In the dynamic world of finance, prop firm expert trading is becoming a leading trend for traders looking to elevate their skills and access substantial capital. No longer just a high-risk individual pursuit, trading with a prop firm is a path to professionalization designed for those truly serious about a trading career.

What is Prop Firm Expert Trading?

A prop firm (proprietary trading firm) is a financial company specializing in providing capital to traders with the goal of generating profits. Instead of trading with personal funds, traders use the prop firm’s capital and share profits according to an agreed-upon ratio.

Prop firm expert trading is a form of trading where a trader not only passes initial challenge tests but also consistently maintains stable performance and high discipline to become a long-term partner of the prop firm. It’s a professional trading environment where skill, mindset, and strategy play pivotal roles.

See more:

- Prop Firm Investment Innovation: Opportunity or Challenge?

- Key Benefits of Prop Firm Trading for Traders

- The Impacts Affecting The Prop Firm Market For Traders

Advantages for Expert Traders

Trading within the prop firm model offers several distinct advantages for expert traders:

- Access to Large Capital: With funded accounts reaching up to $200,000 or more, traders can generate substantial income without risking their personal capital.

- No Personal Capital Risk: Failing a challenge only results in the loss of the initial challenge fee. More importantly, live funded accounts typically do not impact personal assets if managed according to the firm’s rules.

- High Profit Share: Reputable prop firms offer clear profit-sharing structures. Often, traders receive between 70% to 90% of the profits they generate – a highly attractive rate for those with proven capabilities.

- Professional Investment Environment: Traders are trained and operate within a disciplined environment with strict rules, performance targets, and high skill requirements – mirroring professional financial institutions.

- Prop firm expert trading is not for beginners learning to trade. It’s a destination for those who possess adequate skills and aspire to enter a larger arena.

Prop Firm Expert Trading Strategies

In the prop firm trading environment, where every trade must strictly adhere to risk limits and performance targets, choosing and implementing the right strategy is crucial for a trader’s survival and success. Unlike individual investment styles, prop firm expert trading demands discipline, efficiency, and high adaptability to real market conditions. Below are common strategies frequently employed by expert traders in prop trading settings.

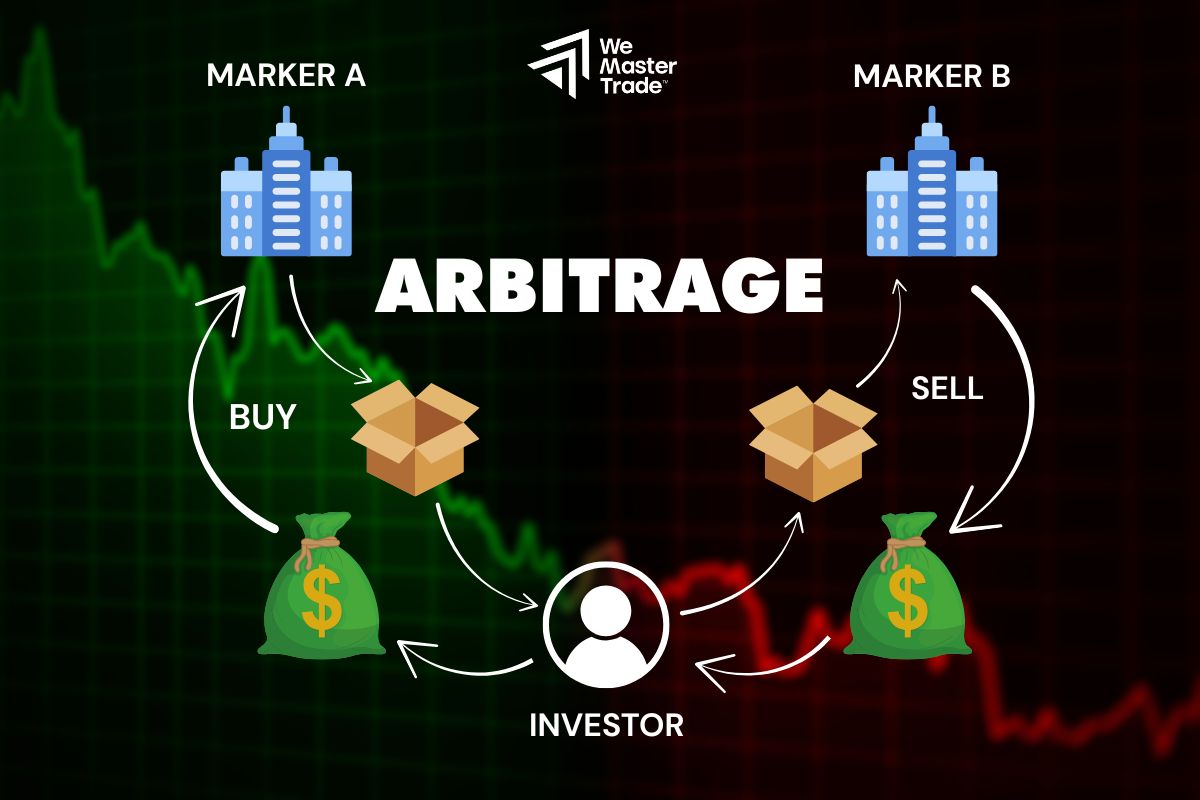

Merger Arbitrage

This strategy capitalizes on price discrepancies when a corporate merger or acquisition is announced. Traders buy shares of the target company, expecting the price to rise to the offer price, and may simultaneously short-sell shares of the acquiring company to hedge risk.

Index Arbitrage

Traders exploit temporary price misalignments between a physical index and its corresponding futures contract. When the futures contract price deviates significantly from the underlying portfolio’s value, an arbitrage opportunity arises, yielding profits when prices converge back to equilibrium.

Volatility Arbitrage

Volatility arbitrage is a trading strategy based on the difference between an asset’s implied volatility (from options prices) and its realized volatility (actual historical price movement). Traders use derivatives like options to bet on changes in volatility. For example, if implied volatility is high but you believe the price will be less volatile, you might sell options to profit from the premium. This strategy is highly statistical and requires a deep understanding of derivatives.

Pairs Trading

Pairs trading involves simultaneously trading two highly correlated assets, often stocks within the same industry. When the prices of these two stocks diverge too far from their historical average correlation, the trader sells the outperforming stock and buys the underperforming one, expecting their prices to revert to their original correlation. This is a market-neutral strategy, which helps limit overall market risk.

Opening Range Breakout Trading

Based on the price range established during the first 15–30 minutes of a trading session, if the market breaks out of this range with significant volume, the trader takes a position in the direction of the breakout. This is often combined with confirmation from candlestick patterns or volume analysis.

Scalping

Scalping is widely adopted in many prop firms due to its excellent risk control capabilities and quick capital recovery. Traders execute dozens of trades daily with small profit targets, accompanied by tight stop-losses to maintain safe drawdown levels.

Global Macro Trading

Global macro trading relies on broad macroeconomic factors such as monetary policy, interest rates, geopolitics, and economic growth. Traders assess major global trends and invest in assets likely to be strongly influenced by these trends – such as currencies, bonds, indices, or commodities.

News Trading

This strategy exploits strong price reactions when major economic news releases occur. Traders can either trade based on the post-news reaction or attempt to predict pre-news movements. It requires exceptional market reading skills and extremely robust risk management.

Risk Management in Prop Firm Expert Trading

Regardless of the strategy employed, risk management remains the vital pillar in prop firm expert trading. This includes limiting the percentage risk per trade, strictly adhering to drawdown limits, avoiding overtrading, and maintaining absolute trading discipline. These are non-negotiable elements for longevity and success.

Essential Skills and Mindset

Success in a prop firm isn’t solely due to technical knowledge. Below are the qualities that define an expert trader:

- Iron Discipline: Whether winning or losing, never deviate from your established process. Expert traders do not trade “by emotion” but by a logical, measurable system.

- Probabilistic Thinking: Trading is not about being right or wrong, but a game of probabilities where winning odds are higher than losing odds.

- Long-Term Mindset: The goal is not a single winning trade, but consistent survival and steady growth over time.

- Self-Management: Knowing when to stop and when to scale up your positions.

All these elements are core to prop firm expert trading, where results stem from mindset more than luck.

Choosing a Suitable and Reputable Prop Firm

Not all prop firms are equally suitable for expert traders. Here are criteria you should consider:

- Reputation & Operating History: Prioritize companies with a clear track record and positive community reviews.

- Profit Split & Payouts: Choose a prop firm that offers a profit share of 80% or more, with consistent payouts through various methods (bank transfer, Wise, etc.).

- Stable Trading Platform: Avoid platforms prone to lag or slow order execution – these are dangerous for short-term strategies.

- Excellent Technical Support: A responsive 24/7 customer support team is a significant advantage.

- Flexible Accounts: Opt for prop firms with multiple account tiers (scaling plans), allowing traders to grow from $10k to $200k, $500k, and beyond.

In the environment of prop firm expert trading, choosing the wrong company can lead to failure, even if your trading skills are strong.

The Journey to Becoming an Expert Trader

If you already have a foundation in technical analysis, have traded personal accounts, and now wish to elevate yourself into a professional environment with prop firms, here’s a step-by-step roadmap distilled from the experiences of many true prop firm expert trading professionals:

- Optimize Personal Trading Skills: Build clear strategies, practice discipline, and control emotions. This foundation is crucial for long-term survival in the market.

- Attempt Low-Cost Challenges: Participate in prop firm evaluation challenges with low or no cost. This helps you familiarize yourself with professional evaluation criteria.

- Pass the Challenge and Get Funded: Once you complete the challenge, you’ll be provided with real capital to trade. This is the transition from individual trader to expert trader.

- Trade Consistently and Withdraw Profits Regularly: Maintain stable performance and strict risk management. Regular profit withdrawals help you build credibility with the prop firm.

- Scale Your Account: Many prop firms will increase your capital if you trade well. This is an opportunity to expand the scale of assets you manage.

- Build a Personal Brand: When investment results are good and profits are stable, consider building a personal brand. Sharing your knowledge, experience, and market analysis on social media platforms helps you stand out in the trading community, build credibility, and increase long-term value. This can open up more opportunities such as teaching, coaching, investment partnerships, and developing your own services.

Conclusion

In conclusion, prop firm expert trading is not just an opportunity to access large capital; it’s a pathway for traders to become true professionals – equipped with strategy, discipline, and a long-term mindset. If you are serious about a trading career, view prop firms as a bridge that takes you from a “market player” to a genuine “financial expert.” Start today, with a sound strategy and persistent dedication.

See more:

- Long Term Investment with Prop Firm: Sustainable Trading

- Prop Firm Reputation Building Process – Safe Trading

- Prop Firm Trading Model – What Traders Need to Know

- 5 Tips to Become a Smart Prop Firm Trader