If you are wondering how to choose between Forex and Commodities trading, do not miss the following article. We will show you the most prominent features of both types and help you compare them so that you can easily make a decision to answer the question of which type of trading is more suitable for your needs and style. Let’s go!

What are Forex and Commodities?

Forex and Commodities are the exchange of buying and selling products that meet daily needs such as crude oil, cotton, corn, etc. to make a profit and protect assets from market fluctuations.

Commodity trading companies on the stock market play an important role in connecting producers with consumers, thereby creating value for products.

There are two main types of trading in the commodity market:

- Spot trading: is the form of buying and selling goods and receiving goods immediately. For example, a bread factory can buy a large amount of flour immediately to serve the production process.

- Futures trading: is the form of buying and selling goods but delivering at a specified time in the future. For example, a sugar factory can buy a futures contract to ensure a stable supply of raw materials at a stable price for the next 6 months.

See now:

- Forex and Stocks Trading What Should Traders Know?

- How to Use Currency Correlations to Trade Forex for beginner

- Choosing PAMM and MAM Accounts for Your Brokerage Platform

Types of Commodities

Commodities traded in the market are diverse, but they can be divided into two main groups:

- Hard commodities: These include precious metals such as gold, silver, copper and energy sources such as crude oil and natural gas. These commodities are often of high value and are used in many industries.

- Soft commodities: These include agricultural products such as wheat, rice, coffee, soybeans and livestock products such as beef and pork.

- In India, the two most actively traded commodities are crude oil and silver. Crude oil is an important source of energy for most industries, while silver is considered a valuable precious metal.

Commodity Trading Advantages and Disadvantages

Commodities trading is a vibrant market because of its many outstanding features. However, there are also notes on the advantages and disadvantages of commodity trading that we need to know to master this type of trading:

Advantages

High Profit Opportunity: Commodity prices fluctuate according to supply and demand. When demand increases, commodity prices also increase, bringing profits to investors. In particular, during periods of high inflation, commodity prices often increase faster than other types of assets, helping to protect the value of investors’ assets.

Diversify your investment portfolio: Investing in commodities helps to minimize risks when the stock market fluctuates. And commodities are considered an effective hedge against inflation.

Transparent and fair: With the participation of many investors, prices are formed fairly, accurately reflecting the supply and demand of the market.

Hedge against inflation and market volatility: When inflation increases, commodity prices often increase. Therefore, investing in commodities is an effective way to protect the value of your assets.

Trading with small capital: To participate in commodity trading, you only need to deposit a small deposit compared to the total contract value. This allows you to invest in larger positions with less capital. Leverage allows more individual investors to participate in the commodities market.

Disadvantages

Although commodity trading is a lucrative market for making profits, it also comes with significant risks that investors need to consider carefully:

- When demand increases while supply is limited, prices will increase and vice versa.

- Events such as natural disasters, wars, or policy changes can have a strong impact on commodity prices.

- Short-term investors often push prices up and down erratically to make quick profits, making the market even more volatile.

- This strong volatility makes predicting prices extremely difficult, even impossible. This means that the risk of losing capital is very high for investors, especially those new to the market.

- Complexity: The commodity market has many different types of goods, each with its own rules. To be successful in commodity trading, investors need in-depth knowledge of the market, analytical skills, and good risk management skills.

- Limitations on diversification: Although commodity funds make it easy for investors to spread their risks, the funds themselves focus on one or a few specific commodities. This makes portfolio diversification more difficult, especially for those who mainly trade commodities.

- Negative impacts on the environment: To meet the growing demand of the market, many commodity production and exploitation activities often come with negative impacts on the environment. For example, when oil prices rise, oil and gas companies may increase exploitation, leading to more serious environmental pollution.

- Risk from leverage: Although it helps investors maximize their capital, the use of leverage also amplifies both profits and risks. Just a small fluctuation in the market can cause an investor to lose all the money invested.

What is Forex Trading?

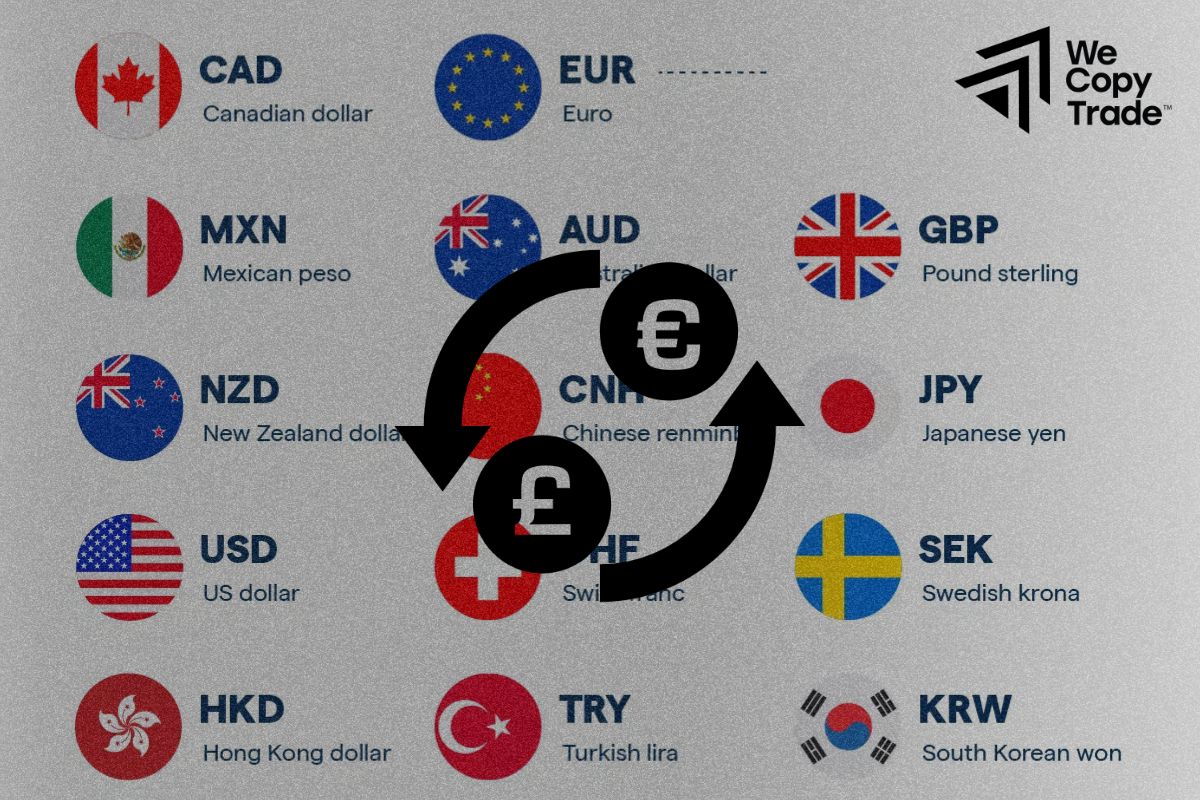

Forex trading is simply understood as you buy or sell one country’s currency for another country’s currency. And Forex traders buy and sell different currencies in the hope of profiting from the difference between the currency rates. Every day, all over the world, trillions of dollars are traded, creating a vibrant financial market.

For example, if you predict that the Euro will increase in value compared to the USD, you can buy Euro and sell USD. When the Euro actually increases in value, you will sell Euro and buy USD back, earning a profit.

Forex Trading Advantages and Disadvantages

Forex trading has proven its appeal with hundreds of billions of dollars traded daily. However, there are some advantages and disadvantages that we need to note to make it easier to succeed with this type of trading:

Advantages

24/5 Trading: The Forex market operates 24/5. This means you can trade whenever you want, as long as you have an internet connection, allowing you to capture investment opportunities even when you are sleeping.

Long and short: Long means you bet on the price going up, while short means you bet on the price going down. You are like a market analyst, predicting the trend and making a decision to buy or sell. For example, if you think the price of gold will go up, you will go long gold. On the other hand, if you think the price of oil will go down, you will go short oil.

High liquidity: Since there are many people participating in the transaction, you can buy or sell foreign currencies at any time without worrying about finding a buyer/seller. This makes the transaction fast and the price is always competitive.

Attractive profits: With leverage and exchange rate fluctuations, you can make big profits in a short time. For example, with $1,000, you can trade a position worth $100,000. This increases your potential for profit but also comes with higher risk. There are hundreds of currency pairs to choose from, allowing you to diversify your portfolio.

Disadvantages

Although Forex trading promises many opportunities for profit, it also comes with certain risks that investors need to be aware of:

- Forex is a 24/7 market, spread across the world. This means that regulations and policies can change constantly, making it difficult to monitor and predict.

- Automated trading algorithms are increasingly popular, making it more difficult to monitor and control the market, especially for individual investors.

- Not all Forex brokers are trustworthy. Choosing a reputable broker is very important to ensure your interests.

- Leverage allows you to trade with larger capital, but at the same time, it also amplifies both profits and losses. If the market moves against you, you can lose your entire investment in a short period of time.

Correlation Between Forex and Commodities Trading

Both forex and commodities are dynamic financial markets that attract many investors. However, there are some notable similarities and differences between the two markets:

Similarities Forex and Commodities Trading

- Forex and Commodities markets allow investors to predict and profit from short-term price movements. Investors can take advantage of price differences between different markets to make a profit.

- For example, acquiring a commodity at a lower price in one market and then selling it at a higher price in another market.

- Forex and Commodities markets use contracts (such as futures) to trade.

Differences Forex and Commodities Trading

- Commodity markets are often more heavily regulated, especially when it comes to the physical trading of commodities. Meanwhile, Forex and Commodities markets are more flexible in regulation and are often traded online.

- Commodities are typically traded on centralized exchanges, while forex is traded through a network of brokers and banks.

- The forex market operates 24/7, while the commodities market has specific trading hours.

Conclusion

In conclusion, both Forex and Commodities trading offer attractive investment opportunities. However, to choose the right type of trading, add your experience, knowledge and investment goals to have smart trading strategies and measures. Your path to success is right in front of you!

See more: