Have you ever heard of Kelly Criterion? It sounds fancy, but in fact, when you understand how it works and know how to take advantage of its advantages and disadvantages, you will definitely have more opportunities for successful trading. Don’t miss the opportunity to learn the calculation tips and apply this standard to your strategy!

What is The Kelly Criterion?

The Kelly Criterion, invented by a scientist named John Kelly in the 1950s, is a useful mathematical formula that helps us decide how much money to invest in an asset to earn the most profit in the long run. Simply put, it is a method of dividing our assets and choosing to invest more in things that have a higher potential for profit. Like a compass, this formula helps us avoid emotional investment decisions and maximize profits in the long run. However, to effectively apply, we need to have enough information about the profitability and risk of each investment.

See now:

- Tips Simplify Your Financial Risks Management Process

- Financial Risk Assessment, Identification and Management

- What is interest rate risk? How to manage interest rates

- Some Steps to Successful Liquidity Risk Management 2024

Pros and Cons of the Kelly Criterion System

Pros and cons you should consider when using the kelly formula

Pros of the Kelly Criterion System

The Kelly Criterion is a useful tool for those who want to manage their money wisely, especially in activities related to investing or betting. Here are the outstanding features:

- The Kelly Criterion helps you build a long-term, sustainable investment plan. By calculating the optimal bet level, you can grow your money steadily over time.

- One of the biggest benefits of the Kelly Criterion is that it helps you avoid emotional investment decisions, which lead to over-betting and losing everything. By calculating scientifically, you can control your risk and protect your capital.

- Formula is quite simple and only requires you to know the probability of winning and the odds. You do not need to be a math expert to be able to use it.

- You can adjust the bet level based on your risk tolerance and personal goals.

- The Kelly is built on a mathematical foundation, helping you make decisions objectively and rationally.

Cons of the Kelly Criterion System

The Kelly Criterion is a useful tool, but it has certain limitations that you need to consider:

- To use the Kelly Criterion effectively, you need to accurately estimate the probability of winning each bet. If you get the estimate wrong, you may bet too much or too little, which can lead to losses. Predicting the probability of winning accurately is not easy, especially in games of chance or in the volatile financial markets.

- One of the biggest limitations of the Kelly Criterion is that it can result in results that require you to bet a large amount of money compared to your total capital. For example, if you need to bet 80% of your bankroll, this is a very high level of risk. Most people are not comfortable betting such a large amount of money, because just a few consecutive losses can cause you to lose everything.

The Kelly Criterion Formula

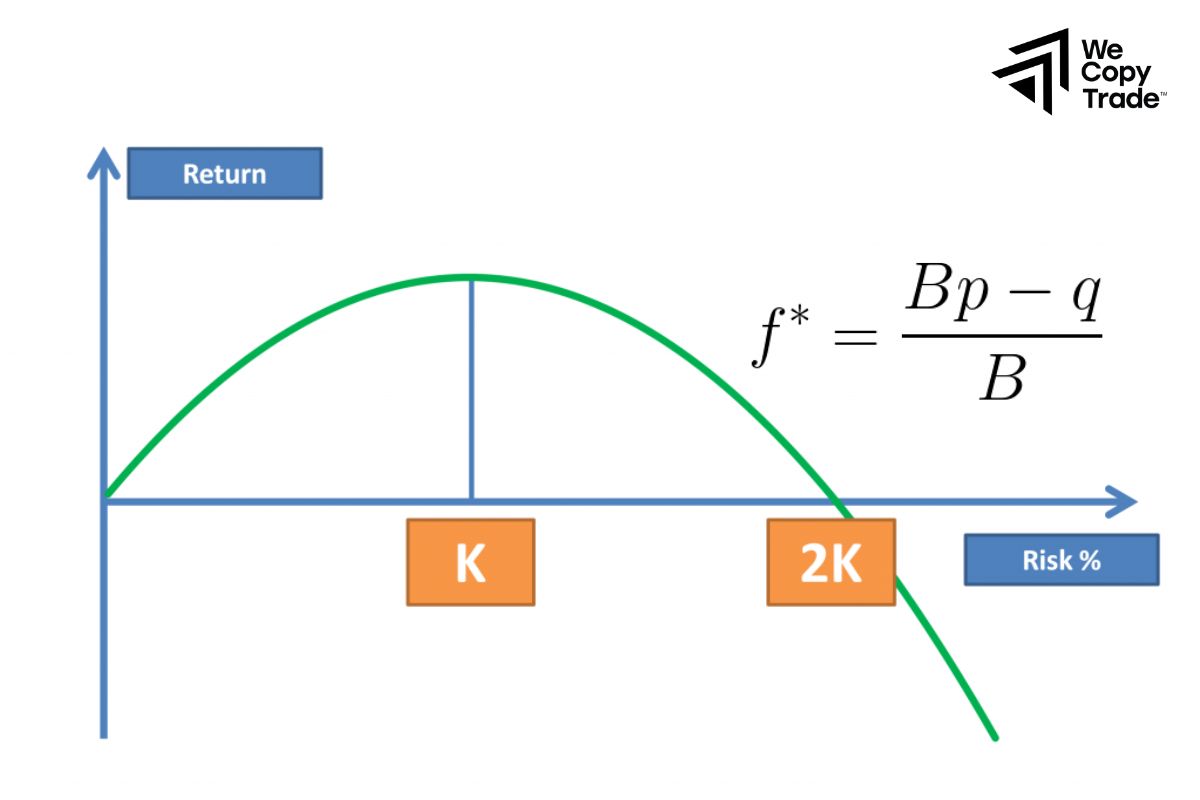

When investing, our goal is to grow our capital over time. Using logarithms helps us measure this growth more effectively.

Logarithms also help us figure out how much our investment will grow on average over the long term, based on the probability of winning or losing and the odds. For example, losing 50% of your money and then making 50% back won’t get you back to where you started. Logarithms help us put this loss into perspective.

?[log(????)]=?log(?(1+??))+?log(?(1−?))

Where:

- W: is your initial capital, i.e. the capital you have before betting.

- f: is the percentage of the amount you decide to bet in each game.

- b: is the odds that you will receive when you win the bet. For example, if you bet 100 and win, you will receive 100*(1+b).

- p: Is the probability that you win a bet.

- q: Is the probability that you lose a bet (1 – p).

Our goal is to find the value of f (the percentage of the bet) that maximizes this expected value using the derivative formula. Once we find the optimal value of f, that is the percentage that the Kelly criterion recommends we bet.

f* = (b*p – q) / b

Where:

f*: The percentage of the amount you should bet.

b: Odds (win/lose ratio).

p: Probability of winning.

q: Probability of losing (1 – p).

Real-world example

Let’s say you want to bet on the game between the Chiefs and the 49ers. You estimate that the Chiefs have a 50% chance of winning (while the bookmaker’s odds imply a 33% chance of winning).

Calculation:

b = 2 (since the decimal odds are 3.0)

p = 0.5

q = 1 – p = 0.5

Apply the formula: f* = (2*0.5 – 0.5) / 2 = 0.25

- According to the Kelly criterion, you should bet 25% of your money on this match. If you have $1,000, you should bet $250.

- Diversifying your investments across different assets will help reduce your risk.

- If you are risk averse, you can apply a “softer” version of the Kelly criterion, called fractional Kelly. This will protect your capital better, but will also reduce your chances of making a high profit.

- If the Kelly criterion gives a negative result, it means that your chances of winning are too low compared to the risk. At this point, it is best to “sit still” and look for other better investment opportunities.

Applying the Kelly Criterion to Trading Systems

The Kelly Criterion is a useful tool, but to use it effectively, you need to keep in mind the following points:

- If the calculation results show that you should not bet (i.e. negative value), respect that result. Do not try to “force” yourself into an unprofitable bet.

- The Kelly Criterion can be combined with other betting systems such as Martingale or Fibonacci to create a more diverse betting strategy. However, do your research before combining these systems, because they can bring both risks and profits.

- If you find the calculation of the Kelly Criterion too complicated, use a calculator or specialized calculation software. Many websites and apps now offer free Kelly Criterion calculation tools.

- When betting, greed and fear are the biggest enemies. Try to keep your mind stable and make decisions based on data, not emotions.

- The most important thing when applying the Kelly criterion is that you must estimate the probability of an event winning accurately. If the estimate is wrong, the calculation will no longer be meaningful.

Conclusion

In conclusion, The Kelly Criterion is a useful tool for investors. However, it does not guarantee that you will always win. To be successful in investing, you need to combine the use of this criterion with your own knowledge, experience, and alertness.

See more: