The broker must have full knowledge, experience and skills in investment transactions because they have a direct impact on the success of your trading decisions. Therefore, the broker must be reputable enough and make you completely trust. So do you know how to choose a safe broker? Don’t miss the following article, I will share with you some interesting tips!

What is a safe broker?

You can think of a broker as an intermediary who helps you buy and sell financial assets such as stocks, bonds, foreign exchange, etc. in the global financial market.

A safe broker will provide you with an online platform so you can monitor the market, place buy and sell orders easily, and connect you with major exchanges around the world, giving you access to thousands of different types of assets. When you place a buy or sell order, they will execute that transaction on your behalf. In addition, they will provide analytical tools and market news to help you make better investment decisions.

See more:

- Top 9 Best Crypto Payments Gateways for Business 2024

- What are eWallets? Top 5 Forex eWallets you should know

- Credit or Debit Cards in Trading? Which one is better?

- Common Deposit and Withdrawal Methods In Forex Trading

Why do you need to know how to choose a safe broker?

Thanks to brokers:

- Trade 24/7, wherever you have an internet connection.

- You can access a wide range of assets around the world.

- Brokers provide tools to help you analyze the market and make better investment decisions.

Safe Brokers usually charge you a fee or commission for your trades. This fee may include account opening fees, transaction fees, account management fees, etc.

How to know if a broker is licensed or not?

The financial market is always full of risks. Choosing an unqualified financial advisor can cost you a lot of money. Therefore, verifying the qualifications of a financial advisor is extremely necessary.

How to verify the qualifications of a financial advisor:

- In Vietnam, financial advisors must be licensed by the State Securities Commission (SSC). You can ask the financial advisor to provide the registration number or operating license to check the information on the SSC website.

- Reputable securities companies often have their own website. On this website, you can find information about financial advisors working at the company, including registration numbers, expertise and experience.

- You can ask the financial advisor to provide supporting documents such as degrees, professional certificates, trading history, etc. to evaluate their capacity.

- Ask friends, family, or people who have used the financial advisor’s services. Investment forums are where you can find reviews and share experiences from people who have worked with different financial advisors.

How to choose a safe broker

When entering the financial market, choosing a reputable broker is extremely important. With so many options, you need to consider carefully to find a suitable partner. Here are some factors you should keep in mind:

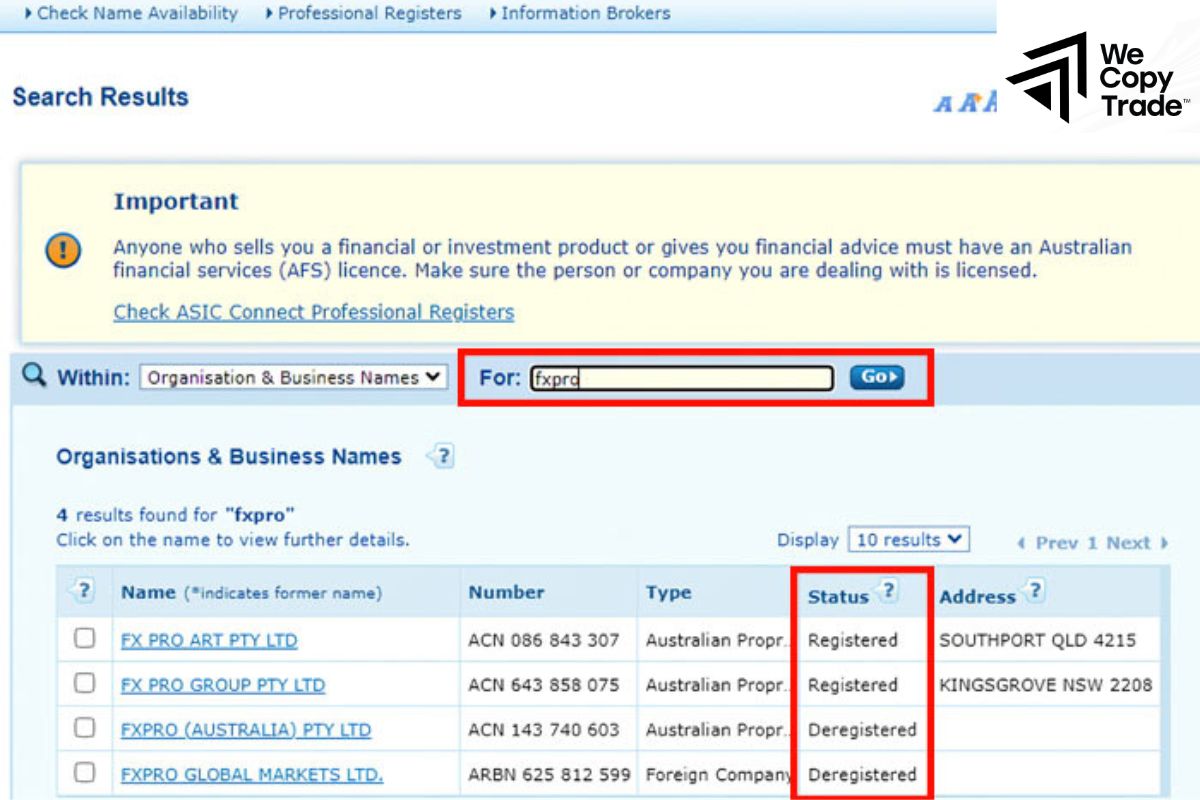

Regulations and licenses

- A license is proof that the broker is operating legally and in compliance with the law. This helps protect your assets and personal information. Check the broker’s license information carefully on their official website or on the website of the financial regulator.

- A reputable broker will always separate client funds from the company’s assets, ensuring that your money is always safe.

Trading products

- A good broker will provide you with a wide range of products to invest in, from stocks, bonds, commodities to derivative products such as CFDs. Choose a broker that offers products that suit your goals and risk tolerance.

- In particular, you should choose products with high liquidity so that you can easily buy and sell when necessary.

Trading platform

A trading platform is a tool that helps you make transactions. A good platform will help you make transactions quickly, easily and intuitively, providing you with technical and fundamental analysis tools to help you make better investment decisions while monitoring and managing risks effectively.

Factors to consider when choosing a trading platform:

- Friendly interface, easy to operate.

- Smooth operation, no interruptions.

- Provide all the necessary features such as charts, drawing tools, market news, trading signals.

Some popular trading platforms:

- MetaTrader 4 (MT4), MetaTrader 5 (MT5): The two most widely used trading platforms, with many powerful features and tools.

- Some brokers develop their own trading platforms, often with unique features.

Trading fees

Don’t let the attractive initial numbers fool you. Learn carefully about all the fees that the broker may charge, including transaction fees, overnight fees, withdrawal fees, etc. A reputable broker will always be open and transparent about its fee schedule. Compare the fee schedules of different brokers to find the most reasonable fee.

Customer service

When participating in investing, having a dedicated customer support team is extremely important. The financial market is always volatile, so receiving timely support will help you make the right decisions.

So, choose a broker that offers multiple communication channels such as live chat, email, and phone so you can easily contact them when needed. If you are not fluent in English, look for a broker that offers support in Vietnamese to avoid misunderstandings.

Knowledge and resources

- A good broker not only helps you trade but also provides you with the knowledge and tools you need to become a successful investor.

- Prioritize brokers who provide updated information about the market so you can grasp the latest developments.

- Participating in seminars and courses organized by brokers will help you improve your knowledge and investment skills.

- Articles and instructional videos will help you better understand investment products and trading strategies.

Warning signs to look out for when choosing a broker

The financial market is always full of risks. To protect your assets, you need to be careful when choosing a broker. Here are some warning signs that a broker may not be trustworthy:

- No operating license is the first and most important sign. A reputable broker should always have an operating license issued by a financial regulatory agency. If the broker does not provide information about the license or the license is invalid, be cautious.

- Transaction fees are an important part of the investment process. If the broker is not clear about the transaction fees, or the fees are too high compared to the general level, it is very likely that they are trying to “hide” other fees.

- Scam brokers often use attractive promises, putting pressure on you to make a quick decision. They may contact you by phone, email or social media regularly and urge you to invest immediately.

- No investor can guarantee 100% profit. If a broker promises too high a profit in a short period of time, it is most likely a lie. Difficulty withdrawing money is a very clear sign of a scam broker. If you have difficulty withdrawing money or the broker gives many reasons to delay the withdrawal, be wary.

Conclusion

In conclusion, understanding how to choose a safe broker is extremely important. Hopefully this article has helped you find the most suitable broker to confidently trade and increase the rate of successful transactions.

See now: