked.

- The Order Rejections type you selected may be experiencing a system error or may be prohibited from trading for a certain period of time.

See now:

- Reasons Cause of Slippage – How To Minimize the Slippage

- Instant vs Market Execution – Which model should we choose?

- How Instant Execution Works – A Guide to Faster Trades

- Define, Guide How To Chart And Calculate The Overnight Fees

Insufficient margin

- The order will not be executed if the amount of money in your account is not enough to guarantee the transaction.

- For example, you want to buy 100 shares at $100/share, but your account only has $5,000. This amount is not enough to execute the transaction, so your order will be rejected in this case.

Exceeding the number of shares owned

- When you want to sell more shares than you currently own, it is not possible.

- This case is similar to case 4, you only have 100 shares but want to sell 200 shares.

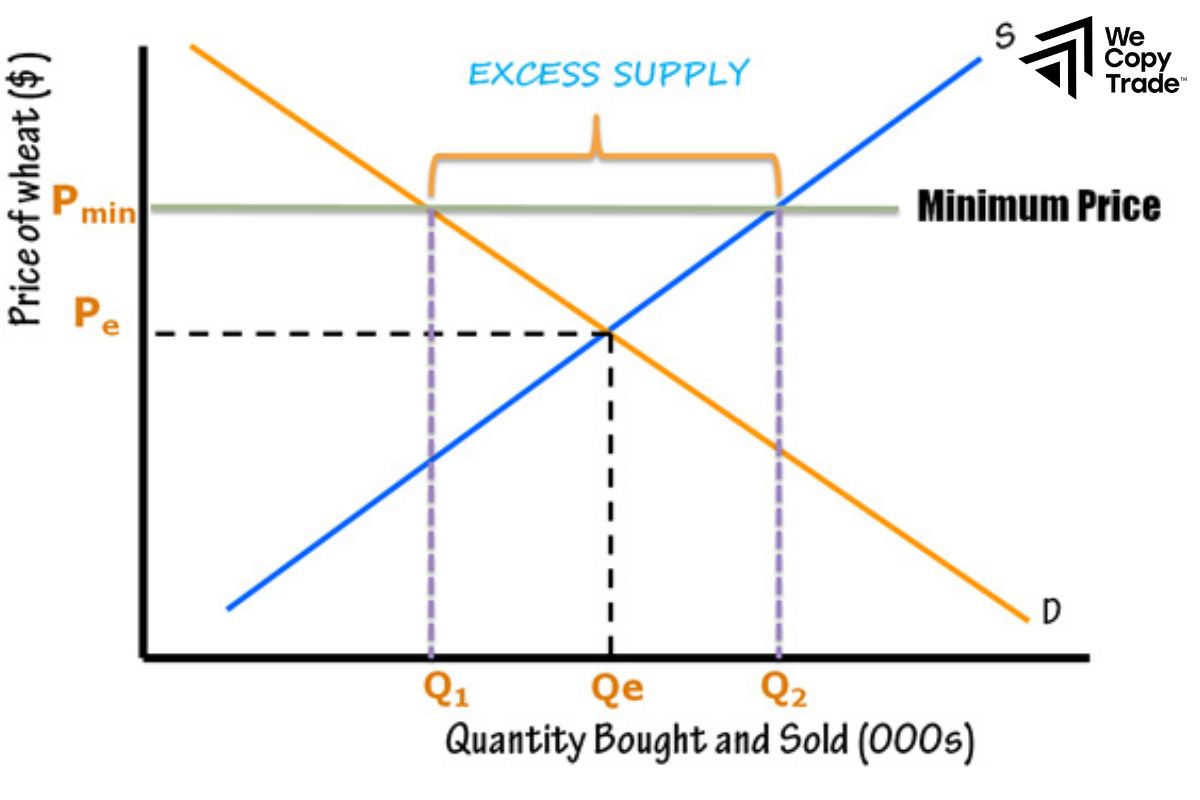

Unreasonable price

- If you set a selling price that is too low compared to the current market price, your order may be canceled because the system recognizes this as an error. Or if you set a sell price that is too high compared to the current market price (for example, double the current price), the Order Rejections may also be canceled to ensure market fairness.

- Exchanges always put investor protection first. Canceling orders that are too low or too high helps prevent unreasonable transactions and protects you from making bad investment decisions. Furthermore, by eliminating orders that are too unusual, the exchange helps maintain market transparency and efficiency.

- Suppose Company A’s stock is trading at $100. You place a sell order at $80. The system will notice that you are trying to sell the stock at a price much lower than the market price and cancel your order.

Price Exceeds Limit

- If the price you enter exceeds the maximum or minimum price limit set by the exchange.

- For example: The exchange only allows trading in the price range of $50 to $150, but you enter a price of $200, the order will not be executed

Unsupported products

- Some new products or high-risk products may be suspended from trading.

- So if the type of product you want to trade is temporarily not supported on the exchange, your order will also be rejected.

Incorrect disclosed quantity

- When placing an Order Rejections outside of business hours, you must declare a portion of the number of shares that will be traded immediately. If this quantity is incorrect, your order may be rejected.

- Trading regulations may vary depending on the exchange, so you should read the terms and conditions carefully before trading.

Some rules to keep in mind when placing orders

- Stocks priced below $25: You can place a buy order up to 10% above the market price and a sell order up to 10% below the market price.

- Stocks priced between $26-$50: You can place a buy order up to 5% above the market price and a sell order up to 15% below the market price.

- Stocks priced above $50: You can place a buy order up to 3% above the market price and a sell order up to 3% below the market price.

- Stop-loss/Stop-buy orders: If you place a stop order too close to the current market price, the order will be considered erroneous and rejected.

Example:

- XYZ stock is trading at $30: You can place a buy order up to $33 (up 10%) and a sell order up to $25.50 (down 15%).

- ABC stock is trading at $100: You can place a buy order at a maximum of $103 (up 3%) and a sell order at a minimum of $97 (down 3%).

How to Avoid Your Order Being Canceled or Rejected

To avoid order rejections, you should:

- Before placing an order, double-check your account’s trading limits.

- Choose the order type that suits your needs and account type.

- Place the order within the specified trading hours.

- Make sure the quantity you want to trade does not exceed the available quantity.

- Make sure the price you place is reasonable and within the allowed range.

If you encounter any difficulties, contact customer support for guidance.

In addition to the above methods, you should combine the use of technical analysis tools and market news provided by the exchanges to help you make better investment decisions:

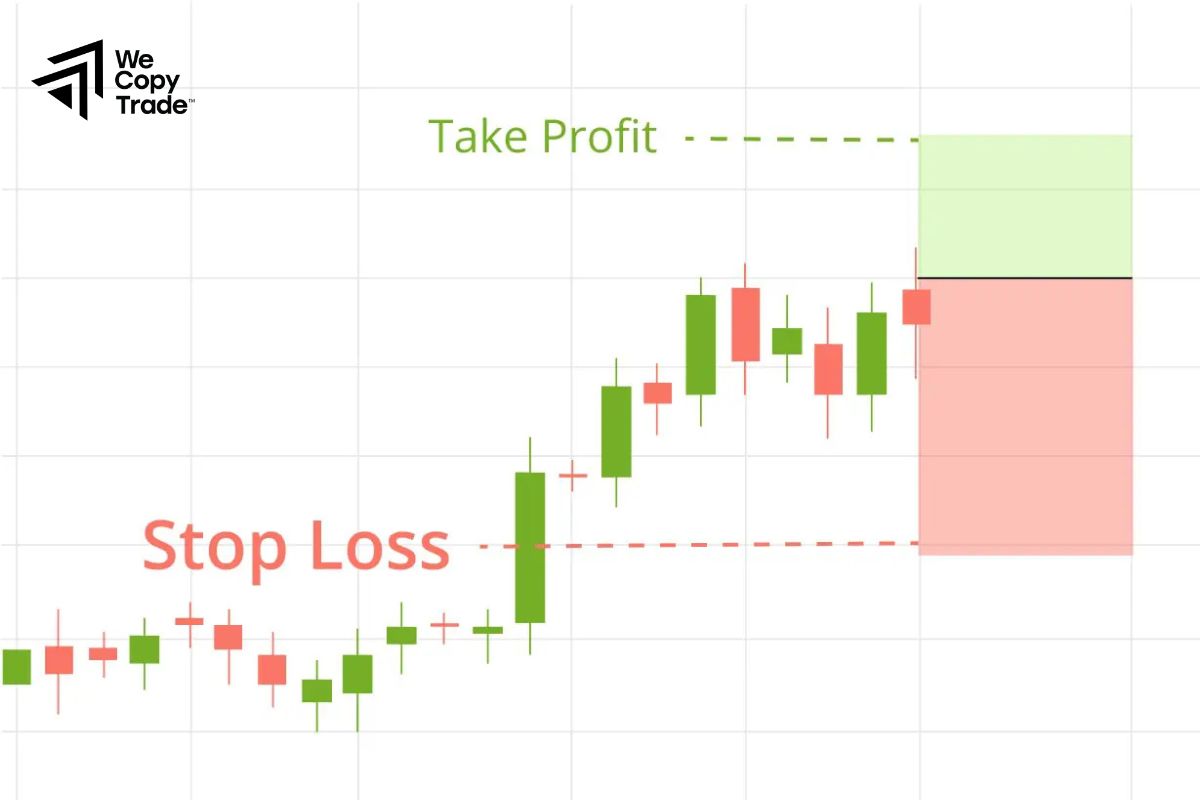

Using stop loss orders

A stop-loss order helps you limit your losses when the stock price falls.

How to place it:

- You set your stop-loss price slightly below the current market price.

- Specifically, your stop-loss price should be at least $0.05 below the highest price at which others are willing to buy the stock (the best bid).

For example, if the current stock price is $100 and the best bid is $99.50, you could place your stop-loss order at $99. If the price falls below $99, your order will automatically execute to sell the stock.

Using Buy Stop Orders

A buy stop Order Rejections allows you to buy a stock when the price rises to a certain price.

How to place it:

- You set a buy stop price slightly above the current market price.

- Specifically, your buy stop price must be at least $0.05 above the lowest price at which someone else is willing to sell the stock (the best offer).

For example, if the current stock price is $100 and the best offer is $100.50, you can place a buy stop order at $101. If the price rises above $101, your order will automatically be executed to buy the stock.

If you set a price too close to the current market price, your Order Rejections may be canceled due to rapid price movements. Setting a price slightly away from the current market price helps ensure that your order will be executed when market conditions reach the price you set.

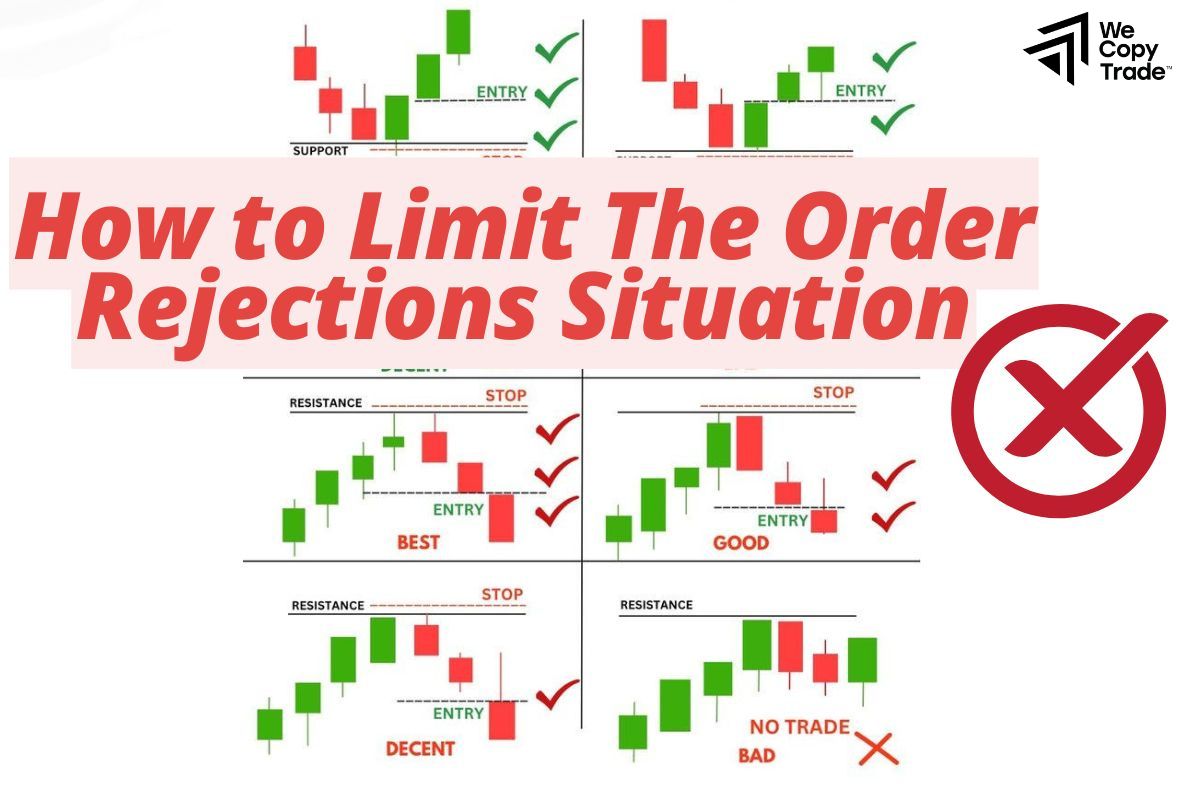

How to Limit The Order Rejections Situation

To ensure smooth and secure trading, exchanges often place limits on the number of shares and the value of Order Rejections you can place at one time.

- Quantity limits: You may not be able to buy more than a certain number of shares in one order. For example, you may only be able to buy a maximum of 20,000 shares in one order. Similarly, you may also have limits on the number of shares you can sell in one order.

- Value limits: The total value of an order (the number of shares multiplied by the price per share) is also limited. For example, you may not be able to place buy or sell orders that total more than $1.5 million.

Suppose you want to buy 50,000 shares of ABC company, while the exchange limit is 20,000 shares/order. You can do the following:

- Place an order to buy 20,000 ABC shares at the desired price.

- After the first order is matched, you place another order to buy 20,000 ABC shares.

- Finally, you place an order to buy the remaining 10,000 shares.

Conclusion

In conclusion, the reasons why you meet the Order Rejections are all aimed at protecting the interests of investors and ensuring market transparency. Therefore, remember the reasons why orders are rejected and avoid making mistakes to have successful transactions.

See more: