Prop firms are becoming an ideal choice for many traders who want to access large capital sources to increase profits without having to invest too much personal capital. However, along with opportunities are prop firm trading loopholes – blind spots, lack of transparency that not every trader is sober enough to recognize. To avoid making these mistakes, let’s find out clearly in the following article:

What are Prop Firm Trading Loopholes?

Prop firm trading loopholes are unreasonable, lack of transparency or easily misunderstood points in the operating process and conditions of a prop firm. These can be unclear regulations, hidden terms or policies communicated in a misleading way, thereby creating risks for traders – especially beginners.

These loopholes are not always wrong, but often create a sense of accessibility – while the actual risk is higher than imagined. That is why many traders fail not because they trade poorly, but because they do not fully understand the rules of the platform they are participating in.

See more:

- Prop Firm Sponsorship: A Golden Opportunity for Traders

- Tips to Improve Prop Firm Skills Effectively – Upgrade Skills

- 5 Effective Ways to Save Prop Firm Costs for Traders

Some Prop Firm Trading Loopholes Commonly Encountered

On the journey to conquer funds, many skilled traders are still prone to prop firm trading loopholes, not because of wrong trading, but because of ambiguous rules, “hidden” algorithms and invisible pressure that cause them to lose their accounts inexplicably. Below are 4 common but little-talked-about prop firm trading loopholes:

Lack of Transparency

Not all prop firms are absolutely transparent. Some platforms use algorithms to monitor trading behavior and automatically adjust market conditions when the account starts to make good profits:

- Spreads suddenly widen abnormally at the time of order entry.

- Orders are slow to match or slippage for no apparent reason.

- Market signals are “noisy”, distorting the trading system.

These tricks are considered sophisticated prop firm trading loopholes, because they do not show up in reports, are not public violations – but they put traders at a disadvantage as soon as they start making real money.

Unclear Terms

Many prop firms build rules that lack transparency or intentionally write ambiguous terms, causing serious misunderstandings for traders:

- Max drawdown is calculated by equity or balance?

- Daily drawdown resets every day or is it calculated continuously?

- Is there a limit to the number of pending orders, maximum trading volume per day?

The seemingly small details are vital to a prop account. The ambiguity here is the loophole in prop firm trading that many people have to pay for with their own money and time.

Exam Psychology Causes Wrong Strategy

At stages such as challenge or evaluation, many traders fall into a psychological spiral:

- Trading too much to catch up with profit targets.

- Ignoring standard setups, rushing orders.

- Deciding based on scores, not market signals.

This pressure makes the strategy undisciplined, leading to traders failing with real accounts after only a few weeks despite passing the exam.

Unreasonable Choices

Not all prop firm trading loopholes are caused by the platform. Sometimes, traders themselves make mistakes when:

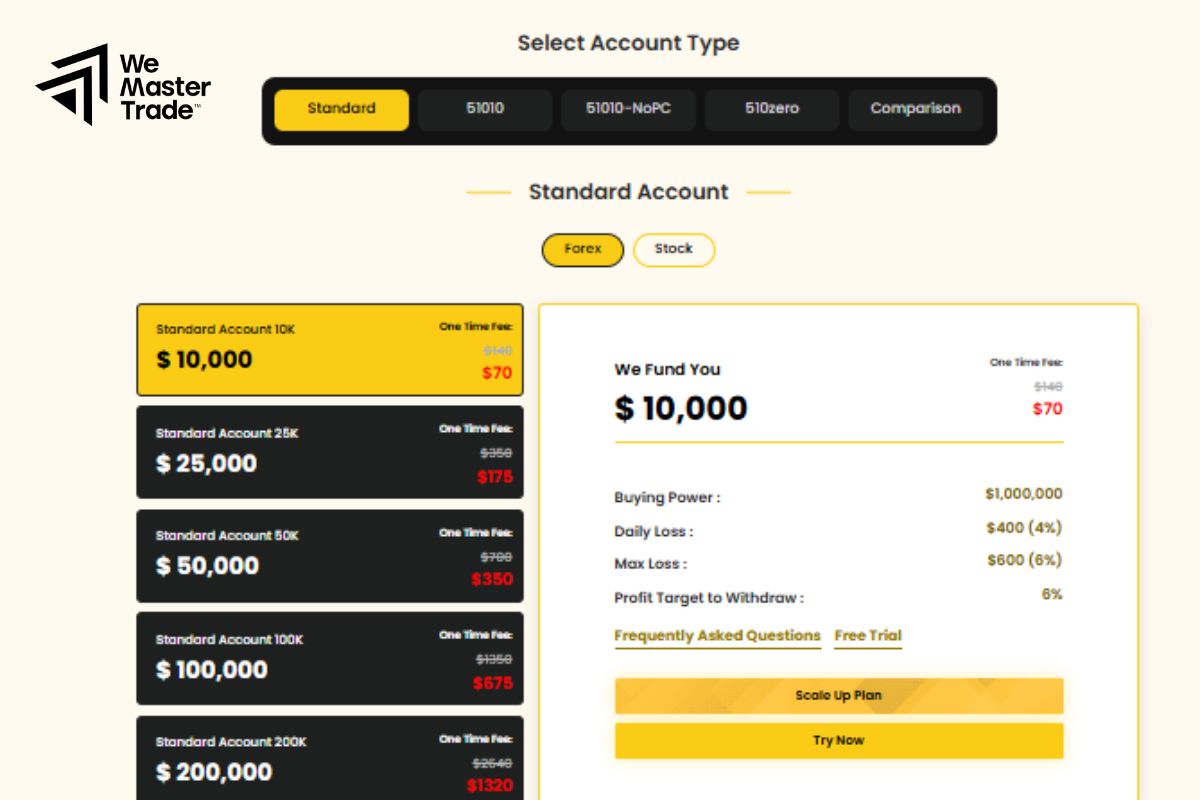

- Choosing the wrong package: For example, choosing Instant but trading according to a long-term strategy that is not suitable for the capital structure.

- Not reading the payout terms carefully: Many funds require a minimum holding time, number of trading days or withdrawal tool limits.

In addition, some traders only look at the profit percentage, ignoring more important factors: the split ratio, withdrawal period, hidden fees, overnight holding regulations… These factors, when added together, can significantly erode profits – even causing unexplained losses.

How to Effectively Take Advantage of Prop Firm Trading Loopholes

When it comes to prop firm trading loopholes, many traders often think of risks or “traps” from the company. But in fact, these loopholes, if properly understood and exploited legally, can become an advantage for you to improve your trading performance and increase your chances of success. So what can traders take advantage of from prop firm trading loopholes wisely? Let’s analyze below.

So what can traders take advantage of prop firm trading loopholes wisely? Let’s analyze below.

Smart Risk Control

Prop firm rules are not always an invisible wall that limits you. In fact, if you apply a strict risk control strategy, you can:

- Keep your drawdown low, avoid violating strict loss limits.

- Optimize the number of orders and order sizes to avoid “over-trading” but still achieve profit targets.

- Plan your trades by time frame to take advantage of daily drawdown reset points (if any).

Thanks to that, you can “legally” get around the rules and maintain stable performance to pass the challenge rounds.

Instant Package

One of the positive loopholes in the prop firm system is the Instant package, which allows traders to enter orders immediately without having to go through the challenge period.

However, the Instant package often comes with stricter regulations on drawdown, order holding time and withdrawal conditions.

If you understand the rules, you can take advantage of this package to:

- Skip the lengthy evaluation steps, save time.

- Focus on trading in your own style without the pressure of exams.

- Go quickly on the path of building profits and withdrawing capital legally.

However, it is important to follow the regulations, otherwise it is easy to make mistakes and lose your account.

Take Advantage of Short-term Incentives

Prop firms often launch attractive incentive programs to stimulate traders to participate, and this is also a positive “loophole” that you should not ignore. If you know how to choose the right time and incentive conditions, you will significantly increase your profits without having to take additional risks.

Conclusion

In summary, prop firms are a great capital and skill financing solution for traders. However, there are also certain risks involved. Understanding these prop firm trading loopholes isn’t just about avoiding unnecessary failures; it’s the crucial first step to choosing the right platform, the right strategy, and ultimately, building sustainable profits.

See more: