An Evaluation Program is essential to measuring the effectiveness of any initiative, providing valuable insights that drive improvement and ensure long-term success. This article will guide you through the basics of creating a strong Evaluation Program that delivers measurable results most effectively.

What is an Evaluation Program?

An audit program is a structured process or plan designed to evaluate the effectiveness, quality, or performance of a particular product, service, project, or system. The primary goal of an audit program is to collect data and insights that can inform decisions, improve outcomes, and ensure that objectives are being met.

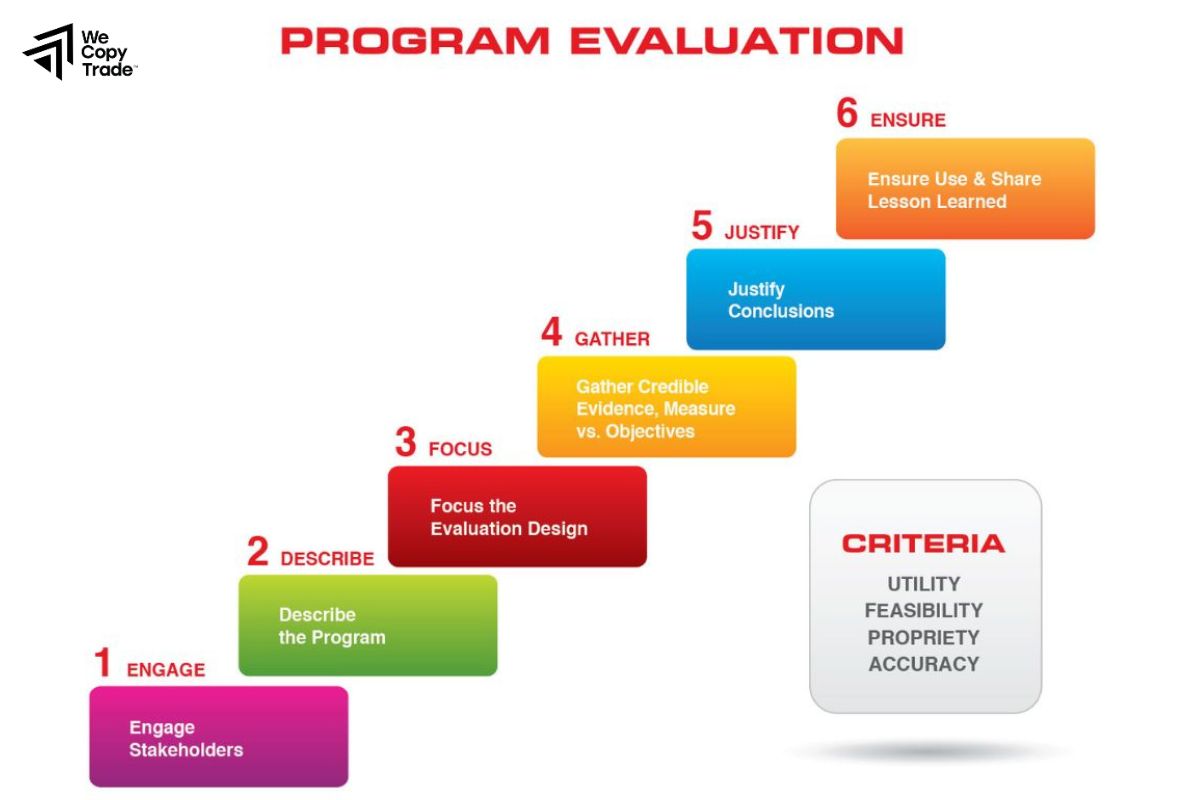

Key Components of an Evaluation Program:

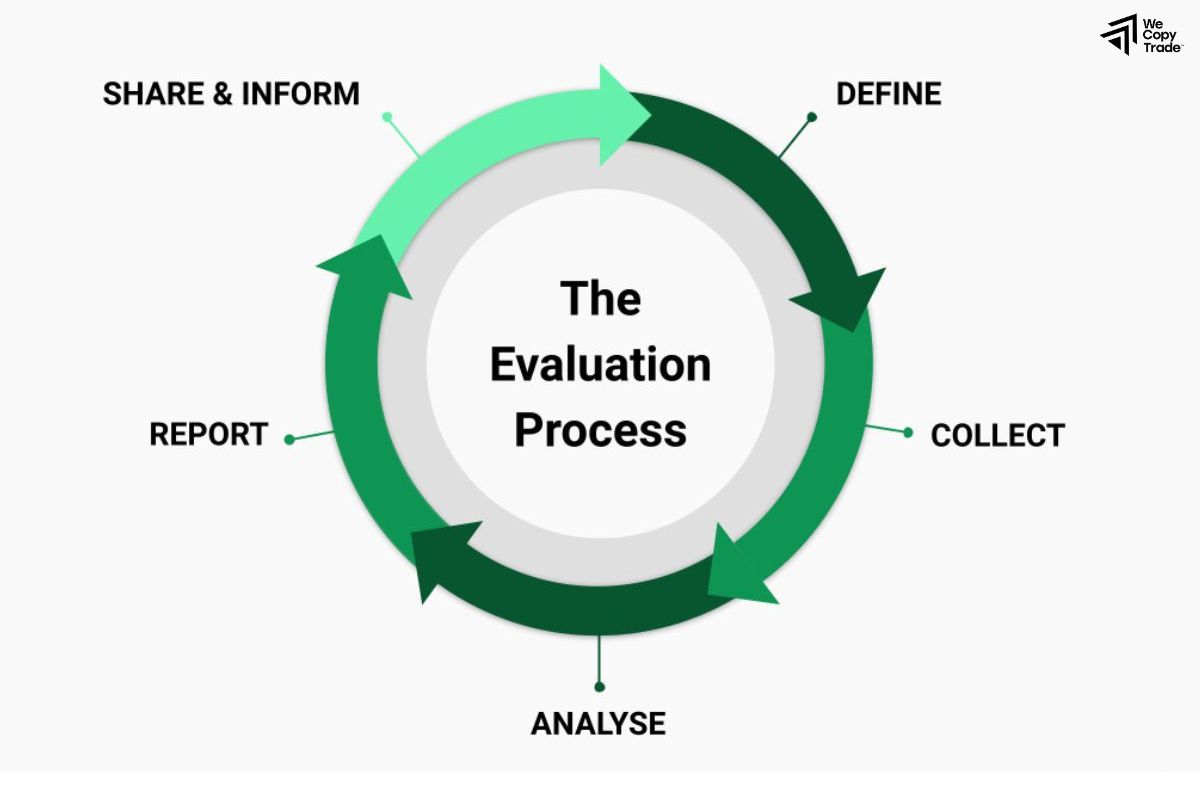

- Objectives and Goals: Clearly defined purposes for the evaluation, such as understanding impact, measuring success, or identifying areas for improvement.

- Criteria and Standards: Specific benchmarks or standards against which the subject of evaluation is measured.

- Methods and Tools: Techniques and instruments used to collect data, such as surveys, interviews, observations, or performance metrics.

- Data Collection: Gathering relevant information from stakeholders, participants, or systems to evaluate performance.

- Analysis: Interpreting the collected data to identify trends, strengths, weaknesses, and overall effectiveness.

- Reporting: Presenting findings in a clear and actionable format, often including recommendations for improvement.

- Feedback and Follow-up: Using the results of the evaluation to make informed decisions, implement changes, and monitor progress over time.

An audit program is therefore essential for continuous improvement and ensuring that resources are being used effectively to achieve desired outcomes.

See more:

- How to apply for a real estate prop firm certificate extremely reputable

- How Do Prop Firms Make Money? An In-Depth Look at Revenue

- What is High-Frequency Trading? How it works and its applications in cryptocurrency trading

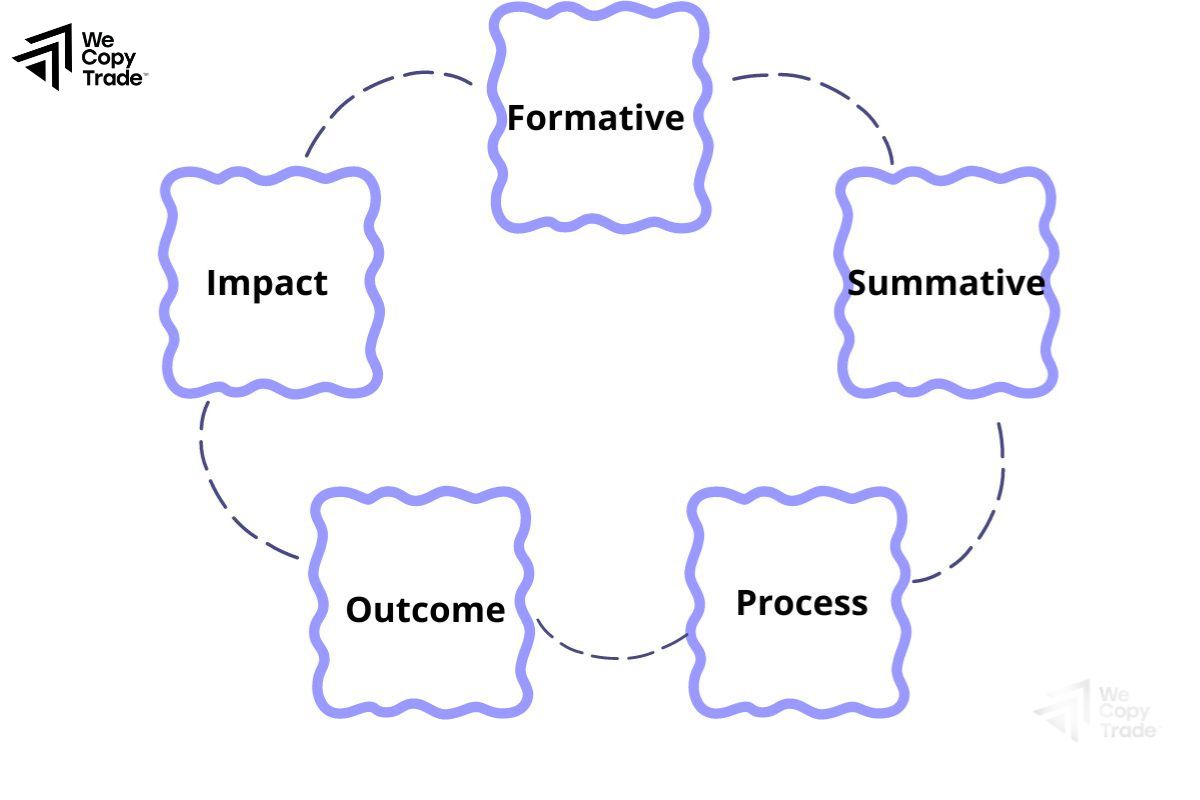

Types of Evaluation Programs

Evaluation Programs come in various forms depending on their purpose, the subject being evaluated, and the methodologies used. Here are some common types:

Formative Evaluation

- Purpose: Conducted during the development or implementation of a program or project to improve its design and performance.

- Focus: Identifying strengths, weaknesses, and areas for improvement.

Summative Evaluation

- Purpose: Conducted after the completion of a program or project to assess its overall impact and effectiveness.

- Focus: Determining the success or failure of a program, often compared to initial objectives.

Process Evaluation

- Purpose: Examines the implementation process of a program to understand how it operates and to identify operational strengths and challenges.

- Focus: Assessing whether the program is being implemented as intended.

Outcome Evaluation

- Purpose: Measures the results or outcomes of a program to determine if it has achieved its intended goals.

- Focus: Assessing the impact of the program on the target audience or system.

Cost-Benefit Evaluation

- Purpose: Analyzes the economic efficiency of a program by comparing its costs to its benefits.

- Focus: Determining whether the benefits of a program justify its costs.

Step-by-Step Guide to Participating in a Prop Trading Evaluation Program

Participating in a prop trading assessment program can be a great way to prove your trading skills and access larger capital. Here is a step-by-step guide to help you navigate the process:

Step 1: Research Proprietary Trading Firms

- Search for reputable proprietary trading firms that offer assessment prop trading evaluation.

- Compare different programs based on criteria such as fees, capital allocation, profit sharing, and trading rules.

- Check reviews and testimonials from other traders to assess the company’s credibility.

Step 2: Understand the assessment criteria

- Read the terms and conditions of the assessment program carefully.

- Understand the rules regarding trading limits, risk management, and performance metrics.

- Be aware of the profit targets you need to achieve to pass the assessment.

Step 3: Apply for the program

- Fill out and submit the application form provided by the proprietary trading firm.

- You may need to provide proof of identity, trading experience, and financial information.

Step 4: Prepare for the Assessment

- Get familiar with the prop trading evaluation platform and tools used during the assessment.

- Create a trading plan that aligns with the prop trading evaluation program rules and your trading strategy.

- If possible, practice on a demo account to refine your strategy and execution.

Step 5: Participate in the Assessment

- Strictly follow the trading rules and guidelines set by the program.

- Implement sound risk management techniques to avoid significant losses.

- Monitor your performance and adjust your strategy as needed.

Step 6: Review Results

- After the assessment period, review the feedback and results provided by the proprietary trading firm.

- Eventually, evaluate your performance based on the firm’s criteria and any feedback received.

Benefits of Participating in Prop Trading Evaluation Programs

Participating in prop trading evaluation programs offers several benefits, especially for traders looking to advance their careers and trade with larger capital. Here are some key advantages:

- Trade with significant funds, boosting potential profits.

- Use the firm’s capital, minimizing personal financial risk.

- Access various markets and advanced trading tools.

- Opportunities for professional growth and networking.

- Clear goals and educational resources for improved trading.

- Earn profit-sharing and incentives based on your success.

- Develop and practice effective risk management techniques.

- Build a trading track record and establish valuable firm relationships.

Conclusion

In conclusion, participating in a prop trading evaluation program offers numerous benefits for traders seeking to elevate their careers and manage risk effectively. Therefore, the structured environment and advanced tools provided in these programs not only enhance trading performance but also open doors to career advancement and long-term success. So, embracing an evaluation program can be a pivotal step in achieving trading goals and leveraging new opportunities in the financial markets.