Are you looking to optimize your forex investment strategy? PAMM and MAM Accounts provide a unique solution for investors and fund managers, combining flexible management with powerful growth potential. Discover how PAMM and MAM Accounts can enhance your portfolio and streamline asset management. Start exploring these accounts today to unlock new opportunities in the forex market!

What is a MAM account?

A MAM account (Multi-Account Manager) is a specialized investment account structure that enables fund managers to manage multiple trading accounts simultaneously. It is widely used in forex trading, where a single master account is connected to multiple sub-accounts.

Here’s how it works:

- Allocation of Trades: With a MAM account, fund managers execute trades from a master account, which are then allocated to each connected sub-account according to predetermined settings, like trade size or risk level.

- Customization: MAM accounts allow for flexible allocation methods (such as percentage-based or lot-based distribution), which can be tailored to each investor’s risk preference.

- Investor Control: Unlike other managed accounts, MAM accounts offer investors some control over their capital, allowing them to withdraw or add funds and adjust account settings.

See more:

- Define, Guide How To Chart And Calculate The Overnight Fees

- How Instant Execution Works – A Guide to Faster Trades

- Instant vs Market Execution – Which model should we choose?

- Reasons Cause of Slippage – How To Minimize the Slippage

What is a PAMM account?

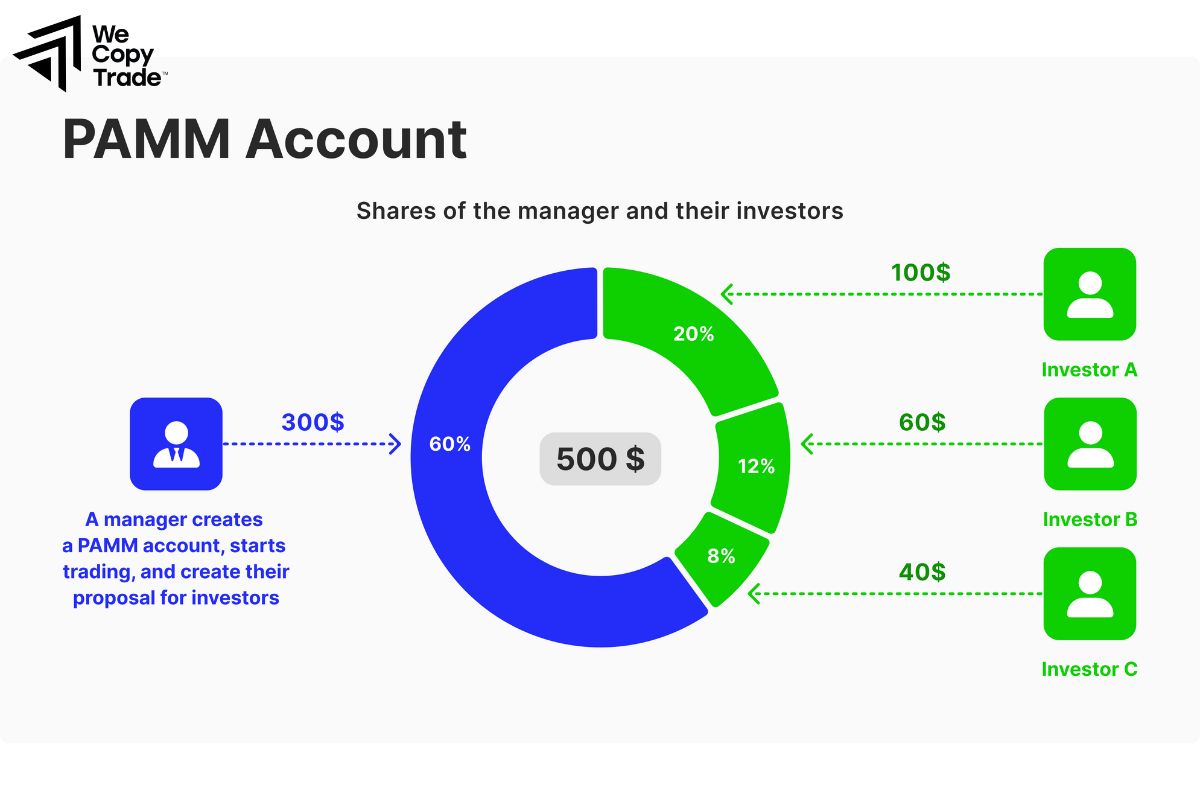

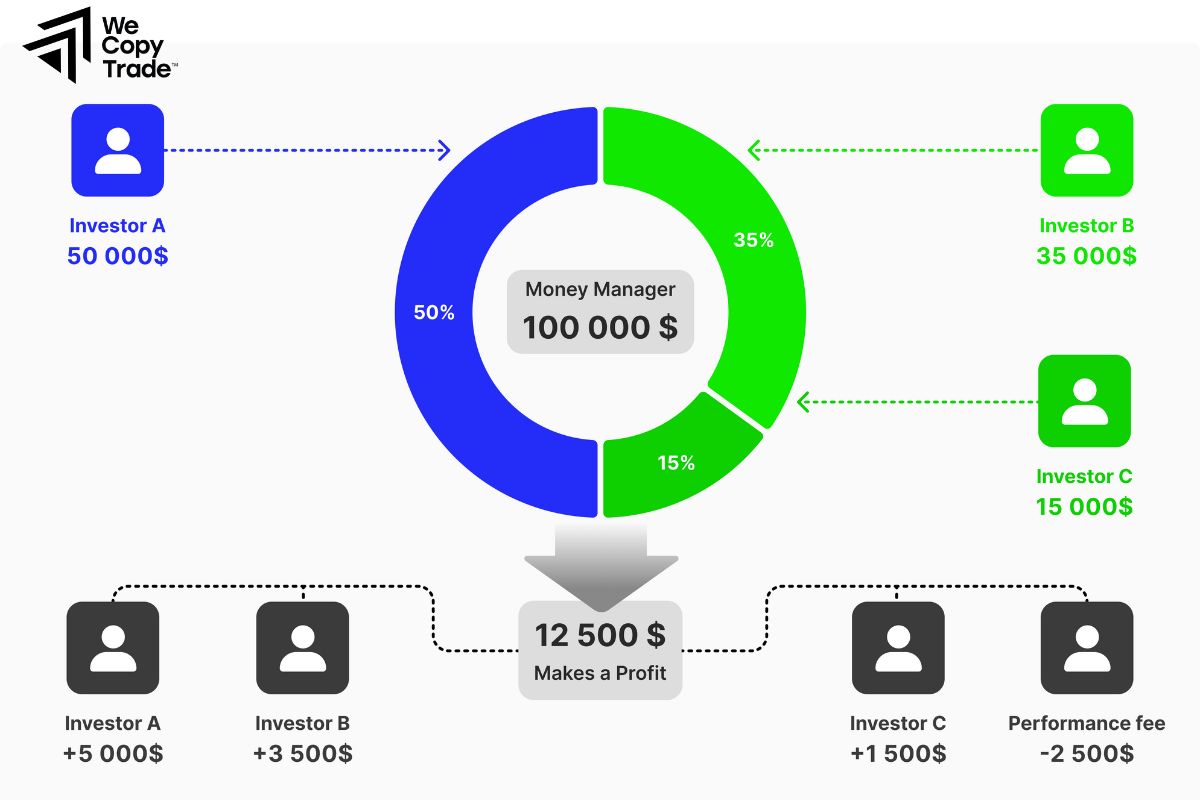

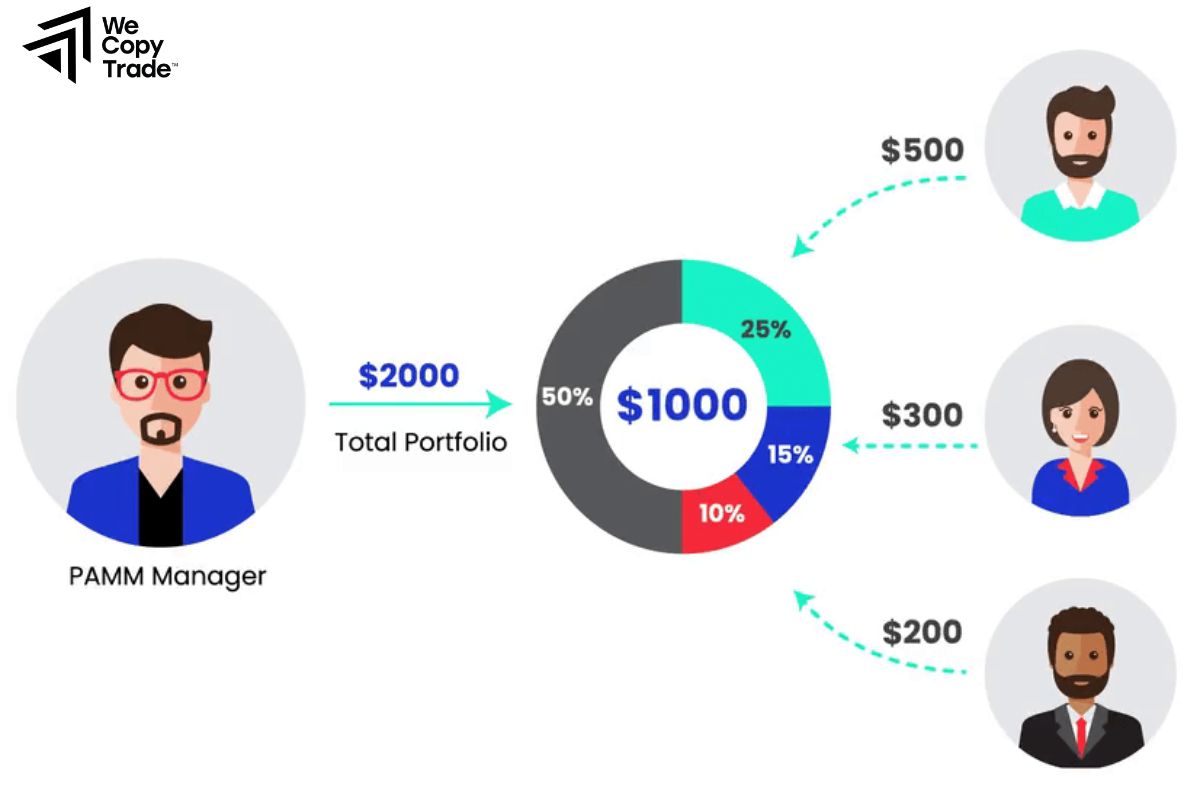

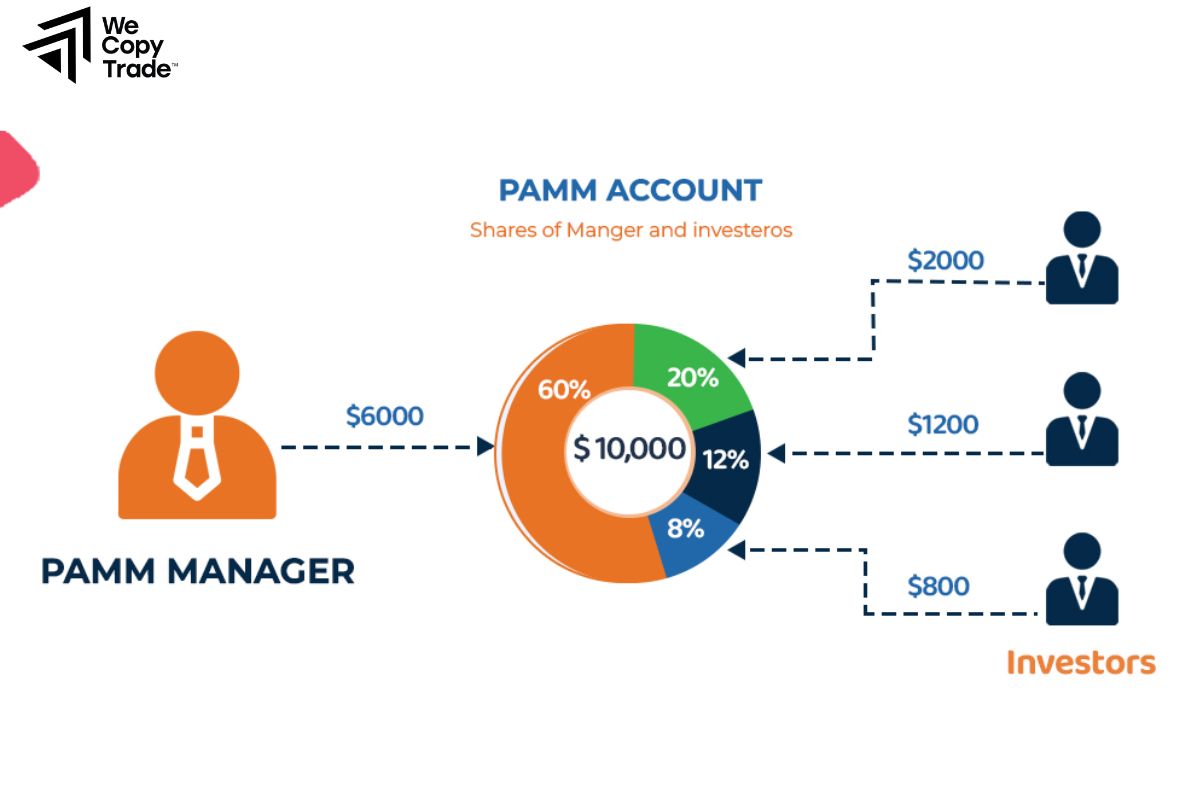

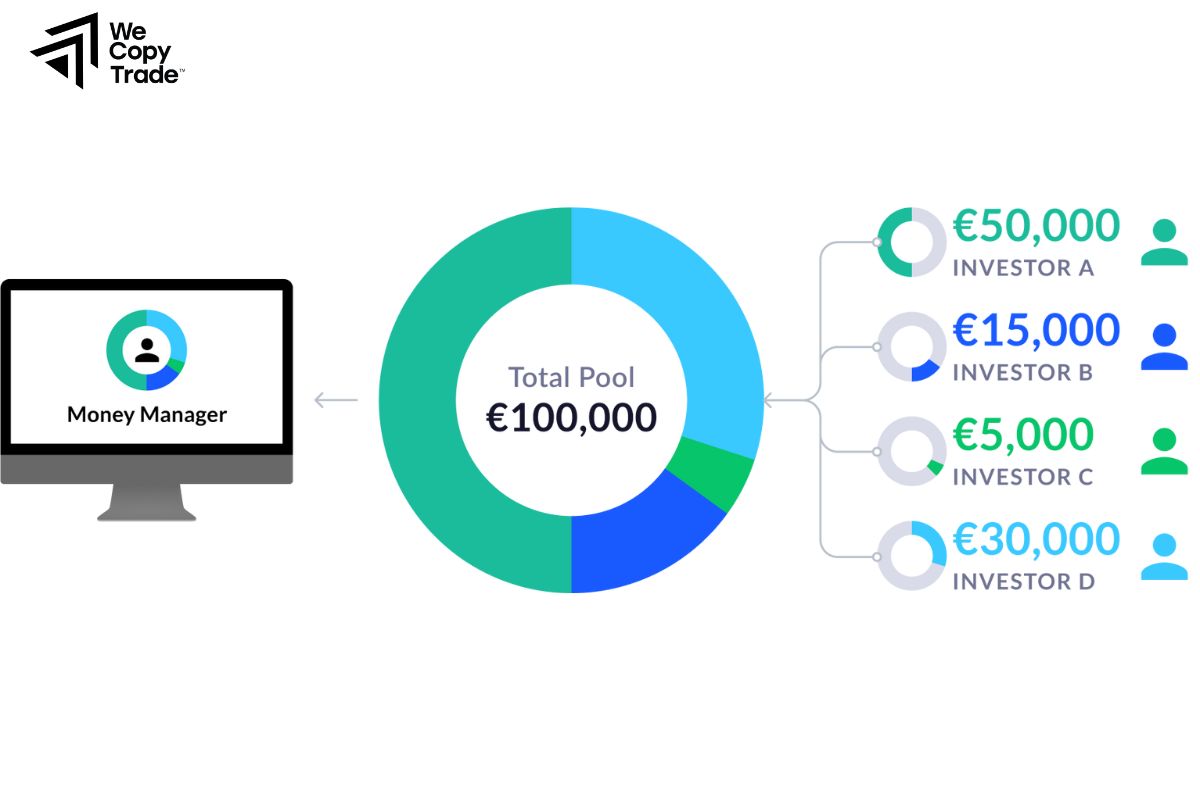

A PAMM account (Percent Allocation Management Module) is a type of managed account in which investors allocate funds to a professional trader or fund manager who manages multiple pooled accounts on their behalf. In this setup, the manager trades using their expertise, and the profits or losses are distributed among investors based on their share of the pooled funds.

Here’s how a PAMM account works:

- Pooled Investment: Investors place funds into a PAMM account, creating a pool managed by the trader. Each investor’s contribution is tracked as a percentage of the total pool, which determines their share of profits or losses.

- Automatic Distribution: When trades are executed by the manager, returns are automatically calculated and distributed to each investor proportionally to their initial deposit and share in the pool.

- Transparency and Oversight: Investors can monitor performance in real time, but they cannot interfere with the manager’s trading decisions. PAMM accounts provide transparency in fund performance, showing individual investors how their portion is doing.

Who should choose a MAM account?

A Multi-Account Manager (MAM) account is ideal for:

- Professional Traders/Fund Managers: For managing multiple client accounts efficiently.

- Passive Investors: For those who want expert management without active trading.

- Trading Firms: To handle numerous client accounts with transparency.

- High Net Worth Individuals: For large investments managed by experienced traders.

- Institutional Investors: For managing diverse client portfolios within regulatory guidelines.

Who should choose a PAMM account?

A PAMM (Percentage Allocation Management Module) account is ideal for:

- Investors Seeking Passive Income: People who want exposure to financial markets without managing trades themselves.

- Experienced Traders: Traders with a solid track record who want to manage multiple investors’ funds and earn performance fees.

- High Net Worth Individuals: Those looking to diversify their portfolios by investing in accounts managed by skilled traders.

- Institutions and Firms: Companies seeking a streamlined way to invest client funds with professional management.

Choosing PAMM and MAM Accounts for Your Brokerage Platform

When selecting PAMM and MAM accounts for your brokerage platform, there are several factors to consider in order to provide your clients with the best possible experience and meet your business objectives. Here’s a guide to choosing between these two account types:

Understand the Key Differences

PAMM Accounts:

- Typically involves a single trader (or money manager) handling multiple client accounts. Investors’ funds are pooled together, and profits or losses are allocated based on each investor’s share in the pool.

- Best for clients who are looking for hands-off investment and trust the money manager’s expertise.

- Offers a high level of transparency since clients can see how the manager is performing and track their investments.

MAM Accounts:

- More flexible than PAMM, as it allows fund managers to trade multiple accounts simultaneously, but each client’s trades and profits are managed individually, with personalized allocation.

- Provides clients with more control over their funds, and allows for more specific trading strategies and risk management tailored to individual accounts.

- Better for clients who want more involvement and customization in how their funds are managed.

Assess Your Client’s Needs

PAMM is ideal for:

- Beginners or investors who prefer a hands-off approach and are not interested in managing their own trades.

- Clients who trust the expertise of a money manager to trade their funds on their behalf.

MAM is ideal for:

- More experienced clients who want greater control over their trades, but still prefer the ease of automated trade execution.

- Clients who wish to maintain flexibility in choosing different strategies and have more customizable risk levels.

Risk Management Features

- PAMM Accounts: The risk management is typically more centralized, as the fund manager controls the trading decisions for all investors. This can make it simpler to manage but less personalized for individual clients.

- MAM Accounts: Since each account is managed individually, risk can be more customized per client. A trader can set individual stop-losses, take profits, and leverage for each client, providing a more tailored risk management experience.

Transparency and Reporting

- PAMM Accounts: Transparent reporting is important in PAMM accounts, as clients need to trust the manager’s decisions. A good PAMM system should offer real-time tracking of investments, performance reports, and profit/loss breakdowns.

- MAM Accounts: MAM accounts also offer reporting, but the system may need to accommodate individual client reporting, making it more complex but also offering more granular insights into performance and trade execution.

Scalability and Broker Flexibility

- PAMM Accounts: These accounts tend to work well when you have a single manager overseeing several accounts, making it easier to manage, but less scalable if your brokerage grows or requires complex strategies.

- MAM Accounts: MAM platforms allow for scalability as multiple managers can manage different sets of accounts. These systems are more versatile for brokerages that cater to diverse needs and trading strategies, as they offer greater flexibility for both managers and clients.

Costs and Fees

- PAMM Accounts: The manager typically takes a percentage of the profits earned, and fees are often based on performance. This can appeal to investors as they only pay if the manager generates a profit.

- MAM Accounts: MAM accounts may have higher costs associated with individual account management, as there are more personalized services. Brokerages may also charge additional fees for setting up and managing MAM systems.

What is the difference between a PAMM and MAM Accounts?

Here is the comparison table between PAMM and MAM Accounts:

| Criteria | PAMM Accounts | MAM Accounts |

| Fund Management Structure | Funds from multiple investors are pooled together and managed collectively. | Multiple individual accounts are managed separately but traded simultaneously. |

| Customization and Flexibility | Less flexible, all investors follow the same strategy. | Flexible, allows customizing strategies for each individual account. |

| Transparency and Reporting | Provides overall performance reports of the pooled fund, with fewer details. | Detailed reports for each individual account, tracking specific trades. |

| Risk Management | Risk is shared among all investors proportionally based on their investment. | Risk is managed individually for each account, with customizable settings. |

| Scalability and Complexity | Easier to scale but less flexible with more individual customization needs. | More complex but scalable, offering greater customization for each investor. |

| Target Audience | Best for passive investors who don’t want to manage individual trades. | Best for investors who want control and customization of their individual accounts. |

| Fee Structure | Usually performance-based, with the manager taking a percentage of the profit. | Fees may include management fees, performance fees, and commissions for each individual account. |

FAQ about PAMM and MAM Accounts

Can I customize my trading strategy in a PAMM account?

No, PAMM accounts do not allow individual investors to customize their trading strategy. All investors in the same PAMM pool follow the same trades executed by the fund manager.

Can a PAMM account handle large numbers of investors?

Yes, a PAMM account can handle a large number of investors pooling their funds together. However, the risk and profit distribution are all based on the total pool, making it less flexible in terms of offering individual customization.

Which type of account is better for active or experienced investors?

A MAM account is more suitable for active or experienced investors who want greater control over their accounts. It allows investors to tailor strategies and risk management according to their personal preferences.

Conclusion

In conclusion, PAMM and MAM accounts cater to different investment needs. PAMM accounts are great for passive investors, offering shared profits and losses, while MAM accounts provide more flexibility and control for experienced traders who prefer customized strategies. Ready to start with PAMM or MAM accounts? Choose the right option for you and take your trading to the next level today!

See now: