The prop trading market is growing rapidly, dozens of prop firm names appear with attractive promises such as large capital funds, high profit sharing, fast process. But with countless choices, how to choose the right place that suits your trading style? The answer may come from traders evaluating prop firms after real experience. This article will help traders have a clearer view before starting their professional trading journey.

Why Should You Listen to Traders Evaluating Prop Firms?

Why Should You Listen to Traders Evaluating Prop Firms?

In the world of prop trading, nothing is more trustworthy than feedback from those who have directly participated. Traders evaluating prop firms not only go through the challenge of skill assessment, but also work with the support system, payout mechanism, and risk management regulations on a daily basis.

See now:

- Pro Traders: 7 Reasons to Choose Prop Firm

- Prop Firm Reputation Building Process – Safe Trading

- Prop Firm Necessary Skills Every Trader Need

- Long Term Investment with Prop Firm: Sustainable Trading

Traders can find hundreds of comments from traders evaluating prop firms based on the following criteria:

- Transparency in the challenge

- Payout time and profit sharing rate

- Quality of trader support service

- Experience using the trading platform

- Stability, reputation and flexibility

Prop Firms That Are Positively Rated by Traders

Based on real data from the trader community, it is clear that traders evaluating prop firms not only base their decisions on profit sharing or easy challenges, but also care deeply about transparency, close support and real trading experience.

Here are some prop firms that are currently receiving positive and trustworthy feedback:

WeMasterTrade

WeMasterTrade

Provides Instant Funding accounts, traders do not need to go through the initial challenge round.

Clear interface, easy to use, transparent and fast payouts.

Flexible withdrawal policy, good support for both newbies and professional traders.

Friendly Vietnamese and international support team, quickly resolve technical or terms issues.

Especially suitable for traders with a consistent and disciplined trading style.

The 5%ers

Stands out with an instant funding model, no requirement to pass a rigorous test.

Traders rate this prop firm as flexible, with a supportive and accessible trading environment.

Suitable for traders who like to go the long way, focusing on stable growth.

FTMO

A name that is very familiar to the global trading community.

Traders often appreciate FTMO for its transparency, fast payouts and professional customer support.

The testing process is clear and methodical, very suitable for veteran traders looking for an international standard environment.

MyFundedFX

MyFundedFX

Received many positive feedbacks from traders about the flexibility in policies and attractive periodic incentive programs.

The support team is proactive, responsive, and highly personalized.

Regularly updated with new packages, suitable for different strategies from day trading to swing trading.

True Forex Funds

Features a stable trading platform, low spreads – which many traders consider a big advantage when trading in volatile markets.

The system is well optimized, especially suitable for traders who require high speed and accuracy.

Has a competitive profit sharing policy, good support after traders pass the evaluation period.

Important Notes From Traders Evaluating Prop Firms

In addition to positive comments, many traders evaluating prop firms also frankly share about bad experiences. These responses are warnings, helping traders avoid unnecessary risks during the process of testing trading with any prop firm.

Common points to note include:

- Unclear or delayed payout policies: Even if a trader completes a challenge or makes a profit, withdrawals may be hampered by slow processing or unclear additional requirements.

- Unstable platform performance: Some traders have reported slippage and slow execution, especially during periods of high market volatility – which can be detrimental to short-term trading strategies.

Key Notes From Prop Firm Review Traders

- Misunderstood terms: Rules such as overnight hold limits, volume requirements, or bans on EAs (trading robots) can lead to unintended violations if traders are not aware of them.

- Unrealistic promises: Promises such as “100% profit sharing,” “no challenge,” or “get rich quick” are often signs of an unsustainable or potentially fraudulent model.

- Lack of legal transparency and management team: If the prop firm does not disclose its headquarters, operating license or information about the team behind it, it is a clear signal that there is a lack of necessary transparency.

- Sketchy website, no specific information: A seriously invested platform will have clear policies, a professional interface and full documentation. Lack of these elements is something to be wary of.

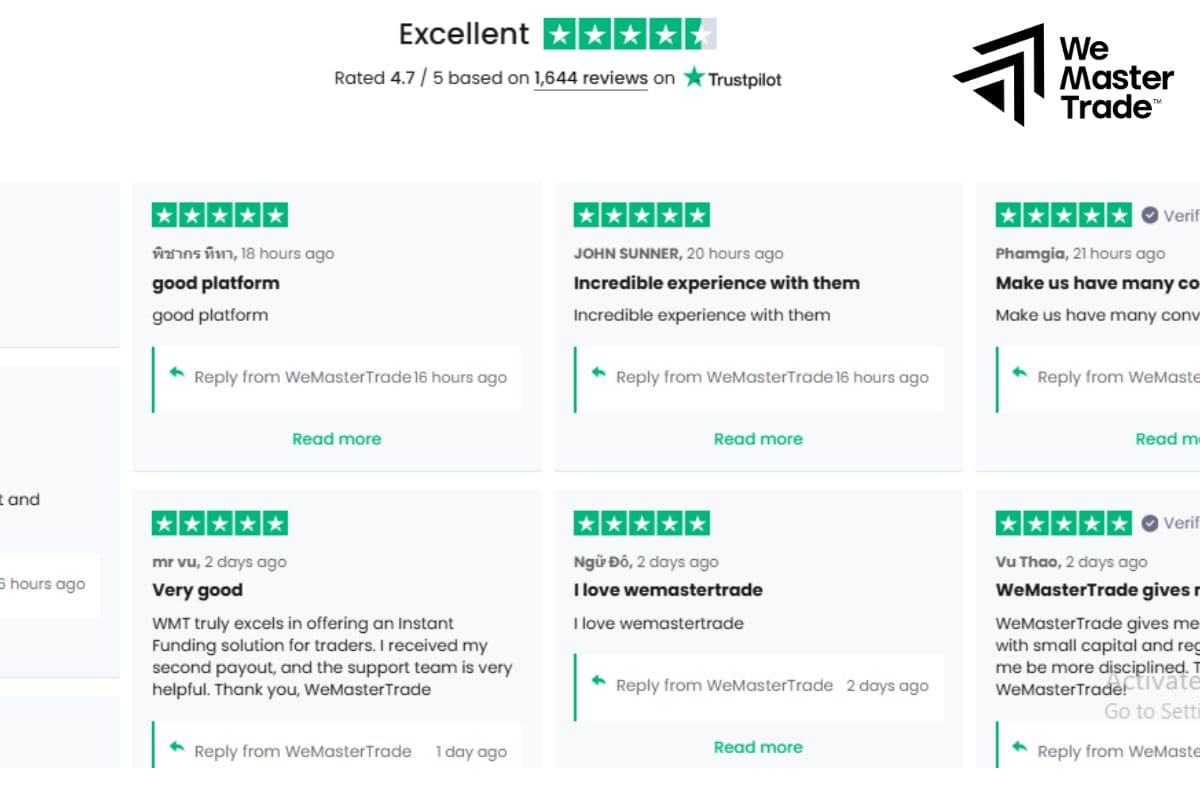

- Unusual reviews, lack of authenticity: If the prop firm only receives 5-star reviews with vague content, without describing specific experiences, it could be a sign of “self-assessment” or reputation manipulation.

It is a smart move to proactively check, compare and contrast real-world experiences before you officially take on the challenge or receive capital from any prop firm.

How to Effectively Read Reviews from Traders Evaluating Prop Firms

Not all reviews are reliable and not all are suitable for your needs. Here are some principles to help you read and analyze information from traders evaluating prop firms intelligently and effectively:

Focus on reviews with real evidence

Focus on reviews with real evidence

The more specific the review is about the trading experience, the payout process, the quality of technical support or the level of order execution, etc., the more clearly it reflects the true value of a prop firm. Avoid reviews that are too short or general like “good” or “unsatisfied” without any reason.

Read both positive and negative feedback

A balanced view is essential. Positive reviews help you see strengths, while negative feedback is an opportunity to identify risks. Sometimes a small weakness with one person may not affect your trading style and vice versa.

Prioritize the latest reviews

Prop firms can change their policies, platforms, or payout processes in just a few weeks. Therefore, recent reviews from traders who rate the prop firm often reflect the current situation more accurately.

Comparing reviews from new and experienced traders

New traders often care about easy-to-use interfaces, clear processes, and full instructions when participating in challenges or receiving capital.

Experienced traders focus on technical factors such as spreads, order execution speed, platform stability, or the ability to scale-up when there is good profit.

Conclusion

In summary, let the prop firm become the perfect opportunity for you to conquer trading! So, before choosing a prop firm to challenge your trading skills, refer to reviews from traders evaluating prop firms on reputable platforms.

See more: