When you start investing, you must have heard the concept of risk per transaction. Why do we have to calculate the risk per transaction, is this really necessary? Follow me in the article below to answer all the questions that need to be answered about Fixed Risk per Trade transaction!

The fixed percentage risk per trade definition

Fixed Risk per Trade is a familiar term, especially for new investors. So what is fixed risk per trade? Simply put, it is the maximum amount of money you are willing to lose in a single trade. Just like setting a limit for yourself, risk per trade helps you control your risk and protect your capital. For example, if you have 10 million VND in your trading account and you decide to set a risk level of 2% per trade, that means you are willing to lose a maximum of 200,000 VND in a single trade.

See now:

- Applying Fixed Fractional Trading Strategy On Your Trading

- What is Capital Management? Strategies You Need to Know

- How to Choose The Best Financial Risk Management Software

- All Processes of Portfolio Management Most Effective

Methods to Calculate Fixed Risk Per Trade

Fixed risk management is one of the most important steps in determining the success of each trade, but it is often overlooked by traders. There are many ways to calculate the Fixed Risk per Trade risk for each trade. Let’s take a look at some of the most popular methods.

Fixed risk

With the fixed risk per trade method, the trader will set a fixed limit on the amount of money he is willing to lose in each trade, regardless of how the market moves. This method is very easy to apply, especially suitable for beginners. You can flexibly adjust this method to suit each specific case.

For example, you can set different risk levels for short-term and long-term trading time frames. For short-term time frames, you should set a lower risk level to minimize risk. Conversely, when trading on long-term time frames, you can increase the risk level a little. In fact, I often combine this method with the percentage of capital risk management method for better results. The reason is that short-term time frames are often more volatile, requiring us to be more cautious. Especially for new traders, it is very important to start with a low risk level.

Capital Ratio

The percentage risk management method is one of the most popular and trusted methods by many investors. With this method, you will set a certain percentage of your total investment amount as a risk limit for each trade.

For example, if you have $10,000 and decide to risk 2% on each trade, you will only accept a maximum loss of $200 in a single trade.

This method is easy to apply and helps protect your account from too much loss, especially when you have a series of losing trades. That is why it is so popular. The percentage you choose will depend on your risk tolerance and trading experience.

Significantly, new investors often choose a lower percentage, while more experienced ones can accept a higher risk.

In addition, you can flexibly adjust this method to suit each specific case, just like the fixed risk method. You can apply different percentages for short-term and long-term trading time frames.

Volatility-Based Position Sizing

Adjusting the size of a trade to market volatility is an effective risk management method that uses the Average True Range (ATR) indicator to measure the volatility of the market and thereby determine the appropriate size for each trade. Basically, this method Fixed Risk per Trade is an evolution of the percentage-of-capital risk management method but adjusted to suit the volatility of the market.

The calculation formula is as follows:

- Risk per trade = Account balance x Risk ratio

- Position size = Risk per trade / ATR x Value per point

When the market is volatile, if you do not adjust your position size accordingly, the possibility of being stopped out will be higher, leading to losses. By using ATR, you can ensure that your position size is appropriate for the volatility of the market, helping to minimize risk and increase the chance of success.

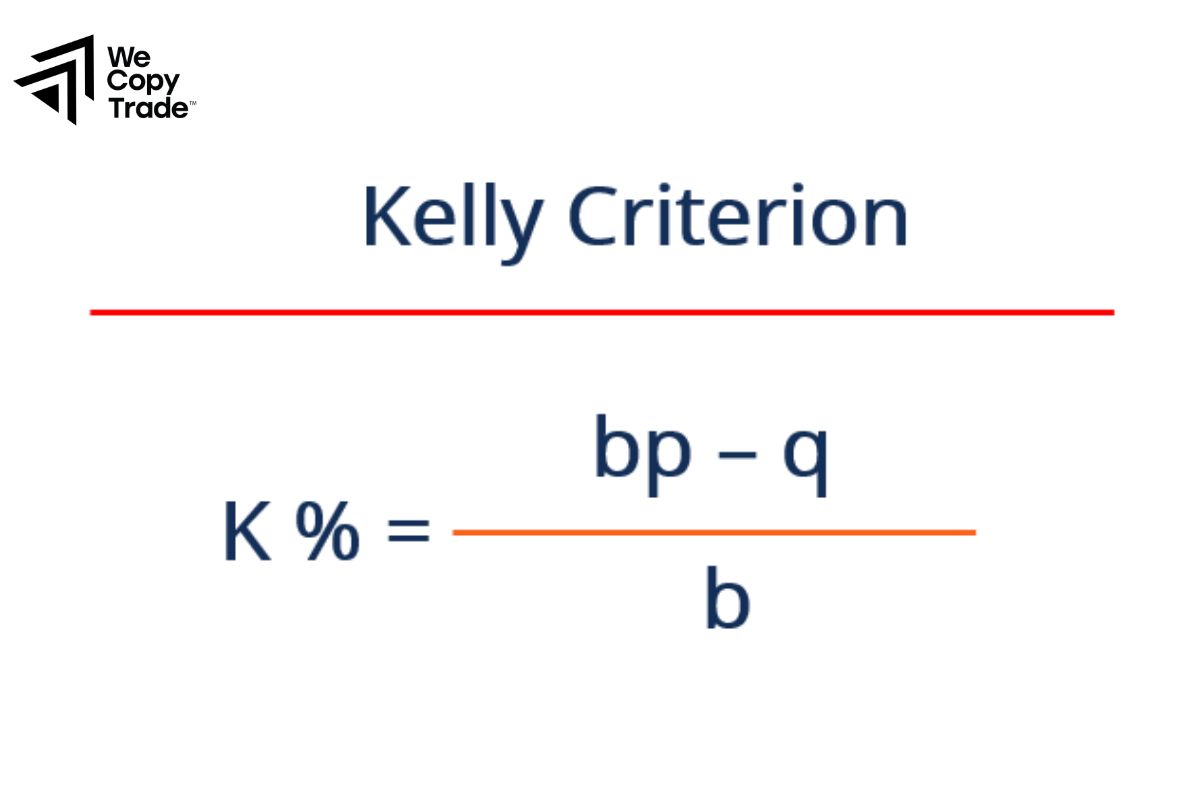

Kelly Criterion

The Kelly Criterion is a mathematical formula that helps investors determine how much money they should invest in a trade to maximize their profits and not lose too much if they lose in the long run.

The formula is based on three main factors:

- Probability of winning (p): Is the probability that you predict the trade will be successful.

- Probability of losing (q): Is the probability that the trade will fail.

- Profit/loss ratio (b): Is the ratio between the amount of money you can earn if you win compared to the amount of money you can lose if you lose.

The Kelly formula is calculated as follows:

f = (bp – q) / b

Where:

- f: Is the percentage of money you should invest in the trade.

- b: Is the profit/loss ratio.

- p: Is the probability of winning.

- q: Is the probability of losing.

For example:

Let’s say you have a trading strategy with a win probability of 60% and a profit/loss ratio of 1.5 (meaning if you win, you will make 1.5 times your investment). Applying the Kelly formula, you will calculate f = 33%. This means that in theory, you should invest 33% of your money in this trade to maximize your long-term profit.

Trading Strategies to Manage Fixed Risk Per Trade

Risk management is not just about determining the percentage of investment capital for each transaction. To effectively control Fixed Risk per Trade, investors need to combine with other tools and strategies, such as:

Position sizing

Choosing the right position to place an order is one of the most important decisions that determine the success of each transaction. You should combine technical analysis tools with formulas to calculate Fixed Risk per Trade on each transaction and place orders that are suitable for your own circumstances.

Stop-loss orders

Stop-loss orders are a useful tool that play an important role in helping investors automatically close positions when the market price moves against their predictions, minimizing the possible loss.

Placing stop-loss orders helps you strictly control the risk level on each transaction, ensuring that you do not lose too much compared to the original plan.

Regularly review the strategy

Risk management is a continuous process. Investors need to regularly re-evaluate their trading strategies and adjust them to changing market conditions. If a strategy consistently results in losses, it may be time to re-evaluate and make necessary changes.

Conclusion

In conclusion, determining the appropriate fixed risk per trade is extremely important. A good risk management method will help investors protect capital, practice patience and discipline, thereby learning and gaining experience from mistakes.

See more: