If you are new to Forex trading, understanding “Forex pair correlations” is a vital concept to learn. Forex pair correlations refer to how different currency pairs move in relation to each other. Some pairs rise and fall together, while others move in opposite directions. Knowing these relationships can help beginner forex traders make more informed decisions.

This guide will dive into the definition of Forex pair correlations, how to identify them, and how to use that information to your advantage as a trader.

What are Forex Pair Correlations?

In forex trading, a “pair” just means two currencies that are traded against each other, like the EUR/USD (Euro versus US Dollar) or the GBP/JPY (British Pound versus Japanese Yen). When we talk about the “correlation” between these currency pairs, we are looking at how they tend to move in relation to each other.

If two currency pairs have a strong relationship, that means they usually go up and down in the same direction. On the other hand, if they have a negative correlation, that means they tend to move in opposite directions.

Understanding these forex pair correlations may be helpful for traders. It lets you see how different currencies are connected and can help you make more informed decisions about your trades.

Why Do Forex Pair Correlations Matter?

Understanding Forex pair correlations may help you avoid unnecessary risks.

Imagine you place trades on two pairs with a high positive correlation, like EUR/ USD and GBP/ USD. If one trade goes wrong, the other one might as well since those pairs tend to move up and down together.

But if you know the Forex pair correlations, you may utilize that information to make smarter choices. You will have a better idea of which pairs are likely to behave similarly, so you don’t end up with all your eggs in one basket.

Positive Correlation in Forex Pairs

When we talk about a “positive correlation” between currency pairs, it just means that the two pairs usually move up and down together.

For instance, EUR/ USD and GBP/ USD often have a strong positive correlation. That makes sense because the Euro and the Pound are both major currencies commonly traded against the US dollar. So when something affects the value of the dollar, it tends to impact both of those currency pairs similarly.

The strength of this relationship can vary though. Sometimes, two currency pairs will have a super tight correlation, which means they move almost exactly the same. Other times, the correlation is a bit weaker, so the pairs only tend to move together under certain conditions.

Forex pairs that usually move in the same direction:

- EUR/USD & GBP/USD

- EUR/USD & AUD/USD

- EUR/USD & NZD/USD

- USD/CHF & USD/JPY

- AUD/USD & NZD/USD

Negative Correlation in Forex Pairs

A “negative correlation” indicates that when one currency pair rises, the other pair often falls. For example, the EUR/USD and USD/CHF (US Dollar/Swiss Franc) frequently fluctuate in opposing ways. That is because as the US currency strengthens, the EUR/USD tends to fall (since the euro weakens versus the dollar), but the USD/CHF normally rises.

Negative correlations may be quite valuable when trying to safeguard your trades. This is known as “hedging”; you arrange transactions that go in opposing ways to balance any losses. So, if you believe the EUR/USD will fall, you may also consider opening trade on the USD/CHF, as those two pairings frequently move in different directions.

Forex pairs that usually move in the opposite direction:

- EUR/USD & USD/CHF

- GBP/USD & USD/JPY

- USD/CAD & AUD/USD

- USD/JPY & AUD/USD

- GBP/USD & USD/CHF

How to Measure Forex Pair Correlations

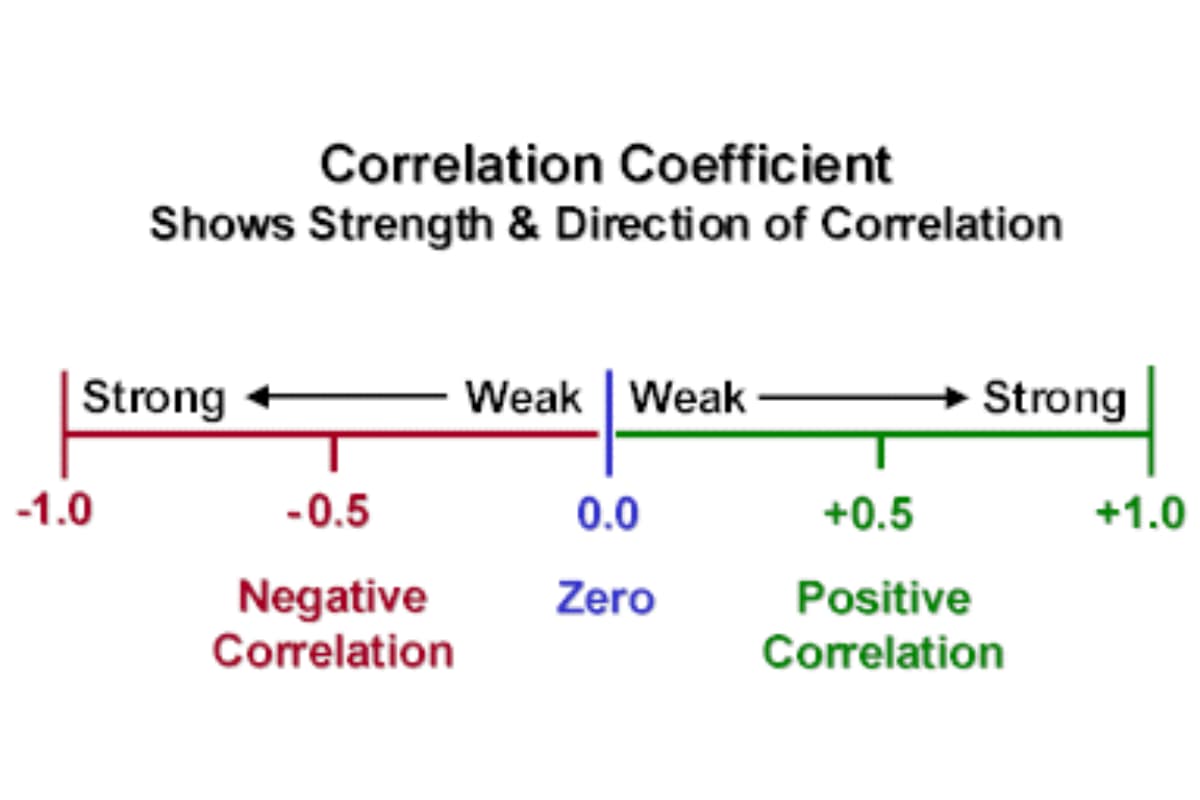

Forex pair correlations are usually measured on a scale from -1 to +1. This scale (known as the correlation coefficient) gives you a sense of how strong the relationship is between the pairs, and whether they move in the same or opposite directions.

- +1: Ideal positive correlation. The pairs always go up and down together.

- 0: No correlation. They move independently.

- -1: Ideal negative correlation. They always move in opposite directions.

Tools for Checking Forex Pair Correlations

Many Forex trading platforms offer tools that show you the correlations between different currency pairs. These tools typically display correlation coefficients over different periods, like one week, one month, or one year.

- Short-term (a day/ a week): Correlations can be more volatile and change quickly based on news events, market sentiment, or short-term economic factors.

- Long-term (a month/ a year): Correlations tend to be more stable, reflecting the overall relationship between currency pairs over time.

You can use these correlation tools to analyze the connections and then adjust your trading strategy based on the time frame you are focusing on.

How to Utilize Forex Pair Correlations in Trading

Now that you know the basics of Forex pair correlations, here is how you can utilize them in trading.

Risk Management

Forex pair correlations may be quite useful for managing trading risk. If you see that two pairs are extremely connected, you may not want to trade them both in the same way, since this might expose you to greater losses if the market swings against you. Instead, consider utilizing one pair to hedge the other, mitigating the possible loss.

Hedging Strategies

Forex pair correlations may help you develop effective hedging strategies. If you know that two pairings often go in different directions, you can take advantage of this. For instance, if you are concerned that one of your trades will fail, you might create a counteracting position on the negatively linked pair to assist in mitigating your risk.

Diversifying Trades

If you want to diversify your forex trades, look for currency pairs that have little to no correlation with each other. This may help spread out your trading risk, so your trades are not all influenced by the same market factors. By trading less connected pairs, you may avoid having all your trades impacted by the same movements.

Building a Trading Plan

Understanding forex pair correlations can help you build a more balanced trading plan. If you notice certain pairs tend to move together, you can use that to your advantage. For example, you might trade one pair based on how the other is performing, since you know they’re closely connected.

Practice trading strategies with WeCopyTrade!

Things to Keep in Mind

While knowing Forex pair correlations can enhance your trading approaches, it is vital to remember that these relationships may change over time. Things like shifts in the economy, new policies, or unexpected global events may impact different currency pairs in different ways, which can alter their correlations.

A few things to keep in mind:

- Keep an eye on correlation changes: Regularly check correlation tools, especially if you are relying on a particular correlation for your trades.

- Stay informed about global events: Economic events may change correlations quickly, so staying updated can help you adapt to these shifts.

- Practice good risk management: Correlations can add complexity, so use them carefully, especially if you’re new to forex trading.

Conclusion

To summarize, learning about Forex pair correlations is a valuable skill for Forex traders to develop. By understanding how different currency pairs move in relation to each other, you can make more strategic trading decisions. Whether it’s diversifying your portfolio, managing your risk, or spotting new opportunities, Forex pair correlations provide useful insights. Discover more trading tips on WeMasterTrade Blog!