Have you ever heard of the hybrid brokers model? This model was formed based on the need to combine and fully promote the features of the broker. Currently, it is becoming more and more popular and trusted by large investors. Don’t miss the following article, I will answer all the information you need to know about a hybrid broker.

Overview of Hybrid Brokers

The Hybrid Brokers model in brokerage means that the broker has many ways to process your trading orders such as executing the order itself, passing the order to a third party or a combination of both. Since each trader has different needs and trading styles, this model is very practical and useful.

First, some major orders will be matched with orders from other traders globally in the ECN brokerage model. Some other orders will be matched with orders from other clients of the same broker or the broker will trade directly with the clients. Each type of order will be processed in the most efficient way, helping the broker maximize profits and minimize risks thanks to the spread of trading orders.

For example, there will be traders who trade large volumes, there will be traders who trade small volumes. The integrated broker will serve large trading clients by placing them in a VIP room (ECN), while smaller trading clients will be served in a regular room (dealing desk).

See more:

- Market Risk Mitigating and Managing Guidelines Most Simple

- Methods used to calculate effective Value at Risk Analysis

- What is Hedging? How to hedge in stock investment

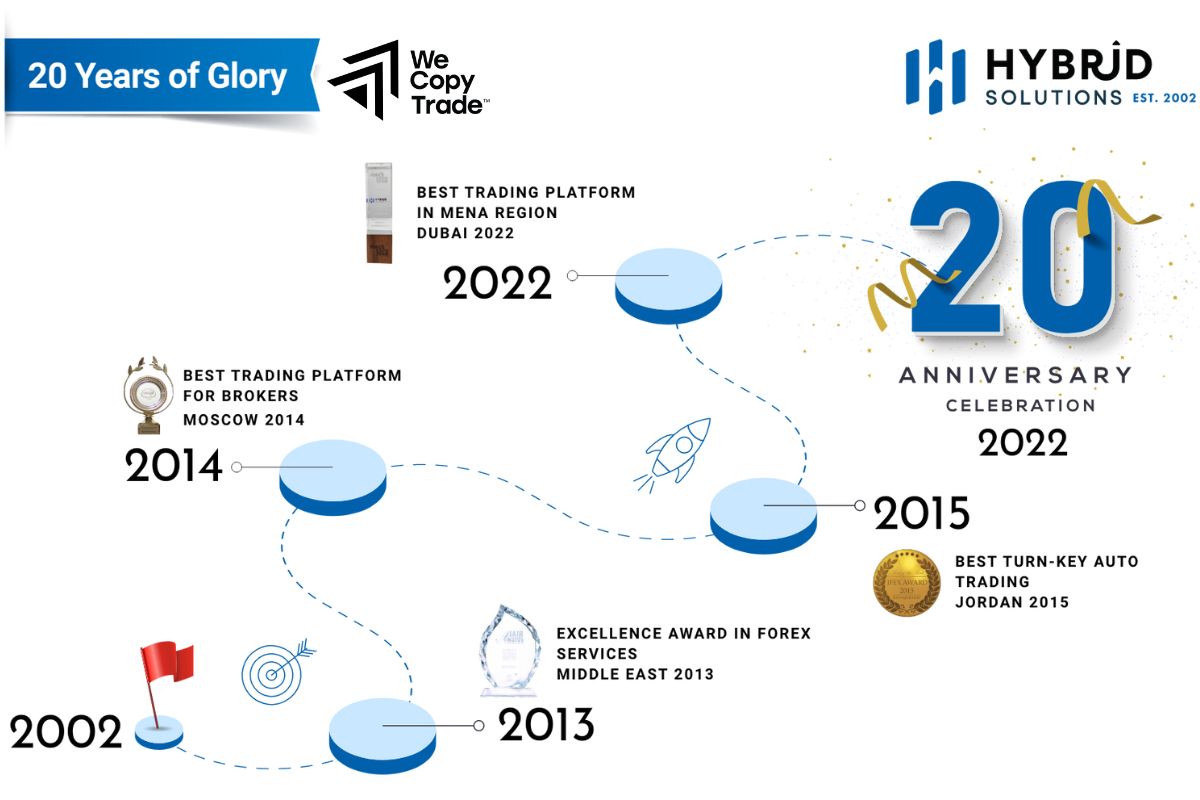

Evolution of Brokerage Models

The brokerage industry has undergone major changes in the way it operates. Initially, most brokers operated on a self-dealing basis. This model was highly profitable for the broker but fraught with risk for the client.

Over time, investors became more sophisticated. They demanded that trades be routed directly to large liquidity providers, much like a stock exchange. This ensured that clients got the best prices and minimized the risk of being exploited by the broker.

Today, many brokers combine both models, known as a Hybrid Brokers model. This allows them to balance profitability and client satisfaction. Brokers may choose to execute some trades themselves to manage risk and increase profits, while routing other trades to liquidity providers to ensure transparency and fairness.

A very important factor that directly affects the development of the hybrid brokerage model is the development of technology and changes in regulations:

- Modern trading software, fast internet speed and complex analysis tools have helped brokers operate more efficiently. As a result, new trading models have emerged, providing more options for investors.

- Increasingly strict regulations to protect investors’ interests and ensure market transparency have prompted brokers to move to safer and fairer operating models.

Pros and Cons of Hybrid Brokers

Hybrid brokers are a great trading platform suitable for most traders. However, here are the pros and cons that we need to understand to promote and overcome to make wise decisions:

Pros of Hybrid Brokers

- Traders have the flexibility to choose the trading method that suits their strategy.

- Fast order execution speed, especially when orders are executed internally or via ECN.

- The trading process is recorded in a transparent and clear manner.

- By utilizing multiple execution channels, costs can be lower.

Cons of Hybrid Brokers

In the case where the broker executes the transactions themselves, if this part is not well managed, it can lead to significant risks.

Key characteristics of hybrid brokers

To become a successful investor, you need to have comprehensive knowledge of the market, need to know all the spices and how to combine them, a good investor needs to understand the nature of assets such as stocks, bonds, gold, … because each type has its own characteristics, suitable for different investment goals, understand the factors that affect prices such as news, policies, investor psychology, … and especially the methods of fundamental, technical, quantitative analysis, … to help evaluate the potential of an asset.

A combined investor is a reliable companion, with all the above qualities to support you on the path to success more easily. A combined investor will use many analytical methods to make investment decisions to help:

- Minimize risks when making investment decisions.

- Find investment opportunities that others ignore.

- Minimize risks by investing in many different types of assets.

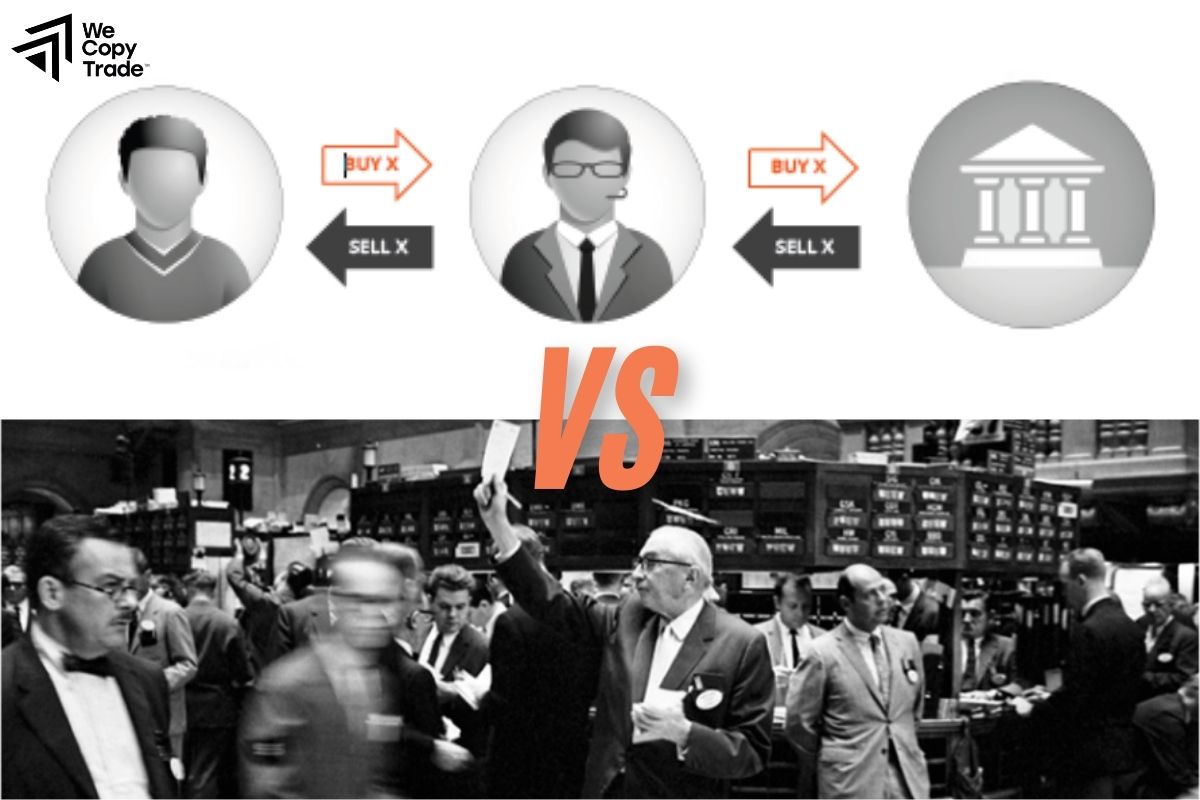

Hybrid brokers trading vs. traditional trading

Compared to traditional investment methods, hybrid investors have more in-depth knowledge of the market and investment tools. They know how to use, combine and promote supporting analytical tools to make the right decisions. They also ensure compliance with investment plans and do not let emotions dominate decisions.

A-Book, B-Book and Hybrids brokers in Forex Trading

- The B-Book model is where the broker executes the client’s trading orders himself. This model usually brings higher profits to the broker but carries more risks for the client.

- The A-Book model is where the broker passes the client’s trading orders to a large liquidity provider (LP). This helps ensure that the client gets the best price in the market.

- The Hybrid brokers model is a combination of both models, depending on each specific transaction, helping to increase profits and meet the needs of many different types of clients.

Choosing the Right Hybrid Brokers

To choose the right broker for you, you should first consider the following factors:

- Make sure they have all the features that suit your needs, goals, resources and trading style. In particular, you should prioritize brokers with advanced technology that can support 24/7 quick entry and exit of orders in case of market fluctuations.

- The broker must provide transparent and clear information about how they execute your trading orders.

- The broker must ensure that you get the best possible price.

- The broker must have a good risk management system to protect the interests of customers.

- The broker must clearly understand and ensure compliance with regulations when conducting transactions.

Conclusion

In conclusion, hybrid brokers are reliable companions, helping brokers to be more flexible in processing trading orders, making the most of knowledge and analytical tools, bringing many benefits to both brokers and traders. However, choosing the right broker depends on your needs and trading style. Above all, learn carefully about their operating model and compare with other brokers.

See now: