News trading is one of the effective trading strategies trusted by top investors. However, to be able to take full advantage of this model and limit the risks, we need to know all aspects about it. Don’t miss the following article, I will answer all your questions in just a second.

What is news trading?

News trading is an investment strategy in which traders take advantage of the latest, hottest information about the markets to make buying or selling decisions. This information may include:

- Reports on inflation, GDP, unemployment rates, etc. This information directly affects the economic situation of a country and thereby affects the stock market, foreign exchange, etc.

- Announcements on business results, personnel changes, new product launches, etc. of listed companies.

- Political events such as elections, wars, crises, etc. can cause major fluctuations in the market.

Today, social networks such as Twitter, Reddit have a great influence on investor psychology. Information shared on these social networks can cause strong market fluctuations.

New information often causes strong price fluctuations in the market, creating opportunities to make large profits in a short time. By getting hold of important information before others, traders can make the right investment decisions and achieve higher returns than the market.

See now:

- Get Started Smart Trading With Top Economic Indicators

- Reveal The Tips and Guide For Effective Momentum Trading

- Popular types of oscillators when trading most effectively

How to read News Trading?

To become a successful trader, reading and understanding the news is extremely important. However, not all news is worth your attention. So how to read the news trading effectively?

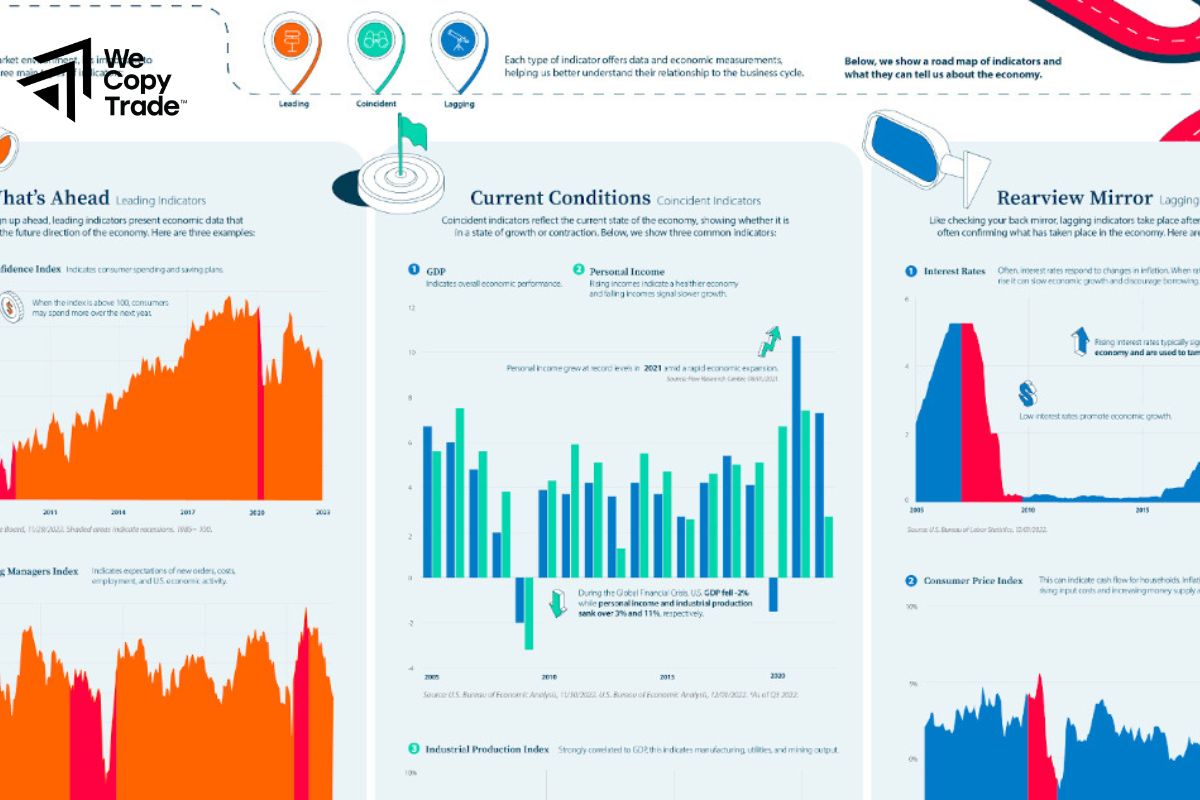

Step 1: Get familiar with economic indicators

- Economic indicators such as interest rates, inflation, unemployment rates, etc. are the “keys” to help you better understand the economic situation of a country. These indicators have a direct impact on the financial market, including the foreign exchange market.

- For example, when the central bank raises interest rates, the currency of that country often appreciates and vice versa.

- Or inflation: High inflation often causes prices of goods to increase, currencies to depreciate and interest rates to increase.

Step 2: Analyze market sentiment

Published economic information often has a strong impact on investor sentiment. If an indicator is better than expected, investors will become optimistic and push prices up. On the contrary, if the index is worse than expected, investors will become pessimistic and sell off.

Step 3. Learn how economic news affects the market

- Each type of economic news trading will affect the market in different ways.

- For example, news about interest rate hikes often causes the currency of that country to appreciate.

- Or if GDP growth is good, the currency of that country also tends to appreciate.

Step 4: Practice analytical skills

To read the news trading effectively, you need to:

- Update economic news daily to grasp the latest developments.

- Read economic reports carefully, compare them with previous forecasts and find out what experts think.

- Do not trust a single source of information, but analyze and draw your own conclusions.

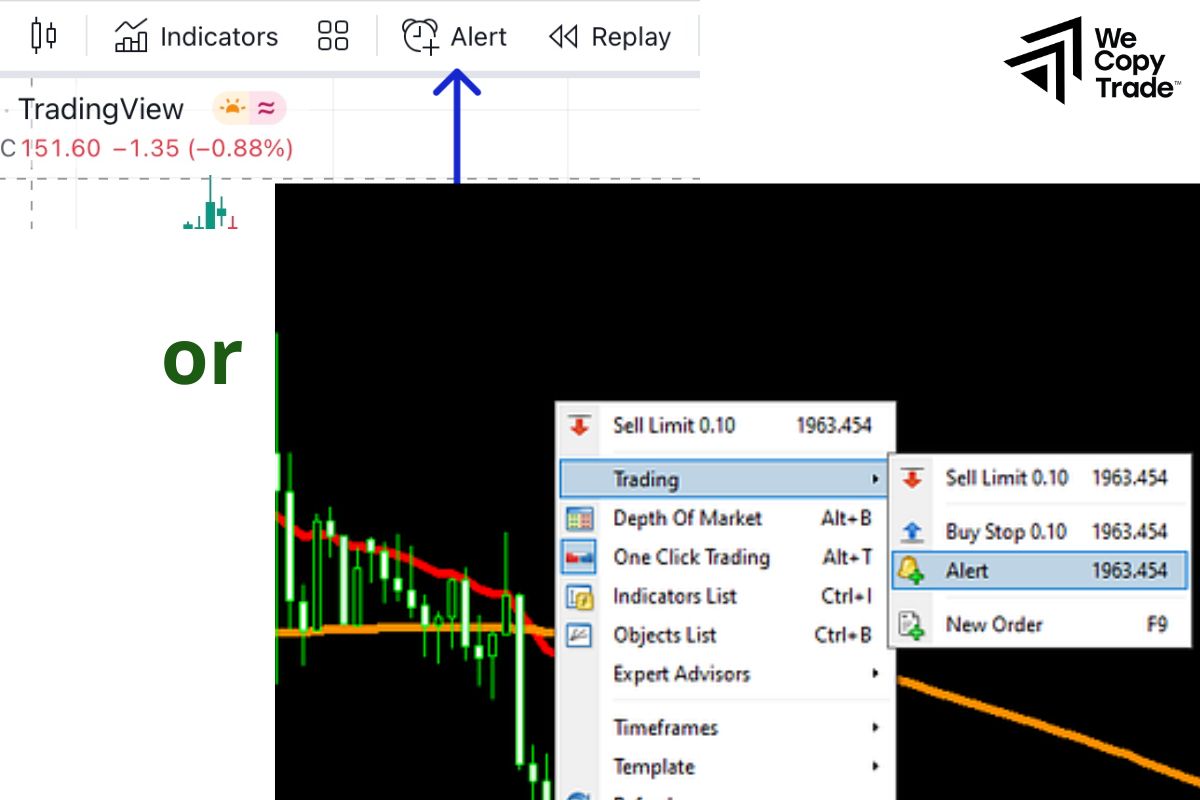

How to set up alerts?

There are many ways to set up alerts on your trading platform. Here are some of the most common:

- On the toolbar at the top of your trading screen, there is usually a button or icon dedicated to creating alerts. Simply click on it and follow the instructions.

- Many platforms have a separate window to manage all your alerts. Here, you can create new alerts, edit or delete existing ones.

- When you hover over a chart or an indicator, a context menu will usually appear. In this menu, you can find the option to create an alert.

- If you draw a trendline or a shape on the chart, you can set an alert when the price touches that line or shape.

- Some platforms allow you to set an alert directly on the price scale. Simply click on the desired price level and select the option to create an alert.

- To save time, you can use keyboard shortcuts to quickly create alerts. Common shortcuts are ALT + A (on Windows) or ⌥ + A (on Mac).

- If you have created a trading idea, you can set up an alert for it to monitor its development.

Forex news trading strategy

To make trading easier, you can refer to the following top strategies:

Learn deeply about the market

To be successful with news trading strategies, the first thing you need to do is become an expert in the market you want to trade. This means you need to:

- Dig deep into the historical data of the currency pair you are interested in. Look at past price trends, important support and resistance levels.

- Find out what types of news have the biggest impact on that currency pair. These can be economic reports, political events, or central bank decisions.

- Observe the relationship between news releases and price movements. Typically, positive news will cause prices to rise, while negative news will cause prices to fall. However, there are exceptions, so you need to analyze each specific case carefully.

- Once you understand the market, you will be able to predict how the market will react to upcoming news releases, know when to enter and when to stay out of the market. From there, you can make the right trading decisions.

For example:

Let’s say you are following the USD/JPY pair. You have studied history and noticed that every time the US Federal Reserve (Fed) raises interest rates, the US dollar usually increases in value compared to the Japanese Yen. When there is information that the Fed is about to raise interest rates, you can predict that the US dollar will increase in value and open a long (buy) position on the USD/JPY pair.

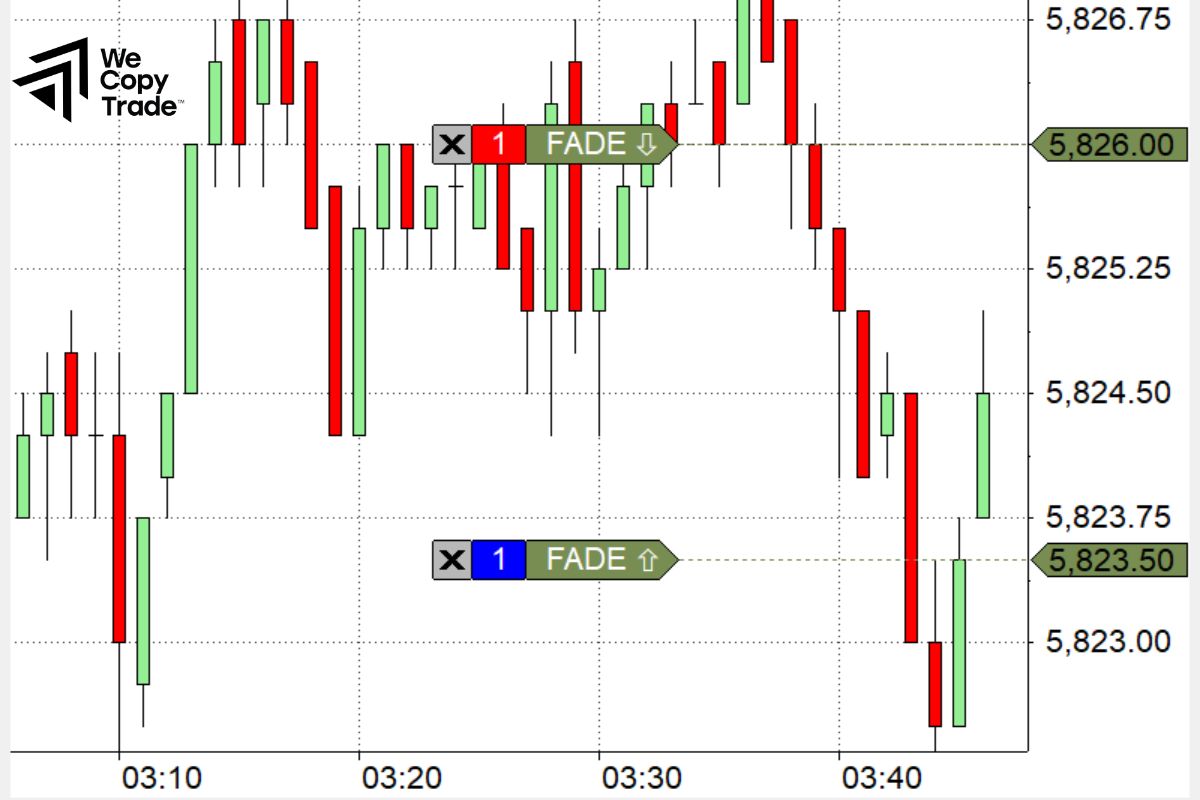

“Fading” Strategy

“Fading” can be simply understood as the act of trading against the current trend, especially when the excitement of the market starts to decrease. This strategy is often applied by news traders to take advantage of strong price fluctuations after a major news trading release.

Illustrative example:

Suppose there is a News Trading report that a company’s profits have increased growth is better than expected. Usually, right after this news is announced, the company’s stock price will increase sharply as investors rush to buy. However, traders who follow The “fading” strategy have a different perspective. They will wait until the stock price peaks, that is, when market excitement reaches its peak. They will then sell the stock with the expectation that the price will fall back as investors start to take profits and the market returns to normal.

Most investors tend to follow the crowd. When good news is announced, many people will buy at the same time, pushing the price up. However, later, when everyone has bought, there are not many buyers left, the price will tend to fall again. By waiting until the price peaks before selling, you will minimize the risk stuck in a losing position.

Alerts and timing

In News Trading, timing is extremely important. Since news can have a strong and rapid impact on the market, Being informed and responding promptly is essential to success. When important news is released, prices can move very quickly in a short period of time. Setting up alerts will help you catch trading opportunities as they arise.

If you are holding If you have an open position and an unexpected news is announced, you may suffer a large loss if you do not close the position in time. Setting up alerts will help you monitor the market closely and take timely corrective actions.

Conclusion

In conclusion, News Trading is an attractive strategy but also a risky one. If you want to try this strategy, equip yourself with the necessary knowledge and always be careful in every decision because nothing is certain in the financial markets.

See more: