Overnight fees are considered the silent enemies of investors. Although they sound simple and insignificant, understanding how to calculate and impact overnight fees will help traders make more effective trading decisions. Follow me to learn useful information about these fees right!

What Are Overnight Fees?

Overnight fees, also known as swap fees, arise due to the difference in interest rates between two currencies in a forex trading pair. Simply put, it is an interest rate charged to help you hold a position overnight. If you buy an asset and its price increases the next day, you will receive the overnight fee as profit. Conversely, if the price decreases, you will have to pay the fee. This fee often appears in forex and CFD trading.

Why should we be concerned about overnight fees?

Overnight fees may seem trivial, but they are a significant factor in your profits, especially if you hold a position overnight. The longer you hold a position, the more you will pay in these fees. If the market moves against you, overnight fees will increase your losses.

These fees also force you to adjust your trading strategy. For example, day traders often close positions before the end of the trading session to avoid these fees.

See more:

- What are Inactivity Fees? Some Real Examples Should Know

- What is Commission Fee? Commission Free Forex Brokers

- What are Trailing Stops? How to Use Trailing Stops in Crypto

Why Is Overnight Funding Charged?

To hold a trading position overnight, a fee will typically be charged to your account. This fee is based on two main factors:

Interest Fee

Interest Fee is charged for borrowing funds to maintain your position.

The interest rate applied to this fee can vary depending on factors like the specific security, market conditions, and your brokerage firm’s policies.

For example, if you buy $1,000 worth of stock on margin and hold it overnight, you’ll pay interest on the borrowed funds. The exact amount will depend on the interest rate and the number of days you hold the position.

Administration Fee

This fee covers the administrative costs associated with holding your position overnight. It’s usually a small percentage of the position’s value, often around 0.5% per year.

For example, if you hold a $10,000 position overnight, the administration fee for one day would be approximately $0.14.

Example of Overnight Fees

Financial markets are constantly changing interest rates. When you hold a position, you are exposed to these changes. Exchanges charge you a small fee for their service.

Let’s say you are investing in the US Tech 100 index. To hold this investment position overnight, you will pay or receive an overnight fee.

For a long position, you will pay a fee equal to the total value of your position multiplied by a certain percentage. This rate includes:

- The SOFR reference rate that banks use to lend to each other overnight.

- The service fee that the exchange charges you.

For a short position, you may receive a small amount of money instead of paying a fee. This amount is calculated by subtracting the exchange’s service fee from the SOFR interest rate.

Let’s say you are holding a long position in US Tech 100 worth $12,475. To hold this position overnight, you would pay: $12,475 x 0.02374% = $2.96

When Do Overnight Fees Apply?

For CFDs with 1:1 leverage and spread bets, you will generally not be charged overnight fees. However, there are some exceptions. Specifically, if you trade the following instruments, you will still be charged: Natural Gas, US Cocoa, and currency pairs involving the Turkish Lira (TRY).

How Are Overnight Fees Calculated?

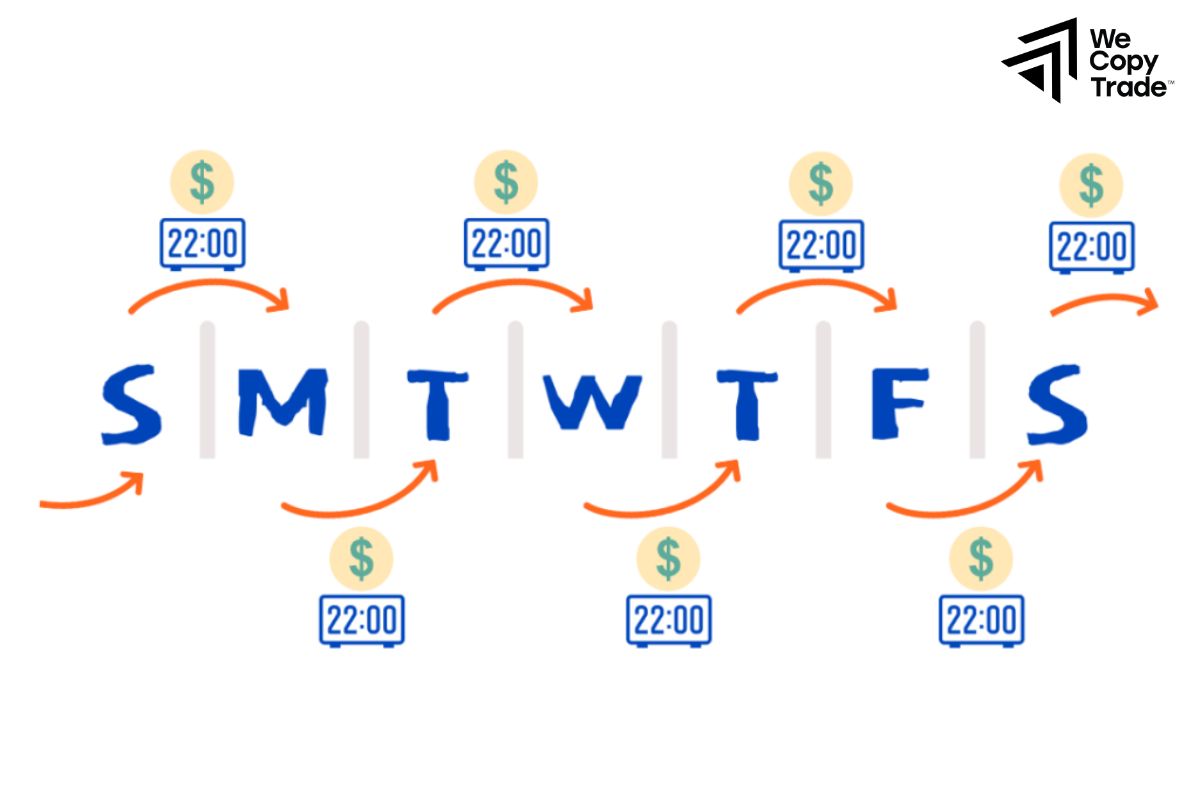

As you may have noticed above, when you want to hold a position overnight, you will have to pay some fees. If you hold a position until the end of the trading day on Wednesday, you may have to pay overnight fees for all three days of the weekend. This is due to the settlement rules of the forex market. On bank holidays, the settlement rules may change. This means that you may have to pay these fees for a longer period of time.

You can easily find information about overnight fees on our trading platform. Just go to ‘Watchlist’ and add the columns ‘Swap Bid’ and ‘Swap Offer’.”

Overnight Fee Formula

To calculate the overnight fee, we will use the following formula

Value = (Closing Price x 0.5%) / 360″

Where:

- Closing Price” is the price of the currency pair at the time of market closing.

- “0.5%” is the annual management fee.

- “360” is the number of days in a year (used to calculate the daily fee).

For example, let’s say you are shorting 1 lot of EUR/USD and the closing price is 1.1000. To calculate the overnight fee, you would do the following:

- Calculate the value: (1.1000 x 0.5%) / 360 = 0.0153

- Calculate the swap rate: (Assume the tom-next rate is 0.03) Swap rate = 0.03 – 0.0153 = 0.0147

- Calculate the fee: 1 lot x value of 1 lot x 0.0147 = (Value of 1 lot) x 0.0147

How to view the swap rate

To view the swap rate, first go to the “Watchlist” section of the trading platform.

Here, you can customize the display columns. Add the two columns “Swap Bid” and “Swap Ask” to see detailed information about overnight fees for each currency pair.

How to minimize the impact of overnight fees

To minimize the impact of overnight fees:

- Different brokers will have different fees. Compare carefully to find the broker with the most competitive fees.

- Some account types may be swap-free or have preferential fees, prioritize the account type that suits you.

- If you frequently hold overnight positions, consider adjusting your strategy to minimize the risk associated with overnight fees.

- Before opening an account, read the terms and conditions carefully to understand all the fees involved.

By understanding the factors that contribute to overnight trading fees and implementing strategies to minimize them, you can improve your overall trading profitability.

Conclusion

In conclusion, you know that we need to pay overnight fees in case we want to keep our trading position. By understanding this fee and finding ways to minimize it, you can increase your chances of success in trading.

See now: