Social Trading is revolutionizing the way people invest, allowing you to follow and copy the strategies of successful traders. This approach makes investing accessible, even if you’re new to the financial markets. Learn the basics, explore expert strategies, and see how Social can simplify your path to profits. Ready to start your journey? Sign up today and watch your investment grow with the guidance of top traders!

What is Social Trading?

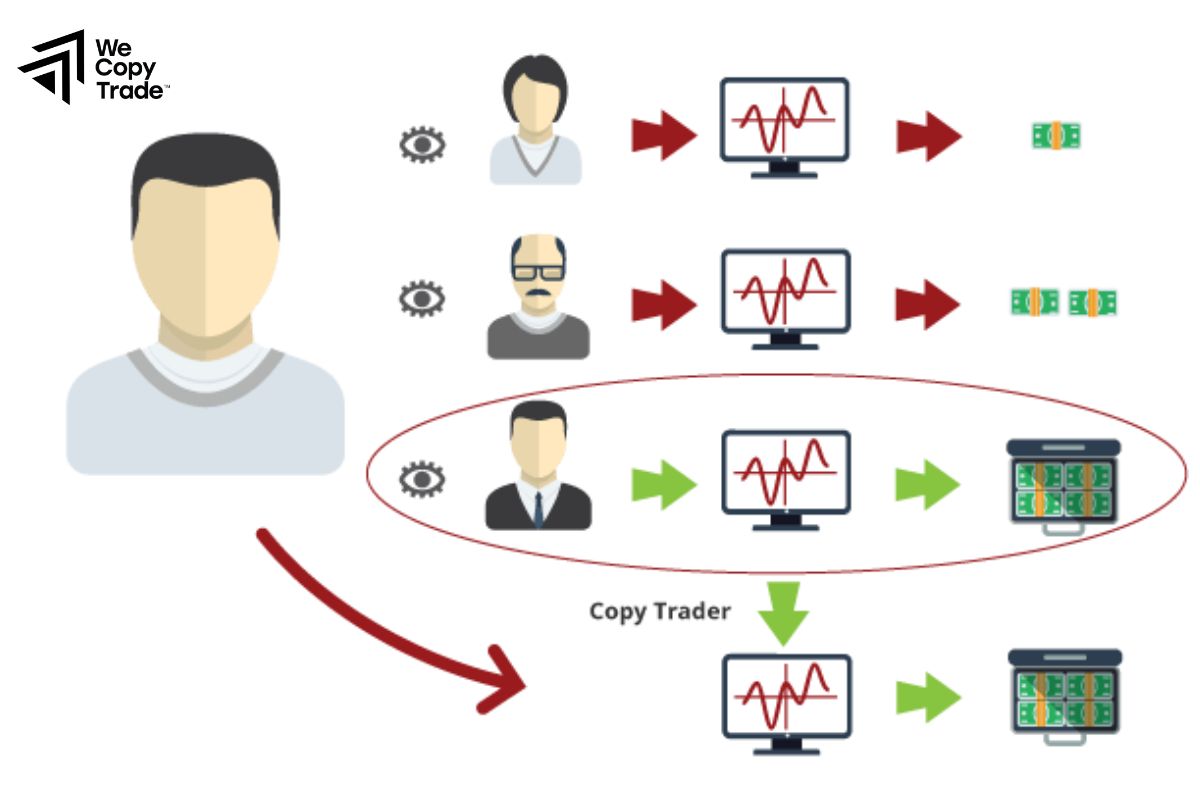

Social Trading is a modern form of investment that allows users to observe, follow, and copy the trades of experienced investors within a community. Instead of analyzing the market and making complex decisions on their own, users can leverage the knowledge and strategies of experts through it platforms. These platforms operate like a social network specifically for investors, where users can share information, strategies, live trades, and market updates.

Besides, Social Trading not only reduces the burden of analysis and decision-making, but it also opens up opportunities to learn from experienced traders, making it easier for newcomers to access and explore financial investments.

See more:

- Maximum Your Profit From Taking Advantages Market Sentiment

- Tools and platforms supporting Geopolitical Trading

- The most effective way to Interest Rate Trading in forex

- Get Started Smart Trading With Top Economic Indicators

Which traders should participate in Social Trading?

Social Trading is suitable for a wide range of traders, but it is especially beneficial for:

Beginners

- New traders who lack experience or market knowledge can greatly. By following and copying seasoned investors, they can gain exposure to successful strategies without having to fully understand complex market analysis. It’s a great way for beginners to learn the ropes and build confidence.

Time-Constrained Traders

- Traders who don’t have the time to conduct in-depth market research can rely on Social Trading platforms to follow experts. This allows them to stay active in the market without dedicating hours to technical analysis or tracking trends.

Traders Seeking Diversification

- Investors who want to diversify their portfolios can use Social to follow multiple experts with different trading styles. This approach spreads risk and increases exposure to various markets and assets, which can enhance long-term profitability.

Intermediate Traders Looking to Improve

- Traders with some experience who are looking to refine their strategies can benefit by observing the tactics of top traders. They can learn advanced techniques, analyze how professionals respond to market changes, and adjust their own strategies accordingly.

Investors Interested in Passive Income

- Social Trading can be a way for traders seeking passive income to generate returns without actively managing every trade. By copying high-performing traders, they can potentially earn profits while maintaining a hands-off approach.

Curious Traders Who Enjoy Community Insights

- Traders who value community insights and enjoy discussing market trends, strategies, and predictions with others will find Social Trading platforms engaging. These platforms allow for sharing knowledge, discussing strategies, and learning collaboratively.

What are the advantages and disadvantages of Social Trading?

Advantages of Social Trading

- Easy Access for Beginners: Social Trading provides a straightforward way for newcomers to get involved in financial markets without extensive knowledge or experience.

- Time-Saving: For those who lack the time to perform detailed market analysis, offers a convenient solution. Users can rely on the expertise of professional traders, allowing them to stay active in the market without hours of research.

- Learning Opportunities: Social Trading platforms serve as educational tools, enabling traders to learn by observing experts. This hands-on experience helps new and intermediate traders understand different strategies, market trends, and risk management techniques.

- Potential for Passive Income: Social Trading can generate passive income, especially for those who prefer a more hands-off investment style. By copying successful traders, users can potentially earn profits without actively managing every trade.

Disadvantages of Social Trading

- Over-Reliance on Others: One of the main risks of Social Trading is the potential over-reliance on other traders’ expertise. If the copied trader makes a poor decision, the followers can also suffer losses. Blindly following without understanding the rationale can be risky.

- Performance Variability: Past success does not guarantee future performance. Even top traders can experience downturns or make mistakes, which can impact followers who rely on their strategies without question.

- Lack of Control: When copying another trader’s strategy, users have less control over their investments. This can be frustrating for those who prefer to make independent decisions or adjust trades based on personal judgment.

The easiest way to become an investor in Social Trading

To easily become an investor in Social, just follow these 4 simple steps:

Step 1: Choose a Reliable Platform

- Find a trustworthy Social Trading platform like eToro or ZuluTrade. Make sure the platform has good reviews and is regulated by reputable organizations.

Step 2: Create an Account & Explore

- Sign up for an account, then explore the profiles of top traders. Choose those with a good trading history that align with your goals.

Step 3: Invest & Start Copying

- Decide how much you want to invest, select a trader to copy, and set any risk limits if needed. Your account will then automatically copy their trades.

Step 4: Monitor & Adjust

- Regularly check your investment’s performance. If a trader isn’t meeting your expectations, you can stop copying them and choose someone else.

Should traders choose to participate in Social Trading?

Traders should participate in Social Trading if:

- Beginners: It’s easy to learn and copy strategies from professional traders.

- Time-constrained: Social Trading allows passive investing without the need for in-depth market analysis.

- Want to learn and diversify: Observing different strategies helps improve skills and reduce risk.

However, be aware of the risks of over-relying on others and fees from the platform. If you want full control over your strategy, Social may not be suitable.

Notes when using Social Trading at Forex floors for effective trading

When using Social Trading at Forex platforms for effective trading, here are some important notes to consider:

- Choose Reliable Traders to Copy: Carefully analyze traders’ profiles before copying them. Look for consistent performance over time, a clear strategy, and risk management practices.

- Diversify Your Portfolio: Avoid putting all your funds into copying a single trader. Diversify by following multiple traders with different strategies and asset focuses.

- Set Realistic Expectations: Social Trading is not a guaranteed way to make profits. Understand that even successful traders can experience losses. Set realistic expectations and don’t expect instant gains.

- Monitor Your Investments Regularly: Although Social can be passive, it’s important to monitor your portfolio and adjust your strategy when necessary. If a trader’s performance drops or you notice changes in their trading style, consider switching to another trader.

- Understand the Risks: Every trade carries risk, and Social is no exception. Don’t blindly follow traders without understanding the risks involved. Be aware that past performance doesn’t guarantee future results, and losses can still occur.

Conclusion

In conclusion, Social Trading offers an accessible and effective way to invest by allowing you to copy the strategies of experienced traders. Whether you’re a beginner or someone looking to diversify your portfolio, it provides valuable opportunities to learn, grow, and potentially earn. However, it’s important to approach it with the right mindset, understanding the risks, and choosing the right traders to follow. Ready to get started? Join a trusted Trading platform today and take the first step towards smarter, more informed investing!

See now: