Effective capital management is crucial for maximizing your business’s financial health and ensuring long-term success. Whether you’re managing investments, operational costs, or expansion plans, mastering is key to staying competitive in today’s market. Ready to take control of your finances? Start improving your today and unlock the potential for greater returns!

What is Capital Management?

Capital management refers to the strategic planning, monitoring, and controlling of financial resources to ensure that a business can maintain its operations, meet its financial obligations, and achieve long-term growth. It involves effectively allocating and managing both the working capital (day-to-day operational funds) and investment capital (funds used for growth and expansion).

The main goals of capital management are to:

- Optimize cash flow and liquidity

- Minimize risks associated with financial investments and debt

- Ensure efficient use of financial resources

- Maximize profitability and shareholder value

See more:

- Tips Simplify Your Financial Risks Management Process

- What is interest rate risk? How to manage interest rates

- Some Steps to Successful Liquidity Risk Management 2024

- Foreign Exchange Risk Mitigation Effectively In 5 Minutes

Types of Capital Management

Each focuses on different financial aspects of a business:

Working Capital Management

This involves managing the day-to-day financial operations of a business to ensure it has enough liquidity to meet short-term obligations. Key components include:

- Cash Management: Monitoring and optimizing cash flow to ensure the business has enough funds for daily operations.

- Accounts Receivable Management: Managing credit sales and collections to ensure timely cash inflow.

- Inventory Management: Controlling inventory levels to balance production needs and storage costs.

- Accounts Payable Management: Strategically managing the timing of payments to suppliers to optimize cash outflow.

Investment (Long-Term) Capital Management

This focuses on managing funds for long-term growth and investment projects. Key elements include:

- Debt Management: Controlling the use of borrowed funds and balancing debt levels to minimize financial risk.

- Equity Management: Managing shareholder equity, issuing new shares, or buying back shares to optimize the capital structure.

- Asset Management: Allocating funds for acquiring or maintaining physical or financial assets, such as property, machinery, or investments.

- Investment Planning: Making strategic decisions on capital investments (e.g., expanding operations, acquiring other companies) to enhance long-term profitability.

Strategies Capital Management Effective

Here are the key capital management strategies, condensed and effective:

Cash Flow Management

- Monitor cash flow regularly to avoid shortfalls.

- Maintain a reserve fund for unexpected situations.

Smart Debt Management

- Use debt to grow but maintain a reasonable debt ratio.

- Consider refinancing high-interest debt.

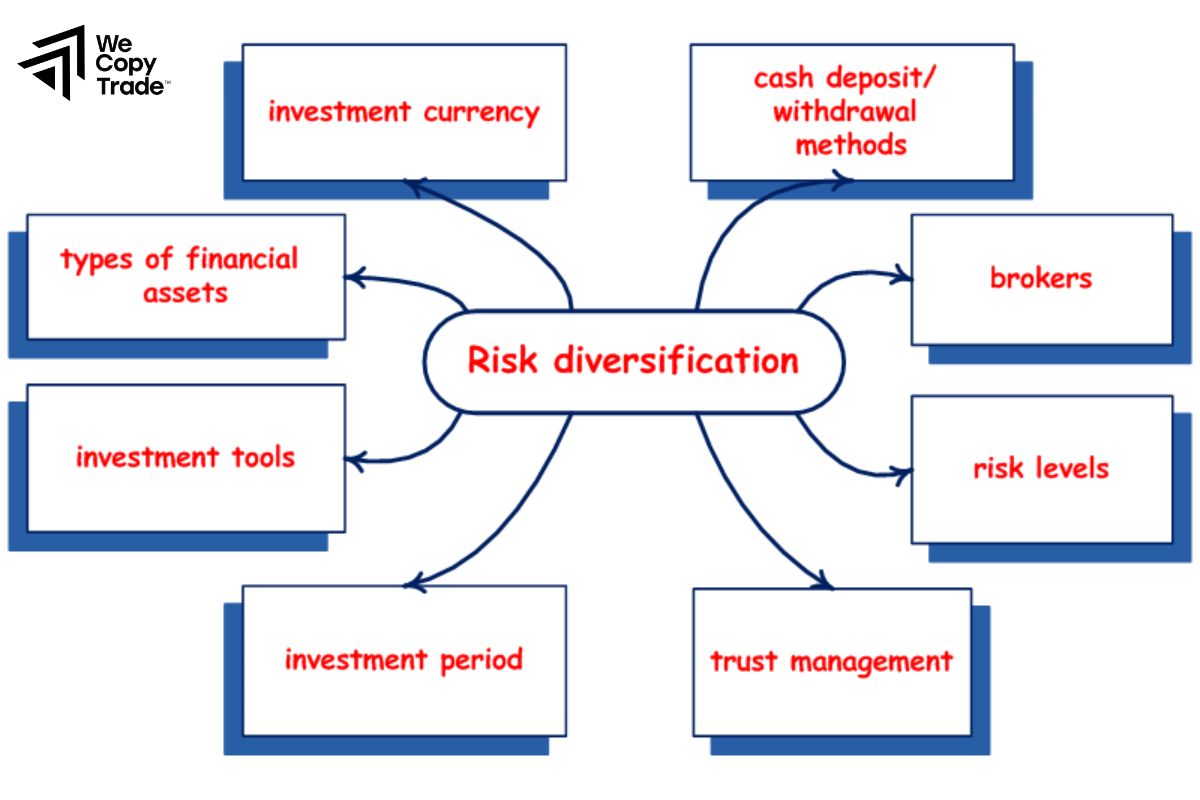

Risk Diversification

- Allocate capital across various asset types and industries to minimize risk.

- Use hedging tools to manage market volatility.

Cost Control

- Identify and cut unnecessary costs.

- Invest in technology to improve efficiency and reduce costs.

Profit Reinvestment

- Reinvest profits into high-potential projects instead of distributing all earnings.

- Create a reserve fund for strategic investments or crisis management.

Maintain Liquidity

- Keep credit lines open and ensure liquidity for short-term needs.

Working Capital Management Ratios

Current Ratio

Current Ratio = Current Assets / Current Liabilities

Measures a company’s ability to pay off its short-term liabilities with its short-term assets. A ratio above 1 indicates good liquidity.

Quick Ratio

Quick Ratio = Current Assets−Inventory / Current Liabilities

Assesses the ability to meet short-term liabilities without relying on selling inventory.

Inventory Turnover Ratio

Inventory Turnover = Cost of Goods Sold / Average Inventory

Measures how many times inventory is sold and replaced during a period. A higher ratio indicates efficient inventory management.

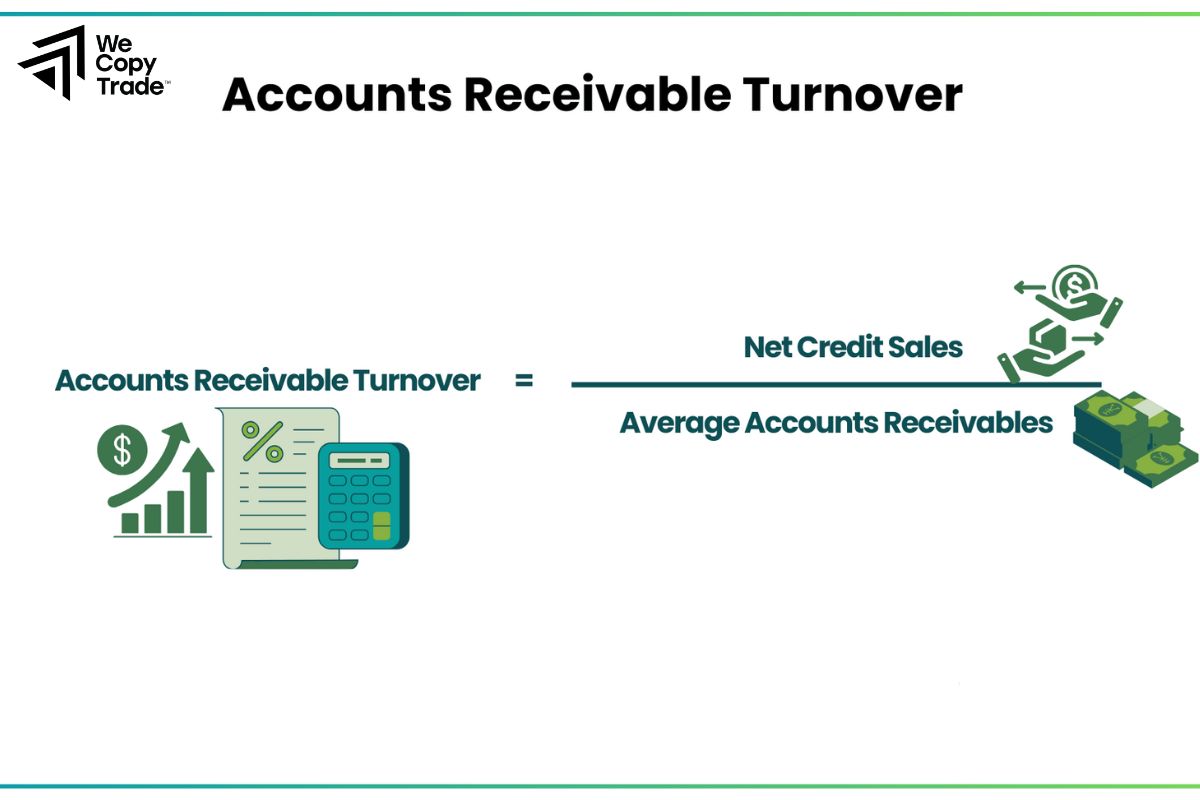

Accounts Receivable Turnover Ratio

Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

Assesses how effectively a company collects its receivables. A higher ratio indicates efficient debt collection.

Cash Conversion Cycle (CCC)

CCC = Days Inventory Outstanding + Days Sales Outstanding − Days Payable Outstanding

Measures the time it takes to convert investments in inventory into cash from sales. A shorter cycle indicates better working.

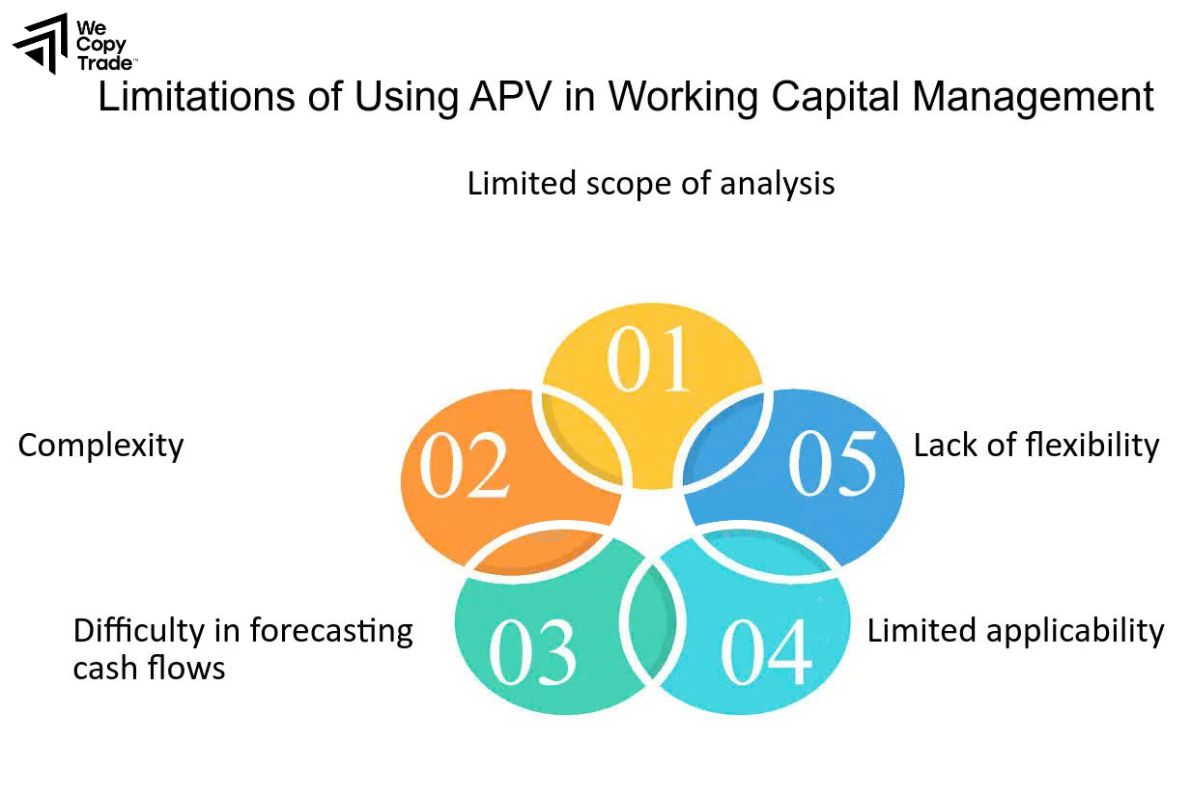

Limitations of Working Capital Management

Here are the important limitations of working capital management:

- Short-term Focus: Working capital management often emphasizes short-term assets and liabilities, potentially neglecting long-term strategic planning.

- Seasonal Variability: Businesses often face challenges in managing working capital due to seasonal fluctuations in revenue and cash flow.

- Overemphasis on Liquidity: Focusing too much on liquidity may lead to underinvestment in growth opportunities or fixed assets.

- Subjectivity in Estimates: Estimating working capital needs can rely on subjective judgments, leading to forecasting errors.

- Complexity in Management: Effectively managing components like inventory, receivables, and payables can be challenging.

- Lack of Standardization: There is no one-size-fits-all approach, making performance comparison difficult.

- Risk of Financial Distress: Poor working capital management can lead to liquidity crises, impacting the ability to meet short-term obligations.

Frequently Asked Questions about Capital Management

Here are some FAQs about capital management:

How often should a business review its capital management strategy?

- Businesses should review their capital management strategy regularly at least quarterly or semi-annually to adapt to changing market conditions, business performance, and financial goals.

What role does cash conversion cycle (CCC) play in capital management?

- The cash conversion cycle measures the time it takes for a company to convert its investments in inventory and accounts receivable into cash flow from sales. A shorter CCC indicates efficient working, leading to improved liquidity.

How does working capital affect business operations?

- Working impacts a business’s ability to meet its operational expenses, invest in growth opportunities, and maintain supplier relationships. Insufficient working capital can lead to cash flow issues, delayed payments, and operational disruptions.

Conclusion

In conclusion, effective capital management is crucial for ensuring the financial stability and growth of any business. Don’t overlook the importance of regularly reviewing and adjusting your management strategies to adapt to changing market conditions. Ready to take your management to the next level? Contact us today to learn how we can help you optimize your financial resources and drive your business forward!

See now: