In the trading environment of proprietary prop firms, applying a suitable strategy is a must. This article provides a comprehensive overview of an effective prop firm strategy, while also analyzing the core elements that help traders maintain consistent performance in the long run.

Why Invest in an Effective Prop Firm Strategy?

Why Invest in an Effective Prop Firm Strategy?

Trading with a prop firm account is not the same as trading with personal funds. In addition to generating profits, traders must comply with a series of strict risk management rules, such as:

- Daily Loss Limit

- Maximum Drawdown

- Rules on holding time, trade volume, and capital management

Without an effective prop firm strategy, you can easily violate these rules even if you’re making profits—leading to your account being terminated immediately. Therefore, a suitable strategy not only helps you trade profitably but also ensures your long-term survival in a tightly regulated risk environment.

See more:

- Common Difficulties at Prop Firms

- Understanding Prop Firm Costs: What Traders Need to Know

- The Most Effective Prop Firm Trading Trends Nowadays

Most Popular and Effective Prop Firm Strategies

Below is a compilation of strategies widely used in professional trading environments, especially those aligned with the evaluation standards of prop firms.

News Trading

This strategy is based on economic or political events that have a strong impact on the market, such as NFP reports, inflation data, monetary policy meetings, or election results. Traders use news to anticipate short-term market direction, capitalizing on high volatility opportunities just before or after the information is released.

Scalping

Scalping

Scalping is a strategy that involves placing many small trades within a short period, taking advantage of minor price movements in the market. This method requires strict discipline, fast decision-making, and precise order execution.

Pairs Trading

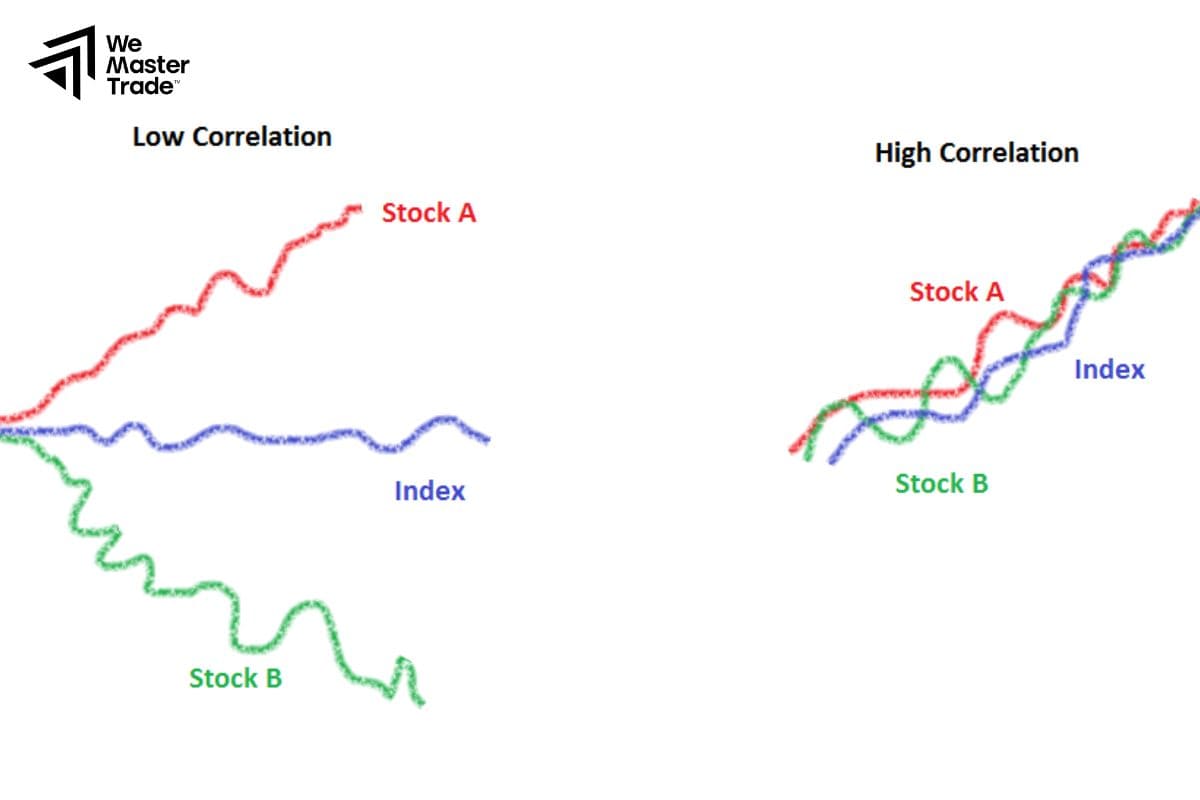

Traders select two assets with a strong correlation (such as two similar currency pairs), going long on one and shorting the other. Profit is generated when the price relationship between the two assets returns to its historical norm.

Volatility Arbitrage

This strategy exploits the difference between expected volatility and implied volatility in derivative instruments. Traders use quantitative tools to identify moments when the market misprices volatility levels.

Opening Range Breakout

Traders place trades based on price behavior during the first few minutes after the market opens. Strong breakout or reversal signals often appear during this period.

Macro Trend Trading

This strategy is based on analyzing global economic factors such as interest rates, monetary policies, inflation, and geopolitical developments. Traders use this analysis to identify medium- to long-term trends and place trades accordingly.

Index Arbitrage

Index Arbitrage

Traders seek price discrepancies in the same index across different exchanges or between correlated indices. This strategy requires high-tech systems and fast execution speed.

Risk Management

An effective prop firm strategy always includes a risk management system. For prop firm traders, this is even more crucial since the trading capital does not belong to the individual.

Essential Risk Management Principles

Per-trade risk limit: Should not exceed 1–2% of the account balance

Set stop-loss and take-profit orders: Always define exit points before entering a trade

Diversify positions: Avoid concentrating risk in a single asset

Use hedging strategies: Especially when trading highly volatile instruments

The Role of Systems and Trading Discipline

In the prop trading environment, maintaining consistency and removing emotional influences are key to achieving long-term success. Many traders choose to use algorithmic trading systems to automate decision-making based on predefined criteria.

Staying Updated with Market News

Even if you don’t trade based on news events, it’s essential for traders to stay informed about events that can impact the market. Doing so helps you:

- Avoid trading during high-risk periods

- Understand the root cause of volatility and avoid misjudged reactions

- Adjust strategies proactively to align with the broader macro context

Common Mistakes When Trading at a Prop Firm

Common Mistakes When Trading at a Prop Firm

Trading Without Testing the Strategy: Many traders use strategies without first going through backtesting or demo trading. This carries high risk, especially in environments with strict limits like prop firms.

Poor Captical Management: Even high win-rate strategies can fail without effective risk control. Violating limits such as the daily loss or max drawdown is one of the most common reasons accounts are terminated.

Trading During News Without Checking Firm Policies: Many prop firms prohibit trading during or around the release of major economic news. Traders often overlook this, leading to account termination—even if the trades were profitable.

Lack of Psychological Discipline: Some traders lose their composure after a few losing trades, resulting in revenge trading or abandoning their own rules. This behavior is especially dangerous in a tightly risk-regulated environment.

How to Build an Effective Prop Firm Strategy

Every successful trader is backed by a well-prepared strategy to deal with unexpected market moves—especially in the context of a prop firm. Below are the step-by-step basics to build an effective prop firm strategy:

Start from the prop firm’s regulatory framework

To be considered effective, an effective prop firm strategy must strictly comply with risk constraints. Key criteria to consider:

- Daily Drawdown: Typically 4%–5%

- Maximum Overall Drawdown: 8%–10%

- Profit Target: 8%–10% within 30 days

When designing your strategy, ensure that even in a losing streak, your drawdown doesn’t breach these limits.

Adjust Your Trading Style Accordingly

Start from the prop firm’s regulatory framework

Not every trading style is suitable in the prop firm environment. For example:

- Scalping: Make sure the firm does not limit the minimum order holding time.

- Swing: You need to manage drawdown effectively during extended holding periods.

An effective prop firm strategy should include:

- A reasonable win-to-risk ratio (RR of 1:1.5 or higher)

- Moderate trade frequency (1–3 trades per day)

- Clear entry setups supported by sound analytical logic

Develop a Clear Weekly Trading Plan

An effective prop firm strategy must be accompanied by a concrete action plan, including:

- Currency pairs and timeframes you will trade

- Pattern/scenario will be prioritized

- When to pause or avoid entering the market

Writing down your weekly plan helps you trade with intention, avoid impulsiveness, and more easily track and measure performance.

Measure and Improve Continuously

No strategy is static. What works well today may not work well in a few weeks. What sets a professional trader apart is the ability to track, analyze, and optimize a strategy over time.

An important tool is a trading journal – where you can record and evaluate the following:

- Win Rate: Number of winning trades out of total trades

- Average reward/risk ratio: Compare expected profit to risk tolerance

- Maximum drawdown: Largest drawdown from peak to trough in an account over a period

- Causes of losing trades: Can be due to incorrect analysis, lack of discipline, emotional overhang, or technical errors

Conclusion

In summary, an effective prop firm strategy is a combination of a suitable trading method, strict risk management, adaptability to market conditions, and strong discipline. Serious traders must continuously test, analyze, and adjust their strategies based on real-world results—ultimately building a trading system that is scalable and sustainable over the long term.

See more:

- Effective Prop Firm Capital Protection Secrets Traders Need to Know

- Prop Firm Trader Interviews – A Practical Perspective

- Learn How to Invest Smartly in Prop Firms in Just 5 Minutes

- Prop Firm Trading Office – Facts Traders Need to Know