In recent years, the prop trading model has emerged as an appealing trend, not only for seasoned traders but also attracting fresh graduates and self-taught individuals seeking career opportunities in the financial sector. So, what exactly are prop firm career opportunities? How can you join and develop a career here? This article will provide you with the most practical, easy-to-understand, and hands-on overview.

See more:

- What is Interest Rate Forex? Understanding Interest Rates in Trading

- What is Drawdown Index? How to Understand to Control Trading Risk

- Prop Firm Investor Experience & Valuable Lessons

What is proprietary trading?

Proprietary trading, or prop trading, is a form where traders use the capital of a prop firm to buy and sell financial products (stocks, futures, options, cryptocurrencies…) in pursuit of profit. Unlike individual investors or asset management organizations acting on behalf of clients, traders at prop firms trade for the benefit of the company itself and will receive rewards based on individual performance.

This is an extremely competitive environment, but it also fosters capability and flexible thinking – a major plus for those who want to advance based on merit.

The Most Common Types of Prop Firms Today

In today’s market, there are three main types of prop firms:

- Churn-and-burn: Require you to pay high “training” fees, provide no base salary, and you only keep profits if you exceed certain thresholds. These are often unreliable companies.

- Semi-professional: Give you access to their trading system but charge monthly fees (data, platform). While seemingly more “legit,” the financial risk still falls on you.

- Professional, legitimate prop firms: Provide real capital, training, a base salary, and performance bonuses. This is the best environment for pursuing long-term prop firm career opportunities.

Who are prop firm career opportunities for?

Trader – the central role

This is the most common and widely mentioned position. You can become:

- Quantitative trader: Apply mathematical models and programming to make decisions.

- Discretionary trader: Trade based on intuition, experience, and manual analysis.

In most modern prop firms, this line is increasingly blurred as traders today are expected to understand at least some coding and data concepts.

Other related roles:

- Quant researcher: Build mathematical models to support trading.

- Software developer: Develop systems and algorithms for traders.

- Operations, compliance, and HR departments: While not directly trading, these are still indispensable parts of large-scale prop firms.

In short, prop firm career opportunities are not only for skilled traders but also extend to technical and managerial professionals.

Salary and career path

One of the most attractive points of prop firm career opportunities is the competitive salary and performance-based bonuses:

- Entry-level trader: $100,000–$200,000/year

- Experienced trader: $200,000–$500,000/year

- Senior trader or Partner: $500,000–over $1 million/year

Note: At prop firms, you are often paid in cash rather than stock or deferred bonuses. This creates a major liquidity advantage early in your career.

Additionally, if you have genuine ability, you can advance quickly – even becoming a Partner after 3–5 years, which is rare in investment banks.

Skills needed to pursue a prop firm career opportunity

Regardless of whether your background is in finance, mathematics, physics, or computer science, if you possess the following abilities, prop firm career opportunities are always wide open:

- Logical thinking and probability awareness

- Ability to work under high time pressure

- Discipline in risk management

- Programming skills are a big advantage (Python, C++)

- Willingness to learn and quickly adjust strategies

Factors such as degrees or GPA are only secondary. The important thing is proving results and the right mindset.

The process of joining a modern prop firm

Unlike traditional financial institutions that require CVs, degrees, or interviews, the modern prop firm model – especially at WeMasterTrade – has opened a completely different path: no resume review, only evaluation of actual trading performance.

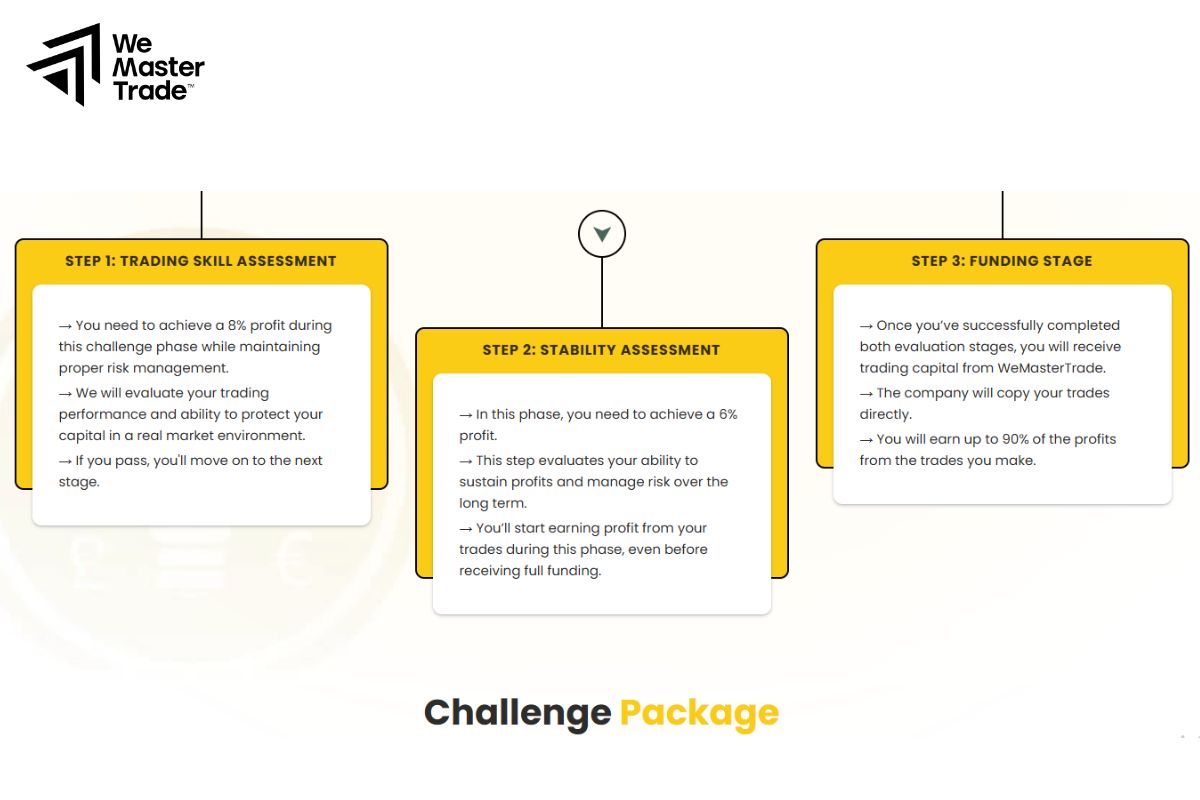

For an Evaluation account (challenge):

This is the most common form, simulating a real trading environment to assess a trader’s capabilities. You must meet certain technical conditions:

- Reach the target profit within the allowed drawdown limit.

- Follow risk management rules: daily loss, overall loss.

- Trade for the required number of days to ensure the system isn’t just “lucky.”

If you complete the challenge: You will be allocated real capital and start receiving regular payouts from the profits you generate.

For an Instant Funding account:

With this form, you are given capital immediately, with no challenge to pass. After meeting some simple conditions, such as trading enough days and making actual profits, you can withdraw money directly from the account.

No interviews, no psychological tests – only real trading performance

This is the key difference in prop firms like WeMasterTrade: Traders are assessed by actions – not words.

- You don’t need a polished CV, only a trading system with clear logic.

- You don’t need a professional degree, only the ability to manage risk and control emotions.

- You don’t need to be a good speaker – but you must know how to keep a trading journal and review past trades.

So, what do you need to prepare?

Although the process is simple, to trade successfully and sustain a long-term career at a prop firm, traders still need:

- A trading strategy tested via backtest/demo.

- Trading discipline – knowing when to stop and not breaking the system.

- Clear capital management, understanding how to control drawdown and scale appropriately.

- Market analysis skills, using multiple timeframes and price action – rather than relying solely on indicators.

Challenges and risks to note

Not everyone is suited to the prop trading environment. Before entering, you should consider:

- High attrition rate if you don’t generate profits

- Heavy psychological pressure when trading with real money

- Few chances to switch industries if unsuccessful

- Some prop firms are illegitimate, with risks of being scammed for training fees or forced to pay unreasonable charges

Therefore, research the company thoroughly before joining. Only choose prop firms with practical training programs, real capital provision, and base salaries.

Conclusion

In short, prop firm career opportunities are expanding with the development of technology, data, and the demand for recruiting real trading talent. If you are serious about trading, start preparing now: learn programming, practice probability mathematics, trade your personal account, and most importantly, develop the mindset of a professional trader.

See more: