Do you think that investing by crowd effect always generates high profits? If you are patient and have certain knowledge about investing, contrarian trading may be suitable for you. Follow me, I will show you the hidden corners and strategies to effectively utilize this form of trading.

What Is Contrarian Trading?

Simply put, contrarian trading is an investment strategy that goes against the general trend of the market. Instead of buying when the market is high and everyone is optimistic, contrarian investors choose to buy when the market is low and everyone is selling. And conversely, they will sell when the market is hot and everyone wants to buy.

Contrarians believe that market prices sometimes do not reflect the true value of a company or asset. They look for opportunities when the market is undervaluing a good stock, or overvaluing a bad stock.

Contrarians need to have a lot of patience, because their strategies often go against the general sentiment of the market. They also need to be able to think independently and not be influenced by the opinions of the crowd.

For example, when the pandemic broke out, many stocks were sold off heavily due to economic concerns. However, some contrarian investors took advantage of this opportunity to buy stocks of companies with solid foundations at very attractive prices.

See now:

- The easiest way to become an investor in Social Trading

- Maximum Your Profit From Taking Advantages Market Sentiment

- The most effective way to Interest Rate Trading in forex

Advantages and disadvantages of contrarian trading

Contrarian investing is known to be an interesting and profitable investment strategy. However, here are the advantages we need to know to promote and the disadvantages we need to know to limit when investing in this form:

Advantages of Contrarian Trading

- tingWhen the market panics and sells off, contrarian investors have the opportunity to buy high-quality stocks at prices deeply discounted compared to their real value. This creates a large margin of safety, helping to minimize the risk of losing capital.

- By going against the crowd, contrarian investors can avoid buying assets that are overvalued and at risk of bursting.

- When the market recovers, the stocks that contrarian investors have bought will have the potential to grow strongly, bringing high profits.

- In the long run, successful contrarian investors often achieve higher profits than the general market.

Limitations of Contrarian Trading

- It can be lonely to go against the crowd and face opposing opinions.

- Finding good investment opportunities requires a lot of research and analysis.

- Contrarian strategies do not always work. If you pick the wrong stocks, you can lose money.

Contrarian Trading strategy

Contrarian investing is an interesting investment style but also has many risks. To limit the risk, you can refer to the following steps:

Identify signs of extreme psychology

- Observe market indexes such as VIX (fear index), P/E (price-to-earnings ratio), and other psychological indicators to assess the level of optimism or pessimism of the market.

- Read articles and analytical reports to better understand investor psychology and current events.

- Pay attention to excessive buying and selling actions of investors.

Look for investment opportunities

- Fundamental analysis, carefully evaluate the financial situation, business operations and future prospects of companies.

- Compare the current price of stocks with the intrinsic value of the company to find stocks that are undervalued or overvalued.

- Look for industries that have good growth prospects in the future, even if they are struggling now.

Build a diversified portfolio

- Don’t put too many eggs in one basket. Diversify your portfolio to reduce risk.

- You can combine contrarian trading with other investment strategies such as value investing or growth investing.

Be patient and disciplined

- Don’t let short-term market fluctuations shake you.

- If an investment doesn’t perform as expected, be ready to cut your losses to limit your losses.

- Conduct periodic portfolio reviews and implement necessary modifications.

5 Famous Contrarian Investors and Valuable Lessons

Learning from successful investors will help you gain more knowledge and experience more effectively. The investment journey is a long process that requires perseverance and a desire to learn, so add knowledge every day. Here are 5 Famous Contrarian Investors and their Valuable Lessons:

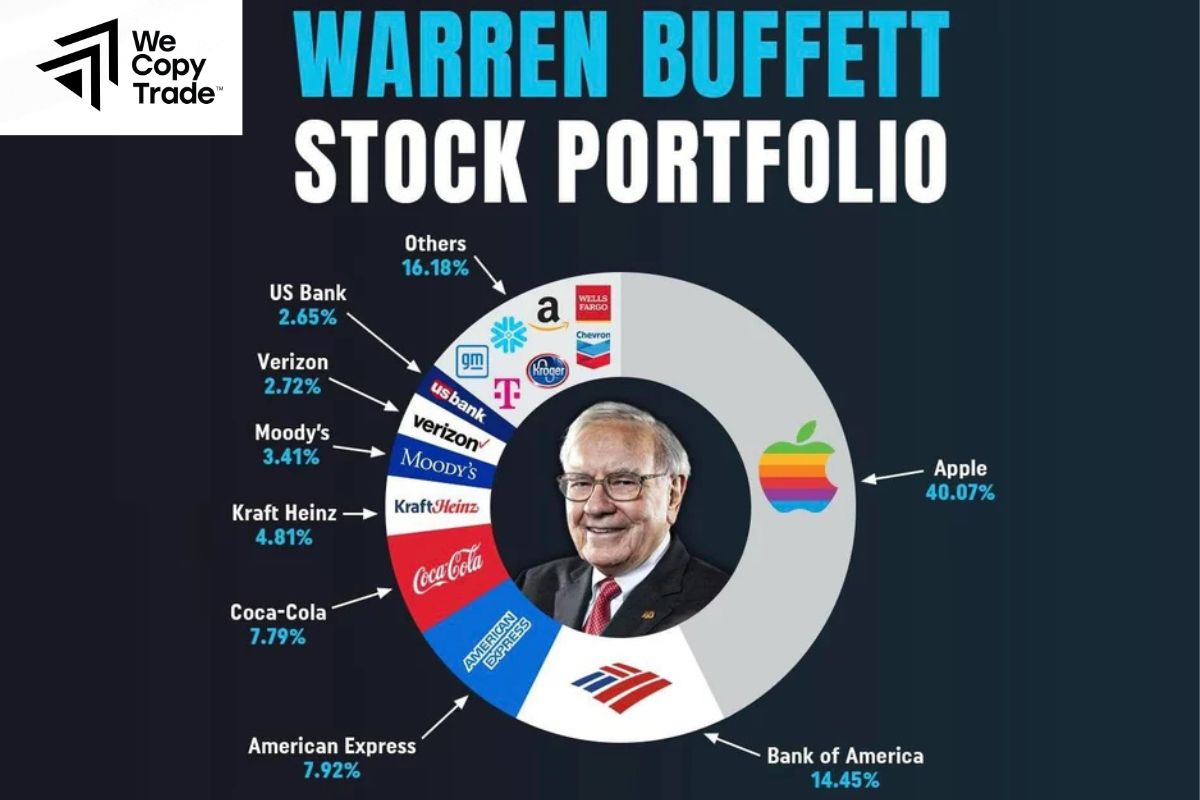

Warren Buffett

With patience, value investing, and a long-term vision, he buys stocks of high-quality companies at bargain prices and holds them for the long term. Buffett often buys when the market is down and other investors are panicking.

Jim Rogers

Rogers is famous for investing in a variety of assets across the globe, from commodities to real estate. He often looks for unique and little-known investment opportunities.

Marc Faber

Faber is known as “Dr. Doom” because he’s usually forecasting a market decline. However, he is also a talented investor who knows how to take advantage of opportunities in a recessionary market.

Bill Ackman

Ackman is famous for using aggressive investment strategies, such as buying stocks of companies that he believes are undervalued and pressuring management to improve performance.

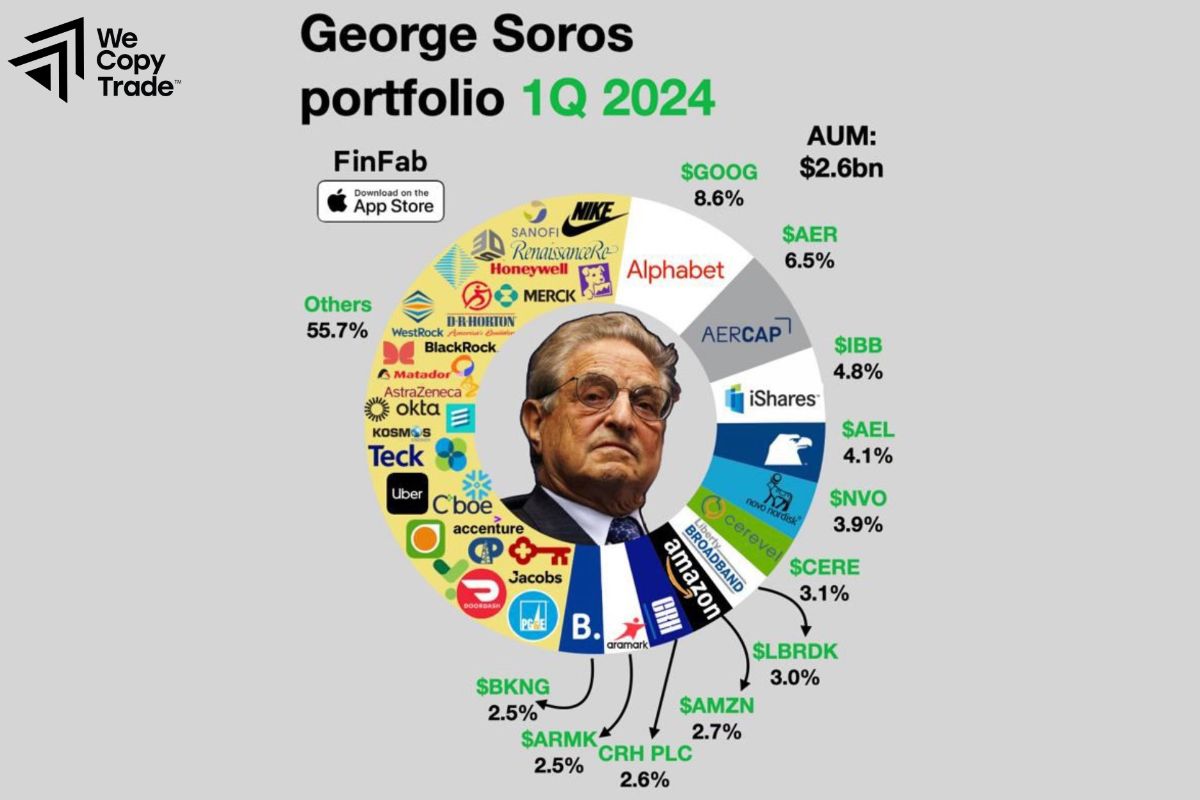

George Soros

Soros is famous for his ability to predict and take advantage of major market fluctuations. He often uses leverage to increase profits but also comes with high risks.

What these investors have in common is that they are all capable of deeply analyzing the markets and identifying potential investment opportunities and are always ready to face risks.

Contrarian Trading vs. Value Trading

Both contrarian investing and value investing are investment strategies that focus on finding opportunities when the market values a stock below its intrinsic value. However, there are important differences between the two strategies:

Value Trading

- Value investors typically focus on analyzing a company’s fundamentals, such as revenue, earnings, and cash flow, to determine the intrinsic value of a stock. They are less concerned with short-term market fluctuations and believe that prices will eventually reflect intrinsic value.

- Value investors typically buy when the market is moving sideways or in a slight uptrend. They patiently wait for buying opportunities when the stock price falls below its intrinsic value.

- The main risk of value investing is that the stock price may continue to decline for a long time if the market does not recognize the intrinsic value of the company.

Contrarian Trading

- In addition to fundamental analysis, contrarian investors also pay special attention to market sentiment. They look for stocks that have been oversold due to investor fear and believe that prices will soon recover.

- Contrarian investors often buy when the market is down or there is bad news affecting the stock. They are willing to buy when most other investors are selling.

- The main risk of contrarian investing is that the stock may continue to fall in price if the economic or industry conditions deteriorate.

Conclusion

In conclusion, contrarian trading is a challenging but also very attractive form of investment. If you have enough knowledge, experience and patience, this can be a way to achieve high profits. However, before deciding to invest in this way, you should learn carefully and consider your limitations and needs carefully.

See more: