Have you ever wondered what other people think about the stock market? Sentiment indicators are the answer to that question. Let’s find out about the influence and how to effectively utilize these indicators in your trading right in the following article. Let’s go!

What Is a Sentiment Indicator ?

A sentiment indicator is a tool that helps us measure and better understand the general “mood” of the market. In the forex market, the forex market sentiment index is a tool that helps us measure the sentiment of traders towards a currency pair or the entire forex market. It shows whether traders are bullish (believe the price will increase) or bearish (believe the price will decrease) about a particular currency pair.

In the forex market, sentiment measures what the majority of investors think about a particular currency pair.

- Counting votes: The sentiment index is like a mini-survey. It counts the number of investors who are buying (i.e. betting on the price going up) or selling (betting on the price going down) a particular currency pair.

- Measuring crowd sentiment: When a large percentage of investors are buying, it shows that they are bullish on the currency pair. Conversely, if many are selling, it shows that they are bearish.

- Predicting trends: By monitoring the changes in sentiment, we can predict the direction of the market. For example, if most people are buying and the price is going up, then the uptrend is likely to continue. However, if the percentage of buyers drops sharply, it could be a sign that the uptrend is about to end.

See now:

- The Power of Trend Confirmation Indicator To Trading Result

- All About Arbitrage Strategy Every Trader Must Know

- Different Types of Economic Sanctions you should know

Advantages of Sentiment Indicator

Investor sentiment has a big impact on market prices. When most investors are optimistic, they will buy more, pushing prices up. Conversely, when most investors are pessimistic, they will sell more, pushing prices down.

Sentiment indicators help you assess the risk of the market. When the sentiment index is too high, it means the market is overheated and a correction may be imminent.

When everyone is too optimistic or too pessimistic, the market will often move against their expectations. Therefore, by monitoring the sentiment index, we can find good buying and selling opportunities by going against the crowd.

Sentiment indicators can help us identify potential buying and selling points. For example, when most people are selling, it may be an opportunity to buy because prices may have bottomed out.

Limitations of Using a Sentiment Indicator

Although sentiment indicators are a useful tool in forex trading, they also have certain limitations. Let’s find out now to make wiser investment decisions.

-

Sentiment indicators do not accurately reflect absolute “buy/sell” signals

Sentiment indicators often reflect past market sentiment, not current sentiment. Therefore, when you see a signal from a sentiment indicator, the price may have moved quite far from the actual reversal point.

Investor sentiment is easily affected by unexpected news and events. Therefore, an extreme sentiment indicator can last for a long time or disappear very quickly.

-

Need to combine with other analytical tools:

To increase the reliability of trading decisions, you should combine sentiment indicators with other analytical tools such as:

Technical analysis: Use charts, trend lines, candlestick patterns to determine entry and exit points.

Fundamental Analysis: Assessing the economic and political factors that influence the exchange rate. Suppose the sentiment indicator shows that investors are extremely optimistic about the Euro. However, if you carefully analyze the economic reports of the Eurozone and see that inflation is rising, the central bank may raise interest rates, which will reduce the attractiveness of the Euro. In this case, although investor sentiment is optimistic, you should still be cautious and consider selling the Euro.

Top Common Sentiment Indicators Forex

Here are some popular sentiment indicators that top investors rely on to accurately assess and predict the direction of the market, you can follow:

-

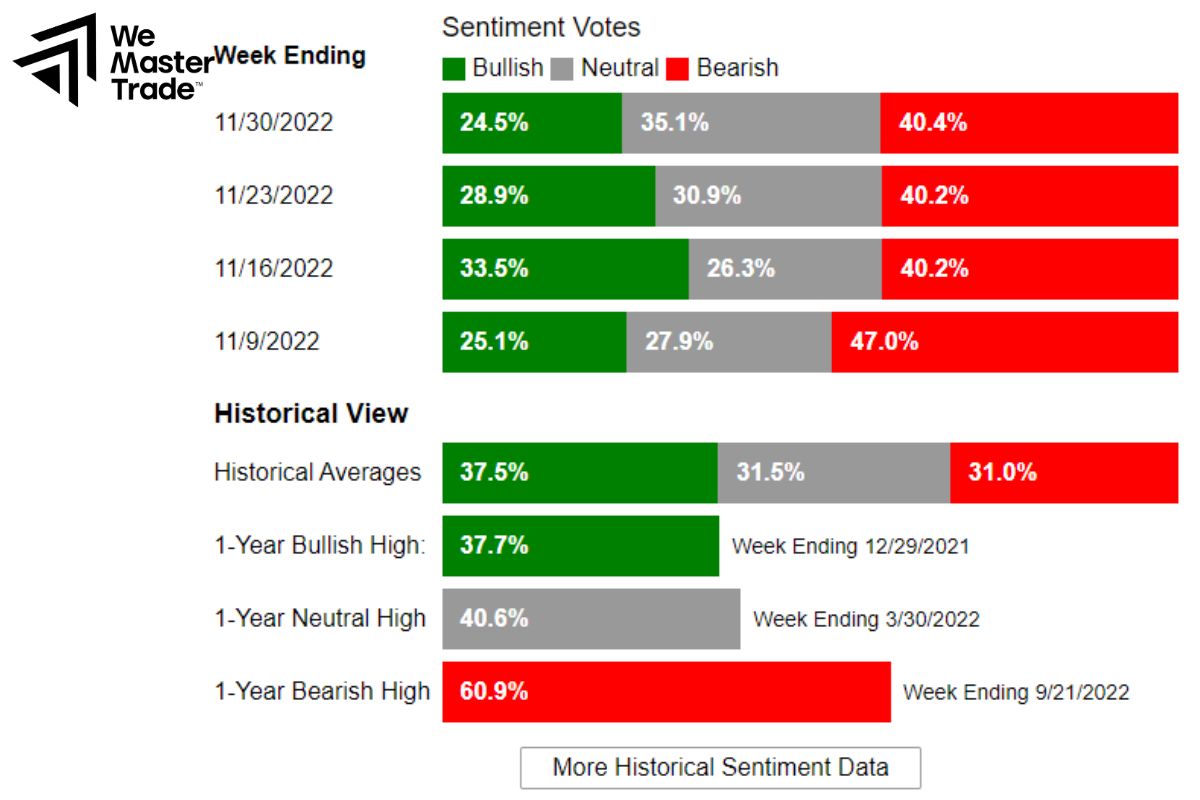

Investor sentiment surveys

Investor surveys are conducted to find out how investors are feeling about the stock market. Do they like it? Hate it? Or are they neutral?

Surveys help us understand what the majority of investors are thinking. If many people feel optimistic, it may indicate that the market is going up. Conversely, if many people feel pessimistic, the market may be going down.

When there is a gap between investor sentiment and market reality, we can find good investment opportunities. For example, if many people feel pessimistic but the market is still rising, it may be a signal that the market still has room to grow.

How to use surveys to invest:

Go against the crowd: When most investors think the same, it is often the time when the market is about to reverse. Therefore, we can look for investment opportunities by going against the crowd.

Determine when to buy and sell: Surveys can help us determine good points to buy and sell. For example, when many investors feel too optimistic, it may be time to sell. Conversely, when many investors feel too pessimistic, it may be time to buy.

-

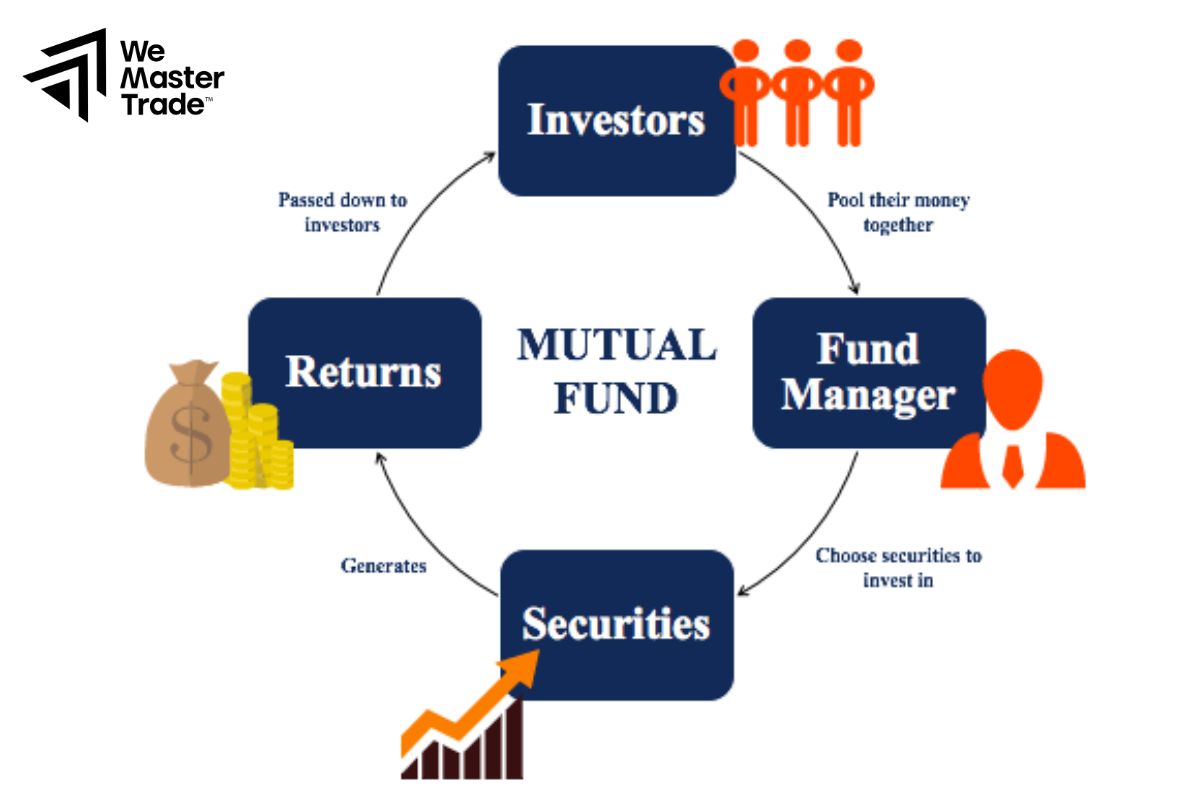

Mutual Fund Cash Flow

Mutual fund cash flow is like a giant savings book, recording the investment decisions of many people. When you or anyone else invests in a mutual fund, you are putting money into a “common pot”. This money will be used by the fund manager to buy different types of assets, such as stocks or bonds.

Like a poll, mutual fund flows tell us what investors think about the market. If a lot of people are pouring money into stock funds, it means that they are optimistic and believe that the market will rise. Conversely, if a lot of people are withdrawing money from stock funds and moving it into bond funds, it means that they are worried and want to preserve their capital. Furthermore, by tracking the flows, we can predict the future trend of the market. For example, if the flow of money into stock funds increases sharply over a long period of time, it is likely that the market will continue to rise.

-

Short Interest Rates

Short interest rates are like a small survey of investor confidence. When they are high, it means that many people think that the stock price will fall and are trying to profit from it.

When many investors short a stock, it creates pressure for the stock price to fall. But if something changes and the stock price goes back up, the short sellers will have to buy the stock back at a higher price to limit their losses. This buying back pushes the stock price even higher.

Sentiment Indicators vs. Technical Indicators

Sentiment Index (Sentiment Index): measures the emotions, beliefs and attitudes of consumers or investors towards the market or economy by collecting information from surveys, opinion polls and expressing those emotions into numbers

Technical Indicators: Analyze historical data on prices, trading volume, use mathematical formulas combined with drawing lines and shapes on price charts to visualize buying and selling signals, helping investors determine reasonable entry and exit points.

Key differences:

| Characteristics | Sentiment index | Technical index |

| Object of analysis | Object of analysis

Investor emotions, confidence |

Historical data on price, volume |

| Objective | Measuring market sentiment | Analyzing trends, finding buying and selling points |

| Tools | Survey, composite index | Mathematical formula, chart |

Conclusion

In conclusion, based on sentiment indicators, investors can identify and predict market trends, thereby making better trading decisions. However, to be successful in forex trading, you need to combine many different factors, including knowledge of technical analysis, fundamental analysis and trading experience.

See more: