In the volatile financial world, joining a prop firm is no longer a distant dream, but has become a realistic goal for many serious traders. However, qualifying for a prop firm requires more than just a few winning trades or basic knowledge of the market. It is a thorough preparation process, including education, skills, experience, strategic thinking and the ability to withstand high pressure.

This article will help you understand the evaluation criteria, the skills to develop, and the practical path to meeting the standards required by reputable prop firms.

Why You Must Understand the Standards Before Joining a Prop Firm?

Clearly identifying the requirements allows you to prepare proactively, save time, and increase your chances of success. Prop firms are not simply looking for people who are good at “reading charts,” but for individuals qualifying for their prop firm from many perspectives: trading psychology, risk management ability, and strategic thinking.

Why You Must Understand the Standards Before Joining a Prop Firm?

While some companies may support beginners through training programs, most professional prop firms focus on traders who already have a strong foundation and a serious mindset. That’s why understanding your current gaps is the first step toward bridging the distance between “beginner” and “ideal candidate.”

See now:

- Prop Firm Finance Trend Unlocks New Investment Opportunities

- Follow prop firm experts to increase success rate

- Top 5 Ways to Choose a Reliable Prop Firm for New Traders

- 10+ Prop Firm Successful Trading Skills Traders Need

Factors That Prove You Are Qualifying for a Prop Firm

To ensure your prop trading journey runs smoothly, you’ll need to demonstrate the following qualities:

Educational Background & Financial Knowledge

You don’t need a Ph.D. in economics, but solid knowledge of finance, risk management, technical analysis, or trading psychology is a big plus. Many prop firms value applicants with certifications such as the CFA or the U.S. Series 57, as they prove commitment and deep understanding.

If you lack formal qualifications, structured self-study combined with the ability to demonstrate practical knowledge through your trading results can still prove you’re qualifying for a prop firm.

Trading Experience & Verified Performance

Firms often require applicants to present a clear trading record covering the past 6–12 months, showing the ability to control drawdowns and maintain consistent profits. They’re less concerned about how many winning trades you’ve had and more interested in how you manage risk, react to losses, and maintain long-term discipline.

A demo account or a funded account with verifiable results is a good way to demonstrate your capability.

Analytical Mindset & Strong Psychology

When trading with company capital, you’ll need to make decisions under intense pressure. Critical thinking, the ability to act quickly, and staying calm in volatile markets are all key criteria for qualifying for a prop firm.

Discipline & System Compliance

Regardless of your strategy, strictly following your system and capital management rules is essential. Prop firms aren’t looking for “impulsive geniuses”—they want consistent traders who won’t break discipline whether winning or losing.

The Typical Evaluation Stages for Prop Firm Applicants

Since a prop firm’s performance is directly linked to a trader’s success, most firms follow two common stages to determine whether a candidate fits their model:

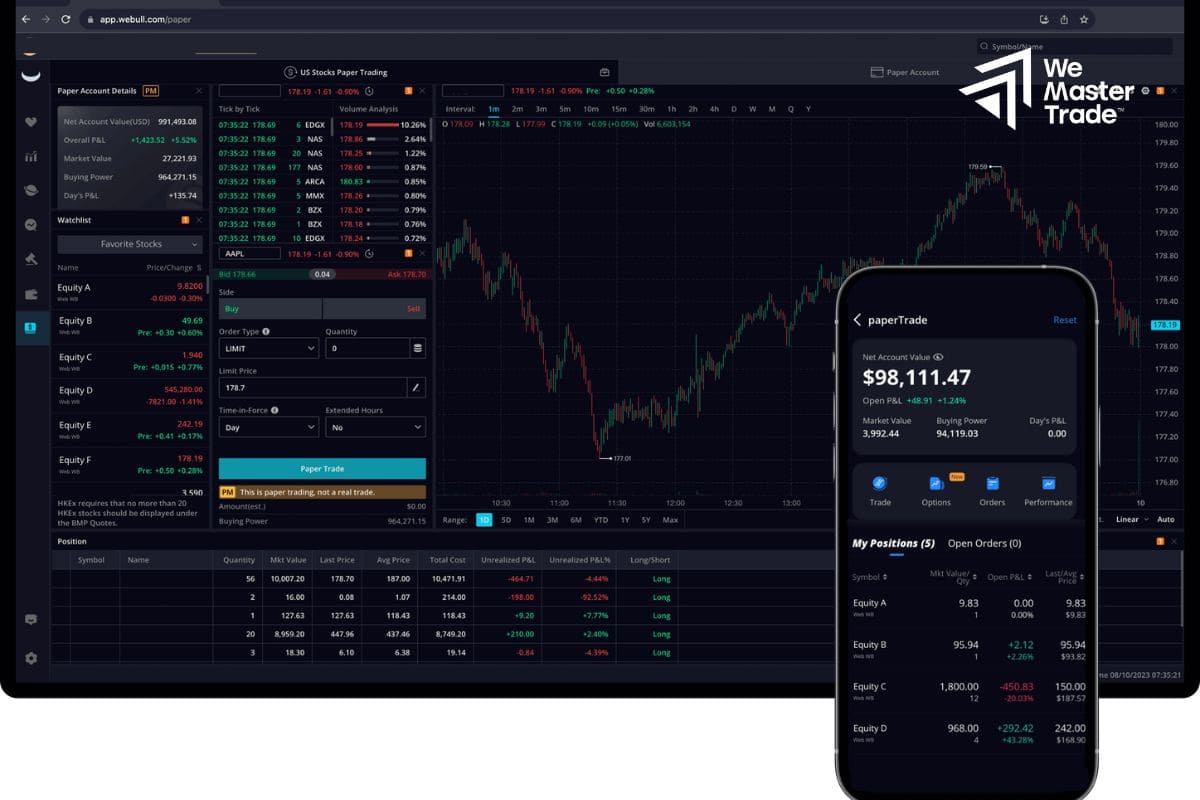

Skill Assessment via Simulated Trading

Skill Assessment via Simulated Trading

Before allocating real capital, many prop firms use simulated accounts to evaluate an applicant’s risk management, reaction speed, and market psychology. This is when your results—not just your words—must prove you are qualifying for a prop firm.

Training & Coaching

Some firms offer intensive training programs once applicants pass the initial challenge. These often include advanced technical analysis, capital management, and strategies for adapting to different market conditions.

Challenges of Working in a Prop Trading Environment

Alongside its outstanding advantages, prop trading also comes with certain limitations:

High-Pressure Environment

Managing large capital, delivering consistent profits, and meeting high expectations from the firm make prop trading a career unsuitable for the faint-hearted. If you can’t stay calm after a few losing trades, you’ll struggle to be seen as qualifying for a prop firm.

Legal Risks and Compliance

In some regions, such as the U.S., trading securities requires licenses like the Series 7 or Series 63. However, for prop firms using funded accounts or proprietary platforms, the requirements can be more flexible—yet still demand strict compliance with regulations.

Roadmap to Becoming a Professional Prop Firm Trader

Roadmap to Becoming a Professional Prop Firm Trader

While the following steps may seem obvious, many traders make costly mistakes and fail to reach their profit goals simply because they don’t follow them:

Step 1: Self-Assessment

Identify exactly where you stand in terms of skills, knowledge, and trading performance. Compare this with the actual requirements of prop firms to determine the gaps you need to close.

Step 2: Join Communities and Practice

Write trading blogs, share strategies, and participate in specialized forums. This helps you sharpen critical thinking, learn from experts, and build an impressive profile when applying.

Step 3: Take Evaluation Challenges

Many prop firms offer evaluation challenges. Treat these as opportunities to prove yourself and move closer to qualifying for a prop firm.

Conclusion

In summary, prop trading is not an easy path—but it’s an ideal environment for building a trading career if you are truly committed. The journey to becoming a professional prop trader requires more than just skill—it’s a blend of sharp thinking, solid discipline, and continuous adaptability. If you are already on this path, stay persistent and regularly check whether you are truly qualifying for a prop firm.

See more: