Bank transfers are a secure and convenient way to move money between accounts, whether you’re paying bills, sending funds to family, or handling business transactions. Discover the benefits of banks, how they work, and the best practices to ensure your money gets where it needs to go safely. Ready to make your next transfer easy and hassle-free? Start using bank transfers today for a reliable and straightforward financial solution!

What is a bank transfers?

The bank transfers is a method of moving money from one bank account to another electronically. This can involve transferring funds between accounts within the same bank or between different banks. Bank transfers are commonly used for paying bills, sending money to family or friends, or managing business transactions.

There are various types of bank transfers, including:

- Wire Transfer: A fast, often international, transfer usually processed within a few hours or days.

- ACH Transfer: A slower but cost-effective option often used for recurring payments, like direct deposits or bill payments.

- Online or Mobile Banking Transfer: Transfers initiated through a bank’s website or mobile app, offering a quick and convenient way to send money.

See now:

- What are the Benefits of Using Expert Analysis Forex?

- What are trading signals? How to use trading effectively?

- How to Predict and Take advantage of Market News thoroughly

How does a bank transfer work?

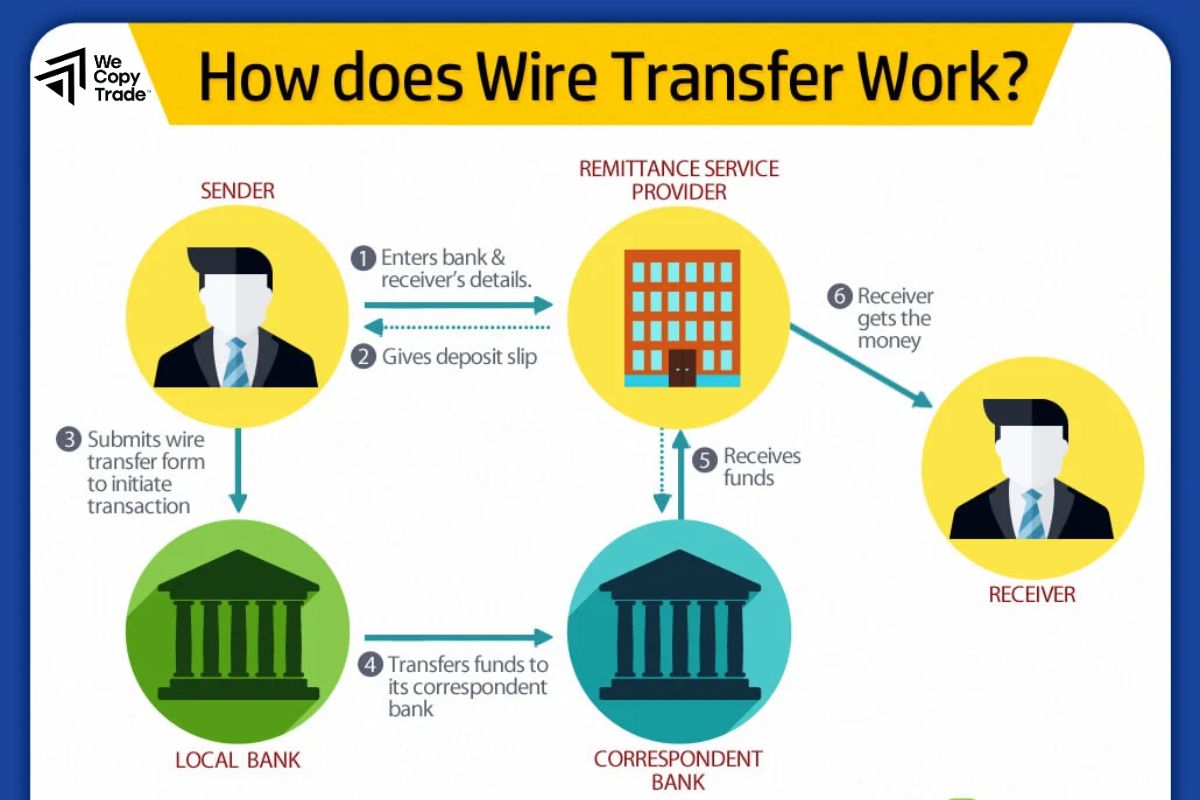

A bank transfer works by electronically moving funds from one bank account to another. Here’s a step-by-step breakdown of how the process typically unfolds:

Initiating the Transfer

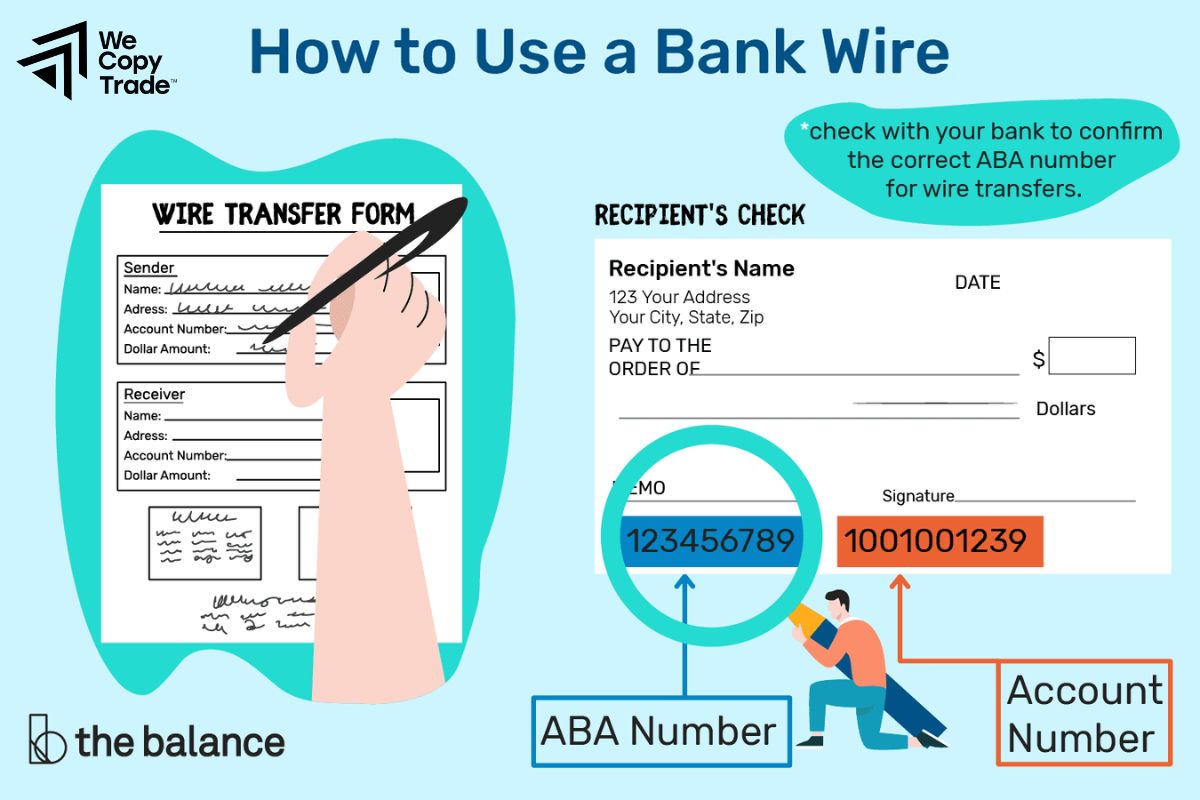

- The sender (payer) starts the transfer using a bank’s online platform, mobile app, or by visiting a physical branch.

- The sender provides key information, such as the recipient’s name, bank account number, routing number (or SWIFT/BIC code for international transfers), and the transfer amount.

Verification and Authorization

- The bank verifies the sender’s identity, usually by requiring a login, PIN, or password for online transfers.

- The sender must authorize the transaction, often by confirming details and agreeing to any fees associated with the transfer.

Processing the Transfer

- The bank processes the payment by debiting the sender’s account. The money is then routed through a secure network, such as ACH (Automated Clearing House) for domestic transfers or SWIFT for international transactions.

- Depending on the type of transfer, the processing can happen almost instantly (as with real-time payments) or take a few days (like with ACH transfers).

Receiving the Funds

- The recipient’s bank receives the transferred funds and credits them to the recipient’s account.

- The recipient can access the money once the transfer is complete, though some banks may impose a short waiting period for funds to clear, particularly with larger amounts or international transfers.

Why use a bank transfer as a deposit and withdrawal method?

Bank transfers are a popular method for deposits and withdrawals because they are secure and convenient. This method is highly secure due to encryption and authentication measures provided by banks, which protect personal and financial information. Banks are also very convenient because they can be done anytime, anywhere via online banking platforms or mobile apps.

Additionally, they often come with low or no fees for domestic transactions, and the processing time is quick, making them an ideal choice. Furthermore, bank transfers provide clear transaction records, making it easy to track and verify payments. Therefore, banks are a reliable method for depositing and withdrawing money, offering peace of mind and convenience to users.

Compare the best bank transfer brokers

When comparing the best bank transfer brokers, it’s important to consider factors such as transaction fees, speed, security, customer support, and the range of services offered. Here’s a comparison of some of the top brokers that accept bank transfers for deposits and withdrawals:

| Broker | Fees | Speed (Deposit) | Speed (Withdrawal) | Security | Customer Support | Trading Services |

| eToro | No deposit fees, $5 withdrawal fee | 3-7 business days | 3-7 business days | FCA, ASIC regulated | 24/7 support | Stocks, Forex, Crypto, Commodities |

| IG Group | Free deposits and withdrawals | 1-3 business days | 1-3 business days | FCA, ASIC regulated | Phone, email, live chat | Forex, Stocks, Options, Indices |

| Plus500 | Free deposit, withdrawal fees may apply | 3-5 business days | 1-3 business days | FCA regulated | 24/7 support | CFD trading (stocks, forex, crypto) |

| Saxo Bank | Free deposit, withdrawal fees may apply | 2-5 business days | 2-5 business days | FCA, Danish FSA regulated | Phone, email, live chat | Stocks, Bonds, ETFs, Options |

| Interactive Brokers | Free deposit, withdrawal fees apply | 1-3 business days | 2-5 business days | Highly regulated, strong security | 24/7 support | Global markets, Stocks, Bonds, ETFs |

Pros and cons of forex bank transfers

Here’s a breakdown of the pros and cons of using bank transfers for Forex trading:

Pros of Forex Bank Transfers

- Security: Bank transfers are highly secure due to the established safety protocols of financial institutions. Banks use encryption and verification processes to protect your financial information, minimizing the risk of fraud.

- Widely Accepted: Most Forex brokers accept banks as a payment method, making it a universal and convenient option for traders worldwide. Whether you’re trading in USD, EUR, or other currencies, banks are typically supported.

- Low or No Fees: For domestic transfers, many banks do not charge fees, or the fees are relatively low compared to other payment methods. Even for international transfers, fees may be lower than using alternatives like credit cards or third-party processors.

Cons of Forex Bank Transfers

- Processing Time: Bank transfers, especially international ones, can take several days to process. This delay can be a significant drawback for Forex traders who need quick access to their funds or wish to take advantage of short-term market movements.

- Not Instant: Unlike some payment methods like e-wallets or credit cards, bank transfers are not instantaneous. Deposits might take anywhere from 1 to 5 business days, which can delay your ability to start trading.

- Limited Availability for Withdrawals: Some brokers may not offer bank transfers for withdrawals, or they may impose restrictions on how frequently you can withdraw using this method. This can be inconvenient if you need to access your funds quickly.

- Potential for Errors: If you enter the wrong bank details during the transfer, it can lead to delays or errors. The process of resolving these mistakes can take time and might involve additional fees or complications.

FAQ about Bank Transfers

Here are some frequently asked questions (FAQs) regarding bank transfers, particularly in the context of financial transactions, Forex trading, and general use.

How long does a bank transfer take?

The time it takes for a bank transfer to process can vary depending on the type of transfer:

- Domestic transfers: Typically take 1-3 business days.

- International transfers: Can take 3-7 business days or more, depending on the banks involved and the countries.

- Same bank transfers: These are often faster and may be processed on the same day.

Can I use bank transfers for Forex trading?

- Yes, many Forex brokers accept bank transfers for both deposits and withdrawals. Banks are a secure and reliable method, especially for larger amounts, although they may take longer compared to other payment methods.

Are there alternatives to bank transfers for fast transactions?

- Yes, alternatives such as credit/debit cards, e-wallets (like PayPal, Skrill, or Neteller), and cryptocurrency payments offer faster transaction times, although they may come with higher fees or lower security levels compared to bank transfers.

Conclusion

In conclusion, bank transfers offer a secure, reliable, and efficient method for transferring funds, making them an essential option for both personal and business transactions. If you’re ready to streamline your payments and ensure your transactions are safe and hassle-free, consider using banks today. Don’t wait, take control of your finances and experience the convenience firsthand!

See more: