Have you ever wondered why the US dollar fluctuates up and down? One of the important factors that affects this is interest rates. Successful traders often take advantage of this to make profits. Do you want to know all tips on interest rate forecasting to master the trading market and make more accurate investment decisions? Follow me!

Interest Rate Forecasting Definition

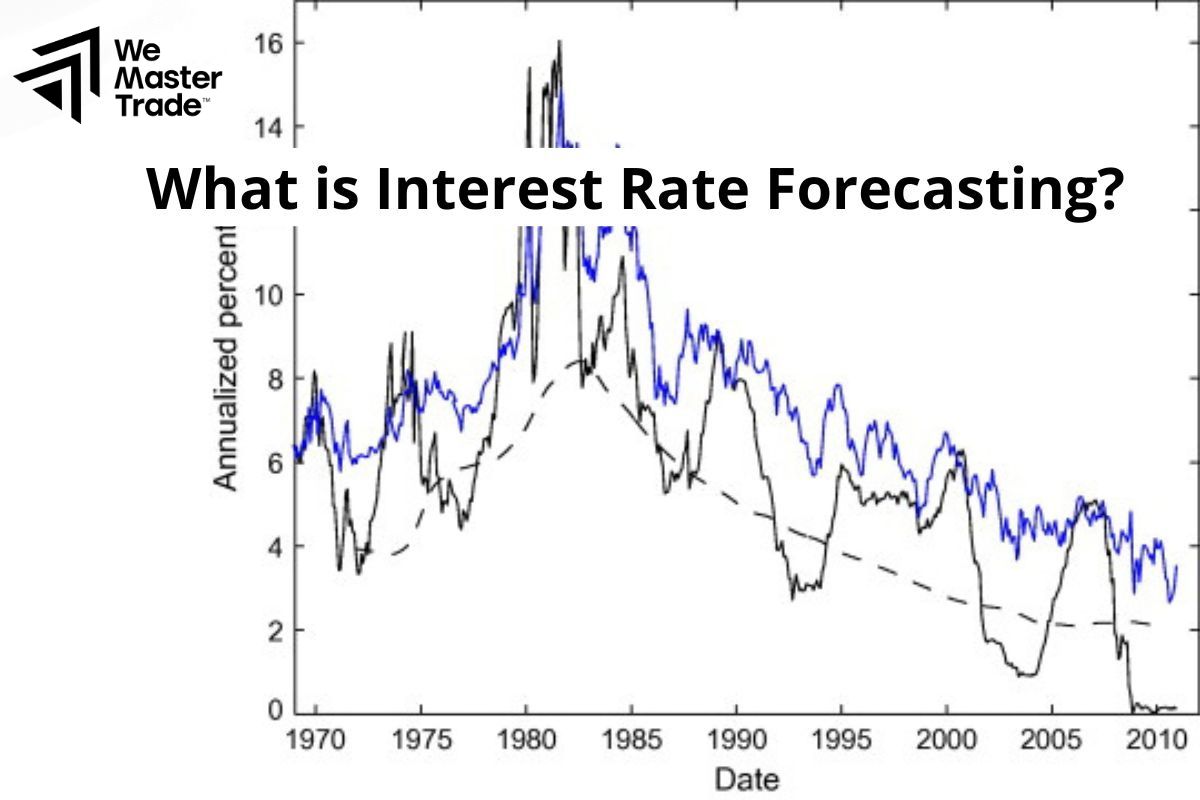

Interest rate forecasting is simply predicting whether interest rates will rise or fall in the future. It’s like forecasting the weather, but instead of predicting whether it will rain or shine, we predict whether interest rates will be high or low.

If you want to invest in stocks, real estate, or savings, knowing where interest rates are going will help you make better decisions. For example, if interest rates are expected to rise, you may want to buy bonds before their prices fall.

Central banks often use interest rate adjustments to regulate the economy. Therefore, interest rate forecasting helps policymakers make appropriate decisions.

See now:

How To Contribute A Good ISM Manufacturing Index In Trading

What is a Contractionary Policy? Tools Used for Policies

Apply The Labor Market Reports Effectively In Forex Trading

Planning To Measure The PMI For Your Successful Trading

Who controls interest rates in the Forex market?

The short answer is the central banks of each country. The central bank has the power to decide the base interest rate that commercial banks must pay when borrowing from the central bank.

The central bank is the “controller” of a country’s monetary policy. They have many tools to adjust interest rates, of which the two most common tools are:

- Open market operations: When they buy bonds, they will inject more money into the economy, reducing interest rates. Conversely, when they sell bonds, they will withdraw money from the market, increasing interest rates.

- Discount rate: This is the interest rate that commercial banks have to pay when borrowing money from the central bank. When the central bank increases the discount rate, commercial banks will also increase their lending rates, leading to an increase in the cost of borrowing for businesses and people.

The central bank has two main goals:

- Controlling inflation: When prices of goods increase too quickly (high inflation), the central bank will increase interest rates to reduce consumer demand, thereby curbing inflation.

- Ensuring economic stability: The central bank will also adjust interest rates to promote economic growth, create jobs and stabilize the exchange rate

For example: When the Fed raises interest rates: The USD usually appreciates against other currencies, as investors move money from other markets to the US to benefit from higher interest rates. When the ECB cuts interest rates: The Euro may depreciate against other currencies, as investors take money out of Europe to look for more profitable investment opportunities.

How do interest rates affect currencies?

When a country raises its interest rates, it means it is paying more “interest” to those who deposit money in its banks. This attracts more foreign investors to deposit their money, increasing the demand for that country’s currency and causing it to appreciate. Conversely, when a country lowers its interest rates, its currency becomes less attractive and tends to depreciate.

For example, suppose Vietnam raises its interest rates, while the US keeps them the same. This makes the Vietnamese Dong more attractive relative to the US dollar. Investors will move money from the US to Vietnam to enjoy the higher interest rates, increasing the demand for the Vietnamese Dong and causing the Vietnamese Dong to appreciate relative to the US dollar.

| Market Expectations | Actual Outcome | Currency Impact |

| Interest Rate Hike | Interest Rate Hike | Currency Appreciation |

| Interest Rate Hike | Interest Rate Hold | Currency Depreciation |

| Interest Rate Cut | Interest Rate Hold | Currency Appreciation |

| Interest Rate Cut | Interest Rate Cut | Currency Depreciation |

The Relationship Between the Business Cycle and Interest Rates

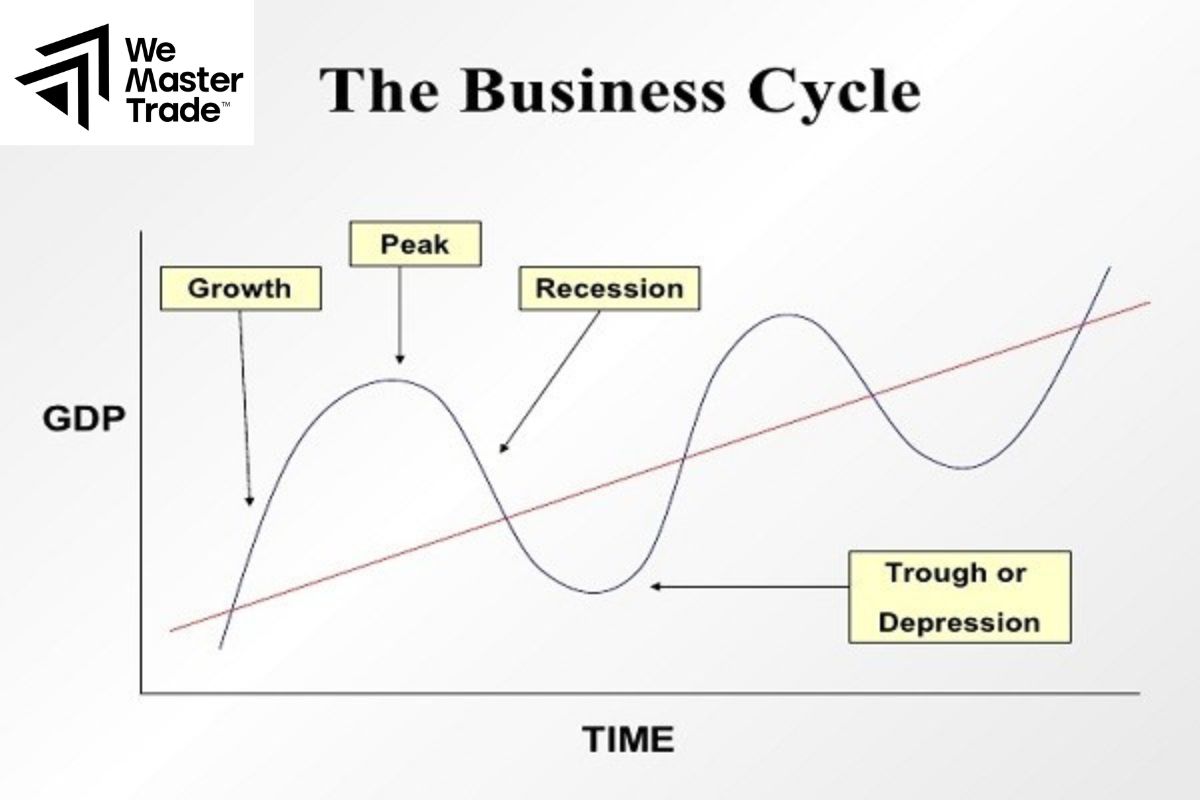

The economy is not always stable but always has ups and downs, called the business cycle. This economic cycle has two main stages:

Expansion: The economy grows, production increases, employment increases, income increases.

Recession: The economy slows down, production decreases, unemployment increases, income decreases.

Interest rates are the tool that central banks use to adjust the economy. Depending on each stage of the cycle, the central bank will adjust interest rates in different directions:

- When the economy is expanding: When people have more money, they will consume more, leading to higher prices (inflation). To control inflation, the central bank will increase interest rates. This makes borrowing money more expensive, people and businesses will limit borrowing and consumption, thereby reducing pressure on prices.

- When the economy is in recession: When the economy is in trouble, people spend less, prices may fall (deflation). To stimulate the economy, the central bank will reduce interest rates. This makes it easier to borrow money, encouraging businesses to invest and people to consume, thereby helping the economy recover.

The relationship between the economic cycle and interest rates is very close. The central bank uses interest rates as a tool to regulate the economy, helping to stabilize inflation and promote economic growth.

Interest Rate Trading Strategy

Interest rate trading is a popular strategy in the forex market. The main idea is to take advantage of fluctuations in exchange rates caused by central bank interest rate decisions.

Popular strategies:

Trading on the news

When a central bank announces an interest rate decision, you can immediately trade based on the results. For example, if interest rates rise, you can buy that country’s currency because it tends to appreciate.

Professional traders often try to predict central bank decisions by analyzing economic data, bank reports, and statements by officials.

Trading on market reactions

After the news is released, the market often has a very strong initial reaction. However, the price may then correct. You can wait for this correction to enter the order, minimizing risk.

In some cases, you may want to trade against the general market trend if you see signs that the market is overreacting.

For example, let’s say the Federal Reserve decides to raise interest rates. This could lead to the following scenarios:

- Short-term: The US dollar may immediately appreciate due to increased demand.

- Mid-term: The price may then correct slightly due to some profit-taking.

- Long-term: If the US economy continues to grow well, the US dollar may continue to strengthen.

Conclusion

In conclusion, the article has shown us the importance of the interest rate forecasting process as well as sharing all the useful strategies in predicting this rate to make the right trading decisions. However, to be successful in forex trading, you need to combine many different factors and have a clear trading strategy.

See more:

How Do Unemployment Rates Impact To Market Vodility?