Do you know that many businesses have encountered big problems due to not being able to control risks, leading to losses and even bankruptcy? That is why Financial Risk Management Software is becoming more important than ever. In the following article, I will share the secret to help you succeed in choosing the right management software for your business. Don’t miss the opportunity!

What is Financial Risk Management Software?

Financial Risk Management Software is a smart tool that helps businesses “see” potential risks in the financial sector. This software will help identify, measure and predict possible risks, thereby providing effective preventive solutions.

Enterprises in the financial sector such as banks, insurance companies, investment funds… are the ones that need to use this software the most. Because these businesses often face many different types of risks, from market risks, credit risks to operational risks. Thanks to the software, they can proactively prevent and minimize damage.

See now:

- All Processes of Portfolio Management Most Effective

- What is Hedging? How to hedge in stock investment

- Methods used to calculate effective Value at Risk Analysis

- Market Risk Mitigating and Managing Guidelines Most Simple

Benefits in Using Financial Risk Management Software

In the volatile business world, risks are always lurking. If not managed well, these risks can cause serious consequences for businesses, even leading to bankruptcy. Therefore, investing in Financial Risk Management Software is an effective method to protect businesses from financial fluctuations. So how does this software help businesses?

- The software will help you manage regulations effectively, avoiding unnecessary legal troubles.

- A business with a good risk management system will be more trusted by customers and partners.

- Risk management software not only helps businesses identify potential problems early, but also helps accurately measure their financial impact. By minimizing risks, businesses can save a lot of costs arising from dealing with the consequences. At the same time, making the right decisions will help increase revenue and profits.

- Risk management software will always closely monitor all business activities, providing you with full information about potential risks and new opportunities. When detecting any abnormal signs, the software will immediately alert, helping businesses promptly handle and prevent damage.

How to Choose the Best Financial Risk Management Software

To choose the right software, you need to follow these steps:

Clearly identify the problems you want the software to solve. For example, do you want to track production costs, manage cash flow, or prepare tax reports?

After identifying your needs, create a detailed plan, including:

- The budget you plan to invest in the software

- The time frame you want to implement the software

- Stakeholders who will be involved in the software selection and implementation process

Make a list of specific requirements that the software needs to meet, for example:

- Is the software easy to use?

- Do the features of software respond to all your needs?

- Can the software integrate with other software you are using?

- Is the software secure?

Once you have a list of requirements, compare different software to find the most suitable software. Learn about each vendor by:

- Read product information, customer reviews, and testimonials.

- Ask the vendor to show you the software. You can request an online or in-person demo

- Ask for opinions from people who have used the vendor’s software.

Once you have a few good options to choose from, compare them based on the following criteria:

- Does the software meet your needs?

- What are the initial and annual maintenance costs?

- Does the vendor provide good customer support?

- Can the software integrate with other software you already use?

Once you have selected the right software, start negotiating a contract. Some things to keep in mind:

- Negotiate on price, licensing fees, maintenance fees, and other costs.

- Determine the contract length and payment terms.

- Discuss the support services you will receive after purchasing the software.

- Agree on the payment method and payment terms.

Best Financial Risk Management Softwares Company

Here are 10 of the most effective and popular Financial Risk Management Software, you can refer to and compare to suit your needs:

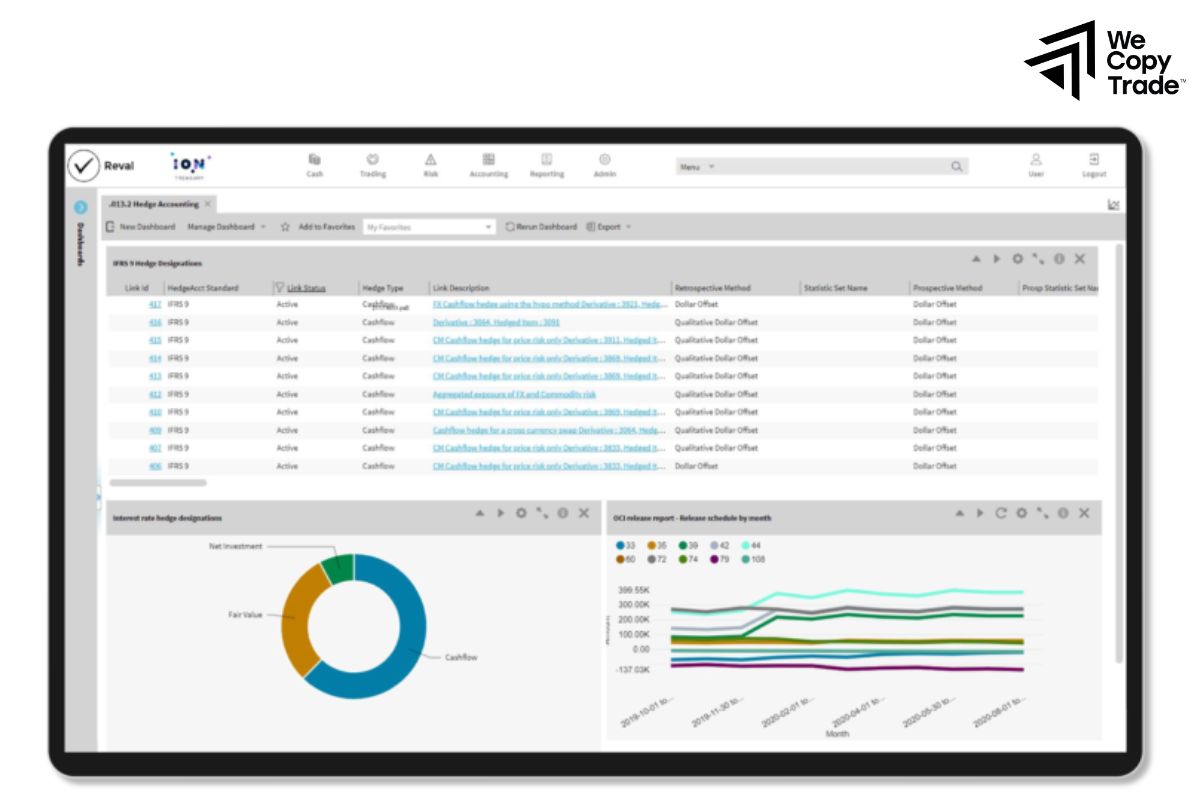

Reval

Reval is a leading support tool that helps banks manage financial risks effectively. Using cloud technology, Reval provides powerful tools for banks to control cash flow, minimize liquidity risk, assess and manage risks such as market risk, credit risk while ensuring banks comply with regulations and protect customer information.

Kyriba

Kyriba is an enterprise finance platform that helps organizations optimize the use of cash. With Kyriba, organizations can track cash flow accurately and promptly, connect with business partners securely and efficiently, and proactively forecast capital needs and manage risks.

MetricStream

MetricStream provides a powerful platform that helps businesses manage operational risks effectively. With MetricStream, businesses can identify factors that can pose risks to their business operations, increase operational efficiency, and protect their assets.

Murex MX.3

Murex MX.3 is a powerful platform, specifically designed for the financial industry. With MX.3, financial institutions can quickly transform their IT systems without much difficulty, connect different parts of the organization to work more effectively, use data and analytics to make informed business decisions, and respond to customer needs quickly and accurately.

D&B Credit

D&B Credit is a useful tool to help businesses manage credit risk. With D&B Credit, you can quickly and accurately assess customer payment ability, monitor and manage credit risk of the entire customer portfolio, and detect abnormalities early to take preventive measures.

SmartRisk

SmartRisk is a powerful platform that helps businesses manage risks effectively. With SmartRisk, you can identify and assess all types of risks that may affect your business, build plans to minimize the impact of risks, optimize workflows to minimize risks.

GTreasury

GTreasury is a cloud platform that helps businesses effectively manage treasury and finance operations. With GTreasury, you can effectively manage cash, payments and other financial operations, assess and manage financial risks, automate processes, save time and manpower.

FactSet

FactSet is a financial data analytics platform that helps investors manage their investment portfolios effectively. With FactSet, you can analyze your portfolio in detail, evaluate performance and risk, and automate data collection and processing tasks. From there, you get the information you need to make the right investment decisions.

FINCAD

FINCAD is a financial risk management platform that helps financial institutions manage risks comprehensively. With FINCAD, you can manage risks across different asset classes, ensure compliance with financial regulations, increase operational efficiency and reduce costs.

Calypso

Calypso is a platform that provides comprehensive solutions for financial institutions, including trading, risk management, derivatives processing and control. With Calypso, you can provide financial services quickly and accurately, manage risks effectively while ensuring compliance with financial market regulations.

Conclusion

In conclusion, investing in Financial Risk Management Software is not only an option, but also a necessity that directly affects the survival and development of businesses in today’s competitive business environment. By following the steps shared in the article above, I guarantee that you will choose the right software and achieve the highest efficiency.

See more: