Range trading is a popular strategy that helps traders profit from predictable price movements between support and resistance levels. By identifying the highs and lows of a trading range, you can make well-informed buying and selling decisions. Ready to learn how to maximize your gains using range trading? Dive in now and explore the techniques, tools, and tips that will help you master this trading approach. Start trading smarter and boost your profits today!

What is Range Trading?

Range Trading is a trading strategy based on identifying price levels that are considered to be the range of an asset over a certain period of time. In addition, this strategy focuses on two main levels, namely support and resistance.

- The support level is understood as the price level at which the asset tends to stop falling and can bounce back, which is considered the ideal buying point.

- The resistance level is understood as the price level at which the asset tends to stop rising and can fall again, and is also the ideal selling point.

In addition, in this range trading strategy, the trader will seek to buy when the price touches the support level and sell when the price approaches the resistance level. Therefore, this helps to take advantage of the price fluctuations that are repeated in a stable market or a market that does not have a clear upward or downward trend.

See more:

- Top Effective Indicators You Should Know In Trend Trading

- How To Identify Entry and Exit Points in Stock Market

- Guide How To Use The Hybrid Trading Strategy In a Right Way

What is the Meaning of Range Trading for Forex Trading?

Range trading in Forex is a strategy where a trader identifies price levels where a currency pair tends to fluctuate within a certain range over a period of time. This means that the price usually moves between a high and a low, creating a “range” within which traders expect the price to fluctuate. The meaning of trading in Forex trading:

Support and resistance levels

- A support level is a price level at which a currency pair usually stops falling and tends to rise again, acting as a “floor”.

- A resistance level is a price level at which a currency pair usually stops rising and tends to fall again, acting as a “ceiling”.

Buy low, sell high

- In range trading, traders usually open buy orders when the price is near the support level

- And open sell orders when the price is near the resistance level.

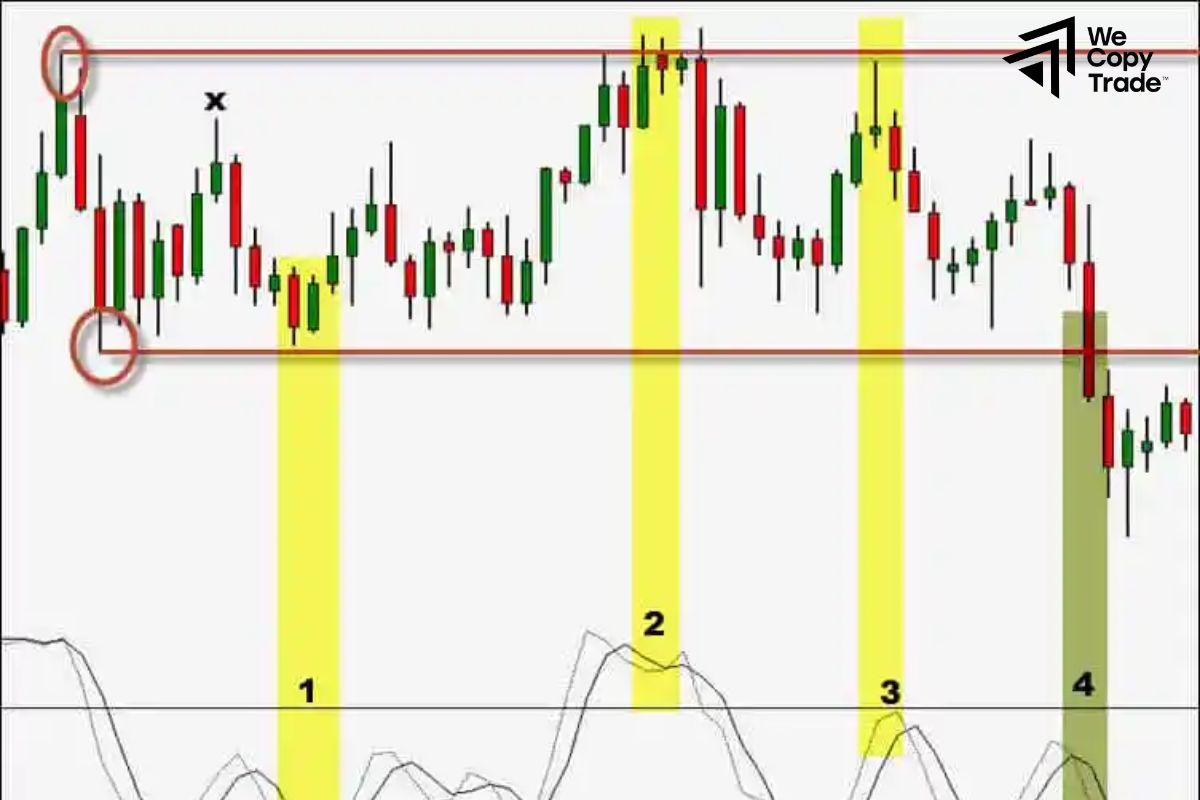

Technical Analysis Tools

- Traders use various tools such as trend lines, moving averages

- Technical indicators (e.g. RSI, MACD) to identify range limits and predict potential price reversal points.

Timeframes

- Ranges can exist on different timeframes daily, weekly or even intraday.

- Traders need to choose a timeframe that fits their strategy.

Range Breakout

- A major risk in range trading is range breakout

- When price moves above a support or resistance level, signaling that a new trend may begin.

Top 3 Simplest Range Trading Strategies

Here are the top 3 simplest range trading strategies that traders often use in Forex:

Support and Resistance Range Trading

This is the most straightforward range trading strategy. Traders identify a clear range with well-defined support and resistance levels. The idea is to buy at the support level and sell at the resistance level.

- Use technical analysis to identify a horizontal range where the price consistently bounces between support and resistance.

- Enter a buy trade when the price touches the support level.

- Enter a sell trade when the price touches the resistance level.

- Set a stop-loss slightly below support for long positions and slightly above resistance for short positions.

Bollinger Bands Range Trading

Bollinger Bands are a popular indicator used to identify potential price ranges. The bands consist of a moving average and two standard deviations away from it, forming a channel.

- Buy when the price hits the lower Bollinger Band (indicating the price might be oversold).

- Sell when the price hits the upper Bollinger Band (indicating the price might be overbought).

- Use the middle Bollinger Band as a potential target or trailing stop.

Moving Average Range Trading

This strategy uses short and long-term moving averages to identify potential ranges. Moving averages help smooth out price data and highlight trends or consolidations.

Identify a market that shows a clear sideways range with minimal trending movement.

- Use a Simple Moving Average, such as a 50-period and 200-period SMA, to confirm the range.

- Buy when the price is near the lower end of the range and above a short-term moving average.

- Sell when the price is near the upper end of the range and below a short-term moving average.

Basic Range Types of Range Trading

In range trading, there are several basic types of ranges that traders need to understand. Each type has its own characteristics and strategies, making it important to recognize which range is in play. Here are the primary types of ranges in range:

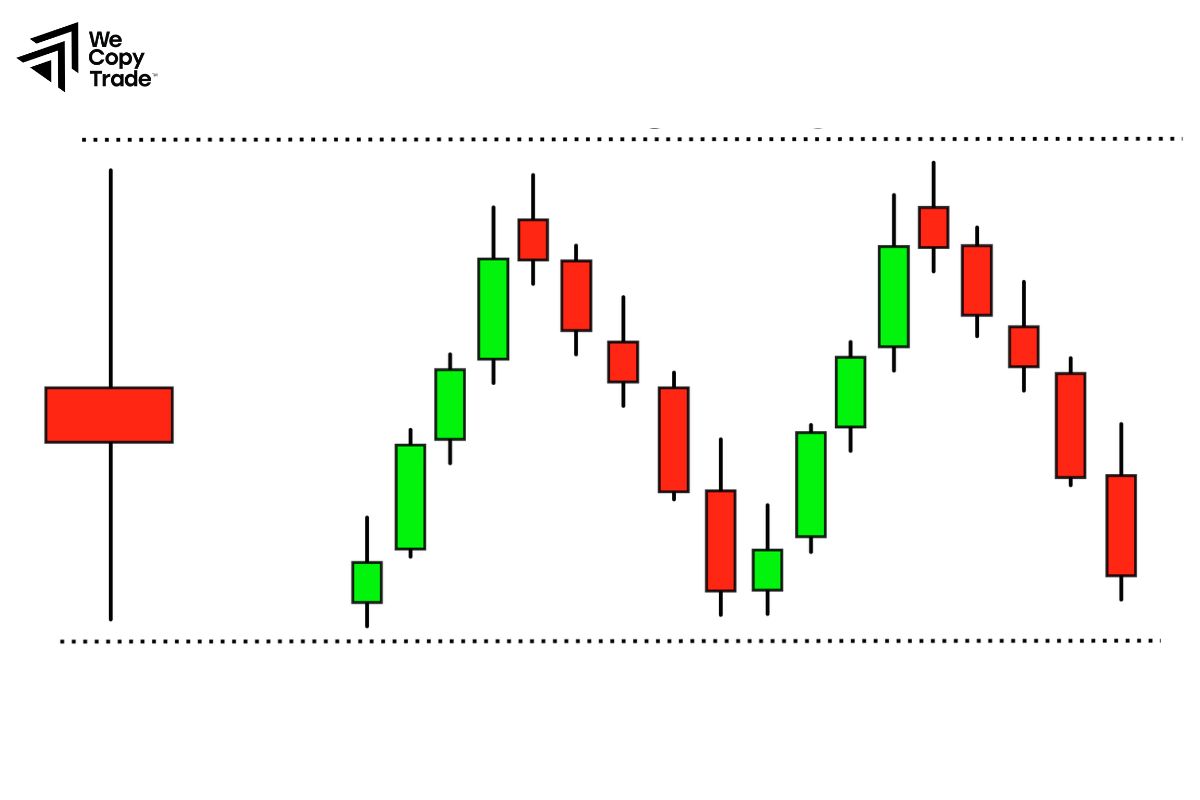

Horizontal Range

A horizontal range is the most common type of range. It occurs when the price of a currency pair moves sideways, consistently bouncing between well-defined support and resistance levels. There is no clear uptrend or downtrend, and the market lacks strong directional movement.

- Price moves in a sideways pattern.

- Clear horizontal support and resistance levels.

- Market is often in a state of indecision.

Diagonal Range

A diagonal range occurs when the price moves in a sloping manner either upwards or downwards. This type of range combines elements of trend trading and range trading because it has a directional bias but still oscillates between two boundaries.

- Price creates a series of higher highs and higher lows or lower highs and lower lows.

- Support and resistance levels are not horizontal but instead form trendlines.

Expanding Range

An expanding range, also known as a “megaphone pattern” or “broadening formation,” is characterized by increasing volatility. The support and resistance levels move further apart over time, creating a widening pattern.

- Price swings become wider, with each high being higher than the previous and each low being lower than the previous.

- A sign of market uncertainty or potential future volatility.

Contracting Range

A contracting range is a narrowing price pattern where the support and resistance levels converge, forming a triangle shape. This pattern shows decreasing volatility as the price consolidates, leading to a breakout in either direction.

- Price swings get smaller over time, forming a tighter range.

- Can appear in both uptrends and downtrends.

- Indicates that a breakout is likely as the price approaches the apex of the triangle.

Irregular Range

An irregular range does not have a clear or consistent pattern. Support and resistance levels may not be perfectly defined, leading to choppy market behavior. These ranges are unpredictable and can include false breakouts and fake signals.

- Erratic price movements with no consistent pattern.

- Harder to identify clear support and resistance levels.

- Indicates uncertainty or lack of direction in the market.

Conclusion

In conclusion, range trading is a powerful and straightforward strategy that can be highly effective for traders looking to capitalize on price movements within defined support and resistance levels. Successful trading relies on the ability to spot key price levels and manage risk with clear entry and exit points. Start practicing trading strategies now and watch your Forex trading success grow!

See now: