Prop firm trading is becoming an increasingly attractive option for traders who want to scale their trading without investing personal capital. However, with the opportunity comes pressure: you need to prove that you can maintain consistent profits and manage your risk carefully. This is why a prop firm investment strategy is not just a tool to support – it is a condition for survival.

Don’t miss the following article to see how successful traders build and apply their strategies:

What is a prop firm investment strategy?

Unlike trading with their own money, prop firm traders are using institutional capital – which creates a distinct difference in psychology, pressure and control mechanisms.

Highlights of a prop firm investment strategy include:

- Adhering to limits on drawdown, position size, risk/reward ratio

- Trading according to proven structures instead of acting emotionally

- Optimizing profits while still prioritizing capital preservation

An effective prop firm investment strategy does not need to be complicated, but it must be built on data and be adaptable.

See now:

- What is Interest Rate Forex? Understanding Interest Rates in Trading

- What is Drawdown Index? How to Understand to Control Trading Risk

- Prop Firm Investor Experience & Valuable Lessons

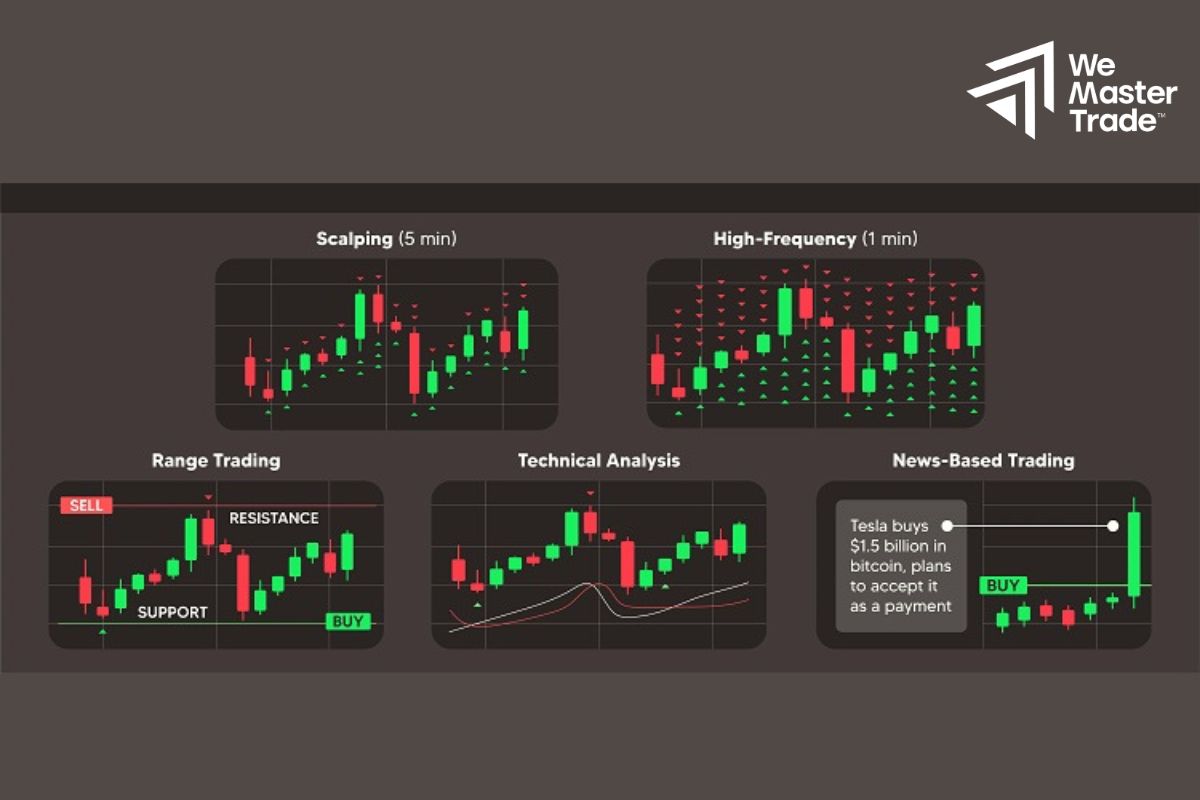

Popular Prop Firm Investment Strategies in 2025

Arbitrage – Exploiting Price Discrepancies

This is a strategy that relies on temporary price differences between two markets or two similar instruments.

For example, if the S&P 500 index futures contract is priced higher than the underlying index, the trader can sell the futures contract and buy the corresponding basket of stocks to benefit from the price convergence.

Advantages:

- Low risk if executed correctly

- High efficiency in volatile markets

Requirements:

- Strong pricing software

- Near-instantaneous order execution speed

- Understanding market structure

Prop firms often support this strategy with specialized analysis tools and data streams.

Scalping & Day Trading – Speed is of the essence

Scalping and Day Trading both aim at small short-term fluctuations. Traders can open and close dozens of positions per day, seeking profits from price movements of just a few pips.

Ideal for:

- Forex, indices, gold markets

- Traders with quick reflexes and absolute discipline

This prop firm investment strategy requires:

- Real-time charts (M1, M5)

- Super-fast order execution environment

- Tight stop-loss order management

At prop firms, scalpers often enjoy low transaction costs, direct support from dedicated platforms and server technology located near the exchange (low latency).

Swing Trading – Medium-term trend trading

Unlike day trading, swing trading holds positions for several days or weeks, taking advantage of clearer market waves.

Effective when:

- The market has a clear trend

- There is time to analyze but cannot follow each price tick

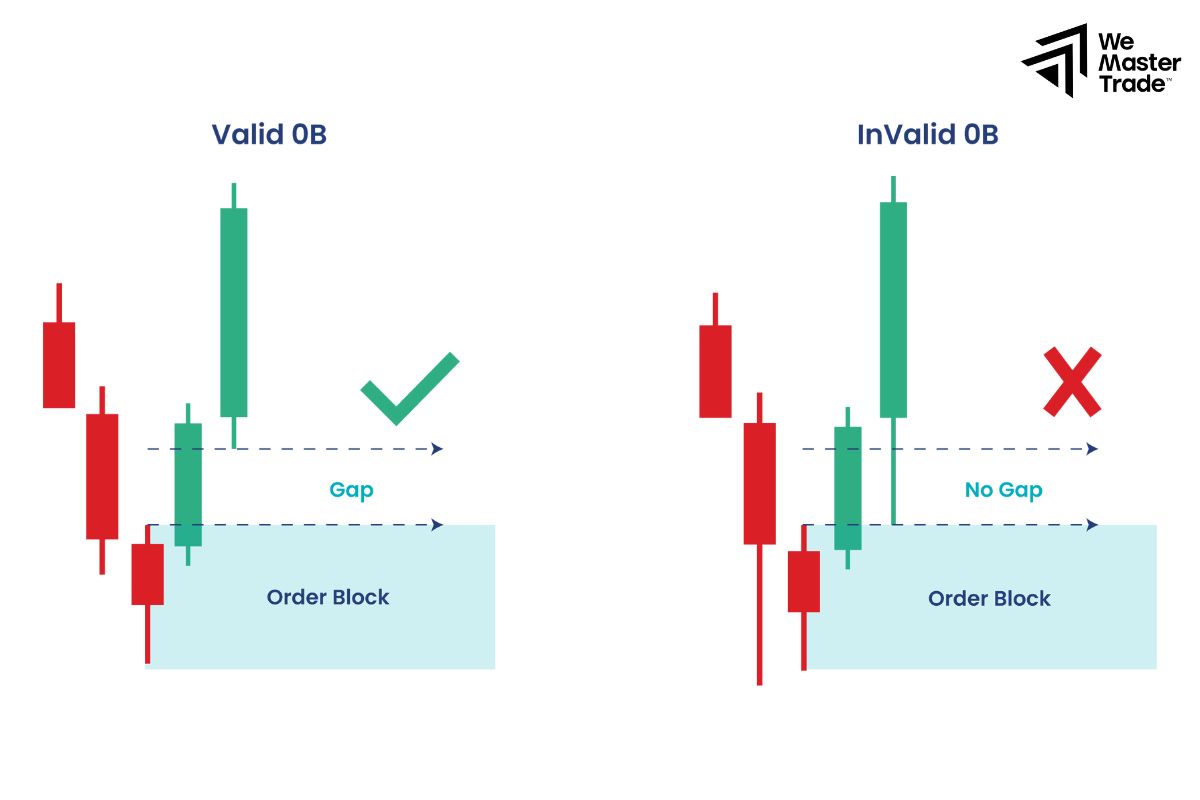

The core of a swing strategy includes:

- Identify support/resistance zones

- Use indicators such as RSI, MACD, MA to determine entry/exit points

- Manage risk according to the R:R ratio (1:2 or more)

Prop firm often allows holding orders overnight, even on weekends, which is good support for swing traders pursuing sustainable performance.

The core of every prop firm investment strategy: Risk management and discipline

No matter what strategy you use, if you do not manage risk, everything will collapse after just a few wrong orders.

The golden rule of prop firm investment strategy is:

- Never let a single order “burn” your account

- Limit the risk of each order < 1–2% of capital

- Always set a stop-loss with a specific reason

Prop firms often set a maximum drawdown threshold (e.g. 6% of total capital), violating it will be eliminated immediately. Therefore, a good strategy must include exit rules, stop losses and reasonable volume.

The Importance of Discipline

In the prop firm environment, discipline is not an option – it is a condition of existence.

You can have a perfect prop firm investment strategy on paper, but just a few times of breaking the rules due to emotions, the consequence is losing all trading rights.

Exhibits of good discipline include:

- Do not enter orders without enough signals

- Do not carry losses beyond the plan

- Do not “take revenge” on the market after a losing streak

When the strategy is executed consistently, you will create data to improve – instead of reacting blindly to emotions.

How to build a suitable prop firm investment strategy

Here are the most basic steps traders need to master to build an effective prop firm investment strategy:

Determine your personal trading style

There is no “one size fits all” strategy. You need to determine:

- How much time can you spend on trading?

- How much drawdown can you tolerate?

- Do you prefer short-term orders or long-term analysis?

Based on that, you will choose the appropriate time frame, analysis tools and asset class.

Test and improve the strategy

Although it sounds appealing, a prop firm investment strategy needs to be thoroughly tested before being applied in practice.

Steps include:

- Backtest on historical data

- Forward test on a demo account or simulation environment

- Record results, statistics on win rate, profit/risk ratio, drawdown

- Tweak entry points, take profit, manage orders if necessary

A strategy is only truly trustworthy when you understand how it works – and have seen it work well in many different market conditions.

Conclusion

In short, the nature of trading at prop firms is not to seek short-term profits, but to demonstrate the ability to control risks, stabilize profits and adhere to the chosen strategy. If you are looking for a professional trading path, start by building yourself a serious, suitable and practical prop firm investment strategy. This is not just a tool – but a long-term companion on your trading journey.

See more: