When learning about the prop firm trading model, many traders will find similarities with the concept of proprietary trading – a common term used in major financial institutions such as banks, brokerage firms, or hedge funds. So, what is the connection between these two concepts, and what makes prop firms an attractive choice for individual traders?

Proprietary Trading vs. Prop Firm Trading Model

It’s understandable that many traders confuse proprietary trading with the prop firm trading model. Let’s explore both models in detail to help you make informed investment decisions:

What Is Proprietary Trading?

Proprietary trading refers to the activity where financial institutions use their own capital to participate in financial markets with the goal of generating direct profits, rather than merely earning fees from facilitating client trades. This allows them to:

- Have full control over trading strategies

- Keep 100% of the profits from their investments

- Actively allocate assets and hold positions based on market expectations

What Is Proprietary Trading?

Some common strategies include volatility speculation, macro trading, technical analysis, or merger arbitrage. These trading desks are often separated internally to prevent conflicts of interest with clients.

See now:

Prop Firm Trading Model

While traditional proprietary trading is typically reserved for large financial institutions, the prop firm trading model offers a self-trading approach that expands access for individual traders. Instead of needing hundreds of thousands of USD in capital, traders can:

- Receive funding from prop firms after passing an evaluation process

- Share profits at clear rates, typically between 75% and 90%

- Trade freely using their own strategies, provided they follow the firm’s risk management rules

The core of the prop firm trading model is that firms still trade with their own capital. However, instead of executing trades internally, they delegate this task to qualified external traders—thereby scaling their profit potential.

How Does the Prop Firm Trading Model Work?

Understanding how the prop firm trading model operates is essential before deciding to participate. This is a structured and transparent system that combines talent selection, risk control, and performance optimization. Let’s explore how prop firms work to better grasp the opportunities and requirements involved.

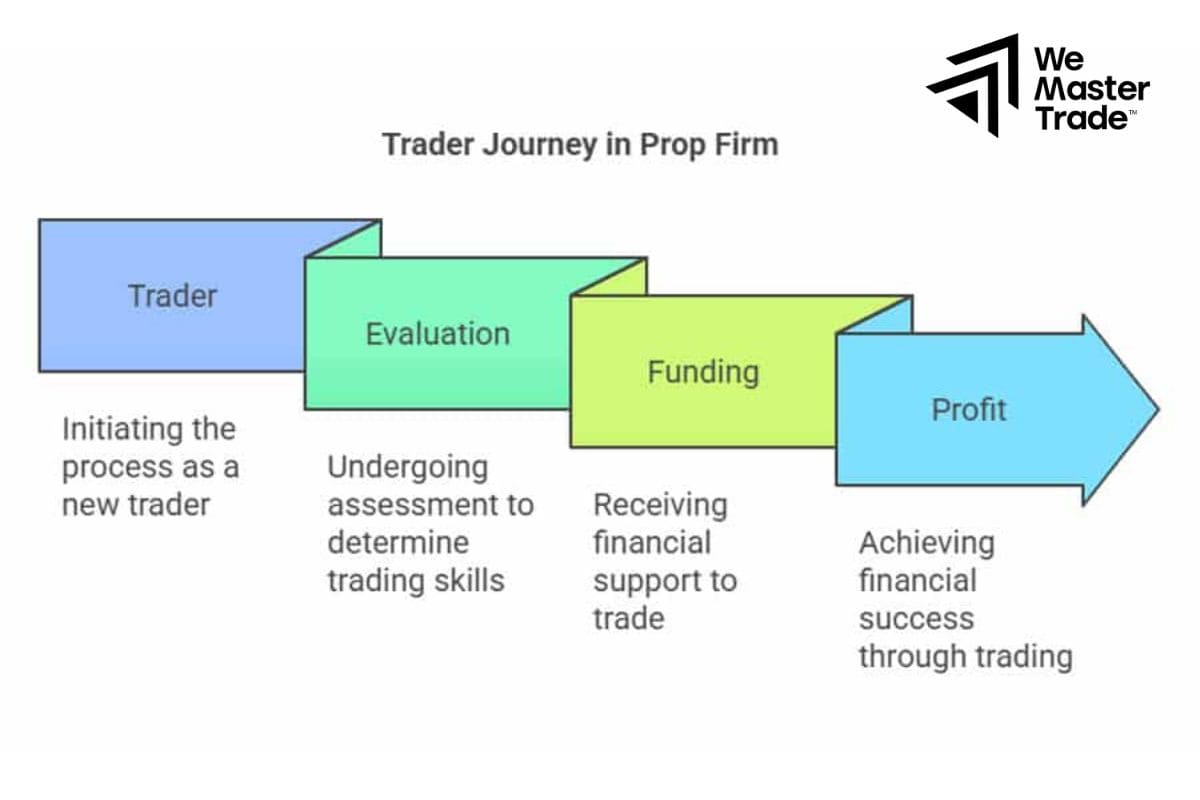

Basic Process: Registration – Evaluation – Funding – Profit Sharing

Basic Process: Registration – Evaluation – Funding – Profit Sharing

A typical prop firm follows these four steps:

- Registration: Traders choose the account type, desired capital, and pay a participation fee (if applicable).

- Evaluation: Through a 1-step or 2-step challenge, traders must prove their profitability and trading discipline.

- Live Funding: After passing the evaluation, traders receive real capital to trade—no personal funds required.

- Profit Sharing: Traders keep the majority of profits (usually 70–90%), with the rest going to the firm as return on investment.

This mechanism allows prop firms to identify and nurture talented traders while maintaining capital safety.

Popular Prop Firm Trading Models

In practice, the prop firm trading model comes in various formats to meet the diverse needs of the trading community:

Instant Funding – Immediate Capital Access

Traders are not required to undergo an evaluation and are granted a live account immediately after registration. This model is suitable for those with prior experience who want to start trading right away.

The main advantage of this model is that traders receive funding quickly without going through a challenge and can begin trading immediately. However, it typically comes with higher costs and a lower initial profit-sharing ratio.

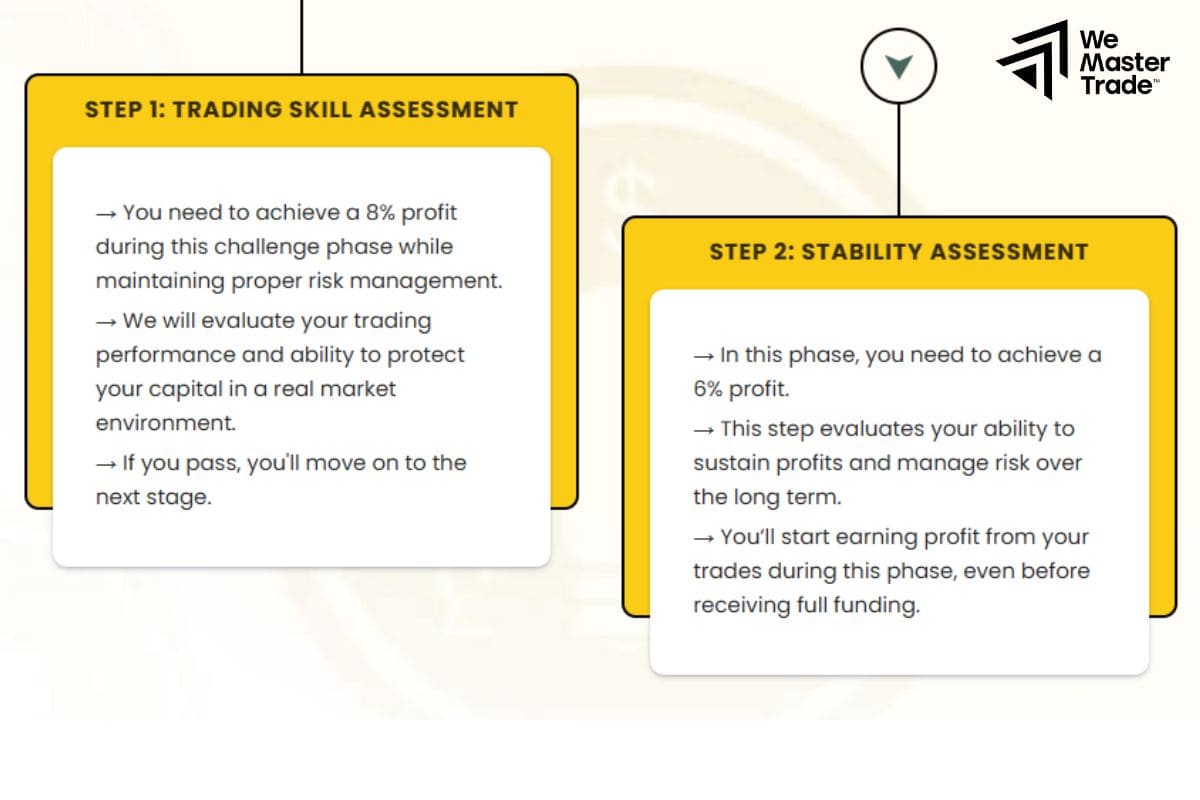

Two-Step Evaluation

Two-Step Evaluation

The most common model, designed to rigorously assess a trader’s skill and risk control.

- Phase 1: Achieve the profit target while staying within strict loss limits.

- Phase 2: Maintain performance under even tighter risk control conditions.

1-Step Challenge – Simple and Fast

Traders only need to pass a single evaluation round, saving time compared to the 2-step model.

- Advantage: Quicker process, ideal for confident traders

- Downside: Higher risk control standards in some firms due to shortened filtering

Benefits of Joining the Prop Firm Trading Model

The prop firm trading model has been creating a modern, transparent, and globally scalable trading ecosystem. Below are the key advantages of prop firms:

Trade with large capital without personal risk

Trade with large capital without personal risk

Unlike trading with personal funds, traders joining a prop firm are provided with a funded account by the company. This allows them to trade at a larger scale without risking their own capital. It’s a key factor that enables many talented traders to grow without being held back by financial limitations.

Transparent skill evaluation

Most prop firms today implement challenge phases to select traders. These are efficient and fair methods to assess real-world trading abilities. With just a small entry fee, traders can demonstrate their strategies, risk management skills, and discipline. If successful, they receive funding and earn a profit split according to the agreed terms.

Risk diversification

One of the significant strengths of the prop firm trading model is its ability to spread risk on a global scale. Instead of relying solely on an in-house team, modern prop firms typically connect with thousands of traders across multiple countries. This allows the firm to diversify strategies, markets, and trading styles—from short-term to long-term, from forex to commodities.

Transparent model

Transparent model

Prop firms operate on automated trade management platforms with clear rules on drawdowns, risk/reward ratios, and holding times. All trader activities are monitored via system-based oversight, making the model both transparent and disciplined. It protects the firm while cultivating good trading habits. Technology also enables prop firms to scale efficiently without doubling their management overhead.

Open-minded approach

At its core, the prop firm model can be seen as a modern evolution of proprietary trading. However, rather than operating as closed-door trading desks, prop firms adopt an open and tech-driven approach. Traders don’t need to be physically present in an office or deal with internal pressure. Instead, they gain access to structured risk management systems, supportive communities, and well-deserved financial rewards.

How Prop Firms Manage Risk

A critical part of the prop firm trading model is active and effective risk management. Even though traders use firm capital, prop firms protect financial security through measures such as:

- Drawdown limits: Control losses on a daily and overall basis

- Lot size and leverage monitoring: Ensuring traders don’t take excessive risks relative to capital.

- Automated tracking: Technology systems detect rule violations and promptly suspend accounts.

- Trading behavior analysis: Firms regularly assess trader psychology, strategy, and compliance to adjust policies as needed.

These mechanisms not only protect capital but also create a professional environment for long-term trader development.

Conclusion

In summary, the prop firm trading model opens doors for those passionate about trading but limited by capital. With transparency, flexibility, and long-term orientation, prop firms are redefining how traders engage with the market—and more importantly—helping them build sustainable careers in the global financial arena. Understanding the prop model gives you a clearer direction for your trading journey.

See more: