Interest Rate can be a powerful way to grow your investments if you know how to navigate the market. Understanding the impact of changing rates can open up new trading opportunities and help you make smarter decisions. Ready to take control of your financial future? Discover proven strategies, expert tips, and tools to succeed in Interest Rate Trading Start trading smarter today!

What is Interest Rate Trading?

Interest Rate Trading involves buying and selling financial instruments, like bonds, futures, swaps, or other derivatives, to profit from changes in interest rates. The goal is to predict how interest rates will shift—whether they will rise or fall—and use that information to make profitable trades. This type of trading is crucial because interest rates directly influence the value of many financial products and can impact everything from government bonds to corporate loans.

Key Aspects of Interest Rate Trading:

- Bonds and Debt Instruments: Traders often focus on bonds because their prices are sensitive to changes in interest rates. When rates rise, bond prices usually fall, and vice versa.

- Futures and Options: These are contracts that allow traders to speculate or hedge against future changes in interest rates. For example, traders might buy interest rate futures to lock in a borrowing cost or hedge against potential losses.

- Interest Rate Swaps: These are agreements between two parties to exchange future interest rate payments. Typically, one party pays a fixed rate while the other pays a floating rate, allowing traders to manage exposure to fluctuations.

- Impact of Central Banks: Central banks, like the Federal Reserve, play a huge role in Interest Rate Trading since their decisions on raising or lowering rates can significantly impact market movements.

See more:

- What Is News Trading? How To Take Advantages News In Trading

- Get Started Smart Trading With Top Economic Indicators

- Popular types of oscillators when trading most effectively

- What is Range Trading? Top 3 Range Trading Strategies

How does Interest Rate work when trading?

When trading, especially in financial markets like Forex, stocks, or bonds, interest rates play a crucial role. Here’s a breakdown of how they work:

Interest Rates in Forex Trading

- In the Forex market, currencies are traded in pairs. Each currency has an associated interest rate set by the country’s central bank.

- If you buy a currency with a higher interest rate and sell one with a lower interest rate, you earn interest.

- Conversely, if you buy a currency with a lower interest rate and sell one with a higher interest rate, you pay interest.

Interest Rates and Stock Trading

- When interest rates increase, borrowing becomes more expensive for companies, potentially reducing profitability and leading to lower stock prices.

- When interest rates decrease, borrowing costs are lower, possibly increasing corporate profits and raising stock prices.

- Dividends paid by companies may also be influenced by interest rates since high-interest environments can lead investors to prefer bonds over dividend-yielding stocks.

Interest Rates in Bond Trading

- When interest rates rise, existing bonds with lower rates are less attractive, so their prices fall.

- When interest rates fall, existing bonds with higher rates become more attractive, so their prices increase.

- The yield of a bond moves inversely to its price. Traders need to understand the relationship between bond prices and yields to anticipate market movements.

Types of Interest Rate Trading

Here are the common types of interest rate trading that often appear:

Intere

st Rate Swaps

- An agreement between two parties to exchange cash flows based on different interest rates, usually between a fixed rate and a floating rate.

- To hedge against interest rate fluctuations or speculate on interest rate changes.

Interest Rate Futures

- Standardized contracts to buy or sell a financial instrument at a future date, with the price determined by current interest rates.

- Used to hedge against interest rate risks or speculate on interest rate movements.

Bonds

- Debt securities issued by governments, corporations, or organizations to raise capital.

- Investors trade bonds based on interest rate expectations; when interest rates rise, bond prices typically fall, and vice versa.

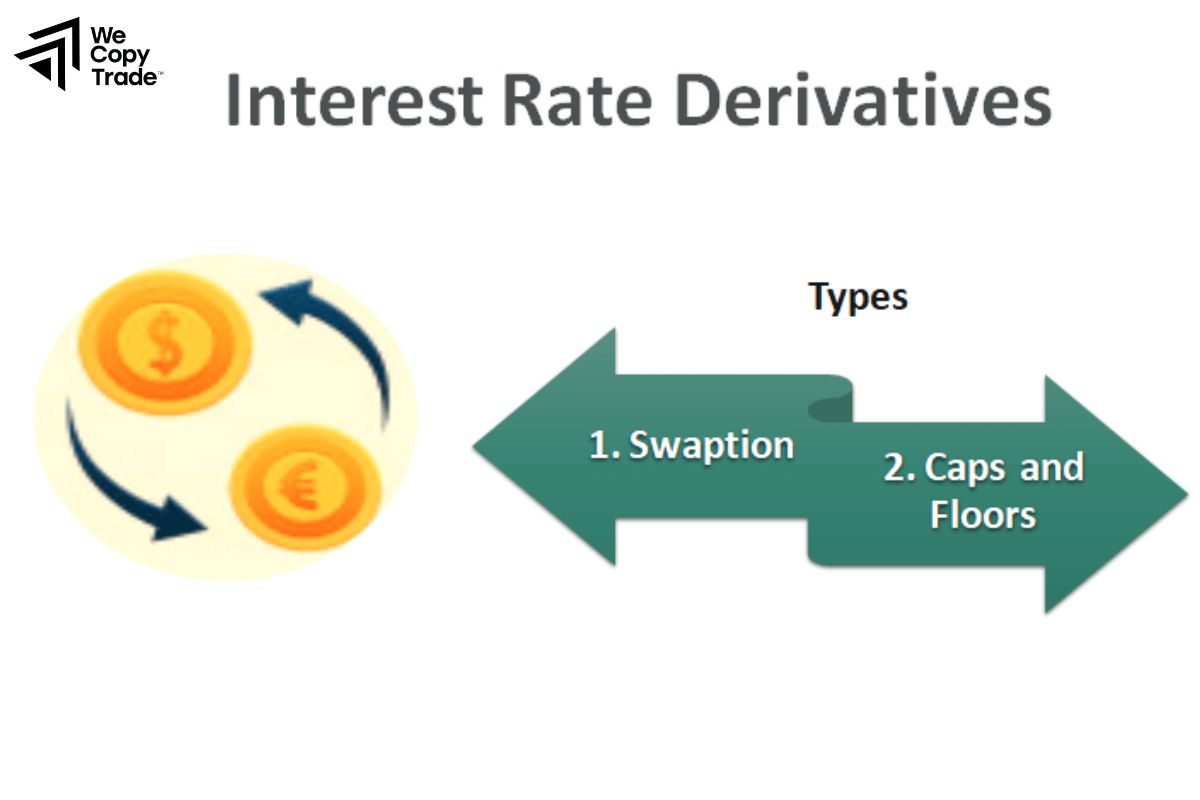

Interest Rate Options

- Contracts that give the buyer the right (but not the obligation) to buy or sell an interest rate instrument or bond at a specified price.

- Protects against undesirable interest rate fluctuations.

Forward Rate Agreements (FRAs)

- Over-the-counter contracts to set an interest rate for borrowing or lending in the future.

- Managing short-term interest rate risks.

How to Trade Interest in Forex Effectively?

To trade interest rates effectively in Forex, you can follow these 3 simple steps:

Step 1: Understand the Relationship Between Interest Rates and Currency Value

Higher interest rates generally strengthen a currency, while lower rates tend to weaken it. Keep an eye on interest rate decisions from major central banks like the Fed (U.S.) or the ECB (Europe) to understand how they impact currency values.

Step 2: Pay Attention to Economic Data and Interest Rate Differentials

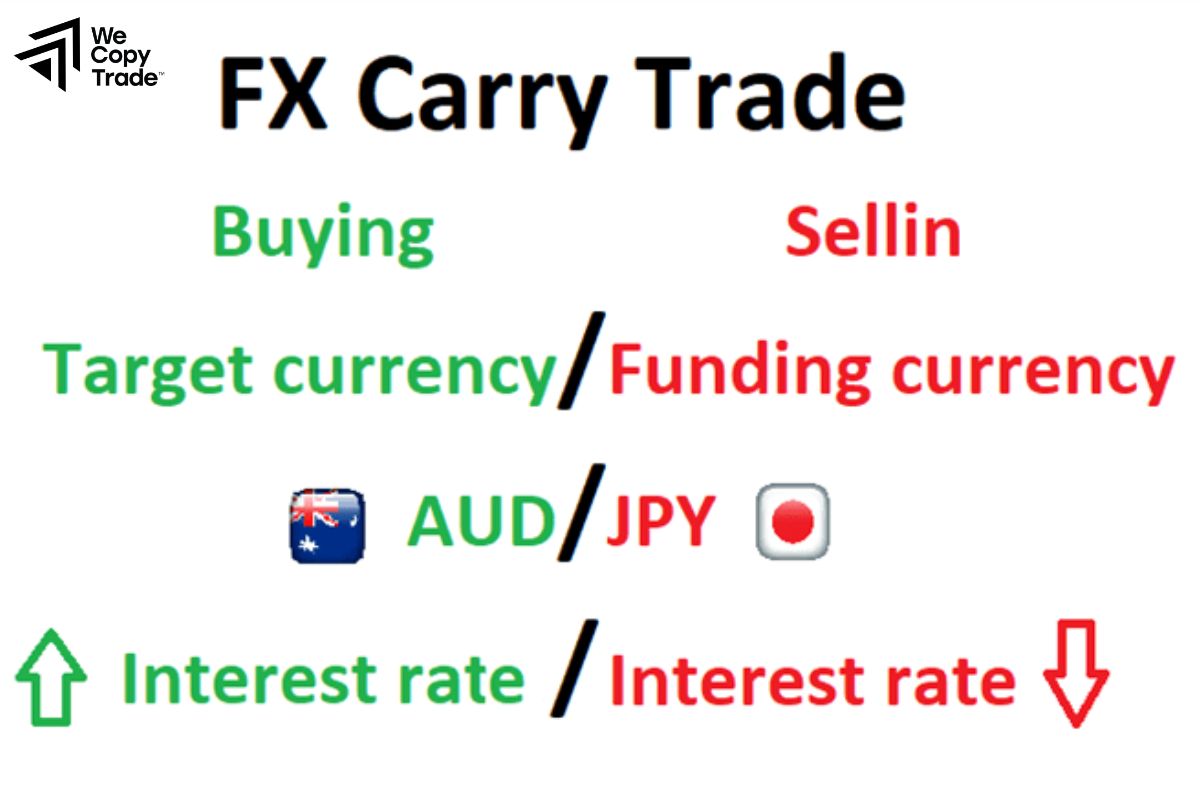

Key factors like inflation, economic growth, and unemployment affect interest rate decisions. If you can anticipate interest rate differentials between countries, you can take advantage of them through strategies like Carry Trade (borrowing in a low-interest currency and investing in a high-interest one).

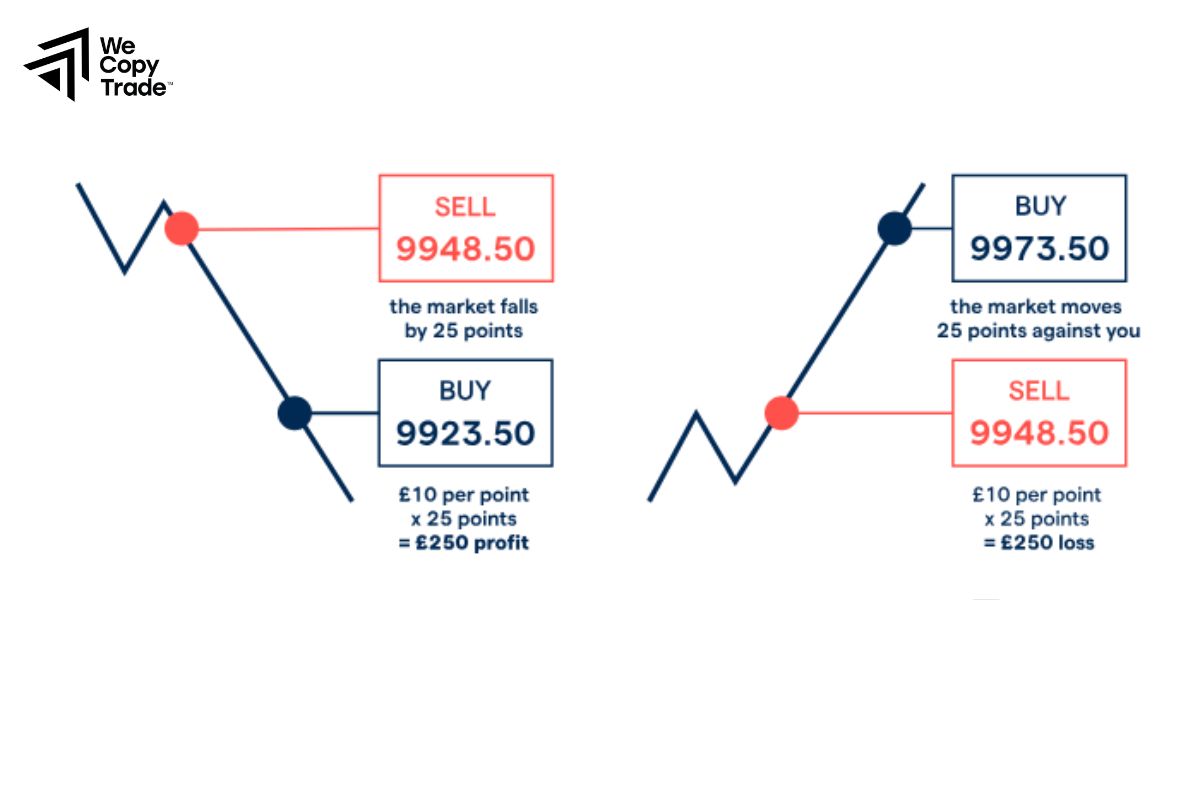

Step 3: Use Risk Management Tools and Technical Analysis

Interest rate trading can be volatile, so make sure to use stop-loss orders to protect your account. Combining fundamental and technical analysis will help you make informed decisions about when to enter and exit the market.

How to Calculate and Example Interest Rate Trading?

Below is a general approach to calculating interest rate trading, particularly in Forex or bond markets:

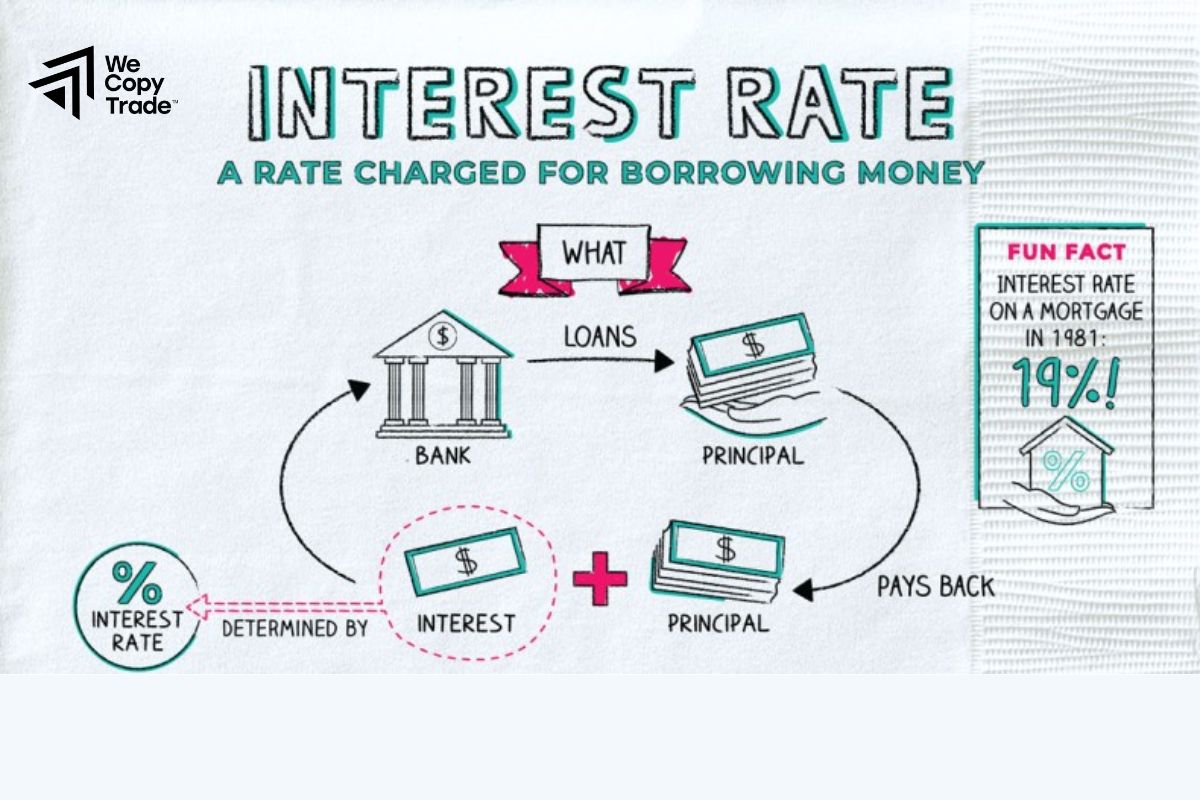

Understand the Interest Rate Differential

- The interest rate differential (IRD) is the key factor driving most interest rate trading strategies. It’s the difference between the interest rates of two currencies or two countries.

Interest Rate Differential = Interest Rate of Currency A − Interest Rate of Currency B

- For example, if the U.S. Federal Reserve has an interest rate of 3%, and the European Central Bank (ECB) has an interest rate of 1%, the interest rate differential between the USD and EUR is 2%.

Use Carry Trade to Profit from Interest Rate Differentials

- In a carry trade, you borrow in a currency with a low interest rate and invest in a currency with a higher interest rate, profiting from the rate differential. To calculate potential profit:

Carry Trade Profit = (Interest Rate of Currency A − Interest Rate of Currency B) × Position Size

- If the interest rate differential is 2% (as in the example above), and you invest $100,000 in the higher-yielding currency, your annual profit would be:

2%×100,000=2,000 USD per year

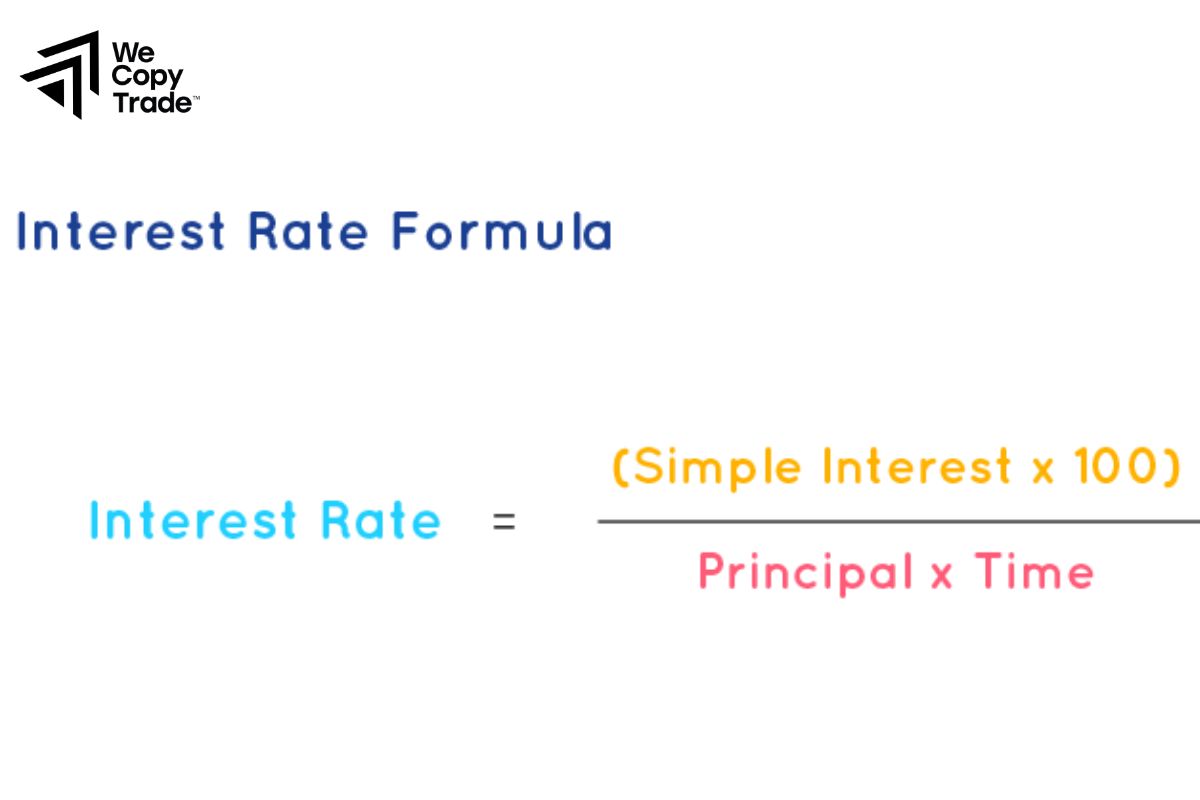

Calculate the Impact of Interest Rate Changes on Bond Prices

- In the bond market, interest rate changes impact bond prices. If interest rates rise, bond prices fall, and vice versa. You can calculate the price change based on the duration of the bond and the change in interest rates.

Formula: Price Change = −Duration × Change in Interest Rate

- For example, if a bond has a duration of 5 years and interest rates increase by 1%, the bond price would decrease by:

−5×1%= −5%

Conclusion

In conclusion, Interest rate offers powerful opportunities for investors to profit from fluctuations in currency and bond markets. By understanding the dynamics of interest rate differentials, utilizing strategies like carry trades traders can make informed decisions that lead to profitable outcomes. Ready to start trading and capitalize on interest rate movements? Join our platform today and explore the exciting world of Interest Rate Trading with expert tools, insights, and resources that can help you thrive in a competitive market!

See now: