“Prop firm terminology” is increasingly common in the investment market, raising many questions about its operational model. It’s seen as a promising form of investment for traders. However, before deciding to join this model, it’s crucial to thoroughly understand key prop firm terminology and important facts presented in this article.

Defining Prop Firm

Proprietary trading – often shortened to “prop trading” – is a form of trading where a financial institution uses its own capital to participate in financial markets to generate profits for the company itself, rather than trading on behalf of clients.

Unlike traditional brokerage models, where firms merely assist clients with buying and selling and collect fees, proprietary trading allows companies to actively buy and sell stocks, foreign exchange (Forex), commodities, or derivative products for their direct benefit. This is the operational foundation of many modern prop firms.

See more:

- Prop Firm Startup Journey From Zero – Discover Now

- Prop Firm Beginners: Your Comprehensive Guide to Success

- Mastering the Key to Prop Firm Success

- Change Your Life with Prop Firms – The Secret for Traders

How Do Prop Firms Operate?

A prop firm invests capital in potential traders, enabling them to trade on a much larger scale than they could with a personal account. This model offers a dual benefit: traders have the opportunity to earn more, while the firm earns a share of the profits from successful trades.

Key elements in prop firm operations include:

- Providing Trading Capital: Traders don’t need to commit personal capital; the prop firm will provide funds after the trader passes an evaluation or challenge.

- Performance Evaluation: Companies typically require traders to undergo simulated tests or trial trading to demonstrate their skills and risk management capabilities.

- Risk Control: Strict rules are in place, such as limits on losing trades, maximum account drawdown, or requirements for setting stop-loss orders to protect capital.

- Technological Support: Prop firms utilize professional trading software, data analysis systems, and performance measurement tools to support their traders.

- Profit-Sharing Model: Traders earn money by sharing a percentage of their profits with the company, typically ranging from 50% to 90%, depending on performance and the specific program. Understanding this aspect of prop firm terminology is crucial for traders

Benefits of Proprietary Trading

Prop firms use their own capital to invest in the market with the goal of generating profits. Additionally, several other common reasons explain why the prop firm model is increasingly attracting individual traders.

Maximizing Profitability

When prop firms or large financial institutions trade with their own capital, they are not limited by fees or commissions as in traditional brokerage services. Instead, they retain 100% of the profits from successful investments. This helps enhance overall profitability, especially during positive market quarters or years.

Accumulating Assets to Anticipate Market Volatility

Proprietary trading activities at financial institutions often allow them to pre-position significant amounts of assets, such as stocks, bonds, or futures contracts. This provides several clear benefits for their management operations and client support, including:

- Proactive Liquidity Provision: When the market experiences significant volatility or reduced liquidity, having assets readily available in their portfolio makes it easier for institutions to execute trades to meet client demands or stabilize the market when necessary.

- Preparing for Market Risk: Asset accumulation is also a way for institutions to hedge against periods of instability or declining liquidity, thereby limiting disruptions to their trading operations.

For traders, understanding this accumulation mechanism used by proprietary trading firms is also very important. It helps traders better predict capital flows, price dynamics, and potential supply-demand shifts in the market, allowing them to adjust their trading strategies accordingly and minimize unexpected risks.

Market Making and Increasing Influence

Some prop firms may act as market makers – meaning they stand ready to buy or sell assets when the market lacks other willing participants. Thanks to their ability to hold assets and abundant capital, prop firms can contribute to maintaining liquidity for the overall market or specific securities.

Most Common Prop Firm Terminology

When engaging in a funded trading model with a prop firm, a clear understanding of prop firm terminology is a prerequisite for traders to operate their accounts effectively and comply with regulations. Here are some frequently encountered terms:

- Funded Account: This is the account a trader receives after passing evaluation challenges. This account is traded using the prop firm’s capital, not personal funds.

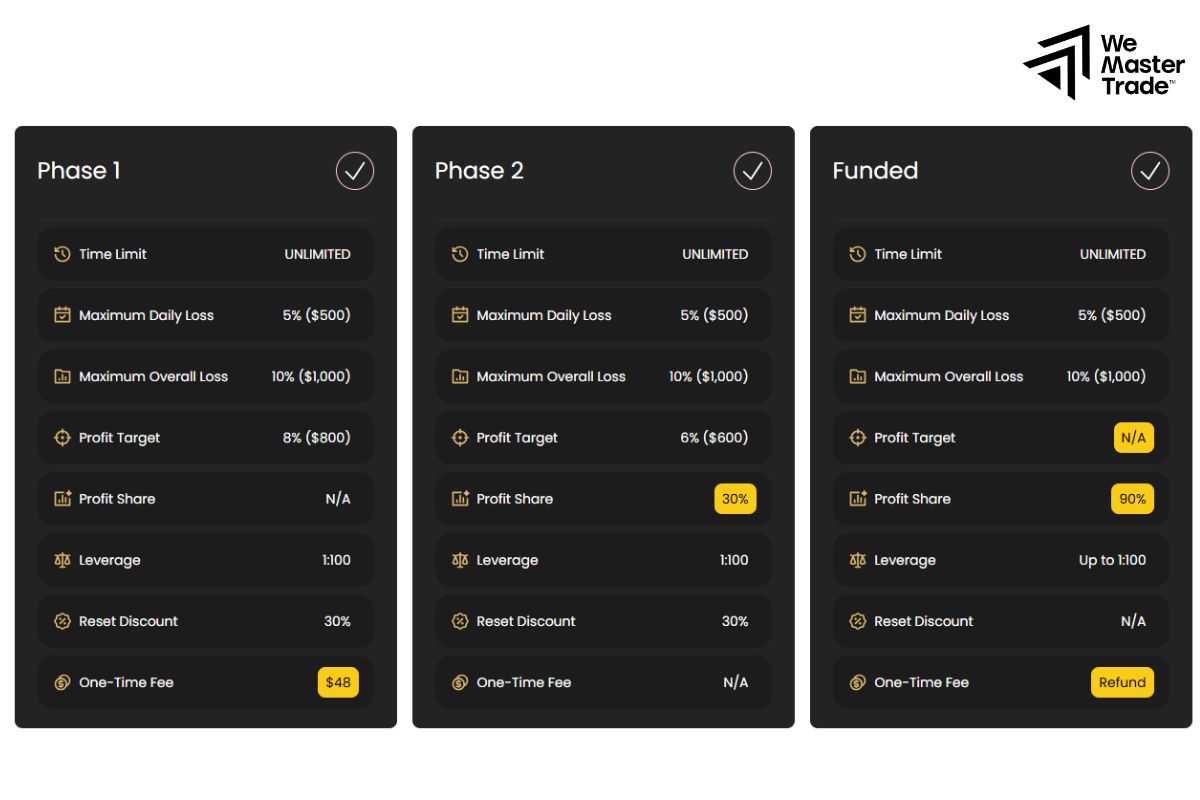

- Challenge / Evaluation: The phase of testing a trader’s abilities. You need to achieve specific profit targets within a defined timeframe, while adhering to risk limits. This is a core concept in prop firm terminology.

- Profit Share: The profits generated from successful trades will be shared between the trader and the prop firm according to a predetermined ratio, typically ranging from 70/30 to 90/10 in favor of the trader.

- Drawdown: This is the allowable loss limit, calculated daily or as a percentage of the total account capital. Violating drawdown limits often results in losing access to the account. Understanding drawdown is critical in prop firm terminology.

- Scaling Plan: Some prop firms have mechanisms to increase the account size for traders who consistently maintain stable trading performance over an extended period.

- Daily Loss Limit: A predefined maximum allowable loss within a single trading day. Exceeding this limit can lead to account cancellation or suspension.

- EA (Expert Advisor): Automated trading software. Not all prop firms permit the use of EAs, so you should thoroughly check the terms and conditions before signing up. Familiarity with these tools falls under essential prop firm terminology.

Mastering prop firm terminology will help traders clearly understand the operational mechanisms of the model, mitigate risks, and optimize trading efficiency.

Current Prop Firm Models

Currently, the prop firm market offers various funding models to cater to diverse trader needs. Among these, the three most common models include:

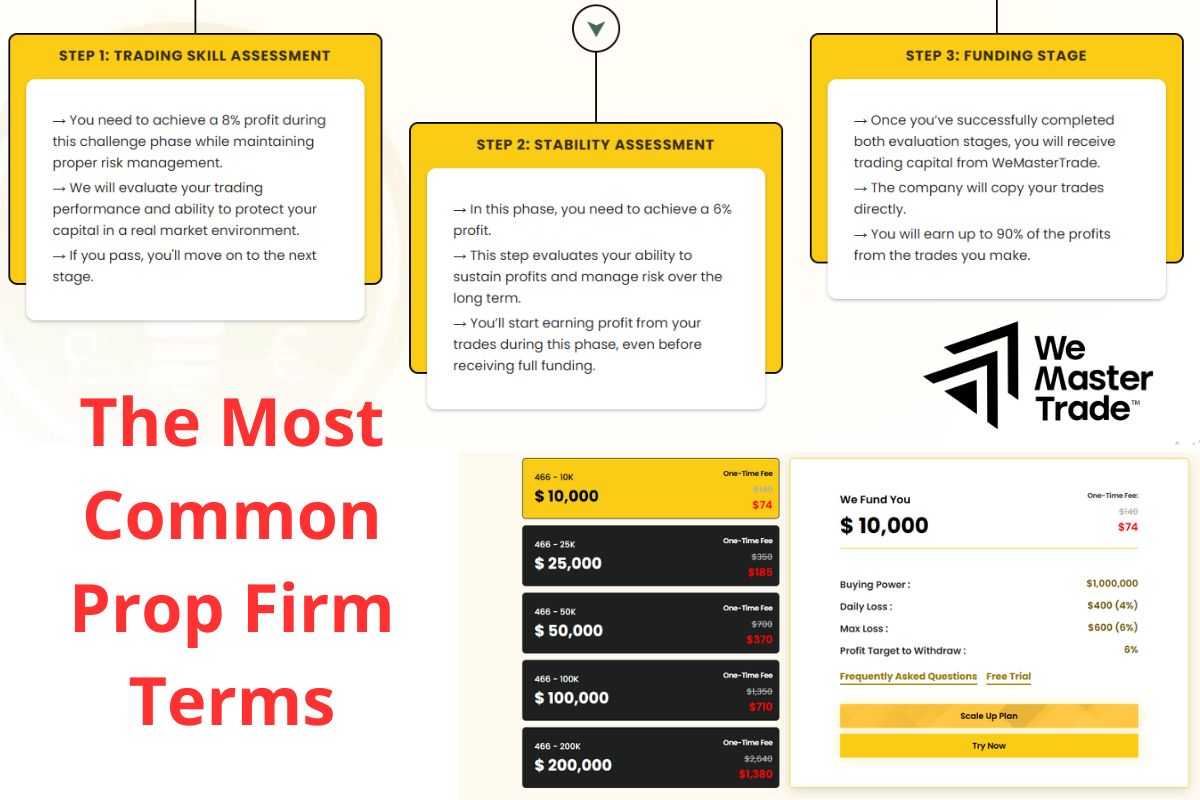

2-Step Evaluation Model

This is a standard challenge comprising two phases:

- Phase 1: Achieve a profit target with specific drawdown limits and within a defined timeframe.

- Phase 2: Lower requirements than Phase 1 but designed to test consistency and stability.

This is the most widely used model, suitable for traders who want to build credibility step-by-step.

1-Step Evaluation Model

Traders only need to pass a single evaluation phase to get funded. The profit target requirements may be higher, and the challenge duration shorter.

This model is suitable for experienced traders who wish to access capital quickly.

Instant Funding Model

Traders can pay a fee to receive a live funded account immediately, without participating in a challenge. However, initial withdrawal limits on profits are usually lower and increase gradually as the trader demonstrates performance.

Each prop firm model has its own advantages and disadvantages. The choice of the appropriate format should be based on your trading ability, risk control capacity, and personal financial goals. Understanding these models is a key part of comprehending prop firm terminology.

Conclusion

In summary, simply put, a prop firm is an organization that trades with its own money to make a profit, rather than acting as an intermediary for others. This opens up opportunities for individual traders with skills but lacking capital, helping them access the market more professionally. If you are interested in this field, a clear grasp of prop firm terminology and operational mechanisms will be the first step towards embarking on a serious and effective trading journey.

See more: