Have you ever wondered why stock prices fluctuate so much? One of the factors that cannot be ignored is market sentiment. Don’t miss the following article, I will help you better understand the factors that make up the market sentiment picture and how to take advantage of them to help us make profits.

What Is Market Sentiment?

Market sentiment is understood as the result of investors’ general feelings towards a stock, an industry or the entire market. It is like a “common emotion” of the investor crowd, directly affecting their buying and selling decisions.

When most investors believe that the price will continue to increase, they will rush to buy, pushing the price up. This shows that the market sentiment is in an optimistic state.

Conversely, when investors are worried about the future, they will sell off stocks, causing the price to decrease. This reflects negative market sentiment.

See now:

- Tools and platforms supporting Geopolitical Trading

- The most effective way to Interest Rate Trading in forex

- Get Started Smart Trading With Top Economic Indicators

How Does Market Sentiment Affect Prices?

Researchers have shown that our investment decisions are not only based on technical or fundamental analysis but are also influenced by emotions, crowd psychology and thinking errors.

We tend to be overconfident in our decisions, fearful when the market fluctuates strongly, or influenced by negative information. These biases can lead to wrong investment decisions.

For example, when a stock price increases sharply, many people will rush to buy it, pushing the price up even higher. However, when too many people buy, the market can become saturated and the price will fall sharply.

Animal spirits are a state where when the stock market is going up, people will feel optimistic and believe that the price will continue to increase. They will pour money into buying stocks without thinking too much, creating a bullish cycle. However, when the market starts to go down, fear will spread. People will start dumping stocks to avoid losing money, causing prices to fall even further.

Market sentiment indicators

Sentiment indicators help us predict future market trends and make appropriate investment decisions. When the market is too pessimistic, it can be an opportunity to buy good stocks at cheap prices. Conversely, when the market is too optimistic, it can be a time to consider selling. Some popular market sentiment indicators:

VIX (Fear Index)

VIX measures the expected volatility of the market in the near future. When the VIX is high, it means that investors are worried and expect the market to be volatile. Conversely, when the VIX is low, investors feel confident and the market may be nearing a peak.

High-Low Index

This index compares the number of stocks that are hitting a 52-week high to the number of stocks that are hitting a 52-week low. If more stocks are hitting a high, it indicates that it is bullish. Conversely, if more stocks are hitting a low, market sentiment is bearish.

Bottom Line Index (BPI)

This index measures the percentage of stocks that are trending up. If the BPI is high, it means that the majority of stocks are rising and market sentiment is positive.

Moving Averages (MA)

- When a short-term MA (e.g., a 50-day MA) crosses above a long-term MA (e.g., a 200-day MA), this is called a “golden cross.” This is typically a signal that the price trend is turning positive and investor sentiment is bullish.

- Conversely, when the short-term MA crosses below the long-term MA, this is called a “death cross”. This signal indicates that the price trend is turning negative and investor sentiment is pessimistic.

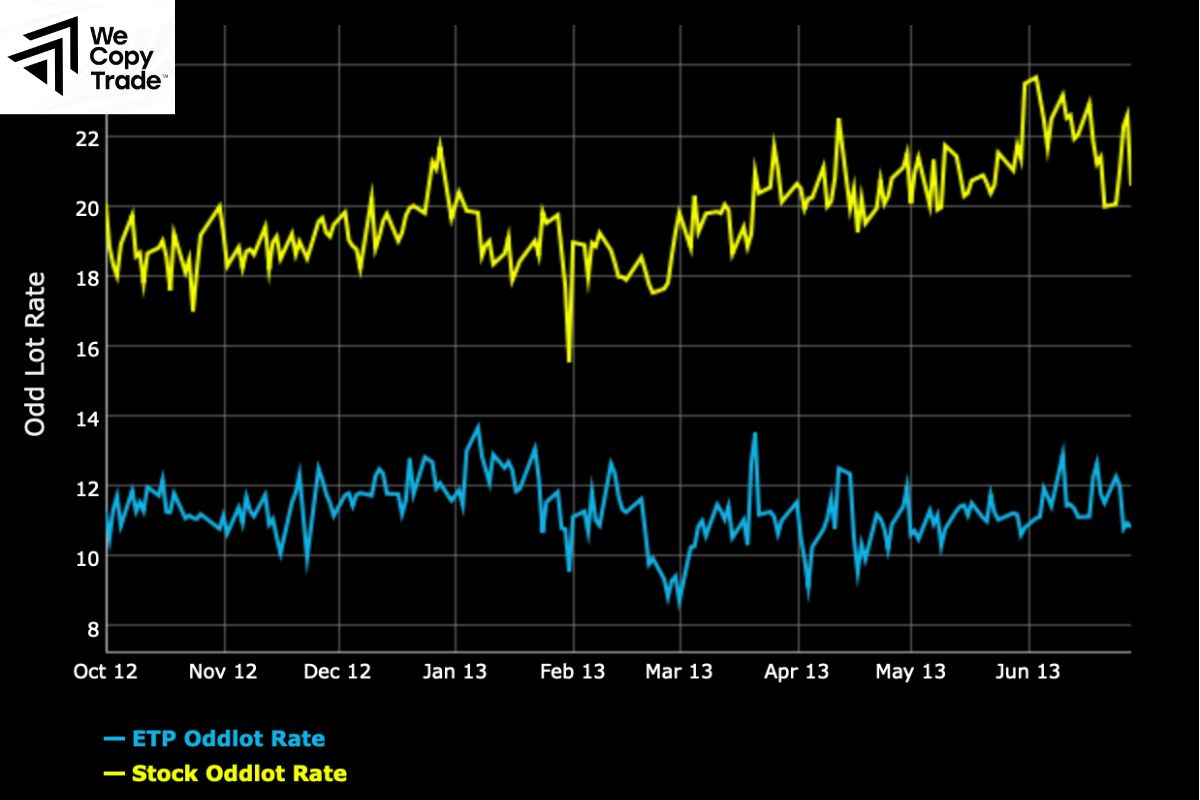

Odd Lot Trading Statistics

- Odd lots are small trades, usually less than 100 shares.

- It is often assumed that retail investors tend to buy when the market is too hot and sell when the market is too cold. Therefore, when they see a sudden increase in odd lot trading, professional investors are often cautious and may consider selling.

Commitment of Traders Report

- This report shows how large investors (such as hedge funds, banks) are buying or selling a particular asset.

- When large investors buy a large amount of an asset, it often pushes the price of that asset up. However, when they buy too much, the market may be too hot and a correction is imminent.

The Limits of Using Market Sentiment

- Market sentiment is easily influenced by emotions, especially fear and greed. This can lead to investment decisions that are not based on facts.

- News, unexpected events, and even rumors can change market sentiment very quickly, especially in highly liquid markets.

- These indicators can be inaccurate or confusing. Misinterpreting market sentiment signals can lead to poor decisions.

Trading Strategies Based on Market Sentiment

Understanding market sentiment helps us to be more automatic when deciding to trade investments. However, to ensure a higher chance of success, you can refer to some strategies to take advantage of this below:

- When most consultants are optimistic and push prices up, you can join this trend to make a profit. On the contrary, when market sentiment turns negative, you can consider selling.

- This is a strategy to go against the crowd. When everyone is scared and selling, you can look for opportunities to buy good votes at cheap prices. On the contrary, when everyone is too optimistic, you can consider selling.

- Combine technical analysis: Use technical indicators such as moving averages, RSI to determine signals from sentiment analysis. For example, if there is a lot of sentiment showing that the market is overbought but technical reports give sell signals, you should be more careful.

- Event Trading: Events such as earnings releases and new product launches can have a strong impact on investor sentiment. By analyzing market sentiment before and after the event, you can anticipate price movements and make informed trading decisions.

For example:

Let’s say you’re following a stock. Sentiment indicators show that investors are bullish on the stock, but technical indicators show that the price is too high relative to its intrinsic value. In this case, you might consider selling or waiting for a better opportunity to buy.

Conclusion

In conclusion, market sentiment is an extremely important factor in investing. Once you understand market psychology and know how to use and combine appropriate analysis tools, investors can make more informed investment decisions and increase their chances of success.

See more: