Trading with personal capital is widely considered one of the biggest psychological hurdles for traders due to the inherent capital risks, which can significantly impact trading performance. This is precisely why the reasons to choose prop firm trading are becoming increasingly popular among traders today.

What is a Prop Firm?

Prop trading, or proprietary trading, is a model where a financial firm—such as a bank, hedge fund, or a prop firm—uses its own capital to execute trades in the financial markets. Unlike traditional brokers who trade on behalf of clients and earn commissions, these firms actively trade to generate profits for themselves.

Distinct from conventional brokerage models, the prop firm structure allows traders access to substantial capital without having to commit their personal funds. This opens up a new pathway for skilled traders with clear strategies who want to elevate their performance without bearing full personal financial risk.

See more:

- Prop Firm Beginners: Your Comprehensive Guide to Success

- What is Prop Trading? Strategies and skills needed for success

- Common Difficulties at Prop Firms

7 Popular Reasons to Choose Prop Firm Trading for Traders

The choice of a suitable trading model can directly influence a trader’s development and income. Below are 7 compelling reasons to choose prop firm trading that professional traders should seriously consider if they aim for sustainable growth:

No Large Upfront Capital Needed

One of the common reasons to choose prop firm trading is that traders don’t need to invest thousands of USD to get started. You only need to demonstrate your competence by successfully passing evaluation phases or challenge accounts. If you meet the criteria, you are then provided with capital to trade.

This significantly lowers the financial barrier, especially for skilled traders who lack sufficient capital. It provides them with an opportunity to access the live market without risking their entire personal savings.

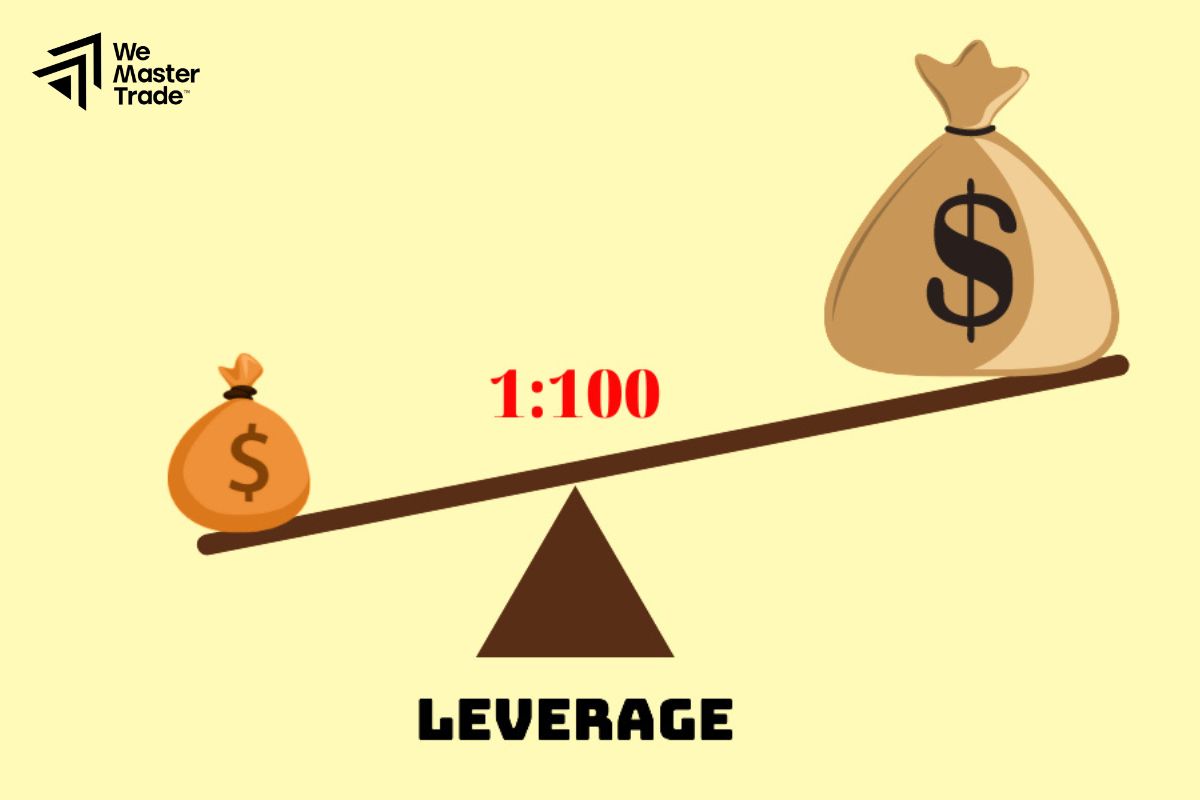

Trade with High Leverage

Prop firms not only offer substantial leverage but also implement strict risk management rules, such as daily and overall drawdown limits. These strict guidelines compel traders to maintain discipline and adopt a responsible trading mindset.

This makes it one of the reasons to choose prop firm trading for those who wish to train and operate within a professional, secure environment that fosters long-term development.

Income Linked Directly to Performance

At a prop firm, your income isn’t capped by fixed working hours or a salary. You share in the profits generated from your own trades, typically through a profit-split model that often ranges from 70% to an impressive 90% in the trader’s favor.

This is one of the compelling reasons to choose prop firm trading for high-performing traders: as long as your trades are profitable, you will be rewarded proportionally, without being confined by a fixed wage.

Professional Trading Career Development Opportunities

Beyond just providing initial capital, many prop firms also offer clear scaling plans. These policies increase the size of your funded account as you consistently achieve stable performance and meet specific milestones.

With this significant reason to choose prop firm trading, serious traders can progressively transform their individual skills into a sustainable career, potentially even managing six-figure accounts as they prove their capabilities.

Transparent Evaluation System

Prop firms operate based on data and merit, ensuring impartiality. All traders must successfully meet clearly defined evaluation criteria; access to funding is not dependent on connections, academic degrees, or personal bias.

One of the compelling reasons to choose prop firm trading here is transparency: your actual trading results are the sole factor determining whether you will be granted funding.

Disciplined and Supportive Environment

Trading independently can sometimes leave traders feeling isolated and without direction. In contrast, prop firms typically cultivate a professional environment, often providing performance management dashboards, real-time risk alerts, and sometimes even access to a community of traders or direct mentorship.

This is one of the excellent reasons to choose prop firm trading for those who want to enhance their systematic thinking and progress within a structured and goal-oriented environment.

Time Efficiency

When working with a prop firm, you don’t need to worry about sourcing capital, navigating complex legalities, handling paperwork, or managing infrastructure costs. Everything is already set up for you, allowing you to concentrate fully on your trading strategy and market analysis.

This is one of the highly practical reasons to choose prop firm trading: you are no longer distracted by non-trading concerns, enabling you to dedicate all your time and mental energy to optimizing your trading results.

Important Considerations Before Joining a Prop Firm

While understanding the reasons to choose prop firm trading is a crucial starting point, to fully leverage the funded trading model, traders need to arm themselves with a realistic perspective and thorough preparation. Here are some essential considerations before you officially embark on the path of “funded trading”:

Choose Reputable Prop Firms with Clear Policies

One of the most frequently cited reasons to choose prop firm trading is the promise of transparency in operations and profit-sharing processes. However, not every prop firm is equally trustworthy.

- Prioritize firms with a transparent operational history, professional support teams, and clear, accessible information on their websites.

- Avoid models that lack clear information, do not publicly disclose their policies, or frequently make sudden changes to their rules.

Choosing the right prop firm will not only provide you with peace of mind while trading but also lay a solid foundation for a long-term professional trading career.

Thoroughly Understand the Rules

Every prop firm has its own specific set of rules designed to manage risk and evaluate performance. This is also a key reason to choose prop firm options for many traders, as these rules help to instill discipline and improve skills.

Before joining, meticulously check:

- Loss limits (drawdown): This usually includes both daily and overall drawdown limits.

- Minimum trading days: The number of days you must actively trade, and sometimes a mandatory account maintenance period.

- Profit withdrawal policies: Minimum profit thresholds for withdrawal, frequency of withdrawals, and any accompanying conditions (such as maintaining a safe drawdown level or completing a certain number of trading cycles).

Having a clear grasp of the “rules of the game” will allow you to be proactive, preventing you from being disqualified from the challenge due to a minor, easily avoidable mistake.

Assess Your Own Suitability for the Prop Model

Not every trader is well-suited for the prop firm model. Therefore, in addition to considering the external reasons to choose prop firm trading, you should also ask yourself:

- Can you strictly adhere to trading discipline, avoiding rule breaches even when feeling euphoric or experiencing losses?

- Do you want to commit to a long-term trading career, or are you just looking for a short-term opportunity?

- Are you ready to embrace a rule-bound environment that offers genuine opportunities for professional development?

If your answers are “yes,” then a prop firm could indeed be the launchpad that helps you trade at a higher level—saving you personal capital while directly linking your income to your actual performance.

Conclusion

In conclusion, the prop firm model is a modern trading structure that provides talented traders with opportunities to experience and demonstrate their effective trading skills. These compelling advantages are precisely why the reasons to choose prop firm trading are becoming increasingly popular among traders. However, make sure to thoroughly research this model and its evaluation criteria to select the prop firm that best aligns with your individual needs.

See more: