Have you ever wondered how to know which direction the economy is headed? Or do you want to make better investment decisions? If so, economic indicators are the useful tool you are looking for. Don’t miss the following article, I will summarize all the most important key points you need to know about these indicators. Let’s go!

What Are Economic Indicators?

Economic indicators are like a road map for investors. Economic indicators are statistics that help us measure and evaluate the health of the economy.

One of the reasons why we cannot ignore economic indicators in investing:

- Economic indicators help us predict what may happen to the economy in the future. For example, if the industrial production index increases, it may show that the economy is growing and companies are producing more.

- Investors use economic indicators to make investment decisions. If the these indicators are positive, investors may want to invest in the stock market. Conversely, if they are negative, investors may be more cautious.

- Governments use economic indicators to evaluate the effectiveness of the economic policies they implement.

See more:

- Reveal The Tips and Guide For Effective Momentum Trading

- Popular types of oscillators when trading most effectively

- What is Range Trading? Top 3 Range Trading Strategies

Types of Economic Indicators

For ease of identification and application, economic indicators are divided into three main categories:

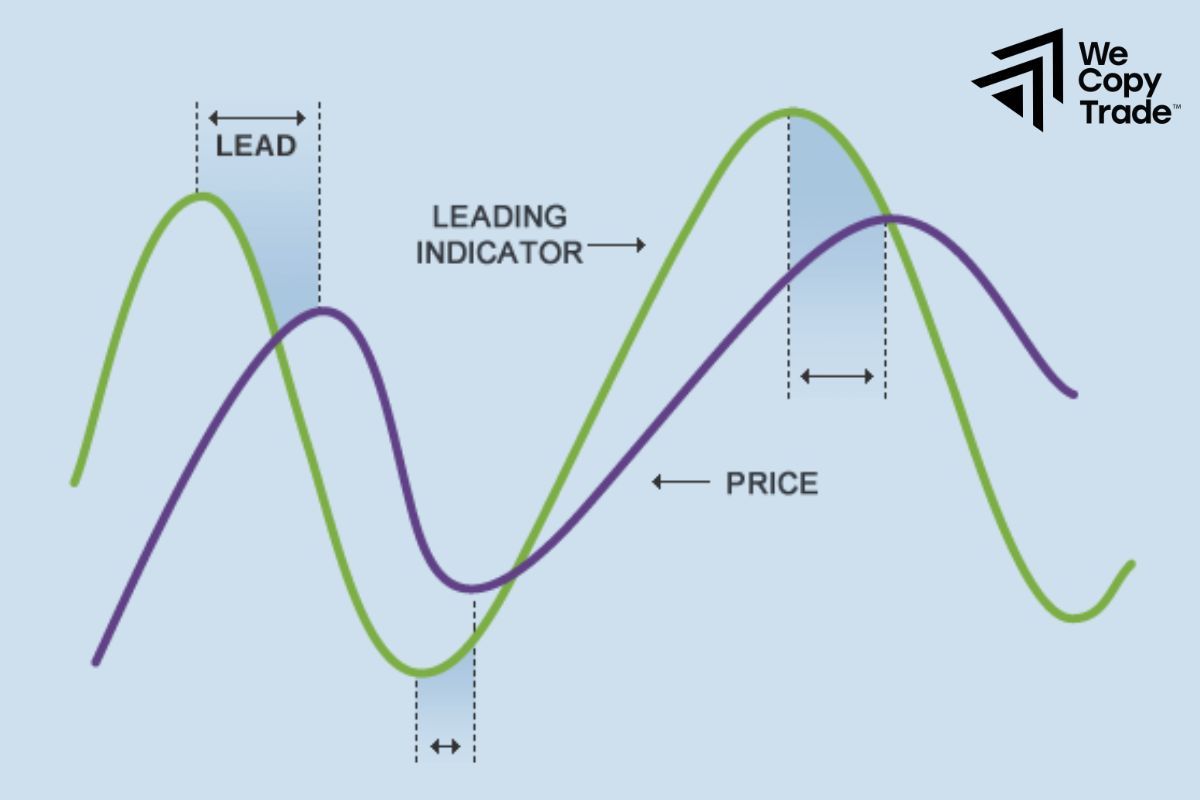

Leading indicators

- These indicators give us a glimpse of what may happen in the future. They are like yellow lights on traffic lights, signaling to us that a change is coming.

- For example, when companies start ordering more raw materials to produce goods, it is a sign that the economy is preparing to grow.

- When bond yields fall, it may indicate that investors are expecting interest rates to fall further in the future and are looking for riskier investments such as stocks.

- Long-term investors often watch leading indicators to identify new investment opportunities and start accumulating assets before the market grows.

- Short-term traders also use leading indicators to predict entry points and place trades.

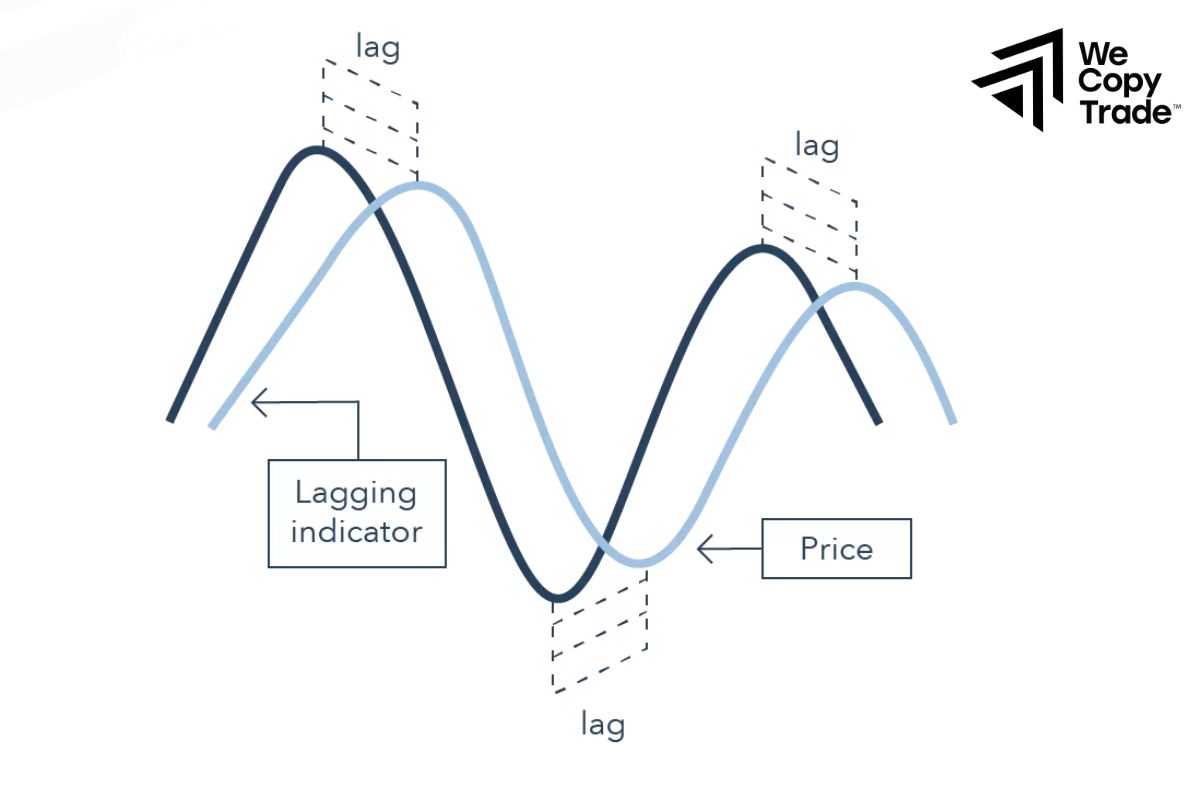

Lagging indicators

- Lagging indicators confirm what has happened in the past. They are like red lights on a traffic light, indicating that an event has already occurred.

- For example, when the unemployment rate rises, it indicates that the economy has entered a recession.

- Or when house prices rise, it is a sign that the economy has recovered and consumers have more money to spend.

- Lagging indicators help us confirm whether a trend is ongoing. For example, if the industrial production index falls and the unemployment rate rises, it confirms that the economy is in recession.

Coincident indicators

Coincident indicators occur at the same time as the event they represent. They are like a green light and a walk signal, both indicating that it is OK to go.

For example:

GDP measures the total value of all goods and services produced in a country over a given period of time. It reflects the current economic situation.

Personal income is another important indicator of consumer purchasing power.

Top 10 U.S. Economic Indicators

Here are the most commonly used economic indicators:

Gross Domestic Product (GDP)

- GDP is a measure of the overall health of the economy. An increase in GDP indicates that the economy is growing, whereas a decrease indicates that the economy is in recession.

- By analyzing the components of GDP (consumption, investment, exports, imports), we can better understand the structure and dynamics of the economy.

- GDP per capita is a general measure of people’s living standards.

- Governments use GDP to evaluate the effectiveness of economic policies and make appropriate decisions. Investors use GDP to assess the prospects of markets and make investment decisions.

Employment data

- Employment data provide us with insight into a country’s employment situation. Specifically, based on this data, we can know:

- The percentage of people of working age who are looking for work but have not found a job. A low unemployment rate usually shows that the economy is strong.

- The number of new jobs created each month shows the health of the labor market.

- By analyzing industries, we can better understand which industries are growing and which industries are struggling.

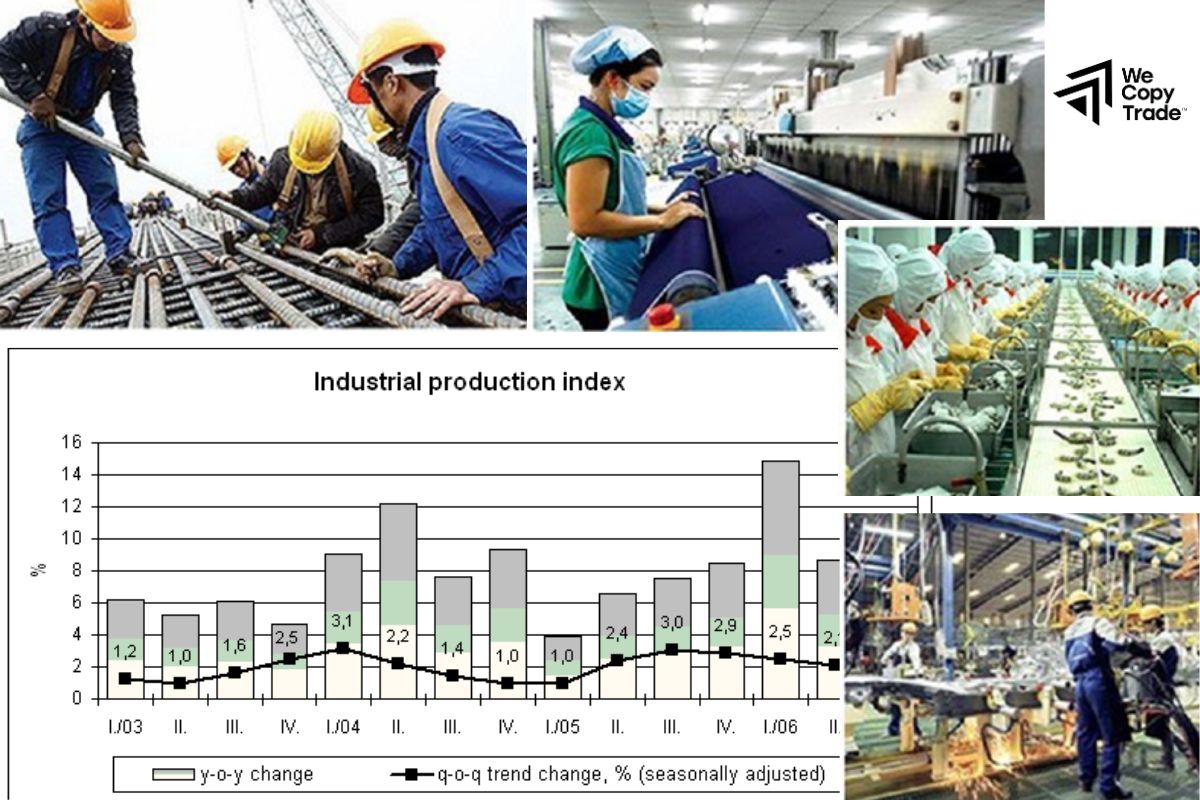

Industrial production

Industrial production is considered the driving force of the economy, reflecting the production activities of factories and enterprises. Based on this index, investors can easily know whether factories are producing a lot or a little.

Consumer spending

Consumer spending is the main engine of the economy. When consumers spend more, the economy will grow stronger. Based on this index, we can easily recognize the health of the economy. Because when consumers feel optimistic about the future, they spend more, boosting economic growth. Conversely, when consumer spending increases too quickly, it can put upward pressure on prices and lead to inflation.

Inflation

Inflation is like a “hidden tax” that we all have to pay. When prices rise, our money buys fewer goods and services.

Inflation reduces the purchasing power of money. Inflation can also affect the prices of assets such as real estate and stocks. Therefore, central banks often target inflation at a certain level to maintain economic stability.

Selling homes

Buying a home is a major financial decision for most people. Therefore, home sales can reflect consumer confidence and the health of the economy.

Increasing home sales indicate that the real estate market is vibrant. When consumers feel optimistic about the future, they will buy more houses.

New Housing Construction

New housing construction not only provides housing for people but also reflects investors’ confidence in the real estate market.

The number of new houses built reflects the population’s demand for housing. When investors believe that the real estate market will grow, they will invest in new housing construction. Above all, housing construction often goes hand in hand with creating more jobs and promoting economic growth.

Construction Spending

Construction spending is the total amount of money spent on building new buildings or repairing old ones.

The construction industry contributes a significant part to GDP and employment. When construction spending increases, it means that the construction industry is doing well. The government often invests in infrastructure projects to promote economic growth.

Manufacturing Demand

Manufacturing demand reflects the demand for goods by consumers and businesses.

Manufacturing demand often fluctuates with the business cycle. When manufacturing demand increases, it means the economy is growing. However, when this demand increases too quickly, it can put upward pressure on prices and lead to inflation.

Retail

Retail sales are the total value of goods and services sold at retail stores.

Increasing retail sales indicate that consumers are spending more. When consumers feel optimistic about the future, they spend more. Retail sales can also be used to track inflation at the consumer goods level.

Conclusion

In conclusion, understanding economic indicators are an important step to becoming a smart investor. By tracking these indicators, you can get an overview of the economic situation, thereby making better financial decisions. However, to achieve maximum effectiveness, combine them with other indicators.

See now: