Unlock the power of oscillators in electronics and signal processing! Whether you’re a hobbyist or a professional, understanding trading is crucial for designing efficient circuits and systems. Learn about different types of trading, their applications, and how they can enhance your projects. Dive into our expert guide now and start mastering oscillators today!

What are Oscillators in Forex?

In Forex trading, an oscillator is a type of technical indicator that helps traders determine the momentum of a currency pair or identify overbought or oversold conditions. It fluctuate between two extreme values (such as 0 and 100 or -1 and 1) and are usually plotted as a line or histogram below or above a price chart.

Oscillators are valuable for traders to gauge market conditions and find potential entry or exit points, especially when the market is in a range or showing signs of a reversal. They are most effective when used in conjunction with other indicators or chart patterns.

See now:

- What is Range Trading? Top 3 Range Trading Strategies

- Top Effective Indicators You Should Know In Trend Trading

- How To Identify Entry and Exit Points in Stock Market

- Guide How To Use The Hybrid Trading Strategy In a Right Way

Popular Types of Oscillators in Trading

In trading, several types of oscillators are commonly used to help traders assess market conditions and identify potential entry or exit points. Here are some of the most popular types:

Relative Strength Index (RSI)

The RSI is one of the most widely used oscillators. It measures the speed and change of price movements, ranging from 0 to 100. Typically, an RSI above 70 indicates that the asset is overbought (potential sell signal), while an RSI below 30 suggests it is oversold (potential buy signal).

Stochastic Oscillators

The Stochastic Oscillator compares a currency pair’s closing price to its price range over a specific period. It also ranges from 0 to 100 and is often used to identify overbought or oversold conditions. A value above 80 is considered overbought, while below 20 is considered oversold. This oscillator helps traders spot potential reversals.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line (difference between the 12-day and 26-day exponential moving averages) and the signal line (9-day EMA of the MACD). The crossing of these lines is used to generate buy or sell signals.

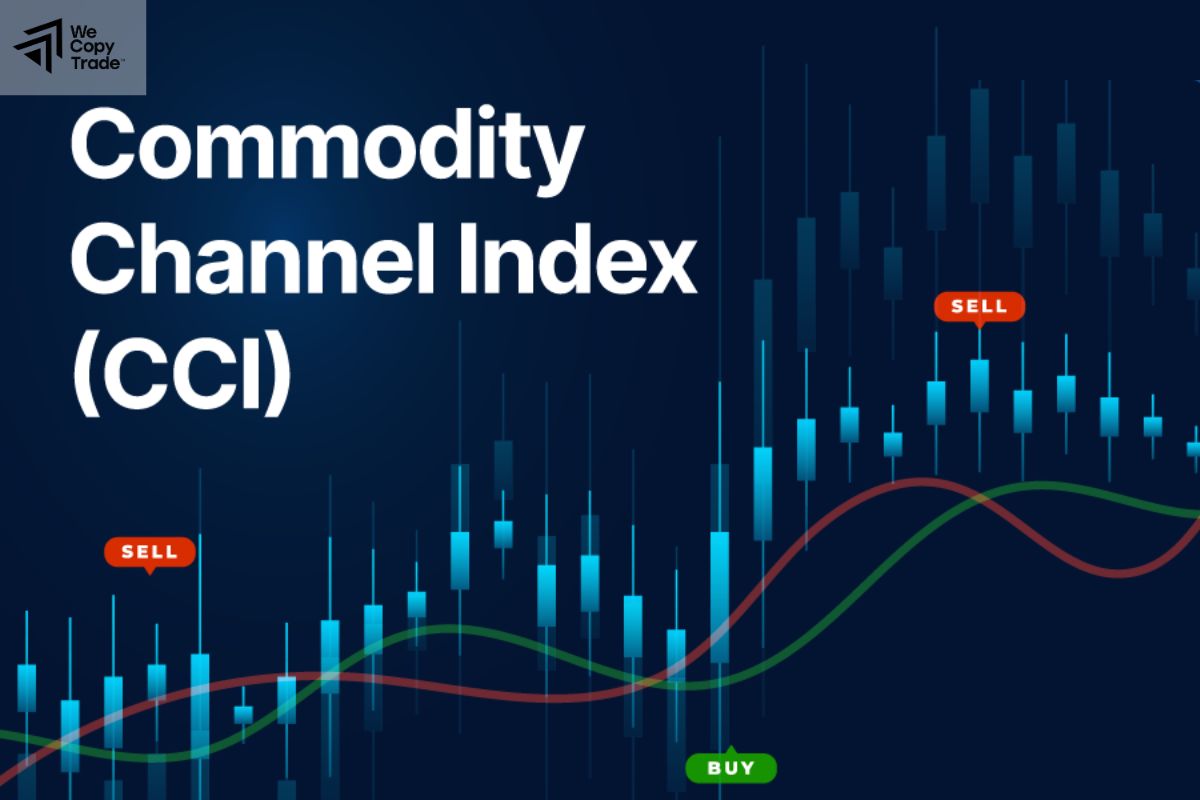

Commodity Channel Index (CCI)

The CCI measures how far the price has moved from its average value. It fluctuates between positive and negative values, helping to identify overbought or oversold conditions. A CCI above 100 indicates overbought, while below -100 signals oversold. It is useful for spotting potential reversal points.

Awesome Oscillator (AO)

The Awesome Oscillator is a histogram that shows the momentum of a market. It compares the current 34-period simple moving average (SMA) with the 5-period SMA. The AO helps to identify the strength of the market’s momentum and possible trend reversals when the histogram changes direction.

Williams %R

This oscillator measures overbought and oversold conditions, ranging from 0 to -100. Readings above -20 indicate overbought conditions, while readings below -80 suggest oversold conditions. It is particularly useful for spotting potential trend reversals in a market.

Some Applications of Oscillators

Oscillators are widely used in trading for several key applications:

- Identifying Overbought and Oversold Conditions: Oscillators like the RSI help identify when an asset is overbought (above 70) or oversold (below 30), signaling potential reversal points.

- Spotting Trend Reversals: Indicators like the Stochastic Oscillator and MACD highlight when trends are losing momentum, signaling potential reversals.

- Divergence Analysis: Divergence between the price and oscillator can indicate a weakening trend or upcoming reversal.

- Confirming Trend Strength: Oscillators like the Awesome Oscillator (AO) confirm strong market momentum, signaling whether a trend is likely to continue or reverse.

- Entry and Exit Signals: Generate buy or sell signals, such as when the Stochastic Oscillator moves out of oversold territory.

- Filtering Market Noise: In volatile markets, help smooth price data and identify the underlying trend.

- Identifying Market Momentum: Momentum indicators like the Williams %R show the strength of a trend, helping to gauge whether a trend will continue.

How Oscillators Compare in Performance

The performance of oscillators can vary depending on the market conditions and the specific trading strategy being used. Here’s how some popular compare in terms of their strengths and weaknesses:

| Oscillator | Best for | Advantages | Disadvantages |

| RSI | Ranging markets | Easy to use, identifies overbought/oversold levels | False signals in strong trends |

| Stochastic | Ranging markets | Good for reversals | False signals in strong trends |

| MACD | Ranging markets | Good for identifying trends | Lagging, less effective in sideways markets |

| CCI | Trending and ranging markets | Versatile, identifies overbought/oversold levels | False signals in strong trends |

| AO | Ranging markets | Identifies trend momentum | Ineffective in sideways markets |

| Williams %R | Ranging markets | Easy to use, effective for reversals | False signals in strong trends |

Frequently Asked Questions about Oscillators

Here are some frequently asked questions about oscillators in trading:

Can oscillators be used in trending markets?

- Yes, some oscillators like the MACD and Awesome Oscillator (AO) perform well in trending markets as they help confirm trend strength. However, like RSI and Stochastic may be less effective in strong trends, as they can stay in extreme zones.

Are oscillators only for short-term trading?

- While oscillators are often used for short-term trading, they can also be applied to longer time frames. Traders can adjust the oscillator’s settings to fit their preferred trading horizon, whether short-term or long-term.

How do I use multiple oscillators together?

- Combining oscillators can provide stronger confirmation of market conditions. For example, using both RSI for overbought/oversold levels and MACD for trend confirmation can help validate potential trades.

Conclusion

In conclusion, Oscillators are essential tools in technical analysis, helping traders make informed decisions by identifying market momentum, overbought or oversold conditions, and potential trend reversals. Ready to enhance your trading skills? Start by exploring different trading and see how they fit into your trading strategy. Don’t miss out on unlocking the power of trading today for more precise and profitable trading decisions!

See more: