The market is always complicated and unpredictable. Therefore, when investing, to seize the opportunity to make a profit and limit unexpected risks, traders often place limit orders. Have you heard of this magical order? Don’t miss the opportunity, let’s find out more right away!

What are Limit Orders?

The limit orders is a tool that allows you to buy or sell stocks at your desired price, helping to protect capital and maximize profits when the market fluctuates sharply.

For example: You want to buy ABC stock at 100 VND/share. You place a limit buy order at 100 VND. If the price of ABC stock drops to 100 VND or lower, your order will be executed.

If you place a market order, your order will be executed immediately at the current market price, whether or not the price is higher than your desired price. However, you may not be able to buy the stock if the price does not drop to your desired level.

See more:

- Top 10 Brokers Offering Standard Accounts you should know

- How to Open Mini and Micro Accounts Easily in just 5 steps

- What are Islamic Accounts in Forex? Top Accounts Forex

- Top 10 STP brokers need to know for your best trading choice

Limit Orders Advantages

Limit orders are a powerful tool for busy investors or those who want to trade smartly. With them, traders can:

- Place a limit order and go to work. When the stock price reaches your desired level, the order will be automatically executed.

- Pre-place a limit order before the news is released. When the news is released and the stock price fluctuates strongly, your order will help you seize the opportunity without missing out.

- Limit orders give you complete control over the buying and selling prices. You will not have to worry about sudden market fluctuations.

- Eliminate the dominant emotional factors (fear of missing out, panic selling) to make the right trading decisions

Limit Orders Risks

Limit orders are convenient, but they also come with some risks that we investors need to be aware of:

- You will not be able to execute the transaction if the market price does not reach the price you set

- You will only be able to buy a portion of the number of shares you want. Let’s say you want to buy 10 shares, but only buy 5 shares. The remaining 5 shares remain unpurchased.

- If your order is executed multiple times over several days, you will have to pay more transaction fees.

- It can be time-consuming to monitor and adjust your order.

- If the price does not reach the level you set on the same trading day, your order will expire.

To limit the risk when placing an order, you should:

- Set a price slightly lower (when buying) or slightly higher (when selling) than the current market price.

- Using orders like “all or none”, “fill or cancel” will give you more control over the execution of the order.”

- Monitor the market regularly and adjust the order if necessary.

- Choose a broker with reasonable transaction fees.

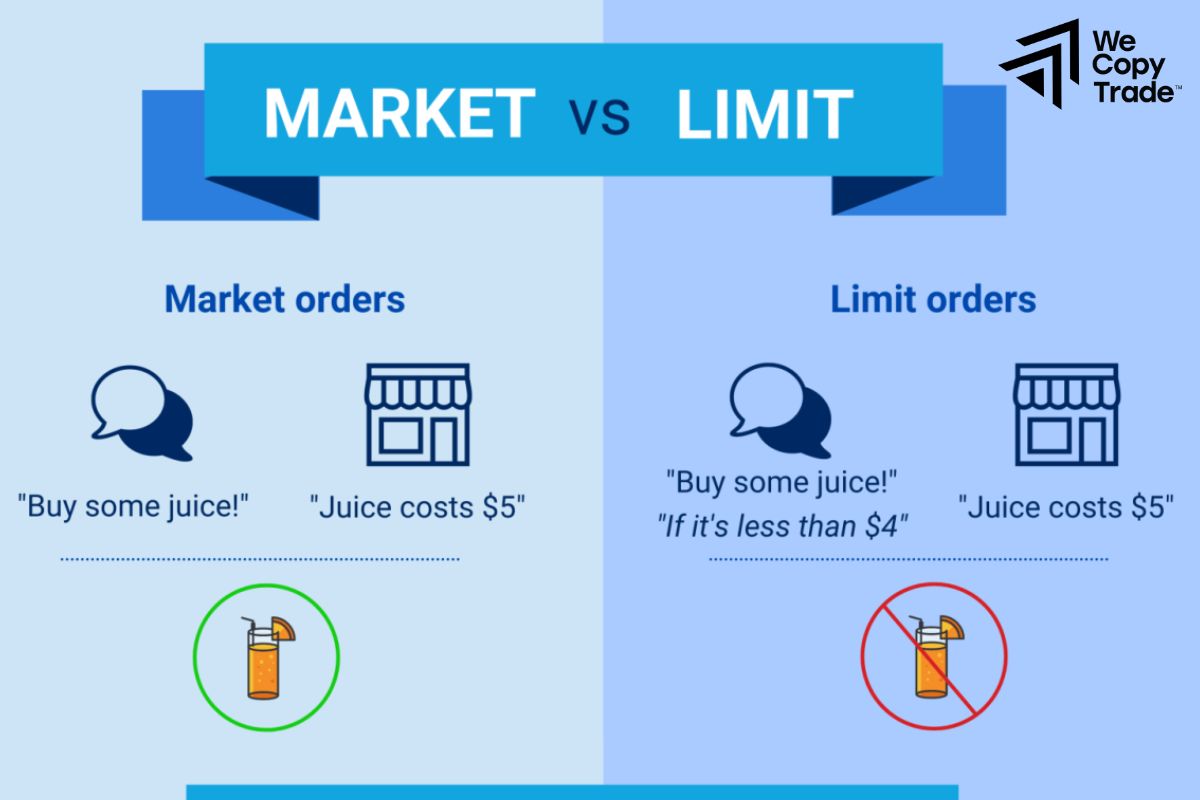

Limit Orders vs. Market Orders

Market orders and limit orders are two different ways to buy stocks.

- A market order is an order when you decide to buy immediately and don’t care about the price. This type of order is quite simple, easy to execute and matches immediately.

- A limit order is made when you want to buy at a certain price, helping to control the price, avoiding buying too expensive. However, you may not be able to buy if the price does not reach the desired level.

| Features | Market Orders | Limit Orders |

| Execution Speed | Very Fast | May be slow or not executed |

| Price | Current Market Price | Price you set |

| Complexity | Simple | More Complex |

| Suitable for | Fast Trading, No Need to Watch the Market | Long Term Trading, Want to Control Price |

Example of Placing Limit Orders

Limit Orders Comparison Table

| Order Time | Investor | Limit Price/Share (Rupees) | Number of Shares |

| 9:30 A.M | A | 95 | 10 |

| 10: 30 A.M | B | 95 | 20 |

| 11 A.M | C | 95 | 5 |

| 11: 30 A.M | D | 95 | 15 |

| 9: 15 A.M | E | 95 | 20 |

| 9: 50 A.M | F | 95 | 5 |

| 10: 13 A.M | G | 95 | 5 |

Live Market Price: Rupee 100/share

- All investors want to buy shares at Rs 95/share, which is lower than the current market price of Rupee 100/share.

- A total of 70 shares are requested to be purchased at the limit price of Rupee 95.

- Since the current market price is higher than the limit price, all these orders will not be executed.

- If the market price drops to Rs 95 or lower and there are enough shares to meet the demand, the orders will be executed in priority order (which may be by order time or by exchange rules).

How to place a limit order

Detailed guide for beginners to CFD trading:

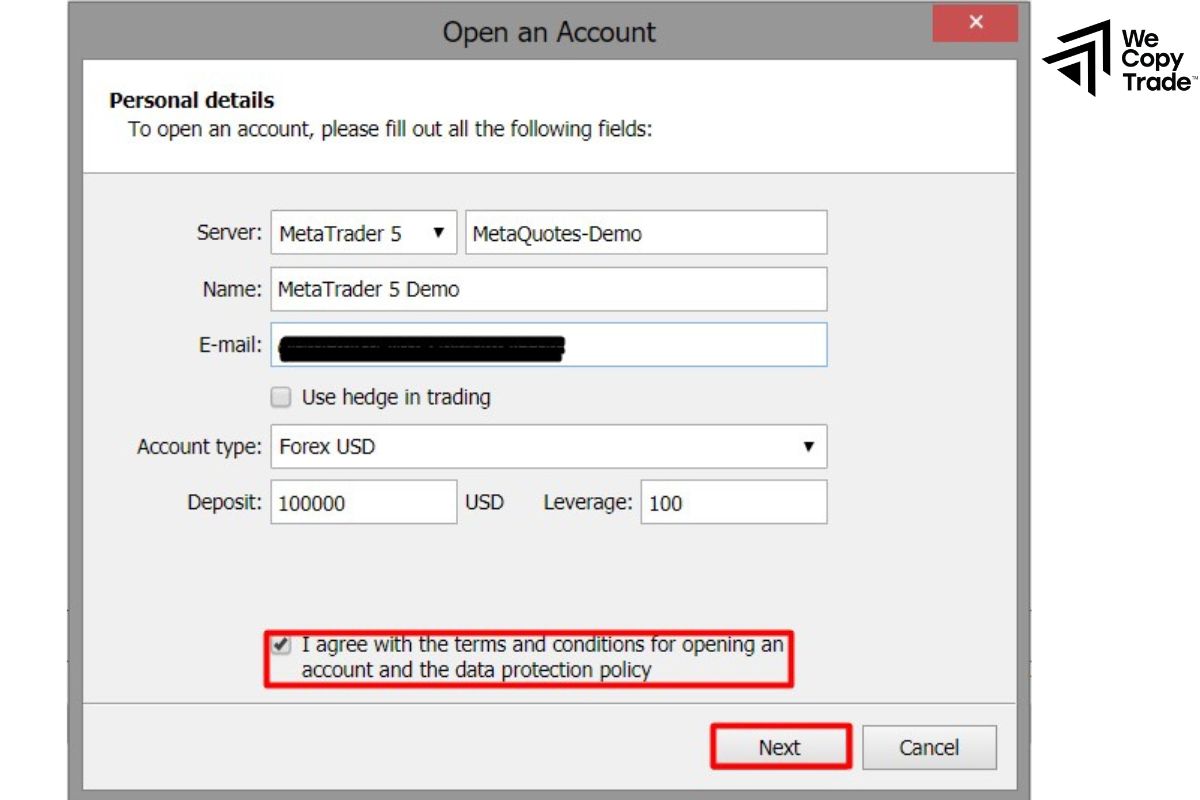

Step 1: Open a trading account

- Demo account: Test the features and trading strategies for free before investing real money.

- Live account: Start trading with your own money.

Step 2: Analyze the market

- Technical analysis: Use charts and indicators to predict price trends.

- Fundamental analysis: Evaluate news and financial reports to make investment decisions.

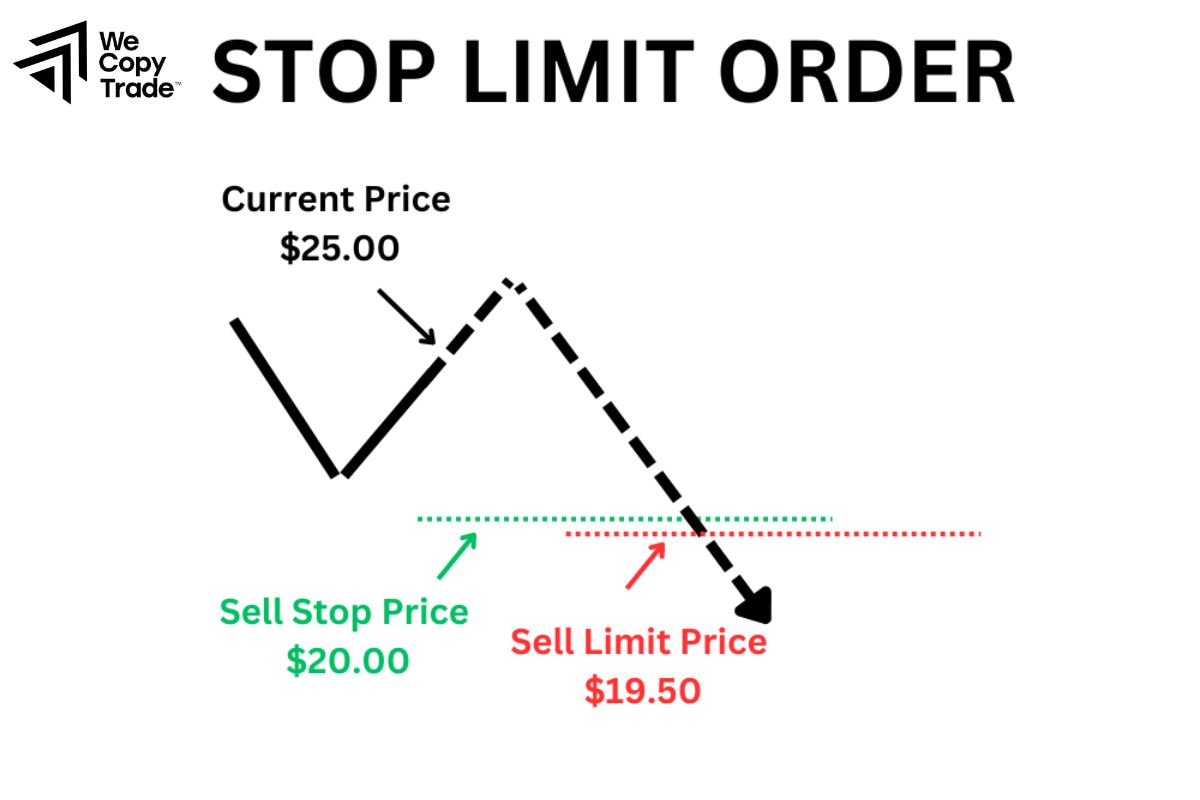

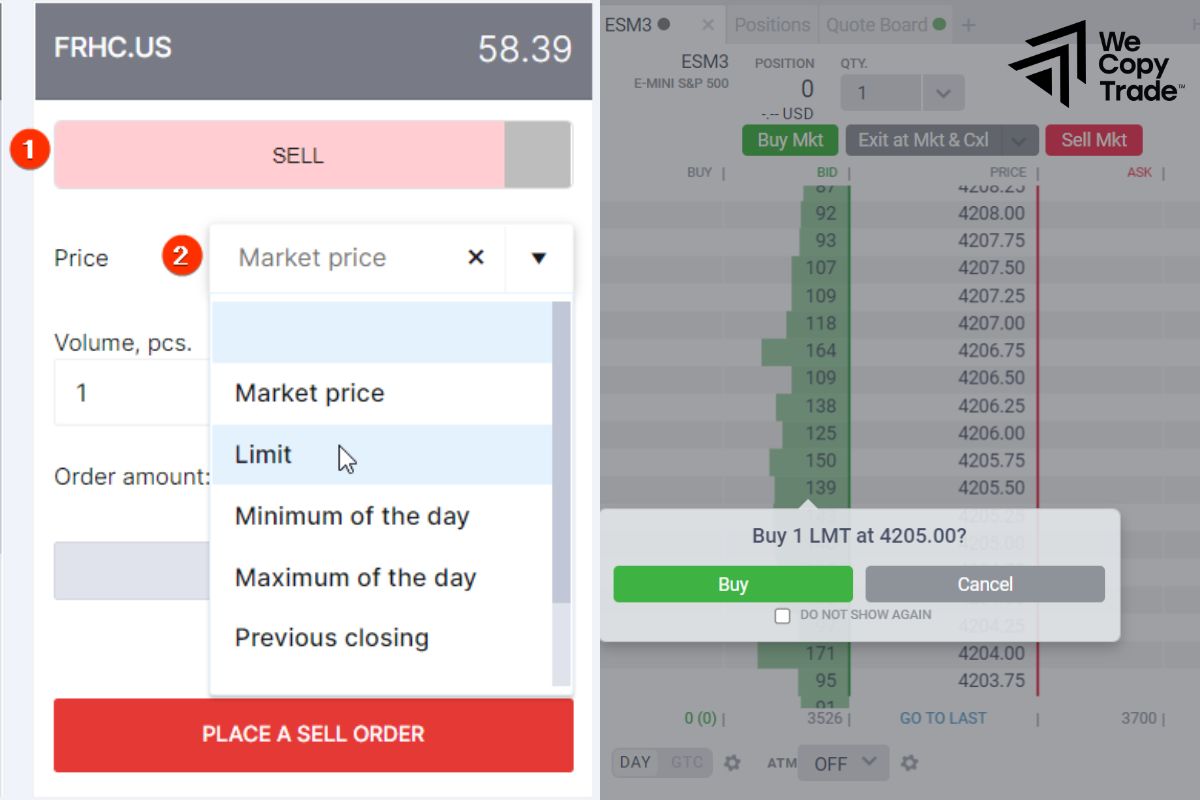

Step 3: Place a limit order

Decide to trade stocks, indices, forex, etc.

Select order type:

- Limit orders: Buy/sell when the price reaches your desired level.

- The order will run until you cancel it or reach the target price.

- The order will be automatically canceled if the target price is not reached before the expiration date.

- Enter the desired price

- The system will tell you the order type (stop or limit) based on the current opening price.

Step 4: Execute the order

- Your order will be automatically executed when the market price reaches the price you set.

- For example: You want to buy 1 share of XYZ at VND 100,000. You place a limit buy order at VND 98,000 and select the order type “effective until canceled”. If the price of XYZ stock drops to VND 98,000, your order will be automatically executed.

Conclusion

In conclusion, limit orders are a useful tool for you to automate trading, minimize risks and maximize profits. Once you understand how this type of order works, you will definitely be able to control risks better and achieve profits more easily. However, don’t be too subjective, but learn carefully before making a decision.

See now: