Are you confused about the martingale strategy? Is it really as good and effective as rumored? Don’t miss the following article, I will help you understand its nature and how it works. I believe that after that you can think more carefully and make the right decisions when using this strategy!

What Is the Martingale Strategy?

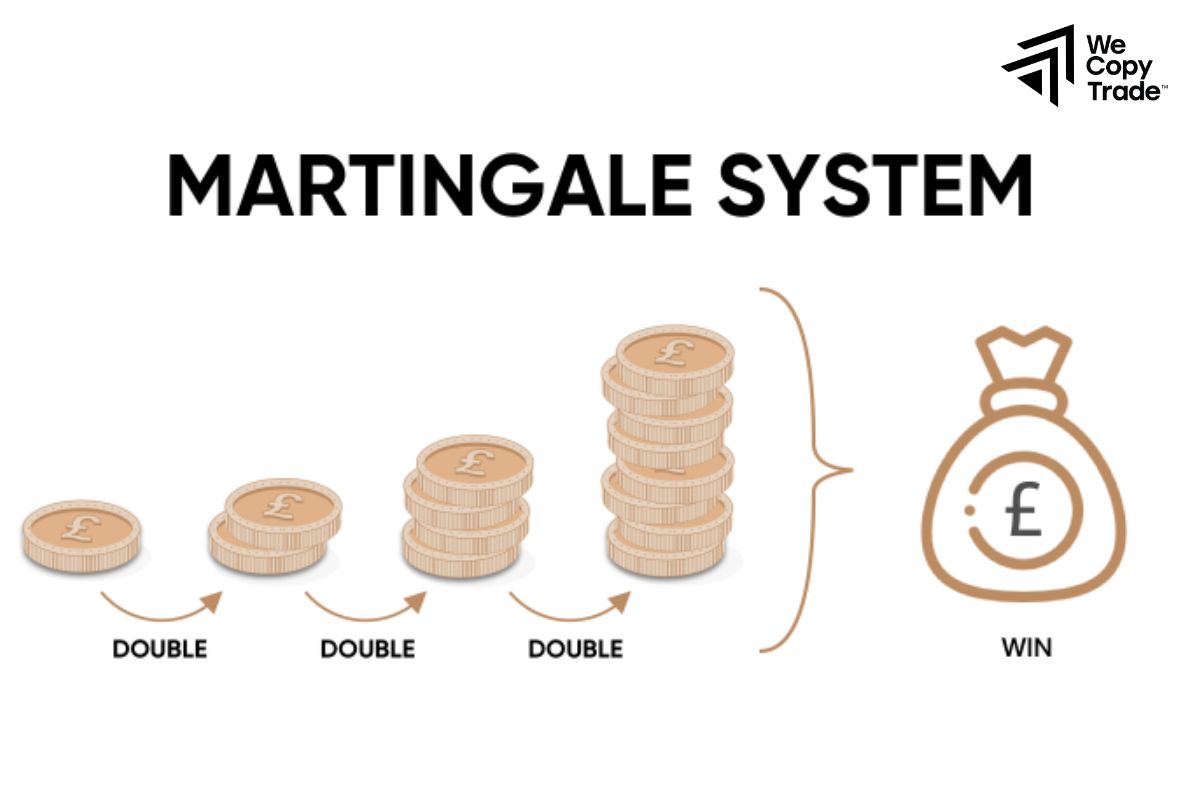

The Martingale Strategy, named after the French mathematician Paul Pierre Levy, is a popular and highly risky investment method that originated in 18th-century French casinos. In it, investors double their bets after each loss. The idea behind this strategy is that investors believe that sooner or later there will be a win. And such a win will offset all previous losses. However, Martingale has many potential risks. Maintaining a betting streak after a long losing streak requires a large amount of capital, and the desire to win back can lead to bad decisions.

Furthermore, Martingale is not suitable for games with maximum betting limits and the false assumption that each bet is independent.

See more:

- Tips Simplify Your Financial Risks Management Process

- What is interest rate risk? How to manage interest rates

- Some Steps to Successful Liquidity Risk Management 2024

- Foreign Exchange Risk Mitigation Effectively In 5 Minutes

Martingale Strategy Example

It’s similar to playing rock-paper-scissors with a friend. You decide to always play scissors. Every time you lose, you double your bet for the next round.

For example, you bet $1 on the first round and lose. The next round, you bet $2. And so on, every time you lose, you double your bet.

The idea behind this strategy is the ability to recover your capital after just one win and still make a profit. Since each round is independent, meaning the result of the previous round does not affect the next round, in theory, you are guaranteed to win a round.

However, the Martingale strategy is very risky. If you have a long losing streak, the amount you need to bet will increase very quickly and may exceed your financial capacity. In addition, there is no guarantee that you will win immediately after a long losing streak. Therefore, you need to consider carefully before applying this strategy.

Illustrative table:

| Play | Bet | Result | Total Win/Loss |

| 1 | $1 | lose | $1 |

| 2 | $2 | lose | $3 |

| 3 | $4 | win | $0 |

| 4 | $4 | lose | $4 |

Pros and Cons of Martingale Strategy

The Martingale strategy is widely used in most business investment decisions. Let’s take a look at their pros and cons to help you make a choice and gain experience for your decision.

Pros of Martingale Strategy

- The Martingale system is easy to understand and apply, even for novice traders. You don’t need to do complex technical analysis or follow market news too much.

- With the rule of doubling the bet amount after each loss, Martingale is a very easy strategy to remember and implement, without requiring traders to have too much specialized knowledge.

- One of the attractive points of Martingale is its ability to help traders quickly recover losses. Just one winning trade can make up for many previous losing trades.

- Martingale can be effective in markets that tend to be volatile and often reverse. However, in sideways or trending markets, this strategy may not be effective.

Cons of Martingale Strategy

The Martingale strategy has serious risks such as:

- The amount of money you have to spend on each transaction can increase very quickly, even after only a few consecutive losses.

- If you do not have enough capital to continue doubling your bet, you may suffer heavy losses.

- The stock market is always volatile and unexpected situations can occur that prevent you from continuing to trade.

- The risk/reward ratio of Martingale is very low. Even if you win in the end, the profit you get will only be equal to the initial bet. Meanwhile, the risk of loss is very high, especially when you encounter a long losing streak.

- This strategy also ignores transaction costs such as commissions and slippage, making the actual efficiency even lower.

- Exchanges often set limits on the number of stocks or futures contracts you can buy or sell in a transaction. This means that you cannot double your bet indefinitely. Once this limit is reached, the Martingale strategy becomes ineffective.

Martingale Strategy Trading in Forex Markets

The Martingale strategy is a risk management technique that involves doubling your position size after each loss. The idea is that eventually, you’ll have a winning trade that will recoup all your previous losses and generate a profit.

Before applying the Martingale strategy to Forex trading, it’s crucial to prepare thoroughly:

- Choose a Suitable Currency Pair: Select a currency pair with high liquidity and a clear historical price trend. This will allow you to analyze market movements effectively and execute trades smoothly.

- Set a Strict Stop-Loss: A stop-loss order is essential to limit potential losses. This helps prevent significant drawdowns in your account balance.

- Define Your Risk Tolerance: Determine the maximum amount of risk you’re willing to take on each trade. This will help you adjust your position size accordingly.

- Choose a Trading Timeframe: Select a timeframe that aligns with your investment goals and risk tolerance. Short-term traders may prefer lower timeframes like 15-minute or 1-hour charts, while long-term traders may opt for daily or weekly charts.

Implementing the Martingale Strategy

Identify Entry Points: Use technical analysis tools and indicators to identify potential entry points based on your chosen strategy.

- Start with a Small Position: Begin with a small position size to minimize initial risk.

- Set a Tight Stop-Loss: Place a stop-loss order to limit potential losses if the market moves against you.

- Double Down on Losses: If your initial trade is a loss, double your position size on the next trade.

- Take Profits and Reset: If you have a winning trade, take profits and reset your position size back to the initial level.

- Monitor and Adjust: Continuously monitor market conditions and adjust your strategy as needed.

Conclusion

In conclusion, the Martingale strategy is one of the most commonly used strategies in most trading sessions. However, once you understand how it works, hopefully you will think more carefully and make more accurate decisions to help limit risks in trading investments.

See now: